Best Insurance For Home

Securing the right insurance for your home is a crucial step in protecting your largest investment and ensuring peace of mind. With a myriad of insurance options available, it can be challenging to navigate the market and choose the policy that best suits your needs. This comprehensive guide aims to provide an in-depth analysis of the best home insurance options, offering valuable insights and considerations to help you make an informed decision.

Understanding Home Insurance

Home insurance, often referred to as homeowners insurance, is a vital protection policy that safeguards your home and its contents against various risks. These risks can range from natural disasters like hurricanes and wildfires to unexpected incidents such as theft, fire, or water damage. The primary purpose of home insurance is to provide financial coverage in the event of such occurrences, helping homeowners rebuild and recover.

The complexity of home insurance lies in its numerous coverage options and policy variations. It is essential to understand the different types of coverage available and tailor your policy to match your specific needs. This includes considerations such as the value of your home, the replacement cost of your belongings, and the unique risks associated with your geographical location.

Key Factors to Consider

1. Coverage Options

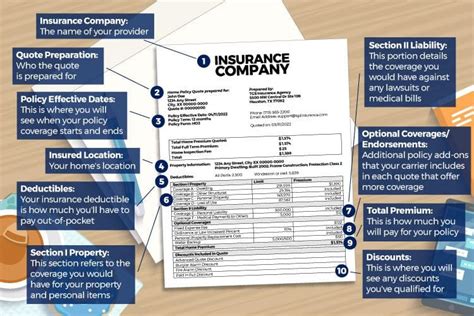

When evaluating home insurance policies, one of the primary considerations is the range of coverage options provided. This includes:

- Dwelling Coverage: This is the core of any home insurance policy, covering the structure of your home. It ensures that in the event of damage or destruction, you can rebuild your home to its pre-loss condition.

- Personal Property Coverage: This aspect of the policy covers the contents of your home, including furniture, appliances, and personal belongings. It provides financial assistance to replace or repair these items if they are damaged or lost due to a covered peril.

- Liability Coverage: Liability insurance is a critical component, as it protects you against claims arising from accidents or injuries that occur on your property. It covers medical expenses and legal fees, providing a safety net against potential financial burdens.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered incident, this coverage pays for additional living expenses, such as hotel stays or rental costs, until you can return to your home.

2. Policy Limits and Deductibles

Policy limits refer to the maximum amount an insurance company will pay for a covered loss. It is crucial to select limits that align with the actual replacement cost of your home and belongings. Similarly, deductibles, which are the amount you pay out of pocket before the insurance coverage kicks in, can vary. Higher deductibles often result in lower premiums, but it’s important to choose a deductible that you can comfortably afford in the event of a claim.

3. Discounts and Bundling Options

Many insurance companies offer discounts and incentives to attract customers. These can include multi-policy discounts (when you bundle home and auto insurance), loyalty discounts, or discounts for safety features such as smoke detectors or security systems. It’s worth exploring these options to potentially reduce your overall insurance costs.

4. Customer Service and Claims Handling

The quality of customer service and the efficiency of claims handling can significantly impact your experience with an insurance company. Researching and reading reviews from current and past customers can provide valuable insights into the company’s reputation and its ability to handle claims promptly and fairly.

Top Home Insurance Providers

1. State Farm

State Farm is one of the largest insurance providers in the United States, offering a comprehensive range of insurance products, including home insurance. Known for its competitive pricing and extensive network of agents, State Farm provides personalized service and tailored coverage options. The company offers a standard homeowners policy with options to customize coverage to meet specific needs. State Farm’s claims process is generally efficient, with a strong focus on customer satisfaction.

2. Allstate

Allstate is another prominent player in the insurance industry, providing homeowners with a wide array of coverage options. Their “Your Choice Home” policy offers flexibility, allowing customers to choose the coverage limits and deductibles that suit their budget and needs. Allstate’s innovative tools, such as the “Digital Locker,” help customers inventory their belongings, making the claims process smoother. Additionally, Allstate provides discounts for policy bundling and offers specialized coverage for high-value items.

