Commercial Car Insurance Quotes Online

For business owners, protecting their commercial vehicles is an essential aspect of running a successful operation. Commercial car insurance is a critical component of this protection, providing coverage for a range of vehicles used for business purposes. Obtaining commercial car insurance quotes online has become a popular and convenient way for businesses to secure the right coverage for their needs.

In this comprehensive guide, we will delve into the world of commercial car insurance quotes, exploring the key considerations, the online quotation process, and the benefits it offers to businesses. By understanding the ins and outs of this process, business owners can make informed decisions and ensure their commercial vehicles are adequately insured.

Understanding Commercial Car Insurance

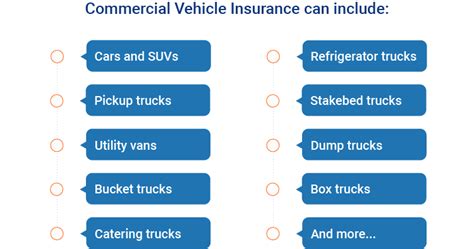

Commercial car insurance is designed to cover a wide range of vehicles used in business operations, including delivery vans, trucks, taxis, and even company cars. Unlike personal auto insurance, commercial insurance policies are tailored to the specific needs of businesses, taking into account the unique risks and exposures associated with commercial vehicle use.

This type of insurance provides comprehensive coverage for various scenarios, such as accidents, theft, vandalism, and damage to property. It also offers liability protection, ensuring that businesses are financially protected in the event of a claim made against them by a third party. With commercial car insurance, businesses can operate with peace of mind, knowing that their vehicles and operations are safeguarded.

The Importance of Online Quotes

In today’s digital age, obtaining commercial car insurance quotes online has become an efficient and convenient option for businesses. The online quotation process offers several advantages that make it an attractive choice for business owners:

- Time Efficiency: Online quotes save valuable time for business owners. Instead of visiting multiple insurance providers or waiting for quotes to be emailed, the entire process can be completed in a matter of minutes. This streamlined approach allows business owners to quickly compare rates and coverage options, making it easier to find the best policy for their needs.

- Convenience: The ability to obtain quotes online provides unparalleled convenience. Business owners can access quotes from the comfort of their office or on the go, eliminating the need for in-person meetings or lengthy phone calls. This flexibility is especially beneficial for busy entrepreneurs who value their time.

- Transparency: Online quotation platforms often provide detailed breakdowns of coverage options and pricing. This transparency empowers business owners to make informed decisions. They can easily compare different policies, understand the specific coverage provided, and ensure they are getting the best value for their insurance premiums.

- Customized Options: Many online platforms allow business owners to customize their quotes based on their unique business needs. Whether it's adjusting coverage limits, adding specific endorsements, or choosing from a range of deductibles, online quotes offer the flexibility to tailor policies to the exact requirements of the business.

The Online Quotation Process

Obtaining commercial car insurance quotes online typically involves a straightforward and user-friendly process. Here’s a step-by-step guide to navigating the online quotation journey:

Step 1: Research and Compare Providers

Before starting the quotation process, it’s essential to research and compare different insurance providers. Look for reputable companies that specialize in commercial car insurance and have a strong track record of providing reliable coverage. Consider factors such as financial stability, customer reviews, and the range of coverage options offered.

Step 2: Gather Necessary Information

To obtain an accurate quote, you’ll need to gather some essential information about your business and its vehicles. This may include the type and number of vehicles, the nature of their usage (e.g., delivery, transportation, etc.), the names and ages of drivers, and any previous claims or violations. Having this information readily available will streamline the quotation process.

Step 3: Visit Online Quotation Platforms

There are numerous online platforms and websites dedicated to providing commercial car insurance quotes. Visit these platforms and explore their interfaces. Look for user-friendly layouts, clear instructions, and comprehensive coverage options. Some platforms may offer additional features, such as instant quotes or the ability to save and compare multiple quotes side by side.

Step 4: Provide Vehicle and Business Details

On the online quotation platform, you’ll be prompted to enter details about your business and its vehicles. This information will be used to generate an accurate quote. Ensure that you provide accurate and up-to-date information to avoid any discrepancies or surprises when it comes to finalizing your policy.

Step 5: Review and Compare Quotes

Once you’ve provided the necessary details, the platform will generate quotes from various insurance providers. Take the time to carefully review and compare these quotes. Consider factors such as coverage limits, deductibles, additional endorsements, and, of course, the premium cost. Look for policies that offer the best combination of coverage and value for your business.

Step 6: Choose the Right Policy

After comparing quotes, select the policy that aligns with your business’s needs and budget. Ensure that you understand the terms and conditions of the chosen policy and that it provides adequate coverage for your commercial vehicles. Don’t hesitate to reach out to the insurance provider or a licensed insurance broker if you have any questions or concerns.

