Quotes For Homeowners Insurance

Homeownership is a significant milestone and a responsibility that comes with its own set of challenges. One of the crucial aspects of protecting your home and assets is securing the right homeowners insurance. In the world of insurance, quotes are the gateway to understanding coverage options and costs. This article aims to delve into the intricate world of homeowners insurance quotes, offering expert insights and a comprehensive guide to help you make informed decisions.

Understanding Homeowners Insurance Quotes

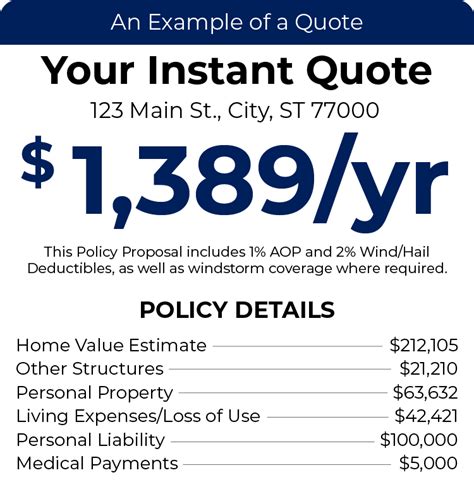

Homeowners insurance quotes are tailored assessments provided by insurance companies to estimate the cost of insuring your home and its contents. These quotes are based on a variety of factors that influence the risk associated with your property. It's essential to recognize that every insurance company uses its unique algorithm to calculate quotes, making it vital to compare multiple options to find the best fit for your needs.

When requesting quotes, insurance companies consider various aspects of your home and its location. Here are some key factors that influence homeowners insurance quotes:

- Home Value and Size: The overall value and size of your home play a significant role. Larger homes with higher replacement costs will typically require more coverage and result in higher insurance premiums.

- Location: Your home's location is a critical factor. Areas prone to natural disasters like hurricanes, floods, or earthquakes may attract higher insurance costs due to the increased risk of damage.

- Construction Type: The materials used in your home's construction can impact insurance rates. For instance, homes built with fire-resistant materials might attract lower premiums compared to those constructed with more flammable materials.

- Age of the Home: Older homes may require more maintenance and repairs, leading to higher insurance costs. Newer homes, on the other hand, might benefit from modern construction techniques and materials, resulting in lower premiums.

- Claim History: Insurance companies consider your past insurance claims. A history of frequent claims could lead to higher premiums or even difficulty in securing insurance.

- Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, but it's essential to consider your financial capabilities when selecting a deductible.

- Coverage Options: Homeowners insurance offers various coverage types, including liability, dwelling, personal property, and additional living expenses. The level of coverage you choose will impact your insurance costs.

Obtaining Accurate Quotes

To obtain accurate homeowners insurance quotes, it's crucial to provide detailed and honest information about your home and its features. Here are some steps to ensure you get precise quotes:

- Research Insurance Companies: Start by researching reputable insurance companies that offer homeowners insurance. Look for companies with a solid financial background and positive customer reviews. You can find valuable information on insurance comparison websites and financial rating agencies.

- Prepare Your Information: Gather essential details about your home, including its age, size, construction type, and any recent renovations or additions. Have your current insurance policy, if you have one, handy for reference.

- Request Multiple Quotes: Contact several insurance companies and request quotes. Be prepared to provide the same information to each company to ensure a fair comparison. Online quote tools can be a convenient way to start the process, but consider following up with a phone call or meeting with an insurance agent to discuss your specific needs.

- Review Coverage Options: Carefully review the coverage options offered by each insurance company. Ensure you understand the differences in coverage limits, deductibles, and additional coverage options like flood or earthquake insurance.

- Consider Bundling: Many insurance companies offer discounts when you bundle multiple insurance policies, such as homeowners insurance with auto insurance. Consider the potential savings and convenience of bundling your policies with the same provider.

- Seek Professional Advice: Consult with an insurance agent or broker who can provide personalized advice based on your specific needs and circumstances. They can help you navigate the complex world of insurance and find the best coverage at the most competitive rates.

Analyzing and Comparing Quotes

Once you have obtained multiple homeowners insurance quotes, it's time to analyze and compare them to make an informed decision. Here are some key considerations:

Coverage Limits and Deductibles

Compare the coverage limits offered by each insurance company. Ensure the limits are sufficient to cover the replacement cost of your home and its contents. Also, consider the impact of different deductibles on your out-of-pocket expenses. Higher deductibles can lower premiums, but it's essential to choose a deductible you can comfortably afford in the event of a claim.

