Home And Insurance

The Homeowner's Guide to Navigating the World of Insurance: A Comprehensive Overview

Homeownership is a significant milestone, bringing with it a sense of pride and accomplishment. However, it also comes with a range of responsibilities, one of which is protecting your investment through insurance. Navigating the world of home insurance can be complex, but with the right knowledge and understanding, you can ensure your home and belongings are adequately covered. In this comprehensive guide, we'll delve into the intricacies of home insurance, offering expert insights and practical tips to help you make informed decisions.

Whether you're a first-time homeowner or looking to review your existing coverage, this guide will provide you with the tools to navigate the insurance landscape with confidence. From understanding the basics of home insurance policies to exploring specialized coverage options, we'll cover it all. So, let's embark on this journey together and unlock the secrets to securing your home and valuables.

Understanding the Fundamentals of Home Insurance

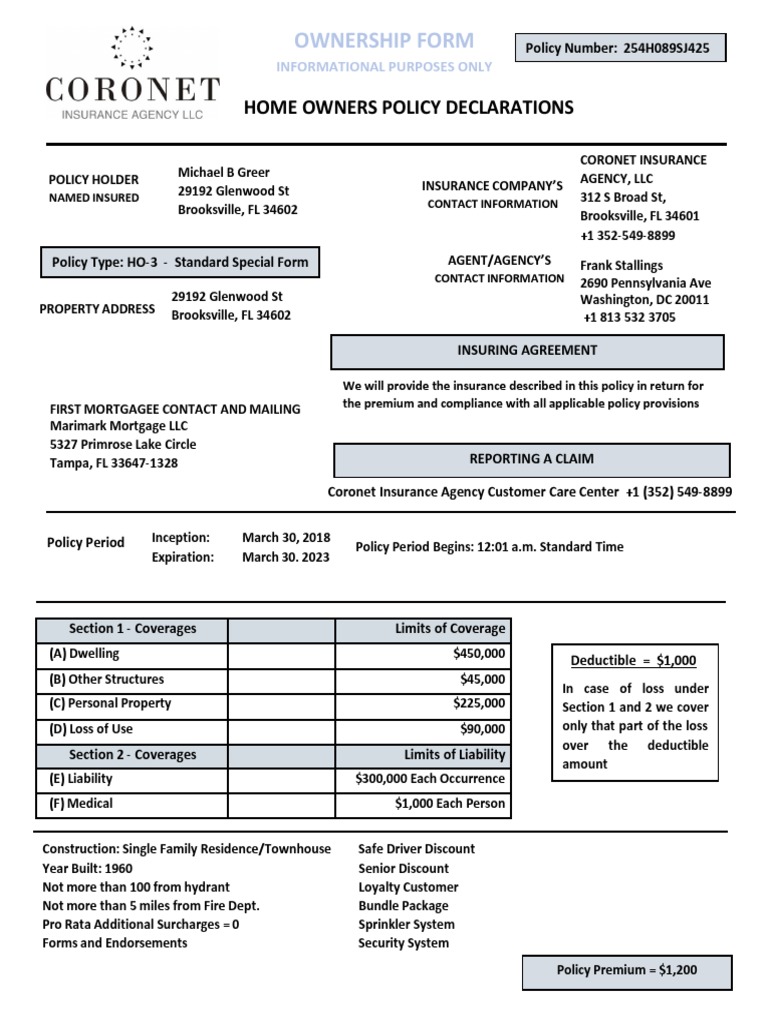

At its core, home insurance is a contract between you, the policyholder, and the insurance company. It provides financial protection against various risks and losses associated with owning a home. These risks can include damage to your property, theft, liability claims, and even natural disasters. By paying a premium, you gain peace of mind knowing that you're protected from unforeseen events that could potentially cause significant financial setbacks.

