Auto Comparison Insurance

Auto Comparison Insurance: Unlocking Peace of Mind and Financial Protection

In today's fast-paced world, ensuring the safety and security of our vehicles is paramount. Auto insurance serves as a crucial safeguard, providing financial coverage in the event of accidents, theft, or other unforeseen circumstances. With a myriad of insurance providers and policies available, choosing the right coverage can be a daunting task. This comprehensive guide delves into the world of auto comparison insurance, empowering you to make informed decisions and unlock the peace of mind you deserve.

When it comes to safeguarding your vehicle and financial well-being, auto insurance is an essential tool. However, with the vast array of options and providers, navigating the insurance landscape can be complex. That's where auto comparison insurance steps in, offering a simplified and efficient approach to finding the perfect coverage for your needs.

Understanding the Importance of Auto Insurance

Auto insurance is more than just a legal requirement; it's a vital component of responsible vehicle ownership. Whether you're commuting to work, running errands, or embarking on a road trip, unforeseen incidents can occur, leaving you vulnerable to significant financial burdens. From accidents causing property damage to medical expenses and legal liabilities, the potential costs can be staggering.

That's where auto insurance steps in as a vital safety net. It provides financial protection, covering a range of scenarios that can impact your vehicle and your wallet. Whether it's collision coverage for repairing or replacing your vehicle, liability insurance to protect against lawsuits, or comprehensive coverage for non-collision incidents like theft or natural disasters, auto insurance offers a comprehensive safety net.

By understanding the importance of auto insurance and the potential risks it mitigates, you can make informed decisions about your coverage needs. This ensures that you're not only complying with legal requirements but also safeguarding your financial stability and peace of mind.

The Rise of Auto Comparison Insurance

In recent years, the insurance industry has witnessed a transformative shift with the emergence of auto comparison insurance. This innovative approach to insurance shopping simplifies the process, empowering consumers to make well-informed decisions quickly and efficiently.

Auto comparison insurance platforms leverage advanced technology to streamline the insurance shopping experience. These platforms aggregate insurance policies from multiple providers, offering a one-stop shop for consumers to compare and contrast various coverage options. By inputting essential details about their vehicle and driving history, users can access a wealth of information, including policy features, coverage limits, and pricing.

This transparency and convenience have revolutionized the way consumers approach auto insurance. Instead of sifting through countless websites or making countless phone calls, auto comparison insurance platforms provide a centralized hub for comparison. Users can easily navigate through different policies, tailor their coverage to their specific needs, and make informed decisions based on comprehensive data.

Benefits of Auto Comparison Insurance

Simplified Comparison Process

One of the primary advantages of auto comparison insurance is the streamlined comparison process. Instead of spending hours researching and contacting multiple insurance providers, you can access a vast array of policies on a single platform. This efficiency saves you valuable time and effort, allowing you to focus on other aspects of your life while ensuring your vehicle is adequately protected.

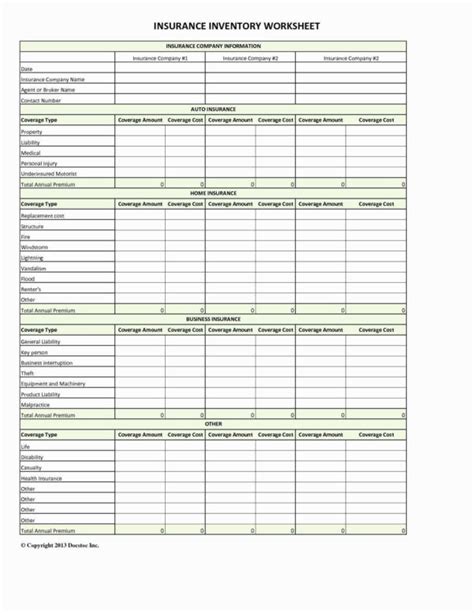

With auto comparison insurance, you can input your vehicle's details, driving history, and desired coverage preferences into a user-friendly interface. The platform then generates a list of relevant policies, displaying key features, coverage limits, and premium estimates. This comprehensive overview empowers you to make apples-to-apples comparisons, ensuring you can make an informed decision with ease.

