Cost Of Life Insurance For Seniors

As we age, the need for financial security and peace of mind becomes increasingly important. Life insurance is a crucial aspect of financial planning, offering a safety net for both the policyholder and their loved ones. However, when it comes to seniors, the cost of life insurance can be a complex and often confusing topic. In this comprehensive guide, we will delve into the factors that influence the cost of life insurance for seniors, explore the various types of policies available, and provide insights to help you make informed decisions.

Understanding the Cost of Life Insurance for Seniors

The cost of life insurance for seniors, like any demographic, is determined by a multitude of factors. These factors are considered by insurance providers to assess the level of risk associated with insuring an individual and, consequently, determine the premium amount. It’s important to note that while life insurance for seniors can be more expensive compared to younger individuals, it remains a valuable investment for those seeking financial protection and legacy planning.

Key Factors Influencing Premiums

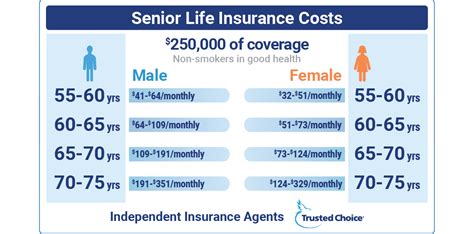

When it comes to life insurance for seniors, several key factors play a significant role in determining the cost of premiums. These factors are used by insurance companies to assess the overall health and longevity of the applicant, which directly impacts the level of risk they pose to the insurer.

- Age: Age is a primary factor in life insurance pricing. As individuals age, the risk of health issues and mortality increases, leading to higher premiums. While life insurance for seniors is available, it's important to note that the cost typically rises with each birthday.

- Health Status: The state of an individual's health is a critical consideration. Pre-existing medical conditions, such as heart disease, diabetes, or cancer, can significantly impact the cost of life insurance. Regular check-ups and maintaining a healthy lifestyle can help mitigate these costs.

- Lifestyle Factors: Insurance companies also assess an individual's lifestyle choices, including smoking status, alcohol consumption, and participation in risky activities. These factors can influence the risk profile and, consequently, the premium amount.

- Family History: Your family's medical history can provide insights into potential genetic predispositions. Insurance companies often consider the health and longevity of your immediate family members when assessing your risk profile.

- Current Medications: The types and dosages of medications you're currently taking can indicate the severity of any existing health conditions. This information is crucial for insurers when determining your overall risk.

It's worth noting that while these factors play a significant role, the specific weight given to each can vary between insurance companies and the type of policy being sought. Additionally, some insurers may offer discounts or incentives for certain health-related achievements or lifestyle choices, so it's always beneficial to shop around and compare quotes.

Types of Life Insurance for Seniors

The market offers a range of life insurance options tailored to the unique needs of seniors. Understanding the different types available can help you make an informed decision about the coverage that best suits your requirements.

Term Life Insurance

Term life insurance is a popular choice for seniors seeking coverage for a specific period, typically ranging from 10 to 30 years. This type of policy provides a death benefit to the beneficiary upon the policyholder’s passing during the term. The key advantage of term life insurance is its affordability, making it an attractive option for those on a budget. However, it’s important to note that the coverage expires at the end of the term, and the policyholder will need to reassess their needs and consider renewing or switching to a different type of policy.

| Policy Duration | Premium Amount |

|---|---|

| 10-Year Term | $250 annually |

| 20-Year Term | $350 annually |

| 30-Year Term | $500 annually |

💡 Pro Tip: Term life insurance is an excellent choice for seniors with short-term financial obligations, such as covering funeral expenses or providing temporary financial support for loved ones.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the policyholder’s entire life, as long as premiums are paid. This type of policy accumulates cash value over time, which can be borrowed against or withdrawn if needed. Whole life insurance provides peace of mind, knowing that your loved ones will receive a guaranteed death benefit upon your passing. However, it’s important to consider that whole life insurance typically comes with higher premiums compared to term life insurance.

| Policy Type | Premium Amount | Cash Value Accumulation |

|---|---|---|

| Whole Life Insurance | $1,500 annually | Yes, with guaranteed growth |

💡 Pro Tip: Whole life insurance is ideal for seniors seeking long-term financial protection and legacy planning. The cash value accumulation can provide additional financial flexibility and ensure your loved ones' financial security.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a unique type of policy designed specifically for seniors, often with no medical exam or health questions required. This makes it an accessible option for individuals with pre-existing health conditions or those who may find it challenging to qualify for traditional life insurance. However, it’s important to note that guaranteed issue life insurance typically comes with a waiting period, during which the beneficiary may not receive the full death benefit if the policyholder passes away. Additionally, these policies often have higher premiums compared to other types of life insurance.

| Policy Type | Premium Amount | Waiting Period |

|---|---|---|

| Guaranteed Issue Life Insurance | $800 annually | 2-3 years |

💡 Pro Tip: Guaranteed issue life insurance is a valuable option for seniors who prioritize accessibility over other factors, such as cost or coverage limitations.

