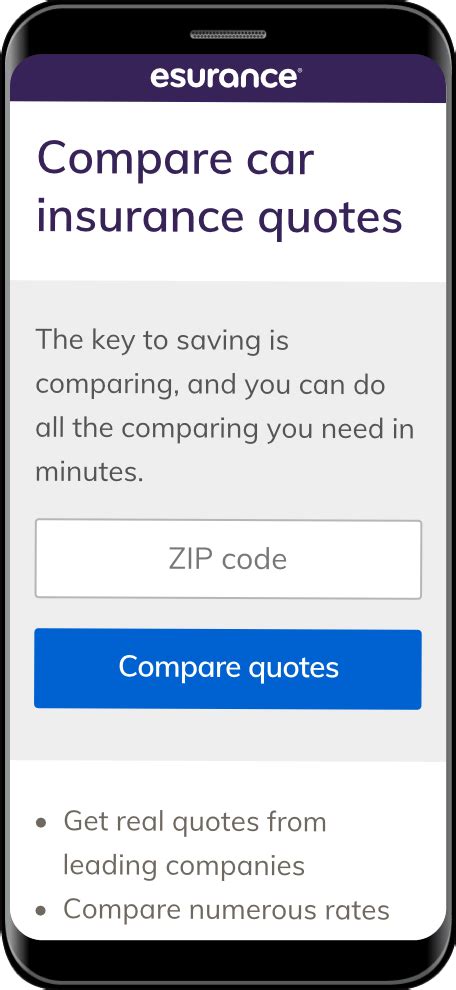

Insurance Quote Car

When it comes to obtaining an insurance quote for your car, the process can seem daunting, especially with the multitude of factors that insurance providers consider. From personal details to vehicle specifications, there's a lot to take into account. This comprehensive guide will delve into the key aspects that influence car insurance quotes, offering a detailed breakdown of what to expect and how to navigate this essential financial decision.

Understanding the Fundamentals of Car Insurance Quotes

Car insurance is a vital component of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The process of acquiring a quote involves a meticulous assessment of various factors by insurance providers. These factors, ranging from personal information to vehicle-specific details, contribute to the overall calculation of your insurance premium.

Personal Factors Influencing Your Quote

Your personal details play a significant role in determining your insurance quote. Age is a critical factor; younger drivers, particularly those under 25, often face higher premiums due to their perceived higher risk on the roads. Conversely, experienced drivers with a clean record and a longer history of safe driving tend to enjoy more competitive rates.

Gender is another aspect that insurance companies consider. While it's important to note that gender discrimination in insurance pricing is illegal in many regions, some insurers may still use gender as a factor in their risk assessment models. However, this practice is gradually becoming less prevalent due to regulatory changes.

Your driving history is a key determinant of your insurance premium. A clean driving record, free from accidents and traffic violations, can lead to lower insurance rates. Conversely, a history of accidents or traffic infractions may result in higher premiums or even difficulty in obtaining insurance.

| Personal Factor | Impact on Quote |

|---|---|

| Age | Younger drivers may pay more; experienced drivers with clean records often pay less. |

| Gender | Gender may influence rates, but regulatory changes are reducing this practice. |

| Driving History | Clean records lead to lower premiums; accidents and violations may increase costs. |

Vehicle-Specific Factors and Their Impact

The type of vehicle you drive significantly affects your insurance quote. Certain vehicle models, particularly sports cars and high-performance vehicles, are often associated with higher insurance costs due to their increased likelihood of accidents and higher repair costs.

The age of your vehicle is another crucial factor. Newer cars, especially those with advanced safety features, may qualify for lower insurance rates. Conversely, older vehicles, especially those without modern safety technologies, might incur higher insurance costs.

The purpose for which you use your vehicle also matters. If you primarily use your car for personal use, your insurance costs may be lower compared to someone who uses their vehicle for business purposes or as part of their profession.

| Vehicle Factor | Impact on Quote |

|---|---|

| Vehicle Type | Sports cars and high-performance vehicles often have higher insurance costs. |

| Vehicle Age | Newer cars with safety features may qualify for lower rates; older vehicles may incur higher costs. |

| Vehicle Usage | Personal use typically results in lower costs compared to business or professional use. |

The Role of Location and Usage in Insurance Quotes

Your location and how you use your vehicle are additional key elements that insurance providers consider when determining your quote. These factors can significantly influence your insurance rates, making them an essential part of the quote calculation process.

Location-Based Differences in Insurance Quotes

Insurance quotes can vary considerably based on your geographical location. Areas with a higher incidence of accidents, theft, or vandalism may see increased insurance rates. This is often the case in densely populated urban areas where the risk of vehicle-related incidents is higher.

Conversely, rural or suburban areas may enjoy lower insurance rates due to the generally lower risk of accidents and theft. However, it's important to note that other factors, such as the cost of living and average income in a particular area, can also influence insurance rates.

