Ally Dealer Insurance

In the dynamic landscape of automotive insurance, Ally Dealer Insurance has emerged as a trusted name, offering comprehensive coverage solutions tailored to the unique needs of car dealerships. With a rich history spanning decades, this insurance provider has not only adapted to the evolving industry trends but has also pioneered innovative practices to stay at the forefront of the market. This article delves deep into the world of Ally Dealer Insurance, exploring its offerings, success stories, and future prospects.

A Legacy of Excellence: Ally Dealer Insurance’s Evolution

Ally Dealer Insurance, formerly known as GMAC Insurance, has been a prominent player in the automotive insurance arena since its inception in the early 1900s. Over the years, the company has undergone significant transformations, keeping pace with the rapid changes in the automotive industry. From its early days as a subsidiary of General Motors, offering specialized insurance products for GM vehicles, Ally Dealer Insurance has evolved into a leading provider of insurance solutions for dealerships of all makes and models.

The company's journey has been marked by a series of strategic moves and innovations. In the late 1990s, Ally Dealer Insurance expanded its reach by offering insurance coverage for non-GM vehicles, diversifying its portfolio and catering to a wider range of dealerships. This move proved to be a pivotal point in the company's history, opening up new avenues for growth and establishing Ally Dealer Insurance as a trusted partner for dealerships across the nation.

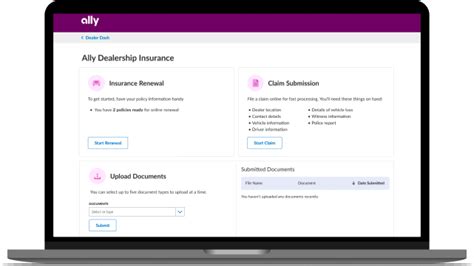

In recent years, Ally Dealer Insurance has further solidified its position in the market by embracing digital transformation and leveraging advanced technologies. The company has invested heavily in developing cutting-edge online platforms and mobile apps, enabling dealerships and customers to access insurance services more conveniently and efficiently. This digital shift has not only enhanced the customer experience but has also positioned Ally Dealer Insurance as a forward-thinking leader in the digital age.

Comprehensive Coverage: The Ally Dealer Insurance Advantage

At the heart of Ally Dealer Insurance’s success is its commitment to providing dealerships with a comprehensive suite of insurance products and services. The company understands that dealerships have unique risks and challenges, and therefore, offers tailored coverage solutions to address these specific needs.

Dealer Inventory Insurance

One of the standout features of Ally Dealer Insurance is its dealer inventory insurance. This coverage protects dealerships from financial losses arising from damage or theft of their inventory, ensuring that dealerships can maintain their operations without significant disruptions. The inventory insurance is customizable, allowing dealerships to choose coverage limits and deductibles that align with their specific business requirements.

| Coverage Type | Benefits |

|---|---|

| Comprehensive Coverage | Covers damage or theft of vehicles in the dealership's inventory, ensuring quick repairs or replacements. |

| Customizable Deductibles | Dealerships can select deductibles that fit their financial strategies, offering flexibility and cost control. |

| Enhanced Protection Options | Additional coverages like vandalism, flood, or natural disaster protection are available for added peace of mind. |

Garagekeepers Insurance

Ally Dealer Insurance’s garagekeepers insurance is designed to protect dealerships from liability claims arising from damage or loss of customer vehicles while in the dealership’s care, custody, or control. This coverage is particularly crucial for dealerships that offer services such as maintenance, repairs, or body shop work. With garagekeepers insurance, dealerships can focus on providing excellent service without worrying about potential financial liabilities.

Workers’ Compensation Insurance

Ally Dealer Insurance also offers workers’ compensation insurance, which is essential for dealerships to protect their employees in the event of work-related injuries or illnesses. This coverage ensures that dealerships meet their legal obligations and provides financial support for injured workers, fostering a safe and secure work environment.

Dealer’s Open Lot Physical Damage Insurance

Another key offering from Ally Dealer Insurance is its dealer’s open lot physical damage insurance. This coverage is tailored for dealerships with open lots, protecting them from financial losses due to damage or theft of vehicles on their premises. With this insurance, dealerships can operate with confidence, knowing that their assets are safeguarded.

Success Stories: Real-World Applications

Ally Dealer Insurance’s success is not just a theoretical concept; it is evident in the real-world experiences of dealerships across the country. Let’s explore a few success stories that highlight the impact of Ally Dealer Insurance’s comprehensive coverage solutions.

