Expat Insurance

Introduction: Understanding the Need for Expat Insurance

As the world becomes increasingly interconnected, the number of individuals seeking international opportunities for work, study, or lifestyle choices has grown exponentially. This trend has given rise to a unique set of challenges, one of which is the necessity for comprehensive insurance coverage tailored to the specific needs of expatriates, commonly referred to as expat insurance.

Expat insurance is a specialized form of insurance that caters to individuals living and working abroad, often for extended periods. It provides a safety net against a range of unforeseen events, ensuring that expats can navigate their new environments with peace of mind. This article aims to delve into the world of expat insurance, exploring its nuances, benefits, and the key considerations for those embarking on an international journey.

The Importance of Expat Insurance

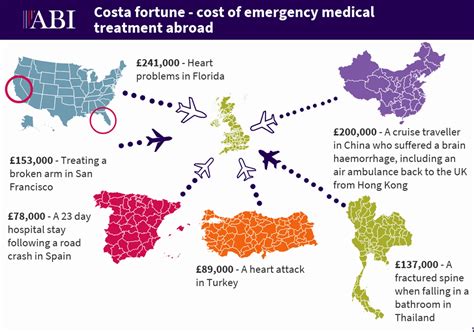

Protection Against Unforeseen Medical Emergencies

One of the primary concerns for expats is the potential for medical emergencies in a foreign country. Health care systems can vary significantly across nations, and the cost of medical treatment can be exorbitant, especially for those without local health insurance coverage. Expat insurance provides essential medical coverage, ensuring that individuals have access to quality healthcare without incurring massive financial burdens.

Safeguarding Personal Belongings and Property

Moving to a new country often involves shipping personal belongings and setting up a new home. Expat insurance offers protection for personal property, covering losses due to theft, damage, or natural disasters. This ensures that expats can focus on settling into their new environment without worrying about the financial implications of unexpected events.

Legal and Liability Coverage

Living and working abroad also brings a unique set of legal and liability risks. Expat insurance policies often include liability coverage, protecting individuals against claims arising from accidental damage to property or bodily injury to others. This aspect of expat insurance is particularly crucial for those working in high-risk professions or engaging in activities that could potentially lead to legal issues.

Key Considerations When Choosing Expat Insurance

Understanding Your Needs and Coverage Requirements

Before selecting an expat insurance policy, it is essential to thoroughly assess your specific needs and coverage requirements. Consider factors such as the country you are moving to, the local healthcare system, and any pre-existing medical conditions. Additionally, evaluate your lifestyle and the potential risks associated with your activities, hobbies, and profession.

Researching and Comparing Insurance Providers

The expat insurance market is diverse, with numerous providers offering a range of policies. It is crucial to conduct thorough research and compare different providers based on factors such as coverage limits, policy exclusions, and additional benefits. Look for providers with a strong reputation and a track record of providing efficient and reliable services.

Customizing Your Policy to Fit Your Circumstances

Expat insurance policies are often customizable, allowing individuals to tailor coverage to their specific needs. This flexibility is particularly beneficial as it ensures that you are not paying for coverage you don’t need while still maintaining adequate protection. Common customizable aspects include medical coverage limits, deductibles, and optional add-ons such as travel insurance or coverage for high-risk activities.

Real-Life Examples of Expat Insurance in Action

Case Study: Medical Emergency Abroad

Imagine an expat teacher working in a remote area of a developing country. While hiking on a weekend, they suffer a severe injury requiring immediate medical attention. In this scenario, expat insurance would be crucial, providing coverage for emergency medical evacuation, hospital stays, and any necessary treatments. Without this insurance, the individual would face significant financial strain and potentially compromised medical care.

Case Study: Property Protection

Consider an expat family renting an apartment in an area prone to natural disasters. Despite taking precautions, their apartment suffers significant water damage due to a severe storm. Expat insurance would cover the cost of repairs, ensuring that the family can quickly return to their normal lives without the added financial burden of unexpected property damage.

Performance Analysis and Expert Insights

Performance Metrics and Industry Standards

When evaluating expat insurance providers, it is beneficial to consider industry standards and performance metrics. Look for providers with a strong financial rating, indicating their ability to honor claims and maintain financial stability. Additionally, consider the provider’s track record in handling claims, particularly in the country or region you will be residing in.

Expert Advice: Tips for Maximizing Expat Insurance Benefits

Choose a Reputable Broker: Working with a reputable insurance broker can provide valuable guidance in navigating the complex world of expat insurance. Brokers have extensive knowledge of the market and can offer personalized advice based on your specific needs.

Read the Fine Print: It is crucial to thoroughly understand the terms and conditions of your policy, including any exclusions or limitations. This ensures that you are aware of any potential gaps in coverage and can make informed decisions about additional coverage options.

Regularly Review and Update Your Policy: As your circumstances change, so too should your insurance coverage. Regularly review your policy to ensure it aligns with your current needs, and update it accordingly. This is particularly important if you plan to engage in new activities or travel to new regions.

Future Implications and Industry Trends

The Growing Demand for Expat Insurance

The demand for expat insurance is expected to grow significantly in the coming years, driven by the increasing number of individuals seeking international opportunities. This trend is particularly evident in sectors such as education, where teachers are increasingly pursuing global teaching positions, and in the corporate world, where companies are expanding their global footprints.

Technological Advancements and Digital Innovations

The insurance industry is undergoing a digital transformation, and expat insurance is no exception. Insurtech companies are leveraging technology to streamline the insurance process, making it more efficient and accessible for expats. This includes the use of digital platforms for policy management, claims processing, and even real-time risk assessment.

Conclusion: Navigating the World with Confidence

Expat insurance is a vital component of international living, providing a comprehensive safety net against a range of unforeseen events. By understanding the importance of expat insurance, carefully considering your coverage needs, and choosing a reputable provider, you can embark on your international journey with confidence, knowing that you are protected against life’s unexpected twists and turns.

FAQ

How does expat insurance differ from regular travel insurance?

+

Expat insurance is designed for individuals living and working abroad for extended periods, often a year or more. It provides comprehensive coverage for medical emergencies, property protection, and legal liabilities. Travel insurance, on the other hand, is typically short-term coverage for travelers, focusing primarily on medical emergencies and trip cancellations.

Can expat insurance cover pre-existing medical conditions?

+

Some expat insurance policies do cover pre-existing medical conditions, but this is often subject to certain conditions and exclusions. It is crucial to disclose any pre-existing conditions to your insurance provider and understand the policy’s terms regarding coverage for these conditions.

What happens if I need to make a claim while abroad?

+

The process of making a claim can vary depending on your insurance provider and the type of claim. Typically, you will need to contact your insurance company and provide relevant documentation, such as medical reports or property damage assessments. The claims process is often streamlined through digital platforms, allowing for efficient and timely resolution.