Car Auto Insurance Rates

In the complex world of automotive finance, understanding the factors that influence car auto insurance rates is crucial for both individuals and businesses. This comprehensive guide will delve into the intricate details, offering an expert perspective on the subject, backed by real-world examples and industry insights.

The Determinants of Auto Insurance Rates

Auto insurance rates are a nuanced landscape, shaped by a myriad of factors. From personal demographics to vehicle specifics, and geographic location, each element plays a pivotal role in the final insurance cost. Let’s explore these aspects in depth, unraveling the mysteries behind these rates.

Personal Factors: Age, Gender, and Driving History

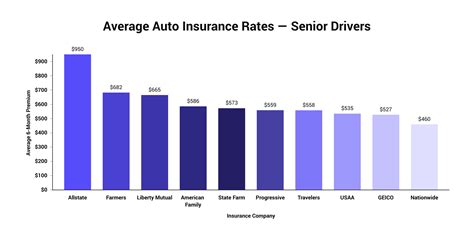

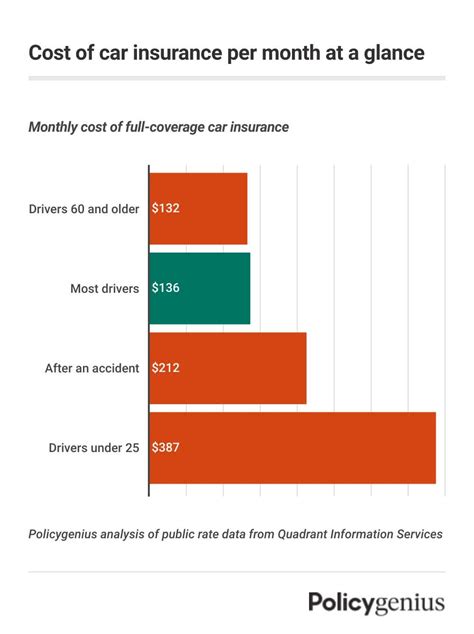

When it comes to personal demographics, age is a significant determinant. Younger drivers, typically aged 16 to 25, often face higher insurance premiums due to their perceived lack of experience and higher accident risk. Conversely, mature drivers, aged 55 and above, may enjoy reduced rates as they are statistically less likely to be involved in accidents. Gender also plays a role, with some insurers offering gender-specific rates, though this practice is becoming less common due to regulatory changes.

Your driving history is another critical factor. A clean record, free of accidents and traffic violations, can lead to significant savings. Conversely, a history of accidents or traffic tickets can drive up insurance costs. For instance, a single at-fault accident could increase your premium by an average of 40%, while multiple accidents or violations can result in even higher surcharges.

| Accidents | Premium Increase |

|---|---|

| 1 At-Fault Accident | 40% |

| Multiple Accidents | Up to 100% or more |

Vehicle Characteristics: Make, Model, and Safety Features

The type of vehicle you drive also influences your insurance rates. Sports cars and luxury vehicles often command higher premiums due to their higher repair costs and perceived risk. On the other hand, sedans and compact cars may offer more affordable insurance rates. The year of the vehicle is also a factor, with newer models generally costing more to insure due to their advanced technology and higher replacement value.

In addition, the safety features of your vehicle can impact insurance costs. Vehicles equipped with advanced safety systems, such as collision avoidance, lane departure warning, and adaptive cruise control, may qualify for insurance discounts. These features not only reduce the risk of accidents but also demonstrate a proactive approach to safety, which insurers appreciate.

| Safety Feature | Potential Discount |

|---|---|

| Collision Avoidance | Up to 5% |

| Lane Departure Warning | Up to 3% |

| Adaptive Cruise Control | Up to 2% |

Geographic Location and Its Impact

Your geographic location is a significant determinant of insurance rates. Factors such as population density, crime rates, and weather conditions can influence the likelihood of accidents and insurance claims. For instance, urban areas often experience higher rates due to increased traffic congestion and a higher risk of accidents and theft.

Additionally, state regulations and insurance laws can vary widely, impacting insurance costs. Some states mandate personal injury protection (PIP) or uninsured/underinsured motorist coverage, which can increase insurance premiums. Understanding the unique insurance landscape of your state is crucial for making informed decisions.

| State | Average Annual Premium |

|---|---|

| California | $1,995 |

| New York | $2,300 |

| Texas | $1,100 |

Strategies for Reducing Auto Insurance Costs

While many factors influencing insurance rates are beyond our control, there are several strategies you can employ to reduce your auto insurance costs. These range from proactive measures to take-advantage-of discounts and benefits offered by insurers.

Improving Your Driving Record

As mentioned earlier, maintaining a clean driving record is one of the most effective ways to reduce your insurance premiums. This involves more than just avoiding accidents and traffic violations. It also includes defensive driving practices, such as obeying speed limits, avoiding aggressive driving behaviors, and being cautious in adverse weather conditions.

