Best House Insurance Rates

When it comes to safeguarding your home and possessions, finding the best house insurance rates is a crucial aspect of financial planning. With a wide range of insurance providers and policy options available, it can be challenging to navigate the market and secure the most advantageous coverage for your needs. In this comprehensive guide, we will delve into the world of home insurance, exploring the factors that influence rates, comparing different providers, and providing you with the knowledge and tools to make informed decisions.

Understanding the Fundamentals of House Insurance

House insurance, also known as homeowners insurance, is a financial safety net designed to protect homeowners against a variety of risks and liabilities. It provides coverage for the structure of your home, your personal belongings, and offers liability protection in the event of accidents or injuries that occur on your property. Understanding the fundamentals of house insurance is essential to ensure you receive adequate coverage while securing the most competitive rates.

Key Components of House Insurance Policies

House insurance policies typically consist of several key components, each covering specific aspects of your home and its contents. These components include:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and foundation. It provides financial protection in the event of damage caused by perils such as fire, storms, or vandalism.

- Personal Property Coverage: This component safeguards your personal belongings, such as furniture, electronics, and clothing. It covers losses due to theft, fire, or other covered perils.

- Liability Coverage: Liability insurance protects you against financial losses resulting from accidents or injuries that occur on your property. It covers medical expenses and legal fees if a visitor or passerby is injured on your premises.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage provides reimbursement for temporary living expenses, such as hotel stays or rental costs, until your home is repaired or rebuilt.

- Optional Coverages: Many house insurance policies offer optional add-ons to cater to specific needs. These can include coverage for high-value items like jewelry or artwork, identity theft protection, or coverage for natural disasters like earthquakes or floods.

Factors Influencing House Insurance Rates

House insurance rates can vary significantly depending on a multitude of factors. Understanding these factors is crucial when comparing policies and seeking the best rates. Here are some key considerations:

Location and Regional Factors

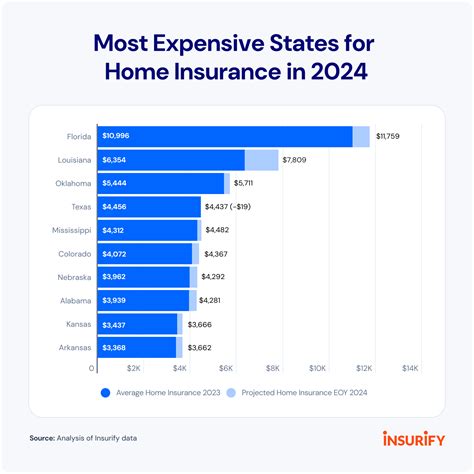

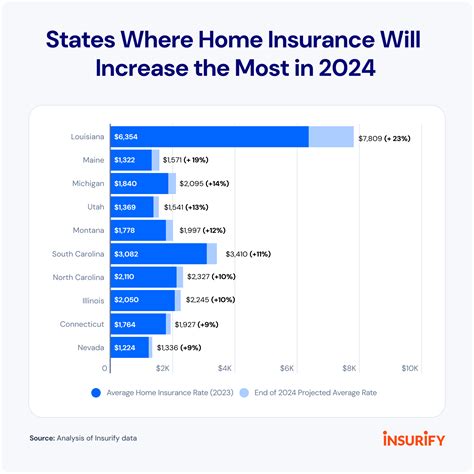

The location of your home plays a significant role in determining insurance rates. Insurance providers assess the risk associated with different areas based on factors such as crime rates, natural disasters, and proximity to emergency services. For instance, homes located in areas prone to hurricanes, wildfires, or floods may face higher insurance premiums.

Home Value and Replacement Cost

The value of your home and the cost to rebuild it are crucial factors in determining insurance rates. Insurance providers assess the replacement cost, which takes into account the current market value of your home and the expenses associated with rebuilding it in the event of a total loss. Higher replacement costs generally result in higher insurance premiums.

Coverage Amount and Deductibles

The amount of coverage you choose and the corresponding deductibles are key elements in determining your insurance rates. Higher coverage limits typically result in higher premiums, while opting for a higher deductible can lower your monthly payments. It’s essential to strike a balance between adequate coverage and a manageable deductible.

Claims History and Credit Score

Your insurance claims history and credit score can impact the rates offered by insurance providers. A history of frequent claims may lead to higher premiums, as it indicates a higher risk profile. Similarly, a good credit score can be advantageous, as it demonstrates financial stability and may result in more favorable rates.

Security and Safety Features

The presence of security and safety features in your home can influence insurance rates. Installing smoke detectors, fire sprinklers, burglar alarms, or reinforcing your home’s security with reinforced doors and windows can potentially lower your insurance premiums. Insurance providers often offer discounts for homes with enhanced safety measures.

Comparing House Insurance Providers

With a myriad of insurance providers offering house insurance policies, it’s essential to compare their offerings to find the best rates and coverage. Here’s a breakdown of key aspects to consider when comparing providers:

Coverage Options and Customization

Different insurance providers offer varying levels of coverage and customization options. Assess the extent to which each provider allows you to tailor your policy to your specific needs. Look for providers that offer comprehensive coverage options, including additional living expenses, personal liability, and coverage for high-value items.

Financial Stability and Reputation

The financial stability and reputation of an insurance provider are crucial considerations. Research the provider’s financial health, customer satisfaction ratings, and their track record in handling claims. A financially stable provider with a good reputation is more likely to offer reliable coverage and efficient claim resolution.

Customer Service and Claims Handling

Evaluating the quality of customer service and claims handling processes is essential. Look for providers with a reputation for prompt and efficient claim handling, as well as easy access to customer support. Consider factors such as online resources, mobile apps, and the availability of dedicated customer service representatives.

