Best Cheapest Insurance

In today's world, securing affordable insurance coverage is a priority for many individuals and businesses alike. With rising costs and an array of options available, finding the best and cheapest insurance can be a daunting task. This comprehensive guide aims to shed light on the process, offering insights and strategies to help you navigate the insurance landscape and make informed decisions.

Understanding Insurance Costs

Insurance costs can vary significantly based on numerous factors, including the type of coverage, your location, personal or business circumstances, and the provider you choose. Understanding these variables is crucial to finding the best value.

Types of Insurance and Their Costs

Insurance is not a one-size-fits-all proposition. Different types of insurance cater to diverse needs. Here’s a breakdown of some common types and their associated costs:

- Health Insurance: This is perhaps one of the most critical types, covering medical expenses. Costs can vary widely depending on factors like age, pre-existing conditions, and the level of coverage desired. On average, an individual health insurance plan can range from $200 to $1,000 per month, while family plans can cost upwards of $1,500 monthly.

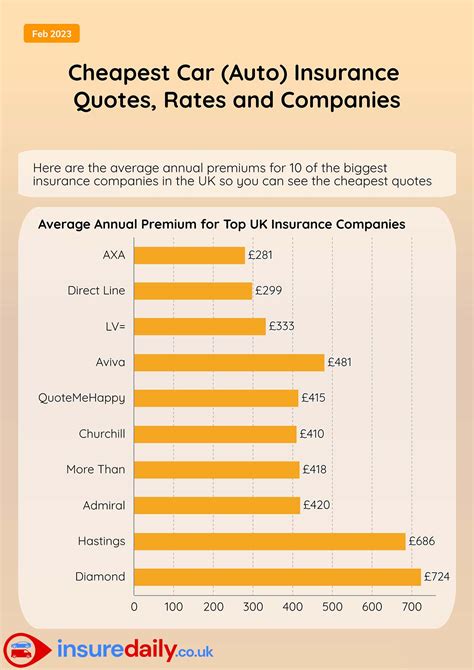

- Auto Insurance: Required by law in most places, auto insurance protects you against financial loss in the event of an accident. Costs depend on factors like your driving history, the make and model of your vehicle, and the level of coverage you select. On average, auto insurance can range from $500 to $1,500 annually.

- Homeowners/Renters Insurance: Protecting your home or rental property is essential. Costs vary based on the location, size, and value of the property, as well as the level of coverage needed. On average, homeowners insurance can cost between $1,000 and $2,000 annually, while renters insurance is generally more affordable, ranging from $150 to $300 per year.

- Life Insurance: Life insurance provides financial protection for your loved ones in the event of your passing. Costs depend on factors like your age, health, and the amount of coverage required. Term life insurance, which is generally more affordable, can cost as little as $200 to $300 annually for younger, healthy individuals. Whole life insurance, which offers lifelong coverage, can be significantly more expensive.

- Business Insurance: Essential for any business, this type of insurance can protect against a range of risks, from property damage to liability claims. Costs vary widely depending on the nature of the business, its size, and the specific coverage needed. On average, small business insurance can range from $500 to $1,000 annually, but this can quickly increase for larger, more complex businesses.

| Insurance Type | Average Cost |

|---|---|

| Health Insurance (Individual) | $200 - $1,000/month |

| Health Insurance (Family) | $1,500+/month |

| Auto Insurance | $500 - $1,500/year |

| Homeowners Insurance | $1,000 - $2,000/year |

| Renters Insurance | $150 - $300/year |

| Term Life Insurance | $200 - $300/year |

| Whole Life Insurance | Varies |

| Small Business Insurance | $500 - $1,000/year |

Factors Influencing Insurance Costs

Beyond the type of insurance, several other factors can influence the cost of your coverage. These include:

- Location: Insurance costs can vary greatly from one region to another. Factors like crime rates, natural disaster risks, and the cost of living can all impact insurance premiums.

- Personal/Business Profile: Your age, gender, occupation, driving history, health status, and the size and nature of your business can all play a role in determining insurance costs.

- Coverage Level: The level of coverage you choose can significantly impact your insurance costs. Higher coverage limits generally result in higher premiums.