Additional Coverage Options

Evaluate the additional coverage options provided by each insurance company. Consider if you require specialized coverage for valuables like jewelry or fine art, or if you live in an area prone to natural disasters and need additional coverage for such events.

Customer Service and Claims Handling

Research the reputation of each insurance company for customer service and claims handling. Read online reviews and seek recommendations from friends and family to gauge the company's responsiveness and fairness in handling claims. A company with a strong track record in these areas can provide peace of mind during challenging times.

Discounts and Savings

Look for opportunities to save on your homeowners insurance. Many insurance companies offer discounts for various reasons, such as bundling policies, installing security systems, or having certain safety features in your home. Ask about available discounts and ensure you meet the criteria to take advantage of them.

| Insurance Company | Annual Premium | Coverage Limits | Deductible Options |

|---|---|---|---|

| Company A | $1,200 | $500,000 | $500, $1,000, $2,000 |

| Company B | $1,100 | $400,000 | $1,000, $2,500, $5,000 |

| Company C | $1,350 | $600,000 | $500, $1,500, $3,000 |

Note: The table above provides a simplified example of annual premiums, coverage limits, and deductible options for three different insurance companies. Remember that your specific quotes may vary based on your home's characteristics and location.

Tips for Negotiating and Saving on Homeowners Insurance

Negotiating your homeowners insurance rates can be a challenging but rewarding endeavor. Here are some tips to help you save on your insurance premiums:

- Shop Around: As mentioned earlier, obtaining multiple quotes is essential. By shopping around, you can compare rates and coverage options, increasing your chances of finding a more competitive policy.

- Understand Your Risks: Be aware of the risks associated with your home and location. If you live in an area prone to natural disasters, consider investing in mitigation measures to reduce the risk of damage. This can lead to lower insurance premiums.

- Increase Your Deductible: Opting for a higher deductible can significantly reduce your insurance premiums. However, ensure you can afford the increased out-of-pocket expense in the event of a claim.

- Bundle Your Policies: Bundling your homeowners insurance with other policies, such as auto insurance, can lead to substantial savings. Many insurance companies offer multi-policy discounts, making it a financially wise decision.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current circumstances. This includes considering any home improvements or additions that might impact your insurance needs.

- Install Safety Features: Installing security systems, fire alarms, and other safety features can lower your insurance premiums. Insurance companies often reward homeowners who take proactive measures to protect their homes.

- Negotiate with Your Current Insurer: If you've been a loyal customer with a good claims history, don't hesitate to negotiate with your current insurance company. They may be willing to offer you a better rate to retain your business.

Common Misconceptions and Frequently Asked Questions

Is homeowners insurance mandatory?

+While homeowners insurance is not legally required in all states, it is highly recommended. Most mortgage lenders will require you to have homeowners insurance as a condition of your loan. Even if it's not mandatory, it's a wise financial decision to protect your home and assets.

What does homeowners insurance typically cover?

+Homeowners insurance typically provides coverage for your home's structure, personal belongings, liability protection, and additional living expenses if you need to evacuate due to a covered event. It also covers certain types of damage, such as fire, theft, and natural disasters (depending on your policy and exclusions).

How often should I review my homeowners insurance policy?

+It's recommended to review your homeowners insurance policy annually or whenever your circumstances change. This includes significant home improvements, additions, or changes in your personal property. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I save money on homeowners insurance if I have a security system?

+Yes, many insurance companies offer discounts for homes equipped with security systems. These systems can deter burglaries and reduce the risk of fire, leading to lower insurance premiums. Be sure to discuss this with your insurance provider to take advantage of any available discounts.

What happens if I need to file a claim with my homeowners insurance?

+If you need to file a claim, contact your insurance company immediately and provide them with all the necessary details. They will guide you through the claims process, which typically involves documenting the damage, submitting supporting evidence, and working with an adjuster to determine the value of your claim.

Homeowners insurance quotes are a critical step in securing the right coverage for your home. By understanding the factors that influence quotes and following the expert tips provided in this article, you can navigate the insurance landscape with confidence. Remember, taking the time to compare quotes and seek professional advice can lead to significant savings and peace of mind.

Stay informed, and happy homeownership!