Insuring

In today's complex and ever-evolving world, the concept of insuring has become an essential part of our lives and businesses. From safeguarding our health and properties to mitigating risks and securing our future, insurance plays a pivotal role in providing peace of mind and financial protection. As we navigate through the myriad of insurance options available, it is crucial to understand the nuances, benefits, and implications of each type of coverage. This comprehensive guide aims to delve into the world of insurance, exploring its various facets and offering expert insights to help you make informed decisions.

The Evolution of Insurance: A Historical Perspective

The history of insurance can be traced back to ancient civilizations, where early forms of risk management and protection were already in practice. However, it was during the Medieval period that the concept of insurance as we know it today began to take shape. In 14th-century Italy, merchants and traders developed a system of marine insurance to protect their goods during sea voyages, a practice that laid the foundation for modern insurance practices.

The Industrial Revolution in the 18th and 19th centuries further propelled the growth of insurance, as the need for risk management expanded with the rise of industrialization and globalization. This era saw the emergence of various insurance types, including life insurance, property insurance, and liability insurance. Companies like Lloyd's of London, founded in 1688, played a pivotal role in shaping the insurance industry, pioneering new forms of coverage and setting standards for the industry.

The Modern Insurance Landscape

Today, the insurance industry is a global powerhouse, offering a vast array of products and services to individuals and businesses alike. With the advent of technology and digitalization, the insurance sector has undergone a significant transformation, making insurance more accessible and customizable than ever before.

The digital age has brought about a revolution in the way insurance is purchased and managed. Online platforms and mobile applications have streamlined the process, allowing individuals to compare policies, calculate premiums, and purchase coverage with just a few clicks. This shift has not only made insurance more convenient but has also empowered consumers to make more informed choices.

| Insurance Type | Coverage | Key Benefits |

|---|---|---|

| Life Insurance | Financial protection for beneficiaries upon the policyholder's death | Provides financial security for loved ones, covers funeral expenses, and can offer tax benefits. |

| Health Insurance | Coverage for medical expenses, including hospitalization, surgeries, and treatments | Ensures access to quality healthcare, provides financial protection against high medical costs, and often includes preventive care coverage. |

| Property Insurance | Protection for homes, businesses, and valuable assets against damage, theft, or loss | Offers financial assistance in case of natural disasters, accidents, or theft, helping policyholders rebuild and replace their properties. |

| Auto Insurance | Coverage for vehicles, including liability, collision, and comprehensive insurance | Provides financial protection in case of accidents, covers vehicle repairs, and often includes rental car coverage. |

Understanding Insurance Policies: A Comprehensive Guide

At its core, an insurance policy is a legally binding contract between an insurance company (the insurer) and an individual or entity (the policyholder). This contract outlines the terms and conditions of the coverage, including what risks are covered, the amount of coverage provided, and the premium payments required.

Key Components of an Insurance Policy

- Coverage Limits: This specifies the maximum amount the insurer will pay for a covered loss or claim.

- Deductibles: The amount the policyholder must pay out-of-pocket before the insurance coverage kicks in.

- Exclusions: Specific risks or situations that are not covered by the policy.

- Premiums: The amount the policyholder pays to the insurer for the coverage, typically on a monthly or annual basis.

- Policy Term: The duration for which the policy is valid, after which it may need to be renewed.

It's crucial to carefully review these components when selecting an insurance policy to ensure it meets your specific needs and provides adequate coverage.

Types of Insurance Policies

The insurance industry offers a wide range of policies to cater to various needs and risks. Here’s an overview of some common types of insurance policies:

- Life Insurance: This policy provides financial protection to the policyholder's beneficiaries in the event of their death. It can include term life insurance, which offers coverage for a specific term, and permanent life insurance, which provides lifelong coverage.

- Health Insurance: A crucial policy that covers medical expenses, including hospitalization, surgeries, and treatments. Health insurance plans vary widely, with some offering comprehensive coverage for a range of medical services, while others focus on specific conditions or treatments.

- Property Insurance: Protects against damage, theft, or loss of homes, businesses, and valuable assets. This can include homeowners' insurance, renters' insurance, and business insurance, each tailored to the specific needs of the policyholder.

- Auto Insurance: Provides coverage for vehicles, offering protection against accidents, theft, and other damages. Auto insurance typically includes liability coverage, which protects the policyholder against claims arising from accidents they cause, and comprehensive coverage, which covers damages from non-accident events like theft or natural disasters.

- Liability Insurance: This policy protects individuals and businesses from claims arising from accidents, injuries, or property damage caused by their actions. It's a crucial coverage for businesses, professionals, and individuals who may be held liable for their actions or the actions of their employees.

The Impact of Insurance on Society and the Economy

Insurance plays a vital role in both society and the economy, offering a safety net that helps individuals and businesses navigate financial challenges and uncertainties. By providing financial protection, insurance encourages economic growth, fosters innovation, and promotes social stability.

