Private Health Insurance Plans California

In the vast landscape of healthcare, understanding your options is crucial. For residents of California, private health insurance plans play a significant role in ensuring access to quality medical care. This comprehensive guide delves into the world of private health insurance in California, offering insights into plan types, coverage, and the benefits that make a difference in your healthcare journey.

Navigating the Private Health Insurance Landscape in California

California’s healthcare market offers a diverse range of private insurance plans, each designed to cater to the unique needs of individuals and families. From comprehensive coverage to more specialized plans, understanding the nuances of each type is essential for making informed choices.

Individual and Family Plans: Customized Care

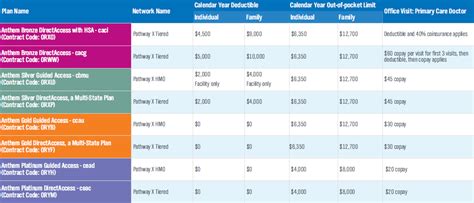

Individual and family health insurance plans are tailored to provide coverage for a single person or a household. These plans offer flexibility in terms of coverage limits, deductibles, and copayments, allowing individuals to choose a plan that aligns with their healthcare needs and budget. For instance, a young, healthy individual may opt for a plan with higher deductibles and lower premiums, while a family with older members might prefer a plan with lower out-of-pocket costs for specialist visits.

Key Considerations for Individual and Family Plans:

- Premium Costs: Monthly premiums can vary based on age, location, and the level of coverage chosen.

- Network Providers: Check if your preferred doctors and hospitals are in-network to minimize out-of-pocket expenses.

- Coverage Limits: Understand the plan's maximum coverage limits and any exclusions or limitations.

- Prescription Drugs: Review the plan's formulary to ensure your essential medications are covered.

Group Health Insurance: Benefits of Scale

Group health insurance plans are often offered through employers, providing coverage for a group of individuals, typically employees and their families. These plans leverage the collective bargaining power of a larger group to negotiate more competitive rates and comprehensive benefits. Group plans often include additional perks such as wellness programs and employee assistance services.

Advantages of Group Health Insurance:

- Cost Savings: Group plans generally offer more affordable premiums compared to individual plans.

- Convenience: Enrollment is often simplified, and changes can be made during open enrollment periods.

- Richer Benefits: Group plans tend to offer a broader range of benefits and coverage options.

- Network Flexibility: Some group plans offer open access, allowing members to choose providers outside the network.

Short-Term Health Insurance: Temporary Solutions

Short-term health insurance plans are designed to provide coverage for a specified period, typically ranging from a few months to a year. These plans are ideal for individuals transitioning between jobs, those awaiting enrollment in a long-term plan, or for those who prefer a more flexible and cost-effective option. Short-term plans often have more limited coverage and may exclude pre-existing conditions.

Factors to Weigh with Short-Term Plans:

- Coverage Duration: Ensure the plan's duration aligns with your needs, and consider renewability options.

- Pre-Existing Conditions: Review the plan's terms to understand how pre-existing conditions are handled.

- Cost versus Benefits: Evaluate the balance between premium costs and the level of coverage provided.

- Renewal Options: Some plans offer the option to renew, providing continuity of coverage.

Health Maintenance Organizations (HMOs): Coordinated Care

Health Maintenance Organizations (HMOs) are a type of managed care plan that emphasizes preventive care and the coordination of services through a primary care physician (PCP). HMOs typically have a more restricted network of providers, and members must choose a PCP who acts as a gatekeeper for specialty care. This model is designed to promote cost-effective, integrated healthcare.

Key Features of HMOs:

- Primary Care Physician: The PCP coordinates all care and referrals to specialists.

- Network Restrictions: Out-of-network care may not be covered, or coverage may be limited.

- Preventive Care Emphasis: HMOs often provide comprehensive preventive services at little to no cost.

- Lower Costs: HMOs can offer more affordable premiums due to their coordinated care model.

Preferred Provider Organizations (PPOs): Flexibility and Choice

Preferred Provider Organizations (PPOs) offer a broader network of providers, allowing members to choose their own doctors and specialists without a referral. PPOs typically cover a portion of the cost for in-network care and a lesser portion for out-of-network care. This flexibility can be advantageous for those with specific healthcare needs or preferences.

Benefits of PPOs:

- Network Flexibility: Members can choose any provider within the PPO network.

- No Referrals: Direct access to specialists without a PCP referral.

- Coverage Options: PPOs often offer a range of coverage levels and benefit packages.

- Cost Sharing: Members share costs with the insurer, with varying levels of copayments and deductibles.

California's Unique Approach to Private Health Insurance

California has implemented several initiatives to enhance the accessibility and quality of private health insurance within the state. These efforts aim to protect consumers, ensure affordability, and promote competition among insurers.

