Usage Based Insurance

Usage-based insurance (UBI), also known as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD), is a revolutionary concept in the automotive insurance industry. It has gained significant traction in recent years, offering a fresh perspective on how vehicle insurance is priced and tailored to individual drivers. This innovative approach to insurance promises to provide more personalized coverage and potentially reduce costs for safe drivers. In this comprehensive article, we will delve into the intricacies of UBI, exploring its mechanics, benefits, challenges, and its impact on the future of automotive insurance.

Understanding Usage-Based Insurance

Usage-based insurance is a data-driven insurance model that calculates policy premiums based on an individual driver’s actual usage and driving behavior. Unlike traditional insurance, which typically relies on demographic factors and historical claims data, UBI utilizes real-time information collected from vehicles to assess risk and determine insurance rates.

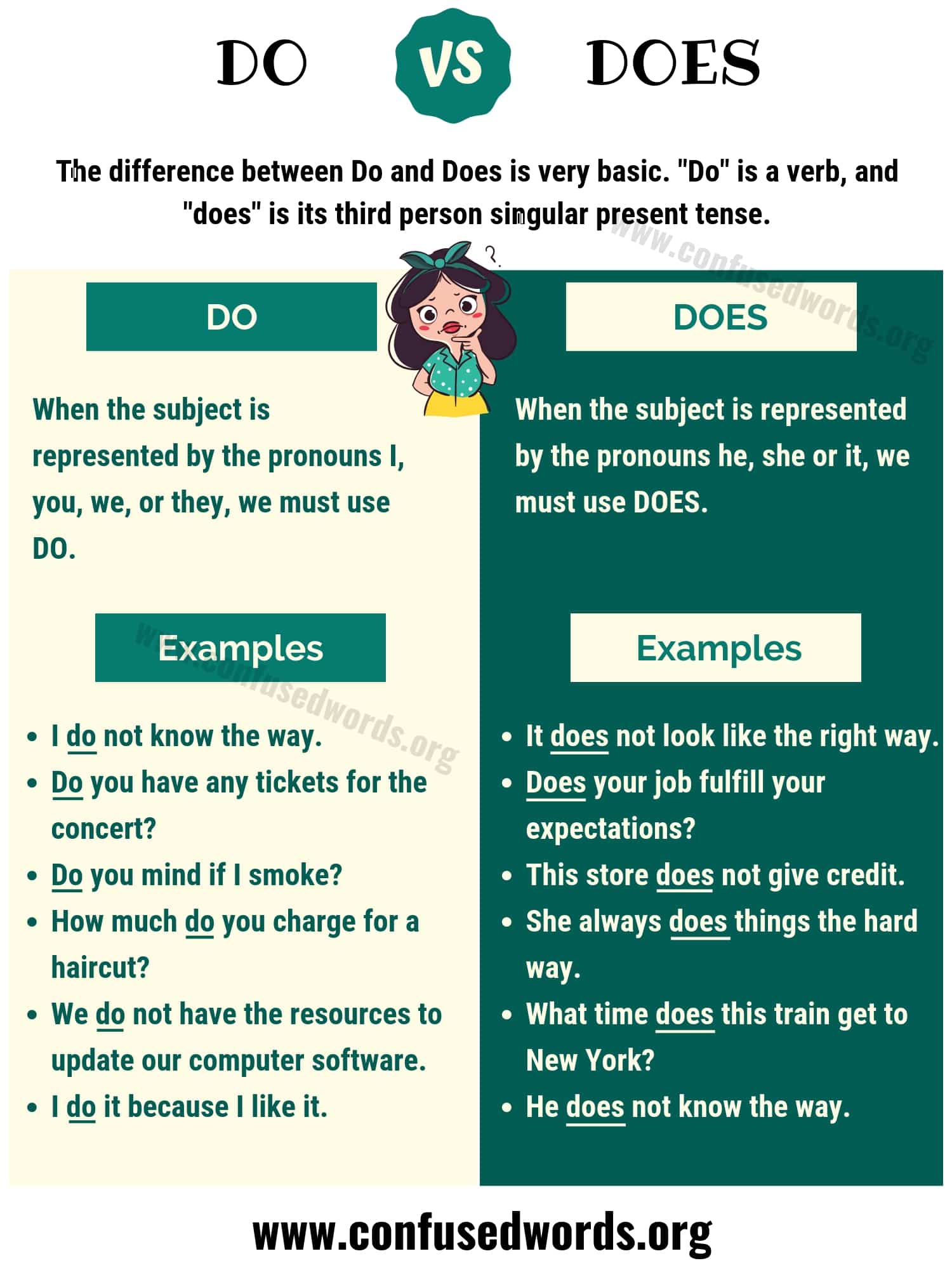

How Does UBI Work?

