Monthly Health Insurance Cost

Health insurance is an essential aspect of modern life, providing individuals and families with financial protection and access to healthcare services. The cost of health insurance is a significant concern for many, as it can vary widely depending on various factors. Understanding the factors that influence monthly health insurance costs is crucial for making informed decisions and managing healthcare expenses effectively.

In this comprehensive article, we delve into the world of health insurance costs, exploring the key factors, analyzing real-world examples, and offering expert insights to help readers navigate this complex landscape. By examining the intricacies of health insurance pricing, we aim to empower individuals with the knowledge needed to make informed choices and optimize their healthcare coverage.

Factors Influencing Monthly Health Insurance Costs

The cost of health insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. Let’s explore some of the key elements that impact monthly health insurance expenses:

1. Age and Gender

Age and gender are fundamental factors in health insurance pricing. Insurance companies often use actuarial data to assess the risk associated with different age groups and genders. Younger individuals are generally considered lower-risk, resulting in lower premiums, while older individuals may face higher costs due to the increased likelihood of health issues. Gender-based pricing, although less common nowadays, can also impact premiums, as certain conditions are more prevalent in specific genders.

| Age Group | Average Monthly Premium |

|---|---|

| 18-25 years | $250 - $350 |

| 26-35 years | $300 - $450 |

| 36-50 years | $400 - $600 |

| 51+ years | $550 - $800 |

These figures provide a general overview, but actual premiums can vary based on other factors and individual circumstances.

2. Plan Type and Coverage

The type of health insurance plan chosen significantly affects the monthly cost. Different plan types offer varying levels of coverage and benefits. For instance, a High-Deductible Health Plan (HDHP) may have lower monthly premiums but require individuals to pay a substantial amount out-of-pocket before insurance coverage kicks in. On the other hand, Preferred Provider Organization (PPO) plans often provide more comprehensive coverage but come with higher premiums.

| Plan Type | Average Monthly Premium | Coverage Highlights |

|---|---|---|

| HDHP | $300 - $450 | Lower premiums, higher deductibles, often paired with Health Savings Accounts (HSAs) |

| PPO | $450 - $650 | Broad network of providers, flexible coverage options, higher premiums |

| HMO | $350 - $500 | Restricted network, lower out-of-pocket costs, usually require referrals for specialists |

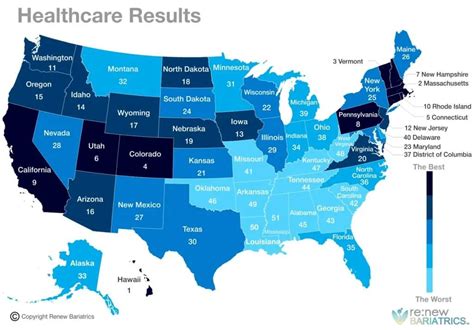

3. Geographic Location

Health insurance costs can vary significantly based on geographic location. Factors such as the cost of living, availability of healthcare services, and regional demographics influence insurance rates. Urban areas with a higher cost of living and denser populations may have higher premiums compared to rural areas.

For example, in a metropolitan city like New York City, the average monthly premium for a comprehensive health insurance plan could be upwards of $600, while in a rural state like Montana, the same plan might cost around $450.

4. Tobacco Use and Lifestyle Factors

Lifestyle choices, particularly tobacco use, can have a direct impact on health insurance costs. Insurance companies often consider tobacco use as a risk factor and may charge higher premiums for smokers. Additionally, other lifestyle factors such as obesity, sedentary lifestyles, or risky behaviors can influence insurance rates.

5. Family Size and Dependents

The size of one’s family and the number of dependents play a crucial role in determining health insurance costs. Family plans are designed to cover multiple individuals, including spouses and children. The more dependents covered, the higher the premium. However, family plans often offer cost-saving strategies, such as discounted rates for additional dependents.

