Quote For Travel Insurance

Travel insurance is an essential aspect to consider when planning any trip, providing peace of mind and financial protection for unexpected situations. With a multitude of options available, it's crucial to understand the various coverages and benefits to ensure you choose the right policy for your specific needs. This comprehensive guide will delve into the world of travel insurance, offering insights and expertise to help you navigate the process of obtaining a quote and making an informed decision.

Understanding Travel Insurance Policies

Travel insurance policies are designed to safeguard travelers against unforeseen events, covering a range of potential risks and providing assistance during emergencies. The coverage options vary, catering to different travel scenarios and individual preferences.

Key Coverage Areas

- Medical Expenses: Covers emergency medical treatments, hospital stays, and prescription medications while abroad.

- Trip Cancellation and Interruption: Reimburses non-refundable trip costs if the journey is canceled or interrupted due to covered reasons, such as illness or natural disasters.

- Lost or Delayed Luggage: Provides compensation for the inconvenience and replacement costs associated with lost, stolen, or delayed baggage.

- Emergency Evacuation: Ensures prompt evacuation in case of medical emergencies or natural disasters, often covering transportation and accommodation expenses.

- Personal Liability: Protects against legal costs and damages if the traveler is found liable for an accident or injury.

- Travel Delay: Offers compensation for additional expenses incurred due to delays in transportation, often including meals and accommodation.

Each policy will have specific terms and conditions, so it's important to review these carefully to understand the coverage limits, exclusions, and any additional benefits that may be included.

Factors Affecting Travel Insurance Quotes

When requesting a quote for travel insurance, several factors come into play that influence the cost and coverage options:

- Destination and Duration: The location of your trip and its duration can impact the quote. Some destinations may have higher medical costs or present specific risks that affect the insurance premium.

- Age and Health: Your age and overall health can influence the premium, as older travelers or those with pre-existing medical conditions may require specialized coverage.

- Travel Activities : Engaging in adventure sports or high-risk activities may require additional coverage, leading to a higher premium.

- Policy Features: The level of coverage and the specific benefits included in the policy will impact the quote. Comprehensive policies with higher limits and additional features generally cost more.

- Deductibles and Excess: Choosing a policy with a higher deductible or excess (the amount you pay out of pocket before the insurance kicks in) can reduce the premium.

Understanding these factors will help you tailor your insurance needs and obtain a quote that aligns with your budget and travel requirements.

Obtaining a Travel Insurance Quote

Securing a travel insurance quote is a straightforward process that can be done online or through an insurance broker. Here’s a step-by-step guide to help you obtain a quote:

Online Quotation

- Visit a reputable travel insurance provider’s website.

- Fill out the online form, providing details about your trip, including destination, duration, and any specific activities planned.

- Enter personal information, including your age, health status, and any pre-existing conditions.

- Choose the level of coverage and benefits you require, considering the factors mentioned earlier.

- Review the quote and the policy details, ensuring you understand the coverage limits and exclusions.

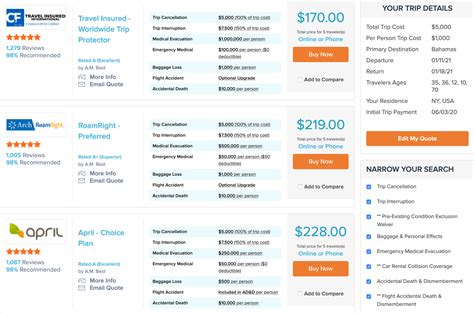

- Compare quotes from different providers to find the best option for your needs.

Broker Assistance

- Contact an insurance broker specializing in travel insurance.

- Provide the broker with details about your trip and your specific insurance needs.

- Discuss any pre-existing conditions or activities that may require additional coverage.

- The broker will source quotes from multiple providers, offering advice and guidance on the best policy for your situation.

- Review the quotes and policy details with the broker to ensure you understand the coverage.

Obtaining multiple quotes allows you to compare options and choose the policy that offers the best value and coverage for your trip.

Evaluating Travel Insurance Policies

When evaluating travel insurance policies, it’s important to consider the following aspects to ensure you make an informed decision:

Coverage Limits and Exclusions

Carefully review the policy document to understand the coverage limits for each benefit. Ensure the limits align with your potential needs. Additionally, be aware of any exclusions, such as pre-existing conditions or specific activities, that may not be covered.

Policy Terms and Conditions

Read the policy’s terms and conditions thoroughly. Understand the obligations and responsibilities outlined in the contract, including any requirements for making a claim and the timeframe for doing so.

Reputation and Financial Stability

Research the reputation of the insurance provider. Choose a reputable company with a solid financial standing to ensure they will be able to honor your claim if needed. Check reviews and ratings from independent sources to get an unbiased perspective.

Customer Service and Claims Process

Inquire about the insurer’s customer service and claims process. A responsive and efficient claims process can make a significant difference when facing an emergency situation. Consider the availability of 24⁄7 assistance and the ease of filing a claim.

