Best Cheap Dental Insurance

In today's world, maintaining good oral health is essential, but the cost of dental care can often be a significant financial burden. This is where dental insurance comes into play, offering an affordable solution to ensure proper dental care without breaking the bank. However, with numerous options available in the market, finding the best cheap dental insurance can be a daunting task. In this comprehensive guide, we will explore the ins and outs of affordable dental insurance plans, providing you with the knowledge to make an informed decision.

Understanding the Importance of Dental Insurance

Regular dental check-ups and timely treatments are crucial for maintaining optimal oral health. Neglecting dental care can lead to various issues, from cavities and gum disease to more severe problems like tooth loss and systemic health complications. Dental insurance plays a pivotal role in encouraging individuals to prioritize their oral hygiene by covering a significant portion of the associated costs.

While some may consider dental insurance an unnecessary expense, it is important to recognize the long-term benefits. By investing in a good dental plan, you can save on costly procedures and avoid the financial strain of unexpected dental emergencies. Furthermore, many insurance providers offer preventive care coverage, which can help identify and address potential issues before they escalate into major problems.

The Cost Factor: Affordable Dental Insurance Options

When it comes to choosing dental insurance, cost is a significant consideration. Thankfully, there are various affordable options available that provide comprehensive coverage without burning a hole in your pocket.

Individual vs. Family Plans

The first step in selecting an affordable plan is determining whether you need an individual or family dental insurance policy. Individual plans are ideal for those who live alone or have a small household, while family plans cater to larger households with multiple members.

| Plan Type | Average Monthly Premium |

|---|---|

| Individual | $25 - $50 |

| Family | $50 - $100 |

It's worth noting that these premiums can vary depending on the provider and the level of coverage you choose. Additionally, some plans may offer discounts for couples or additional family members, making them more cost-effective for larger households.

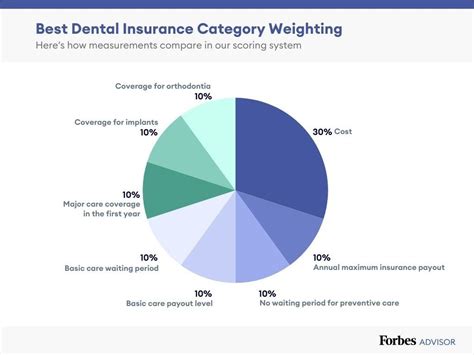

Understanding Coverage Levels

Dental insurance plans typically come in three coverage levels: basic, major, and comprehensive. Basic coverage focuses on preventive care, such as cleanings, check-ups, and X-rays. Major coverage includes more extensive procedures like root canals, crowns, and bridges. Comprehensive coverage combines both basic and major coverage, providing a wide range of dental services.

| Coverage Level | Average Annual Coverage |

|---|---|

| Basic | $1,000 - $1,500 |

| Major | $2,000 - $3,000 |

| Comprehensive | $3,000 - $5,000 |

The choice of coverage level depends on your specific needs and budget. If you primarily require preventive care, a basic plan may suffice. However, if you anticipate needing more extensive treatments, opting for a major or comprehensive plan could provide better value in the long run.

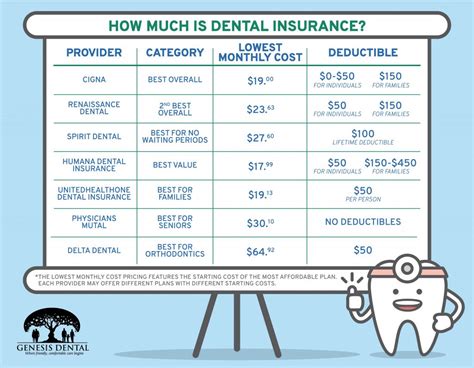

Top Affordable Dental Insurance Providers

Now that we understand the key factors to consider when choosing an affordable dental insurance plan, let’s explore some of the top providers in the market.

Delta Dental

Delta Dental is one of the largest and most reputable dental insurance providers in the United States. They offer a range of affordable plans with extensive coverage, including preventive, basic, and major services. Delta Dental’s network of dentists is extensive, making it convenient to find a provider near you.