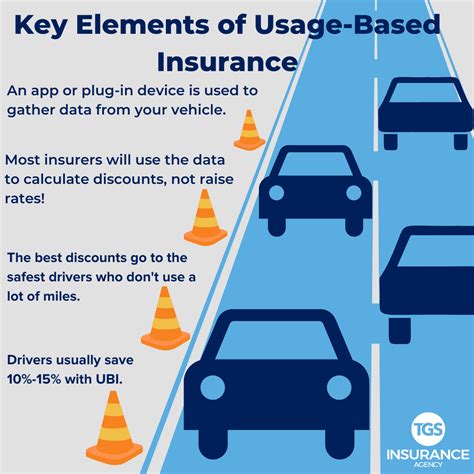

UBI operates by installing a telematics device or smartphone app in the insured vehicle. This device or app collects and transmits data such as driving distance, speed, acceleration, braking patterns, time of day, and even the driver’s location. Insurance companies analyze this data to gain insights into the driver’s behavior and the potential risks associated with their driving habits.

The collected data is then processed using sophisticated algorithms and risk models. These models assess factors like the frequency and severity of hard braking, the consistency of speeding, and the time spent on high-risk roads. Based on these analyses, insurance companies can assign a risk score to the driver, which directly influences their insurance premium.

For instance, a driver who consistently maintains a safe speed, avoids sudden braking, and drives during daylight hours may receive a lower risk score, resulting in a more affordable insurance policy. Conversely, a driver who frequently speeds, brakes harshly, and drives at night might be considered a higher risk, leading to a higher premium.

Types of UBI Programs

UBI programs can be categorized into two main types: mileage-based and behavior-based insurance.

- Mileage-based Insurance: In this model, insurance premiums are primarily calculated based on the number of miles driven. Insurers assume that drivers who cover fewer miles are likely to be involved in fewer accidents, thus posing a lower risk. This type of UBI is particularly attractive to low-mileage drivers who can benefit from substantial savings.

- Behavior-based Insurance: This type of UBI focuses on the driver's behavior and driving habits. It takes into account factors like speeding, harsh acceleration, and braking. By incentivizing safe driving practices, behavior-based UBI aims to encourage drivers to adopt safer habits, which can lead to reduced accidents and, consequently, lower insurance costs.

Benefits of Usage-Based Insurance

UBI offers a range of advantages to both drivers and insurance companies. Here are some key benefits:

Personalized Premiums

One of the most significant advantages of UBI is its ability to provide individualized insurance rates. Traditional insurance often relies on broad generalizations and demographic data, which may not accurately reflect an individual’s driving habits. UBI, on the other hand, tailors premiums to the specific behavior and usage of each driver, ensuring a fairer and more accurate pricing structure.

Incentivizing Safe Driving

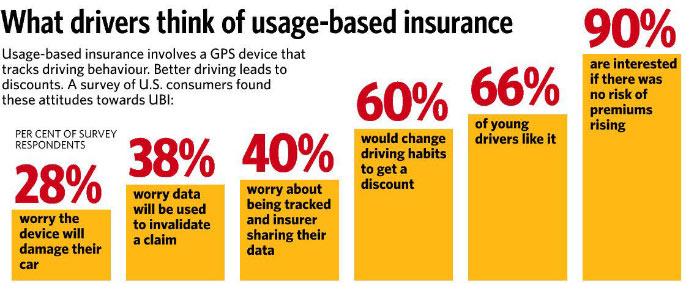

UBI acts as a powerful motivator for drivers to adopt safer driving practices. Knowing that their insurance premiums are directly linked to their behavior, drivers are encouraged to drive more cautiously, reducing the likelihood of accidents and claims. This not only benefits the individual driver but also contributes to overall road safety.

Potential Cost Savings

For drivers with safe driving records and low mileage, UBI can lead to significant cost savings. These drivers, who may have been paying higher premiums under traditional insurance models, can now benefit from more affordable policies. Additionally, UBI allows drivers to make informed decisions about their driving habits, potentially reducing their insurance costs over time.

Data-Driven Insights

UBI generates a wealth of data on driving behavior and vehicle usage. Insurance companies can use this data to gain valuable insights into risk factors, identify trends, and develop more accurate risk models. This data-driven approach enables insurers to offer more competitive rates and improve the overall efficiency of the insurance market.

Challenges and Considerations

While UBI presents numerous benefits, it also comes with its own set of challenges and considerations.

Privacy Concerns

One of the primary concerns associated with UBI is privacy. The collection and transmission of driving data raises questions about the potential invasion of personal privacy. Insurance companies must ensure that they adhere to strict data protection regulations and maintain the confidentiality of their customers’ information.