Personalized Coverage Options

Auto comparison insurance platforms recognize that every driver and vehicle is unique. These platforms offer a range of coverage options, allowing you to tailor your policy to your specific needs. Whether you require comprehensive coverage, liability-only insurance, or specialized add-ons like rental car reimbursement or roadside assistance, auto comparison insurance platforms provide a tailored approach.

By understanding your unique requirements and providing personalized coverage options, auto comparison insurance ensures that you're not overpaying for unnecessary coverage or missing out on vital protections. This tailored approach optimizes your insurance experience, ensuring that your policy aligns perfectly with your driving habits and financial goals.

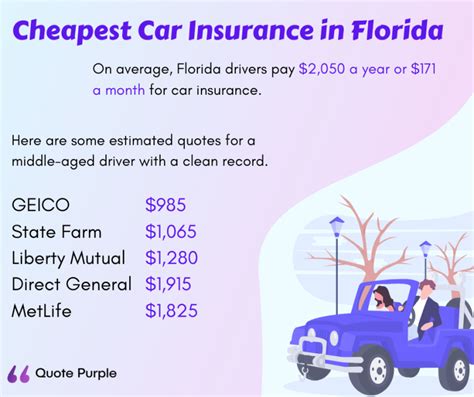

Competitive Pricing and Discounts

One of the most appealing aspects of auto comparison insurance is the potential for significant cost savings. By aggregating policies from multiple providers, these platforms foster competition, driving down prices and offering competitive rates. This benefits consumers, allowing them to secure quality coverage at affordable prices.

Additionally, auto comparison insurance platforms often highlight exclusive discounts and promotions offered by insurance providers. Whether it's multi-policy discounts, loyalty rewards, or safety-related incentives, these discounts can further reduce your insurance premiums. By leveraging these savings opportunities, you can maximize your financial benefits while maintaining comprehensive coverage.

How Auto Comparison Insurance Works

Auto comparison insurance platforms utilize a straightforward process to facilitate the comparison and selection of insurance policies. Here's a step-by-step breakdown of how these platforms work:

Step 1: Provide Vehicle and Driver Information

To initiate the comparison process, you'll need to input essential details about your vehicle and driving history. This includes information such as your vehicle's make, model, year, and mileage, as well as your personal details like name, address, and driver's license number. Accurate and comprehensive information ensures that the platform can generate accurate policy comparisons.

Step 2: Select Coverage Preferences

Once you've provided the necessary vehicle and driver information, the platform will prompt you to select your desired coverage preferences. This step allows you to specify the type of coverage you require, such as liability-only insurance, comprehensive coverage, or specialized add-ons. By indicating your coverage needs, the platform can filter and present relevant policies that align with your preferences.

Step 3: Compare Policy Options

With your vehicle and coverage preferences entered, the auto comparison insurance platform will generate a list of suitable policies from multiple providers. Each policy will be accompanied by a comprehensive overview, including coverage limits, policy features, and estimated premiums. This transparent comparison allows you to assess the pros and cons of each policy, making it easier to identify the best fit for your needs.

Step 4: Review and Select Your Policy

After carefully evaluating the policy options presented, you can select the one that best suits your requirements. The auto comparison insurance platform will guide you through the application process, providing a seamless transition from comparison to coverage. This step may involve additional documentation, such as vehicle registration or proof of prior insurance, to finalize your policy selection.

Step 5: Enjoy Peace of Mind

Once you've completed the application process and secured your chosen policy, you can rest assured knowing that your vehicle and financial well-being are protected. Auto comparison insurance provides peace of mind, ensuring that you've made an informed decision and secured the right coverage at a competitive price. With your policy in place, you can drive with confidence, knowing that you're prepared for any unexpected incidents that may arise.