MetLife Dental

MetLife Dental is another well-known provider known for its affordable plans. They provide a variety of coverage options, including individual and family plans, with premiums starting as low as $20 per month. MetLife Dental’s plans typically cover a wide range of services, making them an excellent choice for those seeking comprehensive coverage at a reasonable cost.

Cigna Dental

Cigna Dental offers a comprehensive range of dental insurance plans tailored to meet different needs and budgets. Their plans often include additional benefits, such as orthodontic coverage and discounts on specialty services. With a large network of dentists and competitive pricing, Cigna Dental is a popular choice among consumers.

Aetna Dental

Aetna Dental is a trusted provider known for its affordable and flexible plans. They offer a variety of coverage options, including individual, family, and group plans. Aetna’s plans typically provide comprehensive coverage, including preventive, basic, and major services. Additionally, they often offer discounts and incentives to encourage good oral hygiene practices.

Tips for Choosing the Right Dental Insurance Plan

Selecting the best cheap dental insurance plan requires careful consideration of various factors. Here are some tips to help you make an informed decision:

- Assess Your Dental Needs: Evaluate your current and potential future dental requirements. Consider factors like the frequency of dental visits, the need for specialized treatments, and any existing dental issues.

- Compare Premiums and Coverage: Research and compare different providers' premiums and coverage levels. Look for plans that offer the right balance of affordability and coverage to suit your needs.

- Check Network Dentists: Ensure that the plan's network of dentists includes providers near your residence or workplace. This will make it more convenient to access dental care without incurring additional travel expenses.

- Read Reviews and Ratings: Research customer reviews and ratings to get an idea of the provider's reputation and customer satisfaction. This can provide valuable insights into the quality of service and coverage.

- Consider Additional Benefits: Some dental insurance plans offer additional perks, such as discounts on orthodontic treatments or vision care. These benefits can enhance the overall value of your plan.

Maximizing Your Dental Insurance Benefits

Once you’ve chosen your affordable dental insurance plan, it’s essential to understand how to make the most of your coverage. Here are some tips to maximize your benefits:

- Stay Up-to-Date with Preventive Care: Utilize your insurance coverage for regular check-ups, cleanings, and X-rays. Preventive care is crucial for maintaining good oral health and can help identify potential issues early on.

- Understand Your Plan's Coverage Limits: Familiarize yourself with your plan's coverage limits and exclusions. This will help you manage your dental expenses effectively and avoid unexpected out-of-pocket costs.

- Choose In-Network Dentists: Opt for dentists within your insurance provider's network to ensure maximum coverage. Out-of-network providers may result in higher out-of-pocket expenses.

- Take Advantage of Additional Benefits: If your plan offers additional benefits, such as discounts on orthodontic treatments or vision care, make sure to utilize them to enhance your overall healthcare coverage.

Conclusion

Finding the best cheap dental insurance is a crucial step towards ensuring your oral health and financial well-being. By understanding the different coverage levels, researching reputable providers, and comparing premiums and benefits, you can make an informed decision that suits your needs and budget. Remember, investing in affordable dental insurance is an investment in your long-term health and peace of mind.

What is the average cost of dental insurance per month?

+The average cost of dental insurance varies depending on factors such as coverage level, provider, and location. However, as a general guideline, individual plans can range from 25 to 50 per month, while family plans can cost between 50 and 100 per month.

Do I need dental insurance if I don’t have any dental issues?

+While you may not have any pressing dental issues currently, dental insurance is still a worthwhile investment. It encourages regular preventive care, which can help detect potential problems early on. Additionally, unexpected dental emergencies can occur, and having insurance can provide financial protection in such situations.

Can I change my dental insurance provider if I’m not satisfied with my current plan?

+Yes, you have the option to switch dental insurance providers if you’re dissatisfied with your current plan. However, it’s important to note that you may need to fulfill any waiting periods or other requirements set by your new provider before certain procedures are covered.