Average Insurance Cost

When it comes to insurance, one of the most frequently asked questions is: What is the average cost of insurance? Understanding the average insurance costs across various categories can provide valuable insights for individuals and businesses alike. In this comprehensive article, we delve into the world of insurance expenses, exploring the factors that influence these averages and offering a detailed analysis of what you can expect.

The Average Cost of Insurance: A Comprehensive Overview

Insurance, a cornerstone of financial protection, varies significantly in cost depending on numerous factors. From auto insurance to health coverage and property insurance, the average expenses can differ drastically. Let’s embark on a journey to uncover the specifics and provide you with a detailed breakdown.

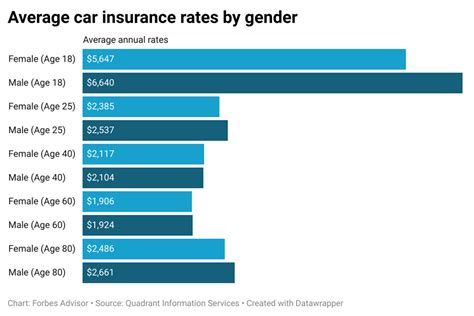

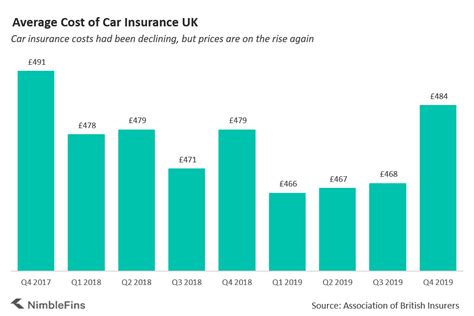

Auto Insurance: Navigating the Average Costs

For many, auto insurance is a necessity. The average cost of car insurance in the United States stands at approximately $1,674 per year, according to recent industry data. However, this figure can fluctuate based on several key factors, including:

- Age and Driving Experience: Younger drivers often face higher premiums due to their perceived higher risk, with an average of $3,276 annually for those under 25. Conversely, mature drivers aged 60 and above enjoy lower rates, averaging around $1,350 per year.

- Location: The state you reside in significantly impacts auto insurance costs. For instance, Michigan boasts the highest average premium at $3,370, while Maine offers the lowest at $915.

- Vehicle Type and Usage: The make and model of your car, as well as how often you drive it, can influence insurance rates. Luxury vehicles and high-performance cars generally command higher premiums.

- Driving Record: A clean driving history can lead to substantial savings, with safe drivers often enjoying discounts on their insurance policies.

| Age Group | Average Annual Premium |

|---|---|

| Under 25 | $3,276 |

| 25-60 | $1,674 |

| 60 and above | $1,350 |

Health Insurance: Unraveling the Average Expenses

Health insurance is a critical aspect of financial well-being. The average cost of health coverage in the U.S. varies depending on the type of plan and the age of the insured individual. Here’s a breakdown:

- Individual Plans: The average premium for an individual health insurance plan is around $450 per month, or approximately $5,400 annually.

- Family Plans: For families, the average cost rises to $1,142 per month, totaling around $13,704 per year.

- Age-Based Premiums: Younger individuals aged 18-24 often pay less, with an average of $300 per month, while those aged 65 and above, eligible for Medicare, may expect to pay $1,500 per month on average.

| Plan Type | Average Monthly Premium |

|---|---|

| Individual | $450 |

| Family | $1,142 |

Property Insurance: Protecting Your Assets

Property insurance, whether for your home or business, is essential to safeguard against unforeseen events. The average costs can vary based on location, type of property, and coverage options.

- Homeowners Insurance: On average, homeowners pay around $1,200 per year for basic coverage. However, this can increase significantly depending on the value of the home and its location. High-risk areas, such as those prone to natural disasters, may see premiums exceed $3,000 annually.

- Renters Insurance: Renters insurance is generally more affordable, with an average cost of $150 to $300 per year, offering coverage for personal belongings and liability protection.

