The Health Insurance Marketplace

The Health Insurance Marketplace, a cornerstone of the Affordable Care Act (ACA), has revolutionized the way Americans access health insurance. This platform, also known as the Health Insurance Exchange, offers a user-friendly interface for individuals and families to compare and enroll in health plans, ensuring they have the coverage they need. In this article, we will delve into the intricacies of the Marketplace, exploring its history, purpose, and the benefits it provides to millions of Americans.

Understanding the Health Insurance Marketplace

The Health Insurance Marketplace was established as a key component of the Patient Protection and Affordable Care Act, signed into law in 2010. It serves as a centralized platform where individuals, families, and small businesses can shop for and purchase health insurance plans that meet their specific needs and budgets.

The Marketplace aims to address the challenges faced by those seeking health insurance, particularly those without employer-provided coverage or those with pre-existing medical conditions. By creating a competitive environment, the Marketplace promotes transparency and makes it easier for consumers to find affordable, quality health insurance options.

Key Features of the Marketplace

The Health Insurance Marketplace offers a range of features and benefits designed to streamline the insurance-shopping experience:

- Plan Comparison: Users can easily compare different health insurance plans based on factors such as cost, coverage, and provider networks. This comparison tool ensures individuals can make informed choices tailored to their healthcare needs.

- Income-Based Subsidies: One of the pivotal aspects of the Marketplace is its provision of income-based subsidies and tax credits. These financial aids help lower the cost of insurance premiums, making coverage more accessible for individuals and families with limited financial means.

- Online Enrollment: The entire enrollment process can be completed online, simplifying the traditional paper-based application process. This convenience encourages more people to explore their insurance options and take advantage of the available plans.

- Open Enrollment Period: The Marketplace operates on a specific schedule, with an annual open enrollment period. During this time, individuals can enroll in a new plan or make changes to their existing coverage. For those with qualifying life events, such as marriage or job loss, enrollment is allowed outside of the open enrollment period.

- Metal Plan Categories: Health insurance plans offered on the Marketplace are categorized into metal tiers based on their actuarial value. These categories include Bronze, Silver, Gold, and Platinum plans, with higher-tier plans offering more comprehensive coverage and lower out-of-pocket costs.

| Metal Plan Category | Actuarial Value |

|---|---|

| Bronze | 60% |

| Silver | 70% |

| Gold | 80% |

| Platinum | 90% |

Navigating the Health Insurance Marketplace

The process of navigating the Health Insurance Marketplace can seem daunting, especially for first-time users. However, with the right guidance and understanding of the platform’s features, finding suitable health insurance becomes more manageable.

Step-by-Step Guide to Enrollment

- Gather Necessary Information: Before starting the enrollment process, collect the required documents and information. This includes personal details like income, family size, and citizenship status. Having this information ready will streamline the application process.

- Access the Marketplace: Visit the official Health Insurance Marketplace website (healthcare.gov) or use the state-based Marketplace if your state has established its own platform. Create an account to begin the enrollment journey.

- Assess Your Eligibility: Determine if you qualify for Medicaid, the Children’s Health Insurance Program (CHIP), or premium tax credits. The Marketplace will guide you through this process, helping you understand the financial assistance you may be entitled to.

- Compare Plans: Utilize the plan comparison tool to evaluate different insurance options. Consider factors such as monthly premiums, deductibles, copayments, and the providers and hospitals included in the plan’s network.

- Choose a Plan: Based on your research and eligibility, select the plan that best suits your needs and budget. Remember that the plan’s premium is just one aspect; consider the overall value and coverage it provides.

- Complete the Application: Provide accurate and complete information in your application. This includes details about your household, income, and any desired coverage adjustments. Double-check your entries to avoid delays in processing.

- Make Payment Arrangements: Finalize your enrollment by selecting a payment method for your insurance premium. Some plans may require an initial payment, while others may offer payment plans.

- Review and Confirm: Carefully review your application and selected plan details before finalizing your enrollment. Ensure that all information is correct and that you understand the coverage and benefits provided.

Tips for a Smooth Enrollment Experience

- Stay informed about the open enrollment period to avoid missing the deadline. Keep an eye on the Marketplace’s website or sign up for email updates to receive timely reminders.

- Take advantage of the Marketplace’s resources and tools. The website offers a wealth of information, including plan details, eligibility criteria, and step-by-step guides to assist you throughout the process.

- Consider seeking assistance from trained navigators or certified application counselors. These professionals can provide personalized guidance and support, especially for those with complex situations or specific questions.

- If you have a pre-existing condition, rest assured that the Marketplace prohibits insurance companies from denying coverage or charging higher premiums based on health status. This protection ensures equal access to affordable healthcare for all.

- Keep track of important dates and deadlines. Make note of when your coverage starts and ends, as well as any deadlines for making changes or renewing your plan.