Tips for Obtaining Affordable Life Insurance as a Senior

While the cost of life insurance for seniors can be higher compared to younger individuals, there are strategies you can employ to obtain more affordable coverage. Here are some tips to consider:

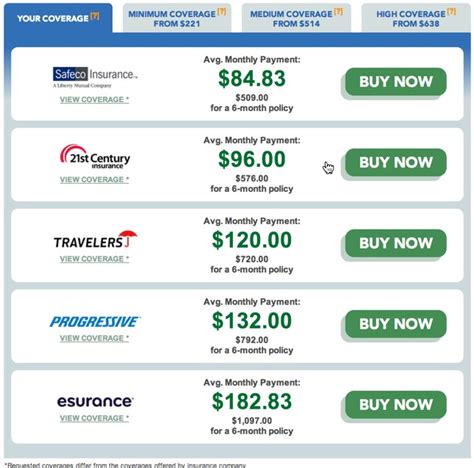

- Shop Around: Compare quotes from multiple insurance companies to find the best rates for your specific circumstances. Online comparison tools can be a valuable resource for this process.

- Consider Term Length: If you opt for term life insurance, choose a term length that aligns with your financial goals and obligations. Shorter terms may offer more affordable premiums.

- Maintain a Healthy Lifestyle: Leading a healthy lifestyle can positively impact your premium costs. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can improve your overall health and reduce insurance risks.

- Bundle Policies: If you have other insurance needs, such as auto or home insurance, consider bundling your policies with the same provider. Many insurers offer discounts for multiple policy holders.

- Review Coverage Regularly: As your circumstances change, so might your insurance needs. Regularly review your policy to ensure it still meets your requirements and consider adjusting coverage or switching policies as needed.

Performance Analysis and Real-World Examples

To illustrate the cost variations and potential savings associated with life insurance for seniors, let’s examine some real-world examples. These scenarios will provide a clearer understanding of how different factors influence premium costs.

Scenario 1: Healthy Senior with Term Life Insurance

Imagine a 65-year-old individual, in good health, seeking term life insurance for a 10-year period. With no pre-existing conditions and a healthy lifestyle, this individual might expect to pay around $250 annually for their policy. This example highlights the affordability of term life insurance for seniors who prioritize health and longevity.

Scenario 2: Senior with Pre-Existing Conditions

Now, consider a 70-year-old individual with a history of heart disease and diabetes. Despite these health challenges, they wish to secure whole life insurance coverage. Due to the increased risk, their annual premiums for whole life insurance could be significantly higher, ranging from 2,000 to 3,000 annually. This scenario underscores the importance of maintaining good health and the potential cost implications of pre-existing conditions.

Scenario 3: Senior Seeking Guaranteed Issue Life Insurance

For a 75-year-old individual with multiple health issues, guaranteed issue life insurance might be the most accessible option. With a waiting period of 2-3 years and higher premiums, this individual could expect to pay around $800 annually for their policy. While the coverage may be limited, it provides peace of mind and ensures some financial protection for their loved ones.

Future Implications and Industry Insights

As the senior population continues to grow, the demand for life insurance tailored to this demographic is expected to increase. Insurance providers are recognizing this trend and are adapting their offerings to cater to the unique needs of seniors. Here are some insights into the future of life insurance for seniors:

- Increased Accessibility: Insurance companies are developing more flexible policies with simplified application processes to make life insurance more accessible to seniors. This includes reducing the need for extensive medical exams and offering policies with fewer health questions.

- Innovative Coverage Options: The industry is exploring new coverage options, such as hybrid policies that combine term and whole life insurance features, providing seniors with more customizable and cost-effective solutions.

- Longevity and Health Management: With advancements in healthcare and an increasing focus on healthy aging, seniors are living longer and healthier lives. This trend is likely to influence the cost of life insurance, potentially leading to more affordable premiums for those who prioritize their health.

- Digital Transformation: The life insurance industry is embracing digital technologies to enhance the customer experience. This includes online applications, digital policy management, and real-time claim processing, making the entire process more efficient and convenient for seniors.

In conclusion, while the cost of life insurance for seniors can vary significantly based on individual circumstances, it remains an essential component of financial planning. By understanding the factors that influence premiums and exploring the various policy options available, seniors can make informed decisions to secure the coverage they need. With the evolving landscape of the life insurance industry, seniors can look forward to more accessible and tailored coverage options, ensuring their financial security and peace of mind.

What is the average cost of life insurance for seniors?

+

The average cost of life insurance for seniors can vary widely based on factors such as age, health status, and the type of policy. However, as a general guideline, seniors can expect to pay anywhere from 250 to 1,500 annually for term life insurance and up to $3,000 annually for whole life insurance. It’s important to shop around and compare quotes to find the most affordable option that meets your specific needs.

Are there any discounts available for seniors on life insurance premiums?

+

Yes, some insurance companies offer discounts or incentives for seniors who meet certain criteria. For example, maintaining a healthy lifestyle, bundling policies, or having certain affiliations (such as being a member of specific organizations) can lead to reduced premiums. It’s always worth inquiring about potential discounts when shopping for life insurance.

Can seniors with pre-existing conditions still obtain life insurance coverage?

+

Absolutely! While pre-existing conditions can impact the cost and availability of certain types of life insurance, there are options specifically designed for seniors with health issues. Guaranteed issue life insurance, for instance, does not require a medical exam and can provide coverage for those with pre-existing conditions. However, it’s important to carefully review the terms and conditions of such policies, as they may have limitations or waiting periods.

How can seniors reduce the cost of their life insurance premiums?

+

There are several strategies seniors can employ to reduce their life insurance premiums. These include maintaining a healthy lifestyle, shopping around for the best rates, considering term life insurance with shorter terms, and exploring the possibility of bundling policies with the same insurer. Additionally, some insurers offer discounts for certain health achievements or lifestyle choices, so it’s always beneficial to inquire about potential savings.