Key Considerations for Choosing the Right Auto Insurance

Understanding Your Coverage Needs

Before diving into auto comparison insurance, it's crucial to assess your specific coverage needs. Consider factors such as the value of your vehicle, your driving habits, and any additional risks you may face. For instance, if you frequently drive in high-risk areas or have a history of accidents, you may require more extensive coverage to protect your financial interests.

By evaluating your unique circumstances, you can determine the type and level of coverage that best aligns with your needs. This self-assessment ensures that you're not overpaying for unnecessary features or underinsured for potential risks. It empowers you to make informed decisions and tailor your policy to your specific requirements.

Researching Insurance Providers

While auto comparison insurance platforms streamline the comparison process, it's still essential to conduct research on the insurance providers offering the policies. Look into the reputation, financial stability, and customer satisfaction ratings of each provider. This due diligence ensures that you're entrusting your coverage to a reliable and reputable company.

Additionally, consider the claims process and customer service offered by each provider. In the event of an accident or incident, you want to work with an insurer that provides efficient and responsive support. Researching customer reviews and feedback can provide valuable insights into the quality of service you can expect.

Reading the Fine Print

When comparing auto insurance policies, it's crucial to thoroughly review the fine print. Pay close attention to coverage limits, deductibles, and any exclusions or limitations that may impact your coverage. Understanding these nuances ensures that you're fully aware of what is and isn't covered by your policy.

Additionally, review the policy's terms and conditions, including any provisions related to policy cancellation, rate increases, or dispute resolution. Being aware of these details empowers you to make informed decisions and ensures that you're not caught off guard by unexpected policy provisions.

The Future of Auto Insurance: Embracing Innovation

The insurance industry is constantly evolving, driven by technological advancements and changing consumer expectations. As we look towards the future, auto insurance is poised to embrace innovative solutions that enhance the customer experience and provide even greater protection.

Telematics and Usage-Based Insurance

Telematics technology, which utilizes sensors and GPS tracking, is revolutionizing the way insurance is priced and delivered. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, leverages telematics data to assess driving behavior and tailor insurance premiums accordingly.

By analyzing factors such as driving speed, acceleration, braking patterns, and mileage, usage-based insurance offers a more accurate reflection of individual driving habits. This data-driven approach allows insurers to provide personalized premiums, rewarding safe drivers with lower rates while encouraging safer driving behaviors across the board.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming various industries, and insurance is no exception. These technologies are being leveraged to streamline claims processing, enhance risk assessment, and personalize insurance offerings.

AI-powered chatbots and virtual assistants are enhancing customer service, providing instant support and resolving queries efficiently. ML algorithms are being used to analyze vast amounts of data, enabling insurers to identify patterns and trends that influence risk and pricing. This data-driven approach enables more accurate risk assessment and the development of innovative coverage options tailored to individual needs.

Blockchain and Smart Contracts

Blockchain technology, known for its security and transparency, is finding applications in the insurance industry. Smart contracts, self-executing contracts with predefined rules, are being leveraged to automate various insurance processes, including claims handling and policy management.

By utilizing blockchain, insurers can create secure and tamper-proof records of insurance policies, claims, and payments. This technology enhances transparency, reduces fraud, and improves the overall efficiency of insurance transactions. Smart contracts can automate claim settlements, triggering payments based on predefined conditions, further streamlining the claims process and enhancing customer satisfaction.

Expert Tips for Maximizing Your Auto Insurance Experience

Bundle Your Policies for Savings

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with a single insurer. Many providers offer multi-policy discounts, providing significant savings on your overall insurance premiums. By consolidating your insurance needs, you can simplify your coverage and potentially unlock substantial cost savings.