Driver Education and Awareness

To maximize the benefits of UBI, drivers need to be educated and aware of how their driving behavior impacts their insurance rates. Insurance companies should provide clear and transparent information to customers, helping them understand the factors that influence their premiums. This education can empower drivers to make informed choices and actively improve their driving habits.

Technical Challenges

Implementing UBI programs requires robust technological infrastructure. Insurance companies must invest in telematics devices, smartphone apps, and secure data transmission systems. Ensuring the accuracy and reliability of the collected data is crucial to maintain the integrity of the UBI model.

Performance Analysis and Real-World Examples

UBI has been implemented in various regions around the world, and its performance has been closely monitored. Let’s examine some real-world examples and analyze the impact of UBI on the insurance industry.

UBI in Practice

In the United States, several insurance companies have embraced UBI, offering policies that reward safe drivers. For instance, Progressive Insurance introduced its Snapshot program, which provides drivers with a discount based on their driving behavior. Similarly, State Farm offers a Drive Safe & Save program, using telematics data to adjust premiums.

In Europe, UBI has also gained traction. Allianz, a leading insurance provider, launched its MyDriving program in several countries, offering mileage-based insurance with potential discounts for low-mileage drivers. This program has been well-received, especially among urban residents who tend to drive less.

Performance Metrics

UBI programs have demonstrated positive results in terms of accident reduction and claim frequency. A study conducted by the Insurance Institute for Highway Safety (IIHS) found that UBI programs led to a significant decrease in accidents among participating drivers. Additionally, insurance companies have reported increased customer satisfaction and loyalty, as drivers feel empowered by the transparency and control UBI offers.

| Insurance Company | UBI Program | Discount Potential |

|---|---|---|

| Progressive | Snapshot | Up to 30% |

| State Farm | Drive Safe & Save | Discount based on driving behavior |

| Allianz | MyDriving | Up to 30% for low-mileage drivers |

Future Implications and Industry Insights

The adoption of UBI is expected to have a significant impact on the future of automotive insurance. Here are some insights into its potential implications:

Increased Competition

UBI has the potential to intensify competition among insurance providers. With more accurate risk assessment and personalized premiums, customers will have a wider range of options, leading to a more competitive insurance market. This competition could drive innovation and further improvements in UBI programs.

Data-Driven Risk Management

The vast amount of data generated by UBI programs will enable insurance companies to refine their risk models and make more precise predictions. This data-driven approach will lead to better-informed underwriting decisions, ultimately benefiting both insurers and customers.

Incentivizing Autonomous Vehicles

As autonomous vehicles become more prevalent, UBI could play a crucial role in their adoption. By offering discounts for drivers who utilize autonomous features, UBI can encourage the transition to self-driving technology, which has the potential to significantly reduce accidents and improve road safety.

Frequently Asked Questions

How accurate is the data collected by UBI devices or apps?

+

UBI devices and apps utilize advanced technology to collect accurate data. They employ GPS, accelerometers, and other sensors to measure driving behavior. While some variations may occur due to environmental factors, the overall data collection process is highly reliable.

Can UBI help me save money on my insurance premiums?

+

Absolutely! UBI is designed to reward safe driving habits. If you consistently drive safely and avoid risky behaviors, you can potentially qualify for significant discounts on your insurance premiums. It’s a great way to incentivize safer driving and save money.

Are there any privacy concerns with UBI?

+

Privacy is a valid concern with any data-driven system. However, reputable insurance companies take privacy seriously and adhere to strict data protection regulations. They ensure that your personal information is securely stored and used only for the purpose of calculating your insurance premiums. It’s essential to review the privacy policies of the insurance provider before enrolling in a UBI program.

Can I opt out of UBI if I don’t want my driving behavior tracked?

+

Yes, opting out of UBI is an option. While UBI programs offer potential savings, some drivers may prefer traditional insurance policies. You have the choice to select the type of insurance that best suits your preferences and comfort level.

What happens if I have an accident while enrolled in a UBI program?

+

If you have an accident while enrolled in a UBI program, the process for filing a claim remains similar to traditional insurance. You’ll need to contact your insurance provider, provide details about the accident, and follow their claim procedures. The UBI program’s data may be used to assess fault and determine the appropriate course of action for your claim.

Usage-based insurance represents a significant evolution in the automotive insurance industry. By leveraging technology and data-driven insights, UBI offers a more personalized and fair approach to insurance pricing. While it presents challenges, the potential benefits, including safer roads and cost savings for responsible drivers, make UBI an exciting development in the world of insurance. As UBI continues to gain traction, it will undoubtedly shape the future of automotive insurance, providing more options and control to drivers worldwide.