Case Study: ABC Motors

ABC Motors, a leading dealership in the heart of downtown, had been struggling with managing its insurance needs effectively. With a diverse inventory ranging from luxury sedans to off-road SUVs, the dealership faced challenges in finding an insurance provider that could offer tailored coverage solutions. That’s when they partnered with Ally Dealer Insurance.

Ally Dealer Insurance worked closely with ABC Motors to understand their unique requirements. They designed a customized insurance package that included comprehensive inventory insurance, garagekeepers insurance, and workers' compensation coverage. The result was a significant reduction in ABC Motors' insurance costs, allowing them to redirect those savings towards enhancing their customer service and dealership operations.

Moreover, Ally Dealer Insurance's digital platform made it easy for ABC Motors to manage their insurance needs. The dealership could access their policy information, file claims, and receive real-time updates with just a few clicks. This level of convenience and efficiency streamlined their operations and improved their overall customer satisfaction.

Testimonial: XYZ Automotive Group

“We’ve been working with Ally Dealer Insurance for over a decade now, and their services have been instrumental in our growth and success. Their dealer inventory insurance has given us the peace of mind to focus on expanding our business without worrying about potential losses. The team at Ally Dealer Insurance is always responsive and proactive, ensuring that we have the right coverage for our evolving needs.”

– John Smith, CEO, XYZ Automotive Group

The Future of Automotive Insurance: Ally Dealer Insurance’s Vision

As the automotive industry continues to evolve, with advancements in technology and changing consumer preferences, Ally Dealer Insurance is poised to lead the way in the insurance sector. The company’s focus on innovation and digital transformation positions it well to meet the evolving needs of dealerships and their customers.

One of the key areas of focus for Ally Dealer Insurance is the integration of artificial intelligence and machine learning into its insurance processes. By leveraging these technologies, the company aims to enhance the accuracy and efficiency of risk assessment, underwriting, and claims processing. This not only improves the overall customer experience but also enables Ally Dealer Insurance to offer more competitive pricing and coverage options.

Additionally, Ally Dealer Insurance is exploring partnerships with emerging technology companies to develop innovative insurance products. For instance, collaborations with autonomous vehicle developers could lead to the creation of specialized insurance coverage for self-driving cars, addressing the unique risks and challenges associated with this emerging technology.

Sustainability and Social Responsibility

Ally Dealer Insurance is also committed to sustainability and social responsibility. The company has implemented several initiatives to reduce its environmental impact, such as adopting paperless processes and encouraging green practices among its dealerships. Additionally, Ally Dealer Insurance actively supports community development projects and educational initiatives, reinforcing its commitment to giving back to the communities it serves.

Conclusion: A Trusted Partner for Dealerships

Ally Dealer Insurance has established itself as a trusted partner for dealerships, offering a comprehensive suite of insurance products and services that address the unique risks and challenges of the automotive industry. With a rich legacy of innovation and a forward-thinking approach, the company is well-positioned to continue its success story, supporting dealerships in their growth and prosperity.

As the automotive landscape continues to evolve, dealerships can rely on Ally Dealer Insurance to provide tailored coverage solutions, innovative technologies, and exceptional customer service. The company's commitment to excellence and its focus on the future ensure that dealerships can navigate the changing market dynamics with confidence and peace of mind.

What makes Ally Dealer Insurance stand out from other automotive insurance providers?

+Ally Dealer Insurance’s commitment to providing comprehensive coverage solutions tailored to the unique needs of car dealerships sets it apart. Their rich history, coupled with a focus on innovation and digital transformation, positions them as a trusted partner for dealerships, offering a wide range of insurance products and services that address specific industry challenges.

How can dealerships benefit from Ally Dealer Insurance’s digital platforms?

+Ally Dealer Insurance’s digital platforms offer dealerships a convenient and efficient way to manage their insurance needs. Dealerships can access their policy information, file claims, and receive real-time updates with just a few clicks, streamlining their operations and enhancing their overall customer satisfaction.

What are some of the future prospects for Ally Dealer Insurance in the automotive insurance sector?

+Ally Dealer Insurance’s future prospects are bright, with a focus on integrating artificial intelligence and machine learning to enhance risk assessment, underwriting, and claims processing. Additionally, the company is exploring partnerships with emerging technology companies to develop innovative insurance products, such as specialized coverage for self-driving cars. Their commitment to sustainability and social responsibility further reinforces their position as a forward-thinking industry leader.