Additional Benefits and Services

Some policies offer additional benefits such as trip cancellation due to weather, rental car coverage, or travel assistance services. Evaluate these extra features to determine if they align with your specific needs and add value to the policy.

Travel Insurance Tips and Considerations

When it comes to travel insurance, there are several key considerations and tips to keep in mind to ensure you’re adequately protected:

Pre-Existing Conditions

If you have a pre-existing medical condition, it’s crucial to disclose this when obtaining a quote. Some policies may offer coverage for specific conditions, while others may exclude them. Understanding the policy’s approach to pre-existing conditions is essential to avoid any surprises when making a claim.

Adventure Activities and Sports

If your trip involves adventure activities or extreme sports, ensure your policy covers these activities. Many standard policies exclude high-risk activities, so it’s important to verify the coverage or opt for a policy that specifically caters to these pursuits.

Trip Cancellation and Interruption

Consider the potential risks associated with your trip, such as natural disasters, political unrest, or personal emergencies. Ensure your policy provides adequate coverage for trip cancellation or interruption, as these situations can lead to significant financial losses if not insured.

Medical Evacuation

Medical evacuation coverage is a critical aspect of travel insurance. In the event of a medical emergency, this coverage ensures you can be transported to an appropriate medical facility, often including air ambulance services. Ensure your policy covers medical evacuation, especially if you’re traveling to remote or less developed areas.

Travel Document Protection

Losing travel documents, such as passports or visas, can be a major setback during your trip. Some policies offer coverage for the replacement of these documents, providing assistance and financial support during the replacement process.

Travel Delay and Missed Connections

Travel delays and missed connections are common occurrences, especially when relying on multiple forms of transportation. Ensure your policy covers these scenarios, providing compensation for additional expenses incurred during the delay.

Future Implications and Innovations in Travel Insurance

The travel insurance industry is constantly evolving, with new trends and innovations shaping the future of coverage. Here’s a glimpse into the potential future of travel insurance:

Digitalization and Personalization

The rise of digital technologies is transforming the travel insurance landscape. Insurers are leveraging data analytics and machine learning to offer personalized policies based on individual risk profiles. This shift towards digitalization also streamlines the quotation and claims process, making it more efficient and customer-centric.

Enhanced Medical Coverage

With the advancement of medical technologies, travel insurance policies are expected to offer more comprehensive medical coverage. This includes improved access to telemedicine services, specialized medical treatments, and coverage for chronic conditions.

Travel Risk Mitigation

Insurers are increasingly focusing on mitigating travel risks rather than just providing financial protection. This includes offering risk management tools, travel advisories, and emergency response services to assist travelers in avoiding potential dangers and navigating challenging situations.

Sustainable and Ethical Travel

The growing awareness of sustainable and ethical travel practices is influencing the travel insurance industry. Insurers are developing policies that encourage responsible tourism, including coverage for eco-friendly activities and support for local communities.

Artificial Intelligence and Automation

Artificial Intelligence (AI) is expected to play a significant role in the future of travel insurance. AI-powered chatbots and virtual assistants will enhance customer service, providing real-time assistance and personalized recommendations. Automation will also streamline the claims process, making it faster and more efficient.

Blockchain Technology

Blockchain technology has the potential to revolutionize the travel insurance industry by enhancing security, transparency, and efficiency. Smart contracts and distributed ledger technology can simplify the quotation and claims process, ensuring secure and tamper-proof transactions.

Conclusion

Obtaining a travel insurance quote is a vital step in ensuring a safe and stress-free journey. By understanding the coverage options, evaluating policies, and considering the future trends in travel insurance, you can make an informed decision to protect yourself and your travel plans. Remember, travel insurance is not just about financial protection; it’s about peace of mind and the assurance that you’re covered in any unforeseen situation.

Frequently Asked Questions

Can I purchase travel insurance after I’ve already begun my trip?

+While it is possible to purchase travel insurance after you’ve started your trip, it may be more challenging and expensive. Some providers offer limited coverage for trips already in progress, but it’s best to secure insurance before departure to ensure comprehensive protection.

What happens if I need to cancel my trip due to a family emergency?

+If you have a travel insurance policy that covers trip cancellation due to unforeseen circumstances, such as a family emergency, you may be eligible for reimbursement. However, it’s important to review your policy’s terms and conditions to understand the specific coverage and any requirements for making a claim.

How do I file a claim for lost luggage?

+To file a claim for lost luggage, you’ll need to contact your insurance provider and provide documentation, such as a police report or a statement from the airline confirming the loss. Keep all receipts for any temporary purchases made while waiting for your luggage to be located or replaced.

Can I extend my travel insurance policy if my trip is longer than expected?

+Yes, it’s often possible to extend your travel insurance policy if your trip duration exceeds the initial coverage period. Contact your insurance provider to discuss the extension and any additional costs or coverage adjustments that may be required.

What should I do if I need emergency medical treatment while traveling?

+In case of an emergency, seek medical attention immediately. Contact your insurance provider’s emergency assistance hotline, if available, to receive guidance and support. Keep all medical records and receipts for reimbursement, and be prepared to provide a detailed report of the incident.