Benefits of Online Commercial Car Insurance Quotes

Obtaining commercial car insurance quotes online offers a range of benefits that make it an advantageous choice for businesses:

- Cost Savings: Online quotes often provide more competitive rates compared to traditional insurance brokers. By leveraging technology and streamlined processes, online platforms can offer lower premiums, allowing businesses to save on their insurance costs.

- Ease of Comparison: With online quotes, business owners can easily compare multiple policies side by side. This comparison process ensures that they can find the most suitable coverage at the best price, without compromising on the quality of protection.

- Flexibility and Customization: Online platforms offer a high degree of flexibility and customization. Business owners can adjust coverage limits, choose specific endorsements, and select deductibles that align with their risk tolerance and budget. This level of control allows businesses to tailor their policies to their unique needs.

- Instant Quotes and Convenience: Many online platforms provide instant quotes, eliminating the wait time associated with traditional quoting methods. This instant access to quotes saves time and allows business owners to make quick decisions, ensuring they can secure the coverage they need without unnecessary delays.

- Transparency and Education: Online quotation platforms often provide detailed explanations of coverage options and policy terms. This transparency helps business owners understand the intricacies of commercial car insurance, empowering them to make informed choices and avoid any unexpected surprises down the line.

Performance Analysis and Expert Insights

When it comes to commercial car insurance, performance analysis plays a crucial role in evaluating the effectiveness of policies. Here are some key metrics and insights to consider:

| Metric | Description |

|---|---|

| Claims Ratio | The claims ratio represents the proportion of claims paid out compared to the total premiums received. A lower claims ratio indicates that the insurance provider is managing claims effectively and maintaining a healthy financial position. |

| Loss Ratio | The loss ratio measures the relationship between incurred losses and earned premiums. A loss ratio of less than 100% indicates that the insurer is generating profits, while a higher ratio may suggest financial strain. |

| Policyholder Satisfaction | Assessing policyholder satisfaction through surveys and reviews provides valuable insights into the overall customer experience. High satisfaction ratings reflect the insurer's ability to provide excellent service and prompt claim resolutions. |

| Renewal Rates | The renewal rate indicates the percentage of policyholders who choose to renew their policies with the same insurer. High renewal rates suggest that customers are satisfied with the coverage and service provided. |

| Risk Management Programs | Some insurance providers offer risk management programs to help businesses mitigate potential risks. These programs may include driver training, safety protocols, and fleet maintenance recommendations. Businesses should consider providers who offer such programs to enhance their risk management strategies. |

Future Implications and Trends

The landscape of commercial car insurance is constantly evolving, driven by technological advancements and changing business needs. Here are some key trends and future implications to consider:

- Telematics and Usage-Based Insurance: Telematics technology, which collects data from vehicles, is gaining traction in the commercial car insurance sector. Usage-based insurance policies, where premiums are based on driving behavior and vehicle usage patterns, offer businesses a more tailored and potentially cost-effective approach to insurance coverage.

- Autonomous Vehicles and Fleet Management: As autonomous vehicles become more prevalent, the insurance industry will need to adapt. Commercial car insurance policies will need to address the unique risks and liabilities associated with self-driving vehicles and the integration of advanced fleet management systems.

- Data-Driven Risk Assessment: With the increasing availability of data, insurance providers are leveraging advanced analytics to assess risk more accurately. This data-driven approach allows for more precise underwriting and the development of innovative insurance products tailored to specific industries and business models.

- Cybersecurity and Data Protection: As businesses rely more on digital technologies, cybersecurity risks become a critical concern. Commercial car insurance policies will need to address the potential impact of cyber attacks on fleets and the protection of sensitive data. Insurers will play a crucial role in helping businesses navigate these emerging risks.

How often should I review and update my commercial car insurance policy?

+

It is recommended to review your policy annually or whenever there are significant changes to your business or fleet. Regular reviews ensure that your coverage remains up-to-date and aligned with your evolving needs.

What factors can influence the cost of commercial car insurance quotes?

+

The cost of quotes can be influenced by various factors, including the type and number of vehicles, driver profiles, claim history, and the level of coverage required. Additionally, the location and nature of your business operations can impact premiums.

Can I bundle my commercial car insurance with other business insurance policies?

+

Yes, many insurance providers offer bundling options, allowing you to combine your commercial car insurance with other business policies, such as property insurance or liability coverage. Bundling can often result in cost savings and streamlined policy management.

What should I do if I’m involved in an accident while using a commercial vehicle?

+

In the event of an accident, it’s important to remain calm and take the necessary steps. First, ensure the safety of all involved parties. Then, collect as much information as possible, including contact details of witnesses, photos of the accident scene, and any relevant documentation. Contact your insurance provider promptly to report the incident and follow their instructions for filing a claim.