Best Insurance Companies In Usa

The insurance landscape in the United States is vast and diverse, with numerous companies offering a wide range of policies to cater to the needs of its citizens. When it comes to choosing the best insurance company, it's essential to consider various factors such as financial stability, customer satisfaction, coverage options, and claims handling. In this comprehensive guide, we will explore some of the top insurance companies in the USA, delve into their strengths, and provide valuable insights to help you make an informed decision.

Understanding the Insurance Industry in the USA

The insurance sector in the United States is highly regulated and competitive. It comprises various types of insurance companies, including national carriers, regional insurers, and specialty providers. Each company offers a unique set of products and services, targeting different segments of the market. From auto and home insurance to health, life, and business policies, the options are vast. Understanding the specific needs of consumers and aligning them with the right insurance provider is crucial.

Top Insurance Companies in the USA

When ranking insurance companies, several factors come into play. Financial strength, measured by ratings from reputable agencies like AM Best and Standard & Poor’s, is a critical aspect. Additionally, customer satisfaction surveys, claims handling efficiency, and the breadth of coverage options play significant roles in determining the top performers.

State Farm

State Farm has solidified its position as one of the leading insurance companies in the USA. With a strong focus on customer service and a comprehensive range of insurance products, State Farm has earned a reputation for excellence. Their auto insurance policies are particularly noteworthy, offering competitive rates and excellent coverage options.

State Farm’s financial strength is impressive, backed by an A++ rating from AM Best. They excel in claims handling, providing prompt and efficient service to their customers. The company’s online resources and mobile apps further enhance the overall customer experience, making it convenient for policyholders to manage their accounts and access information.

Allstate

Allstate is another prominent player in the US insurance market. Known for its innovative approach and extensive product offerings, Allstate caters to a wide range of insurance needs. Their “You’re In Good Hands” slogan reflects their commitment to providing excellent customer service.

Allstate’s financial stability is robust, with an A+ rating from AM Best. They offer a diverse range of insurance products, including auto, home, life, and business policies. One of Allstate’s unique features is its Drivewise program, which rewards safe driving habits with potential discounts on auto insurance premiums.

GEICO

GEICO, an acronym for Government Employees Insurance Company, has become a household name in the insurance industry. Known for its catchy advertising campaigns and competitive pricing, GEICO has gained a strong customer base. They specialize in auto insurance, offering affordable policies with excellent coverage options.

GEICO’s financial strength is exceptional, boasting an A++ rating from AM Best. Their online platform and mobile app are highly user-friendly, allowing customers to manage their policies efficiently. GEICO also provides a range of discounts to help policyholders save on their premiums.

Progressive

Progressive has made a significant impact in the insurance market with its innovative approach and digital-first strategy. They offer a wide array of insurance products, including auto, home, RV, and motorcycle policies. Progressive’s commitment to customer satisfaction is evident through its comprehensive claims handling process and excellent customer service.

Financial stability is a key strength for Progressive, backed by an A+ rating from AM Best. Their Snapshot program is a unique offering that allows drivers to potentially save on their auto insurance premiums by monitoring their driving habits. Progressive also provides a range of discounts and flexible payment options.

USAA

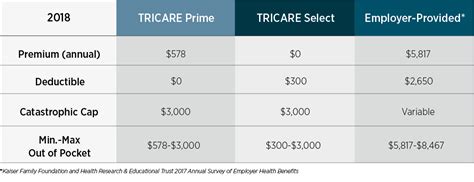

USAA stands out as a top insurance provider, catering specifically to military members, veterans, and their families. With a strong focus on providing excellent service to this unique demographic, USAA has earned a reputation for its dedication and understanding of the military community’s needs.

USAA’s financial strength is exceptional, holding an A++ rating from AM Best. They offer a comprehensive range of insurance products, including auto, home, life, and health insurance. USAA’s claims handling process is highly efficient, and their customer service is renowned for its personalized approach.

Factors to Consider When Choosing an Insurance Company

When selecting an insurance company, it’s crucial to evaluate several key factors to ensure you find the best fit for your needs. Here are some considerations to keep in mind:

- Coverage Options: Assess the range of insurance products offered by the company. Ensure they provide the specific coverage you require, whether it’s auto, home, health, or life insurance.

- Financial Strength: Look for insurance companies with strong financial ratings. Ratings from agencies like AM Best and Standard & Poor’s provide valuable insights into the company’s financial stability and ability to pay claims.