Additionally, completing a defensive driving course can lead to insurance discounts. These courses are designed to improve your driving skills and increase your awareness of potential hazards on the road. Many insurers offer discounts for completing such courses, recognizing the value of proactive safety measures.

Utilizing Discounts and Benefits

Insurance companies often offer a range of discounts and benefits to attract and retain customers. These can significantly reduce your insurance premiums and are well worth taking advantage of.

- Multi-Policy Discounts: Insuring multiple vehicles or combining your auto insurance with other policies, such as home or life insurance, can lead to substantial savings. Many insurers offer bundling discounts of up to 25% or more.

- Good Student Discounts: If you or a family member is a full-time student under 25 with a good academic record, you may be eligible for a good student discount. This discount typically requires a B average or better and can save you up to 20% on your premium.

- Safe Driver Discounts: Insurers often reward drivers with clean records. If you've been accident- and violation-free for a certain period, you may qualify for a safe driver discount, which can reduce your premium by up to 30%.

Understanding Coverage Options

When selecting an auto insurance policy, it’s essential to understand the different coverage options available and choose the ones that best fit your needs. Overinsuring or underinsuring can lead to unnecessary expenses or inadequate protection, respectively.

Consider your liability coverage carefully. While state minimums may be lower, it's often advisable to carry higher limits, especially if you have significant assets to protect. Collision and comprehensive coverage are also important, particularly if you have a loan or lease on your vehicle. These coverages protect you against damage to your own vehicle, which is not covered by liability insurance.

Additionally, understand the deductibles associated with your policy. While higher deductibles can lead to lower premiums, they also mean you'll pay more out of pocket in the event of a claim. Choose a deductible that you're comfortable paying if the need arises.

The Future of Auto Insurance: Technological Advancements

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer behaviors. These developments are set to reshape the way insurance is priced and delivered, offering both challenges and opportunities for insurers and policyholders alike.

Telematics and Usage-Based Insurance

One of the most significant trends in auto insurance is the rise of telematics and usage-based insurance (UBI). Telematics devices, installed in vehicles, collect data on driving behavior, including speed, acceleration, braking, and mileage. This data is then used to calculate insurance premiums, offering a more personalized and dynamic pricing model.

With UBI, drivers can potentially save money by demonstrating safe driving habits. For example, Pay-As-You-Drive (PAYD) insurance plans charge premiums based on the actual distance driven, incentivizing drivers to reduce mileage. Similarly, Pay-How-You-Drive (PHYD) plans reward drivers for safe driving behaviors, such as smooth acceleration and avoiding harsh braking.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and advanced data analytics are transforming the insurance industry, enabling insurers to make more informed decisions and offering enhanced services to customers.

AI-powered systems can analyze vast amounts of data, including historical claim patterns, vehicle and driver data, and even social media and online behavior, to predict risk more accurately. This allows insurers to price policies more competitively and offer personalized coverage options.

Additionally, AI can enhance the claims process, automating certain tasks and providing faster, more efficient service. This can lead to improved customer satisfaction and loyalty, as well as reduced operational costs for insurers.

Connected Cars and Autonomous Vehicles

The increasing prevalence of connected cars and the imminent arrival of autonomous vehicles are set to revolutionize the auto insurance landscape. These vehicles, equipped with advanced technology and connectivity features, generate vast amounts of data that can be used to enhance safety and improve the insurance experience.

For instance, connected cars can provide real-time data on driving behavior, vehicle diagnostics, and location, which can be used to offer more precise insurance rates. Autonomous vehicles, with their enhanced safety features and reduced accident risk, may lead to significant changes in insurance pricing and coverage.

Conclusion: Navigating the Auto Insurance Landscape

Understanding the factors that influence car auto insurance rates is the first step towards making informed decisions about your coverage. By recognizing the impact of personal demographics, vehicle characteristics, and geographic location, you can take proactive steps to reduce your insurance costs.

Additionally, staying abreast of the latest trends and technological advancements in the auto insurance industry can help you navigate this complex landscape more effectively. From telematics and usage-based insurance to AI and connected vehicles, the future of auto insurance is promising, offering enhanced safety, personalized coverage, and improved customer experiences.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually, or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re taking advantage of any available discounts.

Can I get auto insurance if I have a poor credit score?

+Yes, you can still obtain auto insurance with a poor credit score. However, insurers may view you as a higher risk and charge higher premiums. It’s worth shopping around and comparing quotes to find the best rate.

What factors influence the cost of collision and comprehensive coverage?

+The cost of collision and comprehensive coverage can be influenced by various factors, including the make and model of your vehicle, your driving record, the location where the vehicle is garaged, and the coverage limits you choose. These coverages protect against damage to your own vehicle, so understanding these factors is crucial in selecting the right coverage for your needs.