Discounts and Bundle Options

Insurance providers often offer discounts and bundle options to attract customers. Explore the discounts available with each provider, such as multi-policy discounts (combining home and auto insurance), loyalty discounts, or discounts for security features. Bundling multiple policies with the same provider can sometimes result in significant savings.

Policy Features and Additional Benefits

Pay close attention to the policy features and additional benefits offered by each provider. Some providers may offer unique coverage options, such as identity theft protection, pet injury coverage, or coverage for home-based businesses. Additionally, consider the flexibility of the provider in accommodating changes to your policy, such as adding or removing coverage as your needs evolve.

Tips for Securing the Best House Insurance Rates

To ensure you obtain the best house insurance rates, consider implementing the following strategies:

Shop Around and Compare Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. Utilize online comparison tools or seek quotes directly from providers to get a comprehensive understanding of the market. Shopping around allows you to identify the most competitive rates and tailor your policy to your specific needs.

Increase Your Deductible

Opting for a higher deductible can lead to lower insurance premiums. While it may require a larger out-of-pocket expense in the event of a claim, a higher deductible can result in significant savings on your monthly payments. Assess your financial situation and determine a deductible amount that aligns with your comfort level.

Bundle Policies for Discounts

Combining your house insurance with other policies, such as auto insurance or life insurance, can often result in substantial discounts. Many insurance providers offer multi-policy discounts, providing an incentive to bundle your coverage with them. By consolidating your insurance needs, you can save money and streamline your insurance management.

Maintain a Good Credit Score

A good credit score can positively impact your insurance rates. Insurance providers often use credit scores as an indicator of financial stability and responsibility. Maintaining a high credit score can lead to more favorable insurance rates and demonstrate your reliability as a policyholder.

Implement Safety and Security Measures

Installing security and safety features in your home can not only enhance your peace of mind but also potentially lower your insurance premiums. Consider investing in smoke detectors, fire sprinklers, burglar alarms, or reinforced entry points. Many insurance providers offer discounts for homes with enhanced security measures, recognizing the reduced risk associated with these features.

Regularly Review and Adjust Your Coverage

As your life circumstances change, it’s essential to review and adjust your house insurance coverage accordingly. Major life events such as renovations, additions to your home, or changes in your personal belongings can impact the value of your property and the level of coverage required. Regularly assess your coverage to ensure it remains adequate and aligned with your current needs.

The Future of House Insurance: Technological Innovations

The insurance industry is witnessing a wave of technological advancements that are transforming the way house insurance is offered and managed. These innovations are enhancing the customer experience, improving efficiency, and potentially lowering insurance rates. Here’s a glimpse into the future of house insurance:

Digital Transformation and Online Portals

Insurance providers are embracing digital transformation, offering online portals and mobile apps for policyholders. These digital platforms provide convenient access to policy information, allow for easy claim submissions, and enable policyholders to manage their coverage directly. The efficiency and convenience offered by digital platforms can lead to cost savings, which may be passed on to customers in the form of lower insurance rates.

Telematics and Usage-Based Insurance

Telematics technology, which utilizes sensors and data collection devices, is being applied to house insurance. This technology enables insurance providers to gather real-time data on factors such as home occupancy, energy usage, and security measures. By analyzing this data, providers can offer usage-based insurance, where premiums are tailored to individual risk profiles. This innovative approach to insurance pricing can lead to more accurate rates and potentially lower costs for policyholders.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the insurance industry. These technologies enable insurance providers to analyze vast amounts of data, identify patterns, and make more accurate predictions about risk. By leveraging AI and ML, providers can offer personalized insurance products, improve claim handling processes, and potentially reduce costs associated with manual underwriting and claims assessment. The efficiency gains and improved risk assessment capabilities brought about by AI and ML can positively impact insurance rates.

Blockchain Technology and Smart Contracts

Blockchain technology, known for its secure and transparent nature, is being explored for its potential in the insurance industry. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can automate various insurance processes, including policy issuance, claim management, and payments. By eliminating intermediaries and streamlining processes, blockchain technology has the potential to reduce administrative costs and improve efficiency, ultimately leading to more competitive insurance rates.

Conclusion

Securing the best house insurance rates involves a comprehensive understanding of the factors that influence rates, a thorough comparison of insurance providers, and the implementation of strategic approaches. By exploring the fundamentals of house insurance, analyzing the factors that impact rates, comparing providers, and embracing technological innovations, you can make informed decisions and obtain the most advantageous coverage for your home. Remember, house insurance is a vital aspect of financial planning, and with the right knowledge and approach, you can safeguard your home and possessions while keeping your insurance costs manageable.

How often should I review my house insurance policy?

+It’s recommended to review your house insurance policy annually or whenever there are significant changes in your life, such as renovations, additions to your home, or changes in your personal belongings. Regular policy reviews ensure that your coverage remains adequate and aligned with your current needs.

Can I negotiate house insurance rates with providers?

+While insurance rates are typically predetermined based on various factors, some providers may offer flexibility in pricing. It’s worth inquiring about potential discounts or negotiating terms, especially if you have a good claims history or a strong relationship with the provider. However, keep in mind that insurance rates are subject to regulatory guidelines and market conditions.

What are some common exclusions in house insurance policies?

+Common exclusions in house insurance policies may include damage caused by floods, earthquakes, or other natural disasters, unless specific coverage is added. Additionally, damage resulting from neglect, intentional acts, or wear and tear may also be excluded. It’s important to carefully review your policy’s exclusions to understand the limitations of your coverage.