Affordable Auto Insurance Online

In today's digital age, finding affordable auto insurance has become more accessible than ever, thanks to the rise of online insurance providers and comparison platforms. Gone are the days when one had to rely solely on local insurance agents or spend hours making calls to different companies. Now, with just a few clicks, you can explore a wide range of options and secure the best coverage at the most competitive rates. This guide will delve into the world of online auto insurance, offering valuable insights and strategies to help you navigate the process efficiently and make informed choices.

Understanding Online Auto Insurance

Online auto insurance is a modern approach to securing vehicle coverage, providing a convenient and efficient way to compare policies and purchase insurance directly from insurance companies or brokers operating online. This method offers numerous benefits, primarily the ability to quickly obtain quotes from multiple providers, ensuring you can make an informed decision about your coverage.

One of the key advantages of online auto insurance is the ease and speed with which you can compare quotes. Traditional methods often involve contacting each insurance company individually, which can be time-consuming and tedious. Online platforms aggregate information from various providers, allowing you to view multiple quotes side by side and make apples-to-apples comparisons.

Moreover, online insurance companies often have streamlined processes, reducing overhead costs and passing on these savings to consumers. This can result in more competitive pricing, making it easier to find affordable coverage that suits your needs and budget.

The Benefits of Shopping Online

The online insurance market offers numerous advantages that traditional methods often cannot match. Firstly, the sheer convenience of being able to shop for insurance from the comfort of your home or office is unparalleled. You can explore options, compare quotes, and even purchase a policy without ever leaving your seat.

Online platforms also provide a level of transparency that is hard to find elsewhere. With detailed information about coverage options, exclusions, and policy terms readily available, you can make more informed decisions about your insurance needs. This transparency reduces the risk of misunderstandings or surprises later on.

Furthermore, the competitive nature of the online market often leads to better rates. Insurance companies compete for your business, and this competition can drive down prices. You might also find that online providers offer additional perks, such as discounts for bundling multiple policies or for taking advantage of digital tools like mobile apps for policy management.

Factors Affecting Auto Insurance Rates

When it comes to auto insurance, rates can vary significantly based on a multitude of factors. Understanding these factors can help you make more informed decisions and potentially save money on your coverage.

Vehicle Type and Usage

The type of vehicle you drive and how you use it play a significant role in determining your insurance rates. Generally, sports cars and luxury vehicles are more expensive to insure due to their higher repair costs and potential for theft. Additionally, if you use your vehicle for business purposes or frequently commute long distances, your insurance rates may be higher.

Driver’s Profile

Your personal driving record and demographics are crucial factors. Young drivers, particularly those under 25, often face higher insurance premiums due to their lack of driving experience. Conversely, mature drivers, usually those over 55, may benefit from reduced rates. Your driving history, including any accidents or traffic violations, also impacts your insurance costs.

Coverage Options

The level of coverage you choose will directly affect your insurance rates. Comprehensive and collision coverage, which protect against damage to your vehicle, tend to be more expensive than liability-only coverage. However, it’s essential to strike a balance between the coverage you need and the premiums you can afford.

Location and Usage Patterns

Your geographical location and typical driving patterns can influence your insurance rates. Areas with high traffic density or a history of frequent accidents and thefts may have higher insurance costs. Similarly, if you primarily drive in urban areas or during peak traffic hours, your rates might be higher.

Discounts and Bundles

Many insurance providers offer discounts to encourage certain behaviors or to reward loyalty. These discounts can include safe driver discounts, multi-policy discounts (for bundling multiple insurance types), and discounts for installing safety features in your vehicle. Additionally, some providers offer loyalty discounts for long-term customers.

Tips for Finding Affordable Auto Insurance

Navigating the world of auto insurance to find the most affordable coverage can be a challenging task. Here are some practical tips to help you make the most of your search:

Shop Around

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare rates from multiple providers. This can be done efficiently using online comparison tools, which allow you to quickly view quotes from various companies side by side.

Understand Your Coverage Needs

Before you start shopping, take a moment to assess your specific coverage needs. Consider the value of your vehicle, your financial situation, and the level of risk you’re comfortable with. This will help you determine the right balance between comprehensive coverage and affordable premiums.

Explore Discounts

Insurance providers offer a variety of discounts that can significantly reduce your premiums. These may include safe driver discounts, multi-policy discounts (for bundling multiple types of insurance), good student discounts, and more. Ask about available discounts when obtaining quotes, and don’t hesitate to inquire about additional savings opportunities.

Consider Higher Deductibles

Increasing your deductible—the amount you pay out of pocket before your insurance kicks in—can lower your insurance premiums. This strategy works best if you have sufficient savings to cover a higher deductible in the event of an accident or claim. However, be cautious and ensure you can comfortably afford the higher deductible amount.

Review Your Policy Regularly

Insurance rates and coverage needs can change over time. Regularly review your policy to ensure it still meets your requirements and to take advantage of any new discounts or promotions your provider may offer. This practice can help you stay informed and potentially save money.

Comparing Quotes and Choosing a Provider

When it comes to selecting an auto insurance provider, it’s essential to compare quotes from multiple companies to ensure you’re getting the best deal. Here’s a step-by-step guide to help you through the process:

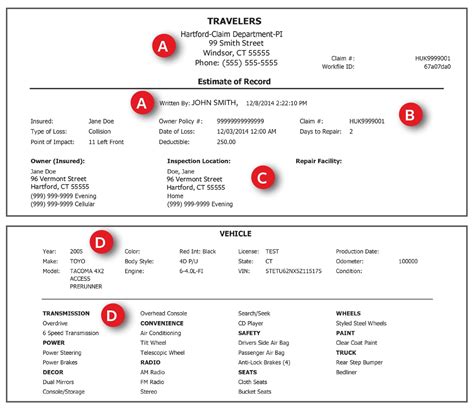

Gather Quotes

Use online comparison tools to obtain quotes from various insurance providers. These tools allow you to input your information once and receive multiple quotes, making the process more efficient.

Evaluate Coverage and Pricing

Review each quote carefully, paying attention to the coverage offered and the associated costs. Ensure that the coverage meets your needs and that you understand any exclusions or limitations. Compare the premiums, deductibles, and any additional fees to get a clear picture of the overall cost.

Consider Customer Service and Reputation

While pricing is important, it’s not the only factor to consider