Car Insurance Quote Without Car

The process of obtaining a car insurance quote typically involves providing detailed information about the vehicle you wish to insure. However, there are scenarios where individuals may seek a car insurance quote without owning a car yet. This could be the case for various reasons, such as planning for a future vehicle purchase, exploring insurance options before finalizing a deal, or even considering a career change that requires driving. Regardless of the reason, it's essential to understand how to navigate the process of getting a car insurance quote without a car and what factors come into play.

Understanding the Basics of Car Insurance Quotes

Car insurance is a vital aspect of vehicle ownership, providing financial protection against potential risks and liabilities associated with operating a motor vehicle. It covers a range of situations, from accidents and collisions to theft, vandalism, and natural disasters. When seeking a car insurance quote, insurance providers assess various factors to determine the level of risk and, consequently, the premium you'll pay.

Key factors influencing car insurance quotes include:

- Vehicle Details: The make, model, and year of the car play a significant role. Certain vehicles may be more expensive to insure due to their repair costs, safety features, or theft frequency.

- Driver Information: Your age, gender, driving record, and years of experience behind the wheel are crucial. Younger drivers, for instance, are often considered higher-risk due to their lack of experience, resulting in higher premiums.

- Coverage Type and Limits: The type of coverage you choose (liability, collision, comprehensive) and the coverage limits you select will impact your quote. Higher coverage limits typically result in higher premiums.

- Location: Where you live and where you primarily drive the vehicle can affect your quote. Areas with higher crime rates or more frequent accidents may result in increased premiums.

- Usage and Mileage: The purpose for which you'll use the vehicle (commuting, business, pleasure) and the estimated annual mileage can influence your quote. Higher mileage generally means a higher risk and a higher premium.

Getting a Car Insurance Quote Without a Car: A Step-by-Step Guide

Obtaining a car insurance quote without a specific vehicle in mind is still possible and can provide valuable insights into the insurance landscape. Here's a step-by-step guide to help you navigate this process:

Step 1: Research and Comparison

Start by researching and comparing different insurance providers in your area. Look for reputable companies with a solid track record and a range of coverage options. Consider factors like customer satisfaction, claim handling processes, and any additional benefits or discounts they offer.

Step 2: Gather Personal Information

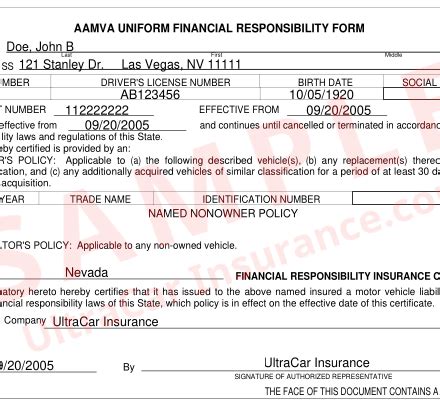

Collect the necessary personal details that insurance providers will require. This includes your full name, date of birth, driver's license number, and details about your driving history (any accidents, tickets, or claims you've made in the past).

Step 3: Estimate Vehicle Details

Since you don't have a specific car in mind, you'll need to estimate vehicle details. Choose a make, model, and year that aligns with your preferences and budget. Consider factors like the vehicle's safety ratings, repair and maintenance costs, and its overall popularity among insurers.

| Vehicle Estimation | Estimated Cost |

|---|---|

| Make | [Make Name] |

| Model | [Model Name] |

| Year | [Year] |

Step 4: Determine Coverage Needs

Decide on the type and level of coverage you require. Consider your budget, the value of the vehicle you plan to insure, and the risks you want to protect against. Common coverage options include liability, collision, comprehensive, and additional endorsements for specific situations.

Step 5: Obtain Quotes

Reach out to the insurance providers you've shortlisted and request quotes based on the information you've gathered. Provide them with your personal details, estimated vehicle information, and coverage preferences. Be prepared to answer additional questions to refine the quote.

Step 6: Analyze and Compare Quotes

Once you have multiple quotes, take the time to analyze and compare them. Consider factors like the premium amount, coverage limits, deductibles, and any additional perks or discounts offered. Assess the overall value each provider offers and choose the one that best aligns with your needs and budget.

Factors Influencing Car Insurance Quotes Without a Car

When obtaining a car insurance quote without a specific vehicle, several factors come into play, influencing the final premium you'll pay. These factors include:

- Driver Profile: Your age, gender, and driving record are significant. Younger drivers or those with a history of accidents or violations may face higher premiums.

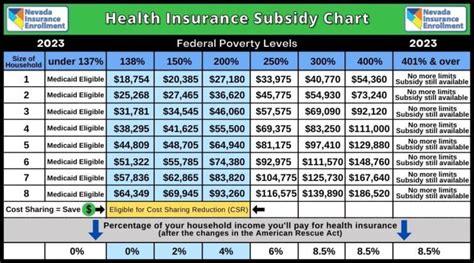

- Coverage Selection: The type and level of coverage you choose will impact your quote. Higher coverage limits generally result in higher premiums.

- Location and Usage: The area where you live and where you plan to drive the vehicle can affect your quote. High-risk areas or those with a history of frequent accidents may result in increased premiums.

- Discounts and Promotions: Insurance providers often offer discounts for various reasons, such as safe driving records, loyalty, or bundling multiple policies. Be sure to inquire about any applicable discounts to lower your premium.

Future Implications and Considerations

Obtaining a car insurance quote without a car can be a strategic move, especially when planning for a future vehicle purchase or career change. It allows you to explore insurance options, compare providers, and understand the potential costs associated with different coverage scenarios. Here are some key considerations and implications to keep in mind:

Personalized Coverage

When you obtain a quote without a car, it's essential to provide accurate information about your driving habits and preferences. This ensures that the quote reflects your specific needs and circumstances. Consider factors like the primary purpose of your driving (commuting, business, pleasure), the estimated annual mileage, and any unique circumstances that may impact your coverage requirements.

Price Variability

Insurance quotes can vary significantly between providers, even for similar coverage scenarios. It's crucial to compare quotes from multiple insurers to ensure you're getting the best value. Price variability can be influenced by factors such as the insurer's risk assessment model, their claims history, and the discounts and promotions they offer.

Long-Term Planning

Obtaining a quote without a car can be a valuable step in long-term financial planning. It allows you to budget for insurance costs when purchasing a vehicle or making significant changes to your driving habits. By understanding the potential insurance expenses, you can make more informed decisions about your vehicle choice and coverage needs.

Flexibility and Adjustments

Insurance quotes without a car provide flexibility in terms of coverage selection. You can experiment with different coverage limits, deductibles, and endorsements to find the right balance between cost and protection. Keep in mind that your insurance needs may evolve over time, so regular reviews and adjustments to your coverage are essential.

Frequently Asked Questions (FAQ)

Can I get a car insurance quote without providing vehicle details?

+Yes, it's possible to obtain a car insurance quote without specific vehicle details. Insurance providers can estimate a quote based on your personal information and coverage preferences. However, providing accurate vehicle details will result in a more precise quote.

<div class="faq-item">

<div class="faq-question">

<h3>How do insurance providers determine quotes without a car?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Insurance providers use various factors to estimate quotes, including your driver profile, coverage selection, location, and usage patterns. They may also consider external data, such as accident and claim statistics, to assess the risk associated with your driving habits.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are quotes without a car accurate for my specific situation?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While quotes without a car can provide a general estimate, they may not be entirely accurate for your specific situation. To get a more precise quote, it's best to provide detailed vehicle information and discuss your unique circumstances with an insurance agent or broker.</p>

</div>

</div>

</div>