Whats Sr22 Insurance

SR-22 insurance, often referred to as a certificate of financial responsibility, is a specialized form of car insurance mandated by state authorities for drivers who have committed serious traffic violations or been involved in at-fault accidents. It serves as proof to the state that the driver carries the minimum level of liability insurance coverage required by law. The SR-22 requirement is typically ordered by a court or the Department of Motor Vehicles (DMV) and remains in effect for a specified period, usually three years.

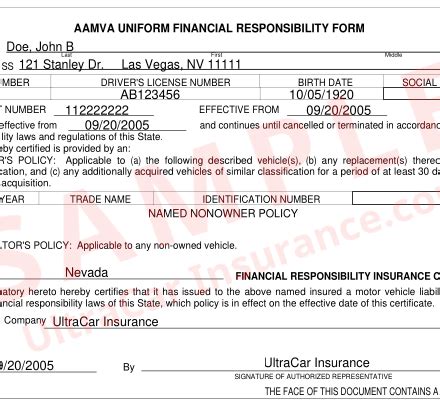

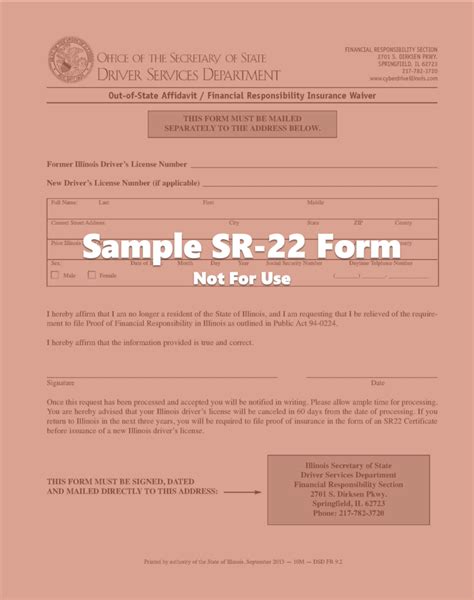

The SR-22 Form and Its Purpose

The SR-22 form itself is not an insurance policy but rather a document filed by the insurance company on behalf of the policyholder. It certifies that the driver has purchased the necessary liability insurance coverage and that the insurance company will notify the state if the policy lapses or is canceled. This notification requirement ensures that the driver maintains continuous insurance coverage during the mandated period.

When Is an SR-22 Required?

SR-22 insurance is typically ordered by a court or the DMV after a driver has been convicted of certain traffic violations, including:

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Hit-and-run accidents

- Reckless driving

- Multiple serious traffic violations

- Driving without insurance

Each state has its own specific list of offenses that may result in an SR-22 requirement.

Obtaining and Maintaining SR-22 Insurance

To obtain SR-22 insurance, drivers must first find an insurance company willing to file the SR-22 form on their behalf. Not all insurers offer this service, as the risk associated with these drivers is often higher. Once the insurance policy is in place, the insurance company electronically files the SR-22 form with the state.

Drivers are responsible for ensuring that their SR-22 insurance remains active throughout the mandated period. Any lapse in coverage or failure to renew the policy can result in the cancellation of the SR-22 and potentially further legal consequences.

Cost and Coverage of SR-22 Insurance

SR-22 insurance is generally more expensive than standard car insurance due to the increased risk associated with the driver’s history. The exact cost can vary widely depending on the driver’s record, the state’s requirements, and the insurance company’s rates. Additionally, some states may require the driver to maintain higher liability limits than the standard minimums.

The coverage included in an SR-22 policy typically includes bodily injury liability, property damage liability, and sometimes personal injury protection (PIP) or medical payments coverage. However, it's important to note that SR-22 insurance does not cover the driver's own vehicle or injuries; it only provides liability coverage for damages caused to others.

| SR-22 Coverage | Description |

|---|---|

| Bodily Injury Liability | Pays for injuries or deaths caused to others in an accident. |

| Property Damage Liability | Covers damage to others' property, such as vehicles or structures. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses and lost wages for the policyholder and their passengers, regardless of fault. |

| Medical Payments Coverage | Covers medical expenses for the policyholder and their passengers, regardless of fault. |

Impact on Driving Record and Insurance Rates

The requirement for SR-22 insurance is a significant marker on a driver’s record and can have long-lasting effects. It remains on the driving record for the duration of the mandated period and may affect future insurance rates and eligibility. Some insurance companies may view drivers with an SR-22 requirement as high-risk and charge higher premiums, while others may not offer coverage at all.

Drivers with an SR-22 requirement should strive to maintain a clean driving record during this period to demonstrate their commitment to safe driving and potentially improve their insurance options in the future.

Frequently Asked Questions

Can I get regular car insurance instead of SR-22 insurance?

+No, if you are required to obtain SR-22 insurance, you must comply with the court or DMV order. Regular car insurance will not meet this requirement, as it does not include the necessary notification process to the state.

How long does the SR-22 requirement typically last?

+The duration of the SR-22 requirement varies by state but is typically three years. However, it’s important to maintain continuous coverage throughout this period to avoid additional legal consequences.

Will my insurance rates go down after the SR-22 requirement ends?

+It’s possible for insurance rates to decrease once the SR-22 requirement is fulfilled, especially if you maintain a clean driving record during this time. However, the impact on rates can vary based on individual circumstances and insurance companies.

Can I travel to other states with an SR-22 insurance policy?

+Yes, your SR-22 insurance policy is valid nationwide. However, if you plan to move to another state, you should inform your insurance company and check if any additional requirements or changes are necessary.

What happens if I let my SR-22 insurance lapse?

+If your SR-22 insurance lapses, the insurance company will notify the state, which can result in the suspension of your driver’s license and additional legal penalties. It’s crucial to maintain continuous coverage to avoid these consequences.