Here are some key components to grasp when understanding home insurance:

- Coverage Types: Home insurance policies typically offer coverage for the structure of your home, personal belongings, and liability. Additional coverage options, such as flood insurance or earthquake coverage, may be available depending on your location and specific needs.

- Policy Limits: These limits define the maximum amount the insurance company will pay for covered losses. It's crucial to ensure your policy limits align with the replacement cost of your home and possessions.

- Deductibles: A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, so choosing the right deductible is a balance between cost and coverage.

- Exclusions: Home insurance policies have specific exclusions, meaning certain risks or damages are not covered. Understanding these exclusions is vital to avoid any surprises when making a claim.

Assessing Your Insurance Needs

Before diving into the world of home insurance, it's essential to assess your unique needs and circumstances. Consider the following factors when evaluating your insurance requirements:

Location and Risk Factors

The location of your home plays a significant role in determining your insurance needs. Areas prone to natural disasters like hurricanes, tornadoes, or wildfires may require specialized coverage. Additionally, factors such as crime rates and proximity to bodies of water can influence the types of coverage you should prioritize.

Home Value and Replacement Cost

Accurately assessing the value of your home is crucial for determining the appropriate level of coverage. The replacement cost, which considers the cost to rebuild your home and replace your belongings, should be the basis for your insurance policy limits.

| Metric | Value |

|---|---|

| Home Value | $450,000 |

| Replacement Cost | $520,000 |

Personal Belongings and Valuables

Home insurance policies typically cover personal belongings, but there may be limitations on high-value items like jewelry, artwork, or collectibles. Consider the value of your possessions and whether you need additional coverage to protect them adequately.

Liability Risks

Liability coverage is an essential aspect of home insurance. It protects you from financial losses if someone is injured on your property or if you are found liable for damages caused to others. Evaluate the potential risks associated with your home and choose liability limits that provide sufficient coverage.

Choosing the Right Home Insurance Policy

With a clear understanding of your insurance needs, it's time to explore the different policy options available. Home insurance policies can vary significantly between providers, so it's important to compare coverage, premiums, and customer satisfaction.

Policy Comparison

When comparing policies, consider the following factors:

- Coverage Options: Ensure the policy covers the specific risks you want to protect against, such as theft, fire, or natural disasters.

- Deductibles and Limits: Compare deductibles and policy limits to find a balance that suits your budget and coverage needs.

- Additional Coverages: Look for policies that offer optional coverages relevant to your situation, like flood or earthquake insurance.

- Discounts and Bundles: Explore insurance companies that offer discounts for multiple policies or safety features like smoke detectors or security systems.

Working with an Insurance Agent

Seeking guidance from an experienced insurance agent can be invaluable. They can help you navigate the complexities of home insurance, provide personalized recommendations, and ensure you have the right coverage for your unique situation.

Understanding Your Policy: Key Terms and Conditions

Once you've selected a home insurance policy, it's crucial to thoroughly understand its terms and conditions. Familiarize yourself with the following key aspects:

Policy Exclusions and Limitations

Every policy has exclusions, so it's important to review these carefully. Common exclusions include flood damage, earthquake damage, and wear and tear. Understanding these limitations will help you identify any gaps in your coverage and consider additional policies if needed.

Policy Endorsements and Riders

Policy endorsements or riders are additions to your base policy that provide extra coverage for specific risks or valuable items. These can include coverage for jewelry, fine art, or personal liability for injuries sustained by pets. Discuss these options with your insurance agent to ensure your valuable possessions are adequately protected.

Filing a Claim: The Process and Best Practices

Knowing the process of filing a claim and best practices can streamline the experience and increase your chances of a successful outcome.

- Documenting Losses: Take detailed notes and photographs of any damage or losses. This documentation will be crucial when filing a claim.

- Contacting Your Insurer: Reach out to your insurance company as soon as possible after a loss occurs. They will guide you through the claims process and provide the necessary forms and instructions.

- Gathering Supporting Documentation: Collect and organize any relevant documentation, such as receipts, appraisals, or police reports, to support your claim.