Economic Benefits of Insurance

- Risk Management: Insurance helps businesses and individuals manage and mitigate risks, allowing them to focus on their core operations and objectives without the fear of financial ruin.

- Capital Formation: The insurance industry is a significant contributor to capital formation, investing premiums in various assets and industries, thereby stimulating economic growth.

- Stability and Security: Insurance provides a sense of financial security, allowing individuals and businesses to plan for the future with confidence, knowing they have protection against unforeseen events.

Social Impact of Insurance

- Health and Well-being: Health insurance ensures access to quality healthcare, promoting better health outcomes and improving overall well-being.

- Social Safety Net: Insurance policies, especially life insurance, provide a financial safety net for families, ensuring they can maintain their standard of living even in the event of a sudden loss.

- Community Resilience: Insurance coverage helps communities recover from disasters and unforeseen events, allowing them to rebuild and restore normalcy.

The Future of Insurance: Trends and Innovations

The insurance industry is undergoing a significant transformation, driven by technological advancements and changing consumer expectations. As we look to the future, several trends and innovations are shaping the way insurance is delivered and consumed.

Key Trends Shaping the Insurance Industry

- Digitalization: The continued digitalization of insurance processes, from policy issuance to claims management, is making insurance more accessible and efficient.

- Personalization: Insurers are increasingly offering personalized policies that cater to the unique needs and circumstances of individuals, allowing for more tailored coverage.

- Data Analytics: Advanced data analytics and artificial intelligence are being used to assess risks more accurately, improve underwriting processes, and offer more competitive premiums.

- Sustainability and ESG: There is a growing focus on sustainability and Environmental, Social, and Governance (ESG) factors, with insurers incorporating these considerations into their policies and investment strategies.

Innovations in Insurance

Several innovative technologies and approaches are transforming the insurance landscape:

- Telematics: In the auto insurance space, telematics devices are being used to monitor driving behavior, offering more accurate risk assessment and potentially reducing premiums for safe drivers.

- Blockchain: Blockchain technology is being explored for its potential to enhance data security, streamline insurance processes, and improve efficiency in areas like claims management.

- Insurtech Startups: Innovative startups are disrupting the traditional insurance model, offering new products, improved customer experiences, and more efficient processes.

- Parametric Insurance: This innovative approach to insurance pays out based on predefined parameters, such as weather events or natural disasters, providing faster and more efficient claims processes.

How do I choose the right insurance policy for my needs?

+Selecting the right insurance policy involves careful consideration of your unique circumstances and needs. Start by assessing your risks and determining the type of coverage you require. Compare policies from different insurers, taking into account coverage limits, deductibles, and premiums. Don’t hesitate to seek advice from insurance professionals or financial advisors to ensure you make an informed decision.

What are some common mistakes to avoid when purchasing insurance?

+Some common mistakes to avoid include underestimating your risks, not reviewing policies thoroughly, and opting for the cheapest option without considering the coverage it provides. It’s also important to avoid being overly optimistic about your ability to handle risks without insurance. Remember, insurance is a long-term investment, and it’s crucial to choose policies that offer adequate protection.

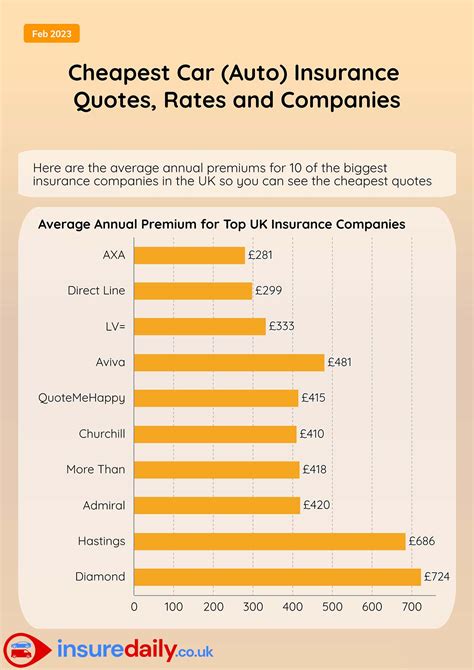

How can I save money on insurance premiums?

+There are several ways to save on insurance premiums. Firstly, shop around and compare quotes from different insurers. Consider increasing your deductibles, as this can lower your premiums. Additionally, maintain a good credit score, as insurers often use credit-based insurance scores to determine premiums. Lastly, explore discounts and rewards programs offered by insurers, such as safe driving discounts or loyalty rewards.

What should I do if I need to file an insurance claim?

+If you need to file an insurance claim, the first step is to contact your insurance provider and inform them of the incident. Provide as much detail as possible and cooperate fully with the claims process. It’s important to keep records of all communications and documentation related to the claim. Be prepared to provide evidence and proof of the loss or damage, and ensure you understand the claims process and any potential limitations or exclusions in your policy.