Benefits of the Health Insurance Marketplace

The Health Insurance Marketplace has brought about significant advantages for individuals and families seeking health coverage. Here are some key benefits it offers:

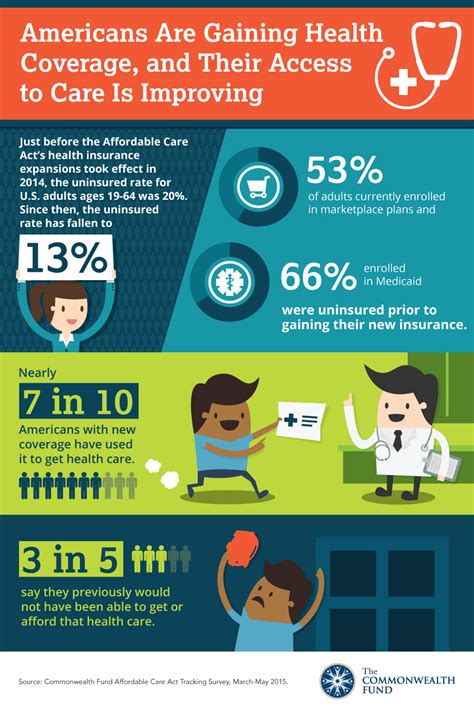

- Increased Access to Healthcare: The Marketplace has made healthcare more accessible to millions of Americans, particularly those who were previously uninsured or faced high costs due to pre-existing conditions. With income-based subsidies and tax credits, even those with limited financial means can afford quality coverage.

- Consumer Protection: The ACA and the Marketplace have implemented essential consumer protections. Insurance companies are now required to cover essential health benefits, such as preventive care, mental health services, and prescription drugs. Additionally, lifetime and annual limits on coverage have been eliminated, ensuring individuals receive the care they need without financial barriers.

- Competition and Choice: The Marketplace fosters a competitive environment, driving insurance companies to offer more affordable and comprehensive plans. Consumers benefit from a wider range of choices, allowing them to select a plan that aligns with their specific needs and preferences.

- Standardized Information: The Marketplace provides standardized information on health plans, making it easier for individuals to compare options. This transparency ensures that consumers can make informed decisions based on accurate and consistent data.

- Online Convenience: The online enrollment process has revolutionized the way people access health insurance. The digital platform simplifies the application and selection process, making it more efficient and less time-consuming.

Impact on Healthcare Outcomes

The establishment of the Health Insurance Marketplace has had a profound impact on healthcare outcomes across the United States. Research has shown that individuals with health insurance are more likely to receive necessary medical care, leading to improved health and well-being. Additionally, the Marketplace’s focus on preventive care and early intervention has contributed to better health management and reduced healthcare costs in the long run.

Future Prospects and Challenges

While the Health Insurance Marketplace has achieved notable successes, it continues to face challenges and evolve to meet the changing needs of the population. Here are some key considerations for the future:

Expanding Coverage Options

Efforts are underway to expand the range of health insurance options available on the Marketplace. This includes exploring alternative plan designs, such as short-term plans or association health plans, to provide more flexibility and choice for consumers. Additionally, ongoing discussions focus on improving the affordability of insurance, particularly for those with higher incomes who may not qualify for subsidies.

Addressing Healthcare Disparities

The Marketplace plays a crucial role in addressing healthcare disparities and ensuring equitable access to care. Ongoing initiatives aim to improve outreach and enrollment efforts in underserved communities, as well as enhance cultural competency training for healthcare providers to better serve diverse populations.

Technology and Innovation

As technology advances, the Marketplace is exploring ways to enhance its digital infrastructure and user experience. This includes leveraging artificial intelligence and machine learning to streamline enrollment processes, personalize plan recommendations, and provide real-time assistance to consumers.

Navigating Political and Regulatory Changes

The Health Insurance Marketplace operates within a dynamic political and regulatory landscape. Ongoing debates and policy changes can impact the availability and affordability of insurance plans. It is essential for consumers to stay informed about these developments and understand how they may affect their coverage options.

How often does the Health Insurance Marketplace open for enrollment?

+The Marketplace typically has an annual open enrollment period, lasting approximately six weeks. However, some states may offer extended enrollment periods or year-round enrollment options. It's important to check the specific dates for your state's Marketplace.

Can I enroll outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you experience a qualifying life event, such as losing your job, getting married, or having a baby. These events allow for a special enrollment period, giving you the opportunity to make changes to your coverage.

Are there income limits for premium tax credits on the Marketplace?

+Premium tax credits are available to individuals and families with incomes between 100% and 400% of the federal poverty level. The exact income limits vary based on family size and the state you reside in. These tax credits can significantly reduce the cost of insurance premiums.

Can I use the Health Insurance Marketplace if I have employer-provided insurance?

+Generally, if you have access to affordable employer-provided insurance, you may not be eligible for premium tax credits or subsidies through the Marketplace. However, it's worth comparing the costs and benefits to determine if switching to a Marketplace plan is more advantageous for your specific situation.

What happens if I miss the open enrollment deadline?

+If you miss the open enrollment deadline, you may still have options. Depending on your circumstances, you may be eligible for a special enrollment period or able to purchase short-term health insurance until the next open enrollment period. It's important to explore your options and understand the potential consequences of missing the deadline.

The Health Insurance Marketplace has transformed the healthcare landscape, empowering individuals and families to take control of their health coverage. With its user-friendly platform and range of benefits, the Marketplace continues to play a vital role in ensuring Americans have access to affordable, quality healthcare. As the landscape evolves, staying informed and engaged is key to making the most of the available resources and achieving optimal health outcomes.