Utilize Safe Driving Programs

Many insurance providers offer safe driving programs or discounts that reward drivers for maintaining a clean driving record. These programs may involve telematics devices or apps that track your driving behavior, rewarding safe driving habits with lower premiums. By participating in these programs, you can not only save money but also develop safer driving habits, reducing your risk of accidents and enhancing your overall driving experience.

Review Your Policy Regularly

Your insurance needs may evolve over time, whether due to changes in your vehicle, driving habits, or personal circumstances. Regularly reviewing your auto insurance policy ensures that your coverage remains aligned with your current requirements. Assess your policy annually or whenever significant life changes occur, such as purchasing a new vehicle, moving to a different location, or adding a young driver to your policy.

Take Advantage of Loyalty Rewards

Many insurance providers offer loyalty rewards or discounts for long-term customers. These rewards can include reduced premiums, bonus coverage, or other incentives that appreciate your loyalty. By staying with the same insurer and maintaining a good claims history, you can unlock these loyalty benefits, further maximizing your insurance experience and savings.

💡 Pro Tip: Stay informed about industry trends and emerging technologies in auto insurance. By staying ahead of the curve, you can leverage innovative solutions, access new coverage options, and make informed decisions that align with your evolving needs and preferences.

Conclusion

Auto comparison insurance has revolutionized the way consumers approach auto insurance, offering a simplified and efficient process for finding the perfect coverage. By understanding the importance of auto insurance, embracing the benefits of auto comparison insurance, and considering key factors in your decision-making, you can unlock peace of mind and financial protection with confidence.

As the insurance industry continues to evolve, embracing innovation and technological advancements, auto comparison insurance will play an even more significant role in empowering consumers. By staying informed, conducting thorough research, and maximizing the benefits of auto comparison insurance, you can navigate the insurance landscape with ease and make informed decisions that align with your unique needs.

Frequently Asked Questions

How do I know if auto comparison insurance is right for me?

+Auto comparison insurance is an excellent option for those seeking a streamlined and efficient approach to finding the right auto insurance coverage. If you value convenience, transparency, and the ability to compare multiple policies in one place, auto comparison insurance can be a great fit. It empowers you to make informed decisions quickly and efficiently, ensuring you get the coverage you need at a competitive price.

Can I trust the accuracy of the information provided by auto comparison insurance platforms?

+Yes, auto comparison insurance platforms prioritize accuracy and transparency. They work closely with insurance providers to ensure that the information displayed on their platforms is up-to-date and reliable. Additionally, these platforms often undergo rigorous verification processes to maintain the integrity of the data presented. However, it’s always recommended to verify key details with the insurance provider directly to ensure accuracy and clarity.

What should I do if I have multiple vehicles and want to insure them all under one policy?

+If you have multiple vehicles, you can explore the option of multi-car insurance policies. Many insurance providers offer discounts and streamlined coverage for insuring multiple vehicles under one policy. When comparing auto insurance options, specify that you have multiple vehicles and seek policies that cater to your specific needs. This can help you save time and money while ensuring comprehensive coverage for all your vehicles.

Are there any limitations or exclusions I should be aware of when using auto comparison insurance platforms?

+While auto comparison insurance platforms provide valuable insights and comparisons, it’s important to be aware of certain limitations. These platforms aggregate information from multiple providers, but the availability and accuracy of data may vary. Additionally, some specialized coverage options or unique circumstances may not be fully represented on these platforms. Always review the fine print of each policy and consult with the insurance provider directly to ensure you understand any limitations or exclusions that may apply.

How can I ensure I’m getting the best possible rate for my auto insurance coverage?

+To secure the best possible rate for your auto insurance coverage, consider the following strategies: compare quotes from multiple providers, utilize auto comparison insurance platforms to streamline the process, review your coverage needs annually and adjust as necessary, explore discounts and loyalty programs offered by insurance providers, and maintain a clean driving record to qualify for lower premiums. By actively managing your insurance and staying informed about available options, you can optimize your coverage and secure the best rates.