6. Pre-existing Conditions

Pre-existing conditions can significantly impact health insurance costs. Insurance companies may charge higher premiums or deny coverage altogether for individuals with certain pre-existing conditions. The Affordable Care Act (ACA) has mitigated some of these challenges by prohibiting insurance companies from denying coverage based solely on pre-existing conditions.

For individuals with pre-existing conditions, it's crucial to carefully research and compare insurance plans to find the most suitable and affordable option.

7. Employer-Sponsored Plans

Many individuals obtain health insurance through their employers, which can significantly impact the cost. Employer-sponsored plans often provide a more cost-effective option, as employers contribute to the premium costs. The specific coverage and premium contributions can vary based on the employer’s policy and the employee’s position within the company.

8. Individual vs. Group Plans

The decision between an individual plan and a group plan can impact insurance costs. Group plans, often offered through employers or organizations, tend to have lower premiums due to the spread of risk across a larger pool of individuals. Individual plans, on the other hand, may have higher premiums, especially for those with unique health needs or specific coverage requirements.

9. Discounts and Subsidies

Insurance companies and government programs offer various discounts and subsidies to make health insurance more affordable. These can include age-based discounts, family plan discounts, or subsidies for low-income individuals. It’s essential to explore these options to potentially reduce the overall cost of health insurance.

10. Plan Deductibles and Out-of-Pocket Costs

The deductible and out-of-pocket costs associated with a health insurance plan directly impact the monthly premium. Plans with higher deductibles and out-of-pocket expenses often have lower monthly premiums, as individuals pay more upfront before insurance coverage begins. Conversely, plans with lower deductibles and out-of-pocket costs typically have higher monthly premiums.

Analyzing Real-World Health Insurance Costs

To gain a clearer understanding of health insurance costs, let’s examine some real-world examples. These scenarios provide a practical perspective on how the factors discussed above come into play and influence insurance premiums.

Example 1: Young Professional in an Urban Area

Meet Sarah, a 28-year-old professional living in New York City. Sarah is in excellent health and has no pre-existing conditions. She opts for a PPO plan to have flexible coverage options and a broad network of providers. Considering her age and location, Sarah’s average monthly premium is estimated at $420.

Example 2: Family Plan for a Rural Family

The Smith family resides in a rural area of Montana. They have two young children and opt for a family plan with an HMO to keep costs manageable. Given their location and family size, their average monthly premium for the family plan is estimated at 900</strong>, with each additional dependent costing <strong>200 less.

Example 3: Older Adult with Pre-existing Conditions

John, a 62-year-old retiree, has a history of diabetes and high blood pressure. He resides in a suburban area and chooses an HDHP plan to save on premiums. Considering his age and health conditions, John’s average monthly premium is estimated at $550. However, he also takes advantage of a subsidy program, reducing his premium by 20%.

Example 4: Employer-Sponsored Plan for a Small Business

ABC Inc., a small business with 15 employees, offers a group health insurance plan to its staff. The company contributes 70% of the premium cost, making the plan highly affordable for employees. The average monthly premium for an individual employee is 280</strong>, with family plans costing an additional <strong>500 for each dependent.

Example 5: Individual Plan for a Self-Employed Person

Emily, a self-employed freelance writer, needs an individual health insurance plan. She opts for an HDHP to keep premiums low but knows she may need to pay more out-of-pocket for certain services. Her average monthly premium is estimated at $380, with the flexibility to choose her preferred providers.

Expert Insights and Tips for Managing Health Insurance Costs

Navigating the complexities of health insurance costs can be challenging. Here are some expert insights and tips to help individuals make informed decisions and manage their healthcare expenses effectively:

1. Shop Around and Compare Plans

Don’t settle for the first insurance plan you find. Compare different plans, providers, and coverage options. Online marketplaces and insurance brokers can be valuable resources for researching and comparing plans.

2. Understand Your Coverage Needs

Assess your individual or family’s unique healthcare needs. Consider factors like chronic conditions, prescription medications, and the likelihood of needing specialized care. Choosing a plan that aligns with your specific needs can help optimize coverage and costs.