- Provider and Policy Terms: Different insurance providers offer varying levels of coverage at different prices. Additionally, the terms and conditions of your policy, such as deductibles and co-pays, can affect your overall costs.

Strategies for Finding the Best and Cheapest Insurance

Now that we’ve explored the factors influencing insurance costs, let’s delve into some strategies to help you find the best and cheapest insurance options.

Shop Around and Compare

One of the most effective ways to find affordable insurance is to compare quotes from multiple providers. Each insurance company has its own pricing structure and policy offerings, so getting multiple quotes can help you identify the best value. Online comparison tools can be particularly useful for this, as they allow you to quickly and easily compare policies and prices.

Understand Your Needs

Before shopping for insurance, it’s crucial to understand your specific needs. Consider the level of coverage you require, the potential risks you face, and your budget. By clearly defining your needs, you can ensure you’re not overpaying for coverage you don’t need, or worse, underinsured.

Explore Discounts and Bundles

Many insurance providers offer discounts for various reasons, such as good driving records, multiple policies, or safety features on vehicles or homes. Additionally, bundling multiple policies with the same provider can often result in significant savings. Be sure to ask about any available discounts and consider bundling your insurance needs to maximize your savings.

Review Your Policy Regularly

Insurance needs can change over time, so it’s important to review your policy annually or whenever your circumstances change significantly. This can help you ensure you’re still getting the best value and the right level of coverage. Regular reviews can also alert you to any changes in policy terms or pricing, allowing you to make informed decisions about your insurance.

Consider Alternative Options

In some cases, alternative insurance options can provide better value or more tailored coverage. For example, health sharing ministries or short-term health insurance plans can be more affordable options for certain individuals. Similarly, for auto insurance, usage-based insurance or telematics programs might offer lower premiums for safe drivers. Exploring these alternatives can help you find the best fit for your needs.

The Future of Affordable Insurance

The insurance landscape is constantly evolving, with new technologies and approaches shaping the industry. Here’s a glimpse into the future of affordable insurance:

Digital Transformation

The digital revolution is transforming the insurance industry, with online platforms and mobile apps offering greater convenience and transparency. Digital tools are making it easier for consumers to compare policies, obtain quotes, and manage their insurance needs. Additionally, digital underwriting and claims processing are streamlining operations, leading to faster service and potentially lower costs.

Personalized Insurance

Advancements in data analytics and machine learning are enabling insurance providers to offer more personalized policies. By analyzing individual behaviors and risks, insurers can tailor coverage to specific needs, potentially reducing costs for lower-risk individuals. This shift towards personalized insurance is expected to become more prevalent in the coming years.

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is gaining traction. This type of insurance uses telematics devices to track driving behavior, with premiums based on actual usage and driving habits. For safe drivers, this can result in significant savings. As technology improves and more drivers embrace this model, usage-based insurance is expected to become a more widespread and affordable option.

Insurtech Innovations

The rise of insurtech (insurance technology) startups is bringing new innovations to the industry. These startups are leveraging technology to offer more efficient and affordable insurance solutions, often with a focus on specific niches. From on-demand insurance for gig workers to parametric insurance for small businesses, insurtech is opening up new avenues for affordable coverage.

Conclusion

Finding the best and cheapest insurance requires a thoughtful approach, considering your unique needs and the various factors that influence insurance costs. By understanding these factors and employing the strategies outlined above, you can navigate the insurance landscape with confidence, ensuring you get the coverage you need at a price you can afford. As the insurance industry continues to evolve, embracing digital transformation and innovative solutions, the future of affordable insurance looks bright.

What is the average cost of health insurance in the United States?

+The average cost of health insurance in the U.S. varies depending on factors like age, location, and coverage level. On average, an individual health insurance plan can range from 200 to 1,000 per month, while family plans can cost upwards of $1,500 monthly.

How can I reduce my auto insurance costs?

+To reduce auto insurance costs, consider shopping around for quotes, maintaining a clean driving record, and exploring usage-based insurance programs. Additionally, bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant savings.

Are there any affordable alternatives to traditional life insurance?

+Yes, there are affordable alternatives to traditional life insurance. Health sharing ministries and short-term health insurance plans can provide more budget-friendly options for certain individuals. Additionally, for those looking for a simpler form of life insurance, term life insurance is generally more affordable than whole life insurance.