The California Health Benefit Exchange (Covered California)

Covered California, also known as the California Health Benefit Exchange, was established as part of the federal Affordable Care Act (ACA) to help individuals and small businesses find and compare health insurance plans. It serves as a one-stop shop for Californians seeking quality, affordable health coverage. Covered California offers a range of plans from multiple insurers, making it easier to compare options and find the best fit.

Benefits of Covered California:

- Transparency: Provides clear information on plan benefits, costs, and provider networks.

- Financial Assistance: Offers income-based subsidies to reduce premium costs for eligible individuals.

- Competition: Encourages competition among insurers, leading to potentially lower premiums.

- Consumer Protection: Ensures that all plans meet minimum standards for coverage and consumer rights.

California's Focus on Consumer Protection

California has a strong commitment to protecting consumers in the health insurance market. The state's Department of Managed Health Care (DMHC) and the Department of Insurance (DOI) work together to enforce regulations, investigate consumer complaints, and ensure that insurers comply with state and federal laws. This commitment to consumer protection provides an added layer of security for Californians navigating the private health insurance landscape.

Innovative Programs for Affordability

Recognizing the importance of affordable healthcare, California has implemented several innovative programs to assist residents with the cost of private health insurance. These initiatives include:

- Healthy Families Program: Offers low-cost health insurance for children and young adults up to age 21.

- Medi-Cal: California's Medicaid program provides free or low-cost health coverage for eligible individuals and families with limited income and resources.

- CalHEERS: The California Health Exchange Enrollment and Retention System helps streamline the enrollment process for individuals and families seeking health coverage.

Choosing the Right Private Health Insurance Plan

Selecting the appropriate private health insurance plan involves careful consideration of your unique healthcare needs and financial situation. Here are some key factors to guide your decision-making process:

Assessing Your Healthcare Needs

Take stock of your current and potential future healthcare needs. Consider factors such as your age, any pre-existing conditions, the likelihood of needing specialist care, and your prescription medication requirements. Understanding your healthcare needs is crucial for choosing a plan that provides adequate coverage without unnecessary costs.

Understanding Your Budget

Evaluate your financial situation and determine how much you can comfortably afford to allocate towards health insurance premiums. Remember that while lower premiums may be tempting, they often come with higher deductibles and out-of-pocket costs. Balancing cost and coverage is essential to ensure you have the financial protection you need without straining your budget.

Researching Plan Details

Dig deep into the details of each plan you’re considering. Pay attention to coverage limits, copayments, deductibles, and any exclusions or limitations. Review the plan’s network of providers to ensure your preferred doctors and hospitals are included. Understanding these specifics will help you make an informed decision and avoid surprises down the line.

Utilizing Online Tools and Resources

Take advantage of online resources and tools provided by organizations like Covered California and the California Department of Insurance. These platforms offer comprehensive information on plan options, provider networks, and consumer protections. Additionally, consider seeking advice from insurance brokers or financial advisors who can provide personalized guidance based on your circumstances.

Conclusion: Empowering Your Healthcare Journey

Navigating the world of private health insurance in California can be complex, but with the right knowledge and resources, you can make informed choices that align with your healthcare needs and financial goals. Whether you’re seeking individual coverage, exploring group plans through your employer, or considering short-term options, understanding the types of plans available and their unique features is the first step toward securing quality healthcare. By leveraging the tools and insights provided by California’s health insurance initiatives, you can take control of your healthcare journey and make decisions that support your well-being and financial stability.

How do I choose the right health insurance plan for my family?

+When selecting a health insurance plan for your family, consider your family’s healthcare needs, the age and health status of each member, and your preferred level of financial protection. Assess whether you require comprehensive coverage or if a more cost-effective plan with higher deductibles is suitable. Research the plans offered by different insurers, comparing coverage, costs, and provider networks. Seek advice from insurance brokers or financial advisors who can guide you based on your family’s specific circumstances.

What are the key differences between HMOs and PPOs in California?

+HMOs and PPOs are two distinct types of health insurance plans in California. HMOs (Health Maintenance Organizations) typically offer more restricted provider networks and require members to choose a primary care physician (PCP) who coordinates their care. In contrast, PPOs (Preferred Provider Organizations) provide greater flexibility, allowing members to choose any in-network provider without a referral. HMOs often have lower premiums but may have more limited coverage, while PPOs offer broader coverage but at a higher cost.

Are there any state-specific benefits or protections for California residents with private health insurance?

+Yes, California has implemented several initiatives to protect consumers and ensure the affordability of private health insurance. Covered California, the state’s health benefit exchange, provides a platform for residents to compare and enroll in plans, offering income-based subsidies. The state also enforces strict regulations through the Department of Managed Health Care and the Department of Insurance, ensuring that insurers comply with consumer protection laws.