3. Explore Cost-Saving Strategies

Investigate cost-saving strategies such as HSAs (Health Savings Accounts) or FSA (Flexible Spending Accounts). These accounts allow you to set aside pre-tax dollars for qualified medical expenses, reducing your taxable income and potentially lowering your overall healthcare costs.

4. Consider High-Deductible Plans with HSAs

If you’re generally healthy and prefer lower monthly premiums, consider HDHPs paired with HSAs. This combination can provide significant tax benefits and allow you to save for future healthcare expenses.

5. Take Advantage of Preventive Care

Most insurance plans cover preventive care services, such as annual check-ups, screenings, and immunizations, at no cost to you. Taking advantage of these services can help identify potential health issues early on, potentially reducing future healthcare costs.

6. Review and Update Your Plan Annually

Insurance plans and costs can change annually. Review your plan and coverage options each year to ensure it still meets your needs. Changes in your health status, family size, or employment situation may warrant a plan update.

7. Understand Network Providers

Familiarize yourself with the network of providers covered by your insurance plan. Out-of-network providers may charge higher fees, and you might be responsible for a larger portion of the cost. Choosing in-network providers can help control your out-of-pocket expenses.

8. Utilize Telehealth Services

Telehealth services have become increasingly popular and accessible. These services allow you to consult with healthcare professionals remotely, often at a lower cost than in-person visits. Consider using telehealth for minor ailments or follow-up appointments to save on healthcare expenses.

9. Explore Government Programs

Government programs like Medicaid and the Children’s Health Insurance Program (CHIP) provide low-cost or no-cost health insurance for eligible individuals and families. Research these programs to see if you qualify and take advantage of the benefits they offer.

10. Seek Professional Advice

If you’re unsure about your health insurance options or need personalized guidance, consider consulting a healthcare professional or financial advisor. They can provide expert advice tailored to your specific circumstances, helping you make informed decisions about your healthcare coverage.

Conclusion: Empowering Choices, Managing Costs

Understanding the factors that influence monthly health insurance costs is crucial for making informed decisions and managing healthcare expenses effectively. By exploring real-world examples and seeking expert advice, individuals can navigate the complexities of health insurance and find the most suitable and cost-effective coverage for their unique needs.

Remember, health insurance is a vital investment in your well-being and financial security. Taking the time to research, compare, and understand your options empowers you to make choices that align with your health needs and budget. Stay informed, stay healthy, and manage your healthcare costs wisely.

How do I choose the right health insurance plan for my needs?

+When selecting a health insurance plan, consider your unique healthcare needs, budget, and preferences. Assess factors like your age, family size, pre-existing conditions, and the likelihood of needing specialized care. Compare different plan types, such as HDHPs, PPOs, and HMOs, and understand their coverage and cost implications. Research and shop around to find the plan that offers the best value for your specific circumstances.

Are there any ways to reduce my health insurance costs?

+Yes, there are several strategies to reduce health insurance costs. Explore options like HDHPs paired with HSAs, which offer tax benefits and the potential for savings. Take advantage of preventive care services covered by most plans. Review your coverage annually to ensure it aligns with your needs and consider updating it to optimize costs. Utilize telehealth services for minor ailments to save on expenses. Finally, seek professional advice to make informed choices and potentially reduce costs.

What if I have a pre-existing condition? Can I still get affordable health insurance?

+Yes, individuals with pre-existing conditions can still obtain affordable health insurance. The Affordable Care Act (ACA) prohibits insurance companies from denying coverage based solely on pre-existing conditions. However, it’s crucial to carefully research and compare insurance plans to find the most suitable and affordable option. Explore government programs like Medicaid or subsidies to reduce costs further.

Can I switch health insurance plans during the year?

+In general, health insurance plans have specific enrollment periods, and switching outside of these periods can be challenging. However, certain life events, such as marriage, divorce, birth or adoption of a child, or loss of other coverage, may qualify you for a Special Enrollment Period. During this period, you can switch plans or enroll in a new one. It’s important to understand the rules and requirements for changing plans to ensure a smooth transition.