3. USAA

USAA is a highly regarded insurance provider, primarily serving military members, veterans, and their families. Known for its exceptional customer service and competitive rates, USAA offers comprehensive home insurance policies with various coverage options. USAA’s policies include standard coverages like dwelling and personal property, as well as additional options such as coverage for high-value items and identity theft protection. The company’s digital tools and resources make managing policies and filing claims straightforward and efficient.

4. Amica Mutual Insurance

Amica Mutual Insurance is the oldest mutual insurer of automobiles in the United States and has expanded its offerings to include home insurance. Amica’s home insurance policies provide comprehensive coverage with flexible options to tailor the policy to individual needs. Their claims process is highly regarded, with a focus on quick and efficient resolution. Amica offers discounts for policy bundling and provides additional coverage options, such as identity theft protection and coverage for service animals.

5. Liberty Mutual

Liberty Mutual is a leading insurance provider, offering a wide range of insurance products, including home insurance. Their “HomeGuard” endorsement provides enhanced coverage for high-value items and offers additional options such as water backup coverage and identity theft protection. Liberty Mutual’s policies are customizable, allowing homeowners to choose the coverage limits and deductibles that align with their budget and needs. The company’s digital tools and resources make managing policies and filing claims convenient.

Comparative Analysis and Expert Insights

When comparing home insurance providers, it’s essential to consider not only the coverage options and pricing but also the company’s reputation and financial stability. Here’s a comparative analysis of the aforementioned top providers:

| Insurance Provider | Coverage Options | Discounts | Claims Handling |

|---|---|---|---|

| State Farm | Comprehensive, customizable coverage | Multi-policy discounts, loyalty discounts | Efficient, customer-centric |

| Allstate | Flexible policy limits, innovative tools | Policy bundling, high-value item coverage | Smooth claims process with digital support |

| USAA | Comprehensive coverage, military-focused | Discounts for military service, identity theft protection | Exceptional customer service, digital tools for efficiency |

| Amica Mutual | Tailored coverage, additional options | Policy bundling, service animal coverage | Highly regarded claims process, quick resolution |

| Liberty Mutual | Customizable coverage, enhanced endorsements | Policy bundling, additional coverage options | Convenient digital tools, efficient claims management |

Each of these providers offers unique strengths and benefits. State Farm stands out for its personalized service and competitive pricing, while Allstate provides innovative tools and flexible coverage options. USAA is highly regarded for its exceptional customer service and military-focused offerings. Amica Mutual impresses with its tailored coverage and highly efficient claims process, and Liberty Mutual offers customizable policies with convenient digital tools.

Frequently Asked Questions

What is the average cost of home insurance?

+

The average cost of home insurance can vary significantly based on factors such as location, the value of your home, and the coverage options you choose. According to industry data, the average annual premium for homeowners insurance in the United States is approximately $1,200. However, it’s important to note that rates can range from a few hundred dollars to several thousand dollars per year, depending on individual circumstances.

What factors affect home insurance rates?

+

Several factors influence home insurance rates, including the location of your home (as some areas are more prone to natural disasters or crime), the age and condition of your home, the coverage limits and deductibles you choose, and your claims history. Additionally, the presence of certain safety features, such as smoke detectors or a security system, can lead to discounts on your policy.

What is the difference between replacement cost and actual cash value coverage?

+

Replacement cost coverage pays the full amount needed to repair or rebuild your home, while actual cash value coverage pays the cost of repairs or replacement minus depreciation. In other words, replacement cost coverage ensures you receive enough to rebuild your home as it was before the loss, while actual cash value coverage may result in a lower payout due to the depreciation factor.

How often should I review my home insurance policy?

+

It’s recommended to review your home insurance policy annually or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and aligned with your needs. Regular reviews also provide an opportunity to explore potential discounts or policy enhancements.

Can I bundle my home and auto insurance policies for discounts?

+

Yes, many insurance companies offer multi-policy discounts when you bundle your home and auto insurance policies. Bundling can result in significant savings, as insurance providers often reward customers for their loyalty and the increased business. It’s a great way to streamline your insurance needs and potentially reduce costs.