- Collaborating with Adjusters: Work closely with the insurance adjuster assigned to your claim. Provide them with all the necessary information and be transparent throughout the process.

Maximizing Your Home Insurance Coverage

To get the most out of your home insurance policy, consider these strategies:

Regular Policy Reviews

Life circumstances and the value of your home and belongings can change over time. Regularly review your policy to ensure it still meets your needs. Consider updating your coverage limits or adding endorsements as necessary.

Home Safety and Prevention

Implementing safety measures in your home can not only protect your property but also potentially reduce your insurance premiums. Consider installing smoke detectors, fire extinguishers, and a home security system. These actions can enhance your home's safety and demonstrate your commitment to risk prevention.

Bundling Policies for Savings

Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. By combining your policies with the same insurer, you may be eligible for significant savings.

Navigating Common Home Insurance Challenges

Home insurance isn't without its challenges. Here are some common issues and strategies to navigate them effectively:

Handling Claims Denials

If your claim is denied, don't panic. Review the reasons for the denial and consider appealing the decision. Work with your insurance agent to gather additional evidence or documentation to support your claim.

Addressing Rising Premiums

Insurance premiums can increase over time due to various factors, including inflation and changes in risk assessments. To manage rising premiums, shop around for competitive rates and consider increasing your deductible to reduce your monthly payments.

Dealing with Natural Disasters

Natural disasters can be devastating, and understanding your coverage in such situations is crucial. Review your policy's coverage for specific natural disasters and consider purchasing additional coverage if necessary. Additionally, create an emergency plan and ensure your home is prepared for potential risks.

Future Trends and Innovations in Home Insurance

The home insurance industry is evolving, and new trends and technologies are shaping the way policies are designed and implemented. Stay informed about the following developments to make the most of your insurance coverage:

Smart Home Technology

The integration of smart home technology is revolutionizing home insurance. Insurance companies are offering discounts for homes equipped with smart devices that enhance security and prevent losses. From smart locks to leak detection systems, these innovations can provide added protection and potential savings.

Data-Driven Risk Assessment

Insurance companies are increasingly using advanced data analytics to assess risk and personalize coverage. By analyzing historical data and emerging trends, insurers can offer more accurate and tailored policies. This approach benefits both insurers and policyholders by providing more precise coverage at competitive rates.

Sustainable and Green Initiatives

The insurance industry is recognizing the importance of sustainability and is offering incentives for homeowners who adopt eco-friendly practices. Policies may include discounts for energy-efficient homes or coverage for green rebuilding after a loss. Embracing sustainable practices not only benefits the environment but can also reduce your insurance costs.

Conclusion

Navigating the world of home insurance is a critical aspect of responsible homeownership. By understanding the fundamentals, assessing your needs, and staying informed about industry trends, you can secure the right coverage for your home and belongings. Remember, home insurance is not a one-size-fits-all solution, so customize your policy to fit your unique circumstances. With the right approach, you can protect your investment and enjoy the peace of mind that comes with comprehensive coverage.

What is the average cost of home insurance?

+The average cost of home insurance can vary significantly based on factors like location, home value, and coverage options. According to recent data, the national average for home insurance premiums is around $1,200 per year. However, it’s important to note that this is just an average, and your specific rate may be higher or lower depending on your circumstances.

Can I customize my home insurance policy?

+Absolutely! Home insurance policies are highly customizable. You can choose different levels of coverage, select specific endorsements or riders to cover valuable items, and even opt for higher or lower deductibles to suit your budget and risk tolerance. Working with an insurance agent can help you tailor your policy to your unique needs.

How often should I review my home insurance policy?

+It’s a good practice to review your home insurance policy annually or whenever there are significant changes in your life or circumstances. This could include renovations to your home, acquiring new valuable possessions, or experiencing life events like marriage or having children. Regular policy reviews ensure your coverage remains adequate and up-to-date.