- Business Insurance: The cost of business insurance varies widely based on the industry and size of the business. On average, small businesses pay $600 to $900 per year for general liability coverage, while larger enterprises may incur costs exceeding $10,000 annually for comprehensive protection.

| Property Type | Average Annual Premium |

|---|---|

| Homeowners | $1,200 (basic) - $3,000 (high-risk) |

| Renters | $150 - $300 |

| Small Business | $600 - $900 (general liability) |

Factors Influencing Insurance Costs: A Deeper Dive

Understanding the average insurance costs is just the beginning. Numerous factors come into play when insurers calculate premiums. Let’s explore some of these critical aspects that can impact your insurance expenses.

Risk Assessment and Underwriting

Insurance companies employ complex risk assessment models to determine premiums. These models consider a range of factors, including:

- Historical Claims Data: Insurers analyze past claims to identify patterns and potential risks. High claim rates in a specific area or for a particular demographic can lead to increased premiums.

- Credit Score: Believe it or not, your credit score can influence your insurance rates. A higher credit score often correlates with lower premiums, as it indicates financial responsibility.

- Demographic Factors: Age, gender, and marital status can impact insurance costs. For instance, young, single drivers may face higher auto insurance rates compared to married individuals with a stable driving history.

Coverage Options and Policy Features

The level of coverage you choose directly affects your insurance costs. Opting for comprehensive coverage, which includes additional protections like collision and comprehensive coverage for auto insurance, will typically result in higher premiums. On the other hand, selecting a higher deductible can lead to lower monthly premiums but may require a larger out-of-pocket expense if you need to make a claim.

Discounts and Savings Opportunities

Insurance providers often offer discounts to attract and retain customers. These discounts can significantly reduce your overall insurance costs. Here are some common discounts to look out for:

- Multi-Policy Discounts: Bundling multiple insurance policies, such as auto and home insurance, with the same provider can result in substantial savings.

- Safe Driver Discounts: Maintaining a clean driving record and avoiding accidents or traffic violations can earn you discounts on your auto insurance.

- Loyalty Discounts: Staying with the same insurer for an extended period often leads to loyalty discounts, rewarding your long-term commitment.

Future Implications and Industry Trends

As the insurance industry continues to evolve, several trends and factors will likely shape the average insurance costs in the coming years.

Technological Advancements

The rise of telematics and usage-based insurance is expected to revolutionize the industry. With telematics, insurers can gather real-time data on driving behavior, potentially offering discounts to safe drivers and adjusting premiums based on individual risk profiles. This technology is set to transform the auto insurance landscape.

Changing Risk Landscapes

Climate change and its associated risks, such as increased frequency and severity of natural disasters, will likely impact property insurance costs. Insurers may need to adjust premiums to account for these evolving risks, particularly in high-risk areas.

Healthcare Reforms

Ongoing healthcare reforms and policy changes can influence the cost and availability of health insurance. Monitoring these reforms is essential to understand how they may impact the average expenses for individuals and businesses.

Conclusion: Making Informed Insurance Decisions

Understanding the average insurance costs and the factors that influence them is crucial for making informed decisions. Whether you’re seeking auto, health, or property insurance, arming yourself with knowledge empowers you to negotiate better rates and choose the coverage that best suits your needs and budget.

What is the average cost of life insurance?

+The average cost of life insurance varies based on age, health, and policy type. Term life insurance, the most common type, has an average monthly premium of 20 to 30 for younger individuals, while whole life insurance can cost 100 to 300 per month. The average annual cost is approximately 500 to 1,000 for term life and 1,200 to 3,600 for whole life insurance.

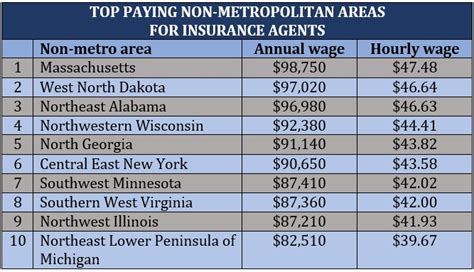

How do insurance costs vary by state?

+Insurance costs can vary significantly by state due to factors like population density, driving conditions, natural disaster risks, and local regulations. For example, auto insurance rates are higher in states with more traffic and accidents, while health insurance premiums can differ based on the cost of healthcare services in the region.

Are there ways to lower my insurance costs?

+Absolutely! You can reduce your insurance costs by shopping around for quotes, maintaining a good driving record (for auto insurance), improving your credit score, and considering higher deductibles. Additionally, bundling multiple insurance policies with the same provider often results in significant savings.