- Customer Satisfaction: Research customer reviews and ratings to gauge the company’s reputation for customer service. Satisfied customers are a strong indicator of a company’s commitment to providing excellent service.

- Claims Handling: Efficient and fair claims handling is crucial. Evaluate the company’s claims process, response time, and customer feedback to ensure they provide a seamless experience during the claims process.

- Discounts and Savings: Many insurance companies offer discounts to help policyholders save on their premiums. Look for companies that provide competitive rates and a range of discounts based on factors like safe driving habits, multiple policies, or loyalty.

- Digital Convenience: In today’s digital age, online and mobile accessibility is essential. Choose an insurance company that offers a user-friendly online platform and mobile app for convenient policy management and access to information.

Comparative Analysis: Top Insurance Companies

To provide a comprehensive overview, let’s compare some of the top insurance companies in the USA across key criteria:

| Insurance Company | Financial Rating | Coverage Options | Customer Satisfaction | Claims Handling |

|---|---|---|---|---|

| State Farm | A++ (AM Best) | Auto, Home, Life, Health | High | Excellent |

| Allstate | A+ (AM Best) | Auto, Home, Life, Business | Good | Efficient |

| GEICO | A++ (AM Best) | Auto, Home, RV, Motorcycle | High | Efficient |

| Progressive | A+ (AM Best) | Auto, Home, RV, Motorcycle | Good | Excellent |

| USAA | A++ (AM Best) | Auto, Home, Life, Health | Excellent | Exceptional |

The Future of Insurance in the USA

The insurance industry in the USA is evolving rapidly, driven by technological advancements and changing consumer preferences. Here are some key trends and future implications to consider:

- Digital Transformation: Insurance companies are increasingly embracing digital technologies to enhance the customer experience. From online policy management to mobile apps and chatbots, digital convenience is becoming a key differentiator.

- Personalized Insurance: With the advent of data analytics and machine learning, insurance companies are moving towards personalized insurance products. By analyzing customer data, companies can offer tailored policies that meet individual needs and preferences.

- Telematics and Usage-Based Insurance: Telematics technology, which collects and analyzes driving data, is gaining traction. Usage-based insurance programs, like Progressive’s Snapshot and State Farm’s Drive Safe & Save, reward safe driving habits with potential premium discounts.

- Insurtech Innovations: The rise of insurtech startups is disrupting the traditional insurance landscape. These companies are leveraging technology to offer innovative products, streamlined processes, and enhanced customer experiences.

- Climate Change and Natural Disasters: As climate change continues to impact the frequency and severity of natural disasters, insurance companies are adapting their strategies. They are developing new products and risk assessment models to address these evolving challenges.

FAQs

How do I choose the right insurance company for my needs?

+When selecting an insurance company, consider your specific needs, such as auto, home, health, or life insurance. Evaluate factors like financial strength, coverage options, customer satisfaction, and claims handling. Research and compare multiple companies to find the best fit.

What sets State Farm apart from other insurance companies?

+State Farm stands out for its strong focus on customer service and a comprehensive range of insurance products. They excel in auto insurance, offering competitive rates and excellent coverage options. Their financial strength and efficient claims handling further solidify their position as a top insurance provider.

Are there any insurance companies that cater specifically to military members and veterans?

+Yes, USAA is a top insurance provider that specifically caters to military members, veterans, and their families. They understand the unique needs of this demographic and provide excellent service and coverage options tailored to their requirements.

How can I save money on my insurance premiums?

+To save on insurance premiums, look for companies that offer discounts based on factors like safe driving habits, multiple policies, or loyalty programs. Additionally, consider using usage-based insurance programs, such as Progressive’s Snapshot or State Farm’s Drive Safe & Save, which reward safe driving with potential premium discounts.

What are the key trends shaping the future of insurance in the USA?

+The future of insurance in the USA is driven by digital transformation, personalized insurance, telematics, insurtech innovations, and the impact of climate change. Insurance companies are adapting to these trends to enhance the customer experience and address evolving challenges.

Choosing the right insurance company is a critical decision that requires careful consideration. By evaluating factors such as financial strength, coverage options, customer satisfaction, and claims handling, you can find an insurance provider that aligns with your needs and provides peace of mind. Whether you’re seeking auto, home, health, or life insurance, the top insurance companies in the USA offer a range of excellent options to choose from.