How Much Term Life Insurance

Term life insurance is a crucial aspect of financial planning, offering individuals and families a way to secure their future and ensure peace of mind. This article aims to delve into the intricacies of term life insurance, providing an in-depth analysis of its features, benefits, and considerations. By understanding the ins and outs of this insurance type, readers can make informed decisions about their coverage needs and choose the right policy for their circumstances.

Understanding Term Life Insurance

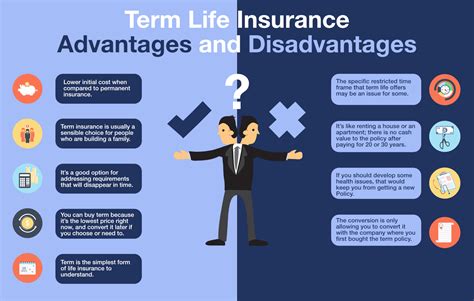

Term life insurance is a type of coverage that provides financial protection for a specified period, known as the policy term. Unlike permanent life insurance policies, term life insurance does not build cash value and is designed to offer pure protection during a specific life stage. The term can vary, typically ranging from 10 to 30 years, depending on the policyholder’s requirements and life expectations.

During the policy term, the insured individual pays a premium to the insurance company, which in return provides a death benefit to their beneficiaries in the event of their untimely passing. This death benefit is a lump-sum payment that can be used by the beneficiaries to cover various expenses, including funeral costs, outstanding debts, daily living expenses, and even future financial goals like education funds.

Key Features of Term Life Insurance

- Affordability: One of the most appealing aspects of term life insurance is its cost-effectiveness. The premiums for term policies are generally much lower than those for permanent life insurance, making it an accessible option for individuals and families on a budget.

- Flexibility: Term life insurance offers flexibility in terms of policy duration. Policyholders can choose a term that aligns with their life stage and needs, such as covering children’s education or paying off a mortgage. If their circumstances change, they can opt for a different term or convert the policy to a permanent one.

- Simplicity: Term life insurance policies are straightforward and easy to understand. The coverage is clear, with a specified death benefit and term, making it a simple yet effective way to secure financial protection.

- Guaranteed Acceptance: Some term life insurance policies offer guaranteed acceptance, meaning individuals can obtain coverage regardless of their health status. While these policies often have higher premiums, they provide a safety net for those with pre-existing conditions or complex health histories.

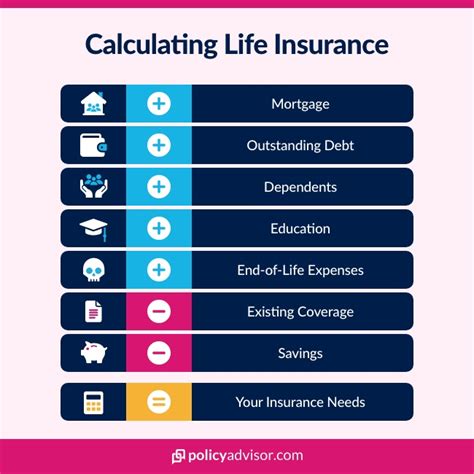

Determining the Right Amount of Coverage

When considering term life insurance, one of the critical questions is how much coverage to purchase. The amount of coverage needed can vary significantly depending on individual circumstances and financial goals. Here are some factors to consider when determining the right amount of term life insurance:

tr>| Factor | Description |

|---|---|

| Financial Dependents | Consider the financial needs of your dependents, such as your spouse, children, or aging parents. The coverage should provide enough to sustain their standard of living and cover essential expenses. |

| Debt and Loans | Evaluate your outstanding debts, including mortgages, car loans, student loans, and credit card balances. The policy should be able to pay off these debts, ensuring your dependents are not burdened with them. |

| Funeral and Final Expenses | Funeral costs can be a significant expense, and term life insurance can help cover these costs, ensuring your loved ones are not left with financial strain during an already difficult time. |

| Future Financial Goals | Consider your family's future financial goals, such as saving for college education, starting a business, or planning for retirement. The coverage should provide enough to help achieve these goals without placing an additional burden on your dependents. |

| Inflation | Take into account the impact of inflation on your coverage needs. Over time, the purchasing power of your death benefit may decrease, so adjusting for inflation can help ensure your coverage remains adequate. |

Factors Influencing Term Life Insurance Premiums

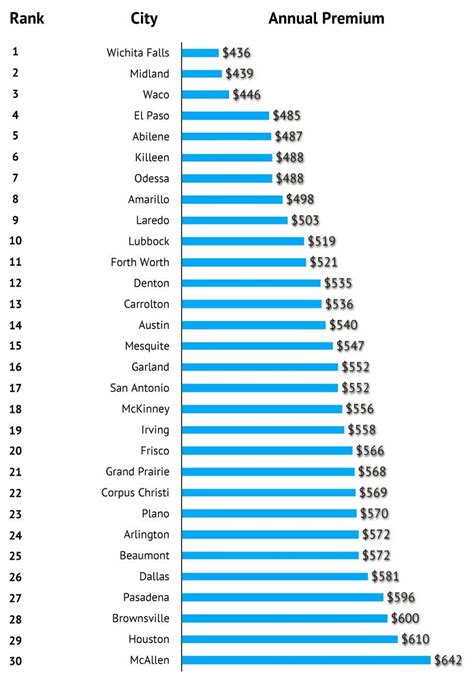

The cost of term life insurance, or the premiums, can vary significantly based on several factors. Understanding these factors can help individuals make informed decisions about their coverage and potentially save on their insurance costs.

