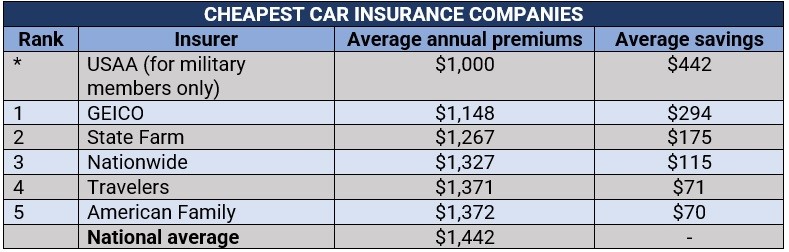

Insurance Companies Cheapest

The cost of insurance policies can vary significantly depending on numerous factors, including the type of coverage, the insurer, and individual risk profiles. While finding the cheapest insurance company might be an attractive prospect, it's essential to consider the broader context of value, coverage, and reliability.

Understanding Insurance Premiums

Insurance premiums are calculated based on a range of variables, with each insurer employing unique methodologies to assess risk. These variables can include age, location, occupation, and lifestyle choices for life and health insurance. For property and vehicle insurance, factors such as the value and location of the asset, as well as its usage, play a significant role.

Insurers also consider historical claims data to determine the likelihood of future claims, which can impact premium costs. For instance, areas with a higher frequency of natural disasters may see increased insurance premiums.

The Role of Deductibles and Coverage Limits

When comparing insurance policies, it’s crucial to look beyond just the premium. Deductibles and coverage limits can significantly influence the overall cost and effectiveness of a policy.

Deductibles

A deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Policies with higher deductibles often have lower premiums, making them seemingly more affordable. However, it’s essential to consider whether you could afford to pay this amount in the event of a claim.

| Policy | Premium | Deductible |

|---|---|---|

| Policy A | $500/year | $2,000 |

| Policy B | $1,000/year | $500 |

In the above example, Policy A might appear cheaper at first glance, but it could be less cost-effective if you're likely to make claims that exceed the deductible.

Coverage Limits

Coverage limits define the maximum amount an insurer will pay for a covered loss. Insufficient coverage limits can leave you exposed to significant financial risks. For instance, a health insurance policy with low coverage limits might leave you liable for substantial medical expenses in the event of a serious illness or injury.

The Importance of Insurer Reputation and Financial Strength

While cost is a significant factor, the financial strength and reputation of an insurance company should not be overlooked. A financially stable insurer is more likely to be able to pay out claims, even in the event of a large-scale disaster.

Rating agencies like A.M. Best and Standard & Poor's provide financial strength ratings for insurance companies, which can be a useful guide when comparing insurers. These ratings assess an insurer's ability to meet its ongoing obligations, including paying out claims.

Customer Service and Claim Handling

The quality of an insurer’s customer service and claim handling processes can also significantly impact the value of a policy. A company with a reputation for slow or contentious claim processes might save you money on premiums, but it could cause significant stress and financial hardship if you need to make a claim.

Personalizing Your Insurance Coverage

Finding the cheapest insurance company is not a one-size-fits-all proposition. Your unique circumstances, such as your health status, driving record, or the value of your assets, will influence the most cost-effective insurance provider for you.

For example, if you're a young driver with a clean record, you might find more affordable car insurance with a company that specializes in this demographic. On the other hand, if you own a high-value home, you might benefit from the expertise and coverage of an insurer that caters to this market.

Comparing Quotes

Obtaining multiple quotes is essential to finding the best value for your insurance needs. Online comparison tools can be a convenient way to start this process, but it’s important to follow up with individual insurers to discuss your specific circumstances and coverage requirements.

Remember, the cheapest option might not always be the best. It's essential to balance cost with coverage, reputation, and your individual needs to find the right insurance solution.

FAQs

How can I reduce my insurance costs without sacrificing coverage?

+You can explore options like increasing your deductible (if you’re comfortable with a higher out-of-pocket cost in the event of a claim) or reducing unnecessary coverage. Additionally, maintaining a good credit score and a clean driving record can often lead to lower premiums.

Are there any insurance companies that consistently offer the lowest premiums across all types of insurance?

+While some insurers may be known for their competitive pricing in certain types of insurance, it’s rare to find a company that consistently offers the lowest premiums across all lines of coverage. The best value for you will depend on your specific needs and circumstances.

What should I look for in an insurance company besides low premiums?

+Financial stability, a good reputation for customer service and claim handling, and a comprehensive understanding of your specific insurance needs are all crucial factors to consider. It’s also beneficial to choose an insurer that offers clear and transparent policies.