The specific location where your vehicle is parked overnight can also impact your insurance quote. If you park your car in a secure garage or a well-lit, monitored area, you may qualify for a lower premium. On the other hand, parking on the street or in an unsecured lot may lead to higher insurance costs.

| Location Factor | Impact on Quote |

|---|---|

| Urban vs. Rural/Suburban | Urban areas often have higher rates due to increased accident and theft risks. |

| Parking Location | Secure parking can lead to lower premiums; unsecured parking may increase costs. |

Usage Patterns and Their Effect on Insurance Quotes

The way you use your vehicle can significantly influence your insurance quote. If you primarily drive your car for pleasure or personal errands, your insurance costs may be lower compared to someone who uses their vehicle for business or professional purposes.

The number of miles you drive annually is another crucial factor. Generally, the more you drive, the higher your insurance costs. This is because the increased mileage raises the likelihood of being involved in an accident or other road-related incidents.

The time of day you typically drive can also affect your insurance quote. For instance, if you often drive during rush hour or in the early morning when visibility may be reduced, your insurance costs may be higher. This is because these times are associated with a higher risk of accidents.

| Usage Factor | Impact on Quote |

|---|---|

| Purpose of Use | Personal use typically results in lower costs; business or professional use may increase rates. |

| Annual Mileage | Higher mileage often leads to higher insurance costs due to increased accident risks. |

| Time of Day Driven | Driving during high-risk periods, like rush hour, may increase insurance costs. |

Additional Considerations: Coverages and Discounts

Beyond the basic factors discussed above, there are several additional considerations that can influence your car insurance quote. These include the types of coverages you choose and any applicable discounts you may qualify for. Understanding these aspects can help you make more informed decisions when choosing an insurance policy.

Understanding Different Types of Coverages

When obtaining a car insurance quote, you’ll be presented with various coverage options. These options determine the specific risks and incidents your insurance policy will cover. Here’s a breakdown of some common coverage types:

- Liability Coverage: This coverage is mandatory in most states and covers damages you cause to others' property or injuries you cause to others in an accident. It does not cover damages to your own vehicle or injuries you sustain.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It's particularly beneficial if you have a newer or more valuable vehicle.

- Comprehensive Coverage: This coverage protects against damages caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals. It's often required if you have a loan or lease on your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers after an accident, regardless of fault.

The type and level of coverage you choose will directly impact your insurance quote. Opting for higher coverage limits or more comprehensive coverage will typically result in a higher premium, while selecting lower limits or more basic coverage will lead to a lower premium.

Exploring Available Discounts and Savings

Insurance providers offer a variety of discounts that can significantly reduce your insurance quote. It’s important to inquire about these discounts when obtaining a quote to ensure you’re getting the best possible rate. Here are some common discounts to be aware of:

- Safe Driver Discount: If you have a clean driving record, you may qualify for a safe driver discount. This is one of the most common discounts and can significantly reduce your insurance premium.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in substantial savings.

- Loyalty Discount: Many insurance companies offer loyalty discounts to reward customers who have been with them for an extended period.

- Good Student Discount: If you're a student or have a student driver in your household, you may be eligible for a good student discount. This discount typically applies to full-time students under 25 with a certain GPA or rank in their class.

- Vehicle Safety Discounts: Having certain safety features in your vehicle, such as anti-lock brakes, air bags, or an anti-theft system, may qualify you for a discount.

It's crucial to discuss these discounts with your insurance provider to ensure you're taking advantage of all the savings opportunities available to you.

Tips for Obtaining the Best Car Insurance Quote

Now that we’ve explored the various factors that influence car insurance quotes, here are some expert tips to help you obtain the best possible quote:

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurance providers to ensure you're getting the most competitive rate.

- Understand Your Coverage Needs: Assess your specific coverage needs based on your vehicle, driving habits, and personal circumstances. This will help you choose the right coverage and avoid unnecessary expenses.

- Review Your Credit Score: Your credit score can impact your insurance quote. Maintaining a good credit score can help you secure a more favorable rate.

- Consider Bundling Policies: If you have multiple insurance needs, such as homeowners or renters insurance, consider bundling these policies with your car insurance to potentially save money.

- Take Advantage of Discounts: Be sure to inquire about all applicable discounts when obtaining a quote. This can include discounts for safe driving, loyalty, good students, or vehicle safety features.

By following these tips and understanding the factors that influence car insurance quotes, you can make an informed decision and secure the best insurance coverage for your needs at a competitive rate.

Frequently Asked Questions

How often should I review my car insurance policy and quote?

+

It’s recommended to review your car insurance policy and quote annually, or whenever your circumstances change significantly. This ensures you’re getting the best coverage and rate for your current needs.

Can I get a car insurance quote without providing my Social Security number?

+

Yes, many insurance providers allow you to obtain a quote without providing your Social Security number. However, they may require it at the time of purchasing the policy.

Are there any ways to lower my car insurance quote if I have a less-than-perfect driving record?

+

Yes, you can potentially lower your quote by increasing your deductible, taking a defensive driving course, or opting for usage-based insurance if available in your area.