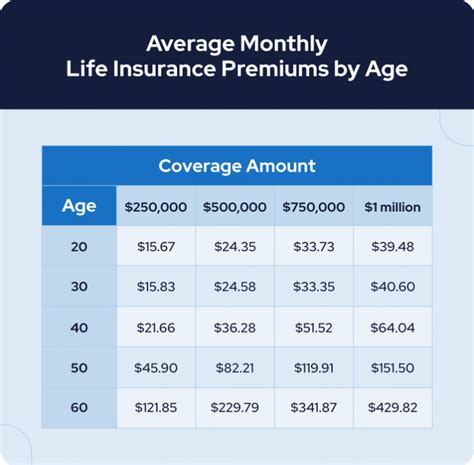

Age and Health

One of the most significant factors affecting term life insurance premiums is the age and health of the policyholder. Generally, younger and healthier individuals pay lower premiums. This is because younger individuals have a longer life expectancy, and better health reduces the risk of premature death, making them less costly to insure.

For instance, a 30-year-old non-smoker in excellent health may pay considerably less for a term life insurance policy than a 50-year-old with health complications. The insurance company assesses the risk associated with insuring an individual based on their age and health status, and this risk directly influences the premium rates.

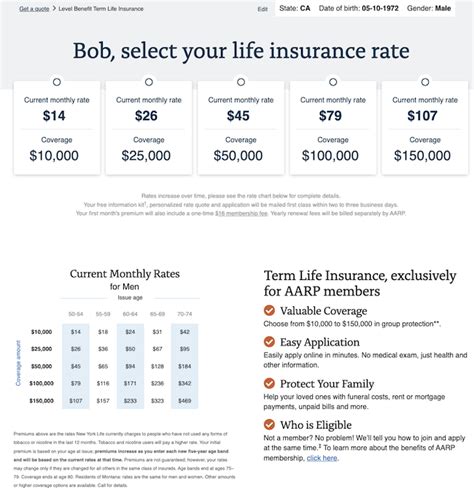

Policy Term and Coverage Amount

The length of the policy term and the amount of coverage also play a vital role in determining premiums. Longer policy terms and higher coverage amounts typically result in higher premiums. This is because the insurance company is taking on a greater risk by providing coverage for an extended period or by offering a more substantial death benefit.

For example, a 10-year term policy with a coverage amount of $500,000 will likely have lower premiums than a 20-year policy with a $1 million coverage amount. The insurance company must ensure they have sufficient funds to pay out the death benefit over the extended term, which contributes to the higher premium.

Smoking Status and Lifestyle Factors

Smoking and other lifestyle factors can significantly impact term life insurance premiums. Smokers are generally charged higher premiums due to the increased health risks associated with smoking. Similarly, individuals with hazardous hobbies or occupations may also face higher premiums as these activities increase the likelihood of an early death.

Insurance companies often require medical examinations and review an applicant's medical history to assess their health status and potential risks. By understanding the impact of lifestyle choices on premiums, individuals can make informed decisions about their habits and potentially qualify for lower rates.

Family History and Occupation

An individual’s family history and occupation can also influence their term life insurance premiums. If there is a history of certain health conditions or diseases in the family, the insurance company may charge higher premiums to account for the increased risk. Similarly, certain occupations, especially those involving hazardous duties, may result in higher premiums due to the increased likelihood of work-related accidents or health issues.

For instance, individuals working in high-risk occupations like firefighting or construction may face higher premiums compared to those in less hazardous professions. Insurance companies carefully evaluate these factors to assess the potential risks and set appropriate premium rates.

Tips for Choosing the Right Term Life Insurance Policy

Selecting the right term life insurance policy is crucial to ensure adequate financial protection for your loved ones. Here are some tips to guide you through the process:

Assess Your Needs

Start by evaluating your specific needs and circumstances. Consider factors like your financial obligations, such as mortgages, loans, and credit card debts, as well as your dependents’ future financial goals. Determine the coverage amount that would provide sufficient financial support to your loved ones in the event of your untimely passing.

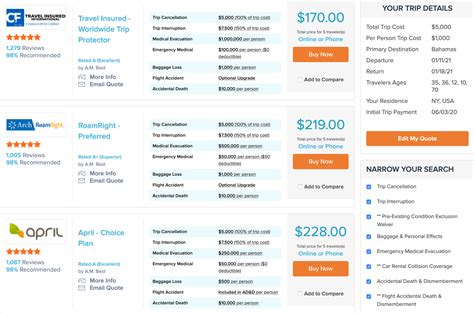

Compare Multiple Policies

Don’t settle for the first policy you come across. Compare multiple term life insurance policies from different providers to find the best fit for your needs. Look at factors like coverage amounts, policy terms, and premiums to ensure you’re getting the most value for your money. Online comparison tools and insurance brokers can be valuable resources for this process.

Consider Convertibility

Some term life insurance policies offer the option to convert them into permanent life insurance policies later on. This can be beneficial if your financial situation or needs change over time. By converting your policy, you can ensure continuous coverage without the need for a new medical examination or the risk of being denied coverage due to health changes.

Evaluate Rider Options

Riders are additional benefits or features that can be added to your term life insurance policy. These riders can enhance your coverage and provide extra protection. Common rider options include accelerated death benefits, waiver of premium, and disability income. Evaluate these riders based on your specific needs and ensure they align with your financial goals.

Seek Professional Advice

If you’re unsure about which term life insurance policy to choose or have complex financial needs, consider seeking advice from a financial advisor or insurance professional. They can provide expert guidance tailored to your circumstances, ensuring you make the right decision for your financial protection.

Future of Term Life Insurance

The term life insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Here are some key trends and developments to watch for in the future of term life insurance:

Digital Transformation

The insurance industry is experiencing a digital transformation, with an increasing number of companies offering online applications and policy management. This trend is expected to continue, making it easier and more convenient for consumers to purchase and manage their term life insurance policies.

Online platforms and mobile apps will likely play a more significant role in the term life insurance space, allowing for real-time policy updates, claim submissions, and premium payments. This digital shift will enhance the overall customer experience and make term life insurance more accessible to a broader audience.

Personalized Coverage

Insurance companies are leveraging data analytics and artificial intelligence to offer more personalized coverage options. By analyzing an individual’s health data, lifestyle choices, and other relevant factors, insurers can provide tailored term life insurance policies that meet specific needs.

Personalized coverage can result in more accurate risk assessments, allowing insurers to offer competitive premiums to policyholders. This trend aligns with the growing demand for customized financial products and services, catering to the unique needs of individual consumers.

Focus on Wellness

The term life insurance industry is recognizing the importance of wellness and preventative care. Many insurers are now offering incentives and discounts to policyholders who maintain healthy lifestyles and engage in wellness programs. This shift towards wellness-focused policies aims to encourage healthier behaviors and reduce long-term healthcare costs.

For instance, some insurance companies provide premium discounts for policyholders who maintain a healthy weight, exercise regularly, or participate in smoking cessation programs. By promoting wellness, insurers can potentially reduce the risk of early mortality, leading to more sustainable term life insurance policies.

Emerging Technologies

Emerging technologies like blockchain and artificial intelligence are expected to play a significant role in the future of term life insurance. Blockchain technology can enhance the security and transparency of policy transactions, while artificial intelligence can improve risk assessment and fraud detection processes.

Additionally, the use of wearable devices and health tracking technologies can provide insurers with real-time health data, enabling more accurate underwriting and potentially reducing premiums for policyholders who lead healthy lifestyles. These technological advancements will likely transform the term life insurance industry, making it more efficient and customer-centric.

Increased Competition

The term life insurance market is becoming increasingly competitive, with new entrants and innovative startups disrupting traditional insurance models. This competition is driving insurers to offer more competitive premiums, enhanced customer service, and unique policy features to attract and retain customers.

As a result, consumers can expect a wider range of term life insurance options, with more customizable policies and improved value propositions. Increased competition will likely benefit policyholders, leading to more affordable and accessible term life insurance coverage.

What is the difference between term life insurance and permanent life insurance?

+Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is designed to offer pure protection during a specific life stage. On the other hand, permanent life insurance, such as whole life or universal life insurance, offers lifelong coverage and builds cash value over time. Permanent life insurance policies are more expensive but provide long-term financial protection and can be used as an investment vehicle.

Can I renew my term life insurance policy when it expires?

+Yes, many term life insurance policies offer the option to renew them at the end of the initial term. However, the renewal process may involve a new medical examination and potentially higher premiums due to the increased age of the policyholder. It’s important to review your options and consider your financial needs when deciding whether to renew or switch to a new policy.

Are there any tax benefits associated with term life insurance?

+Term life insurance premiums are generally not tax-deductible. However, the death benefit paid to your beneficiaries is typically received tax-free, providing a significant financial advantage in the event of your passing. It’s essential to consult with a tax professional to understand the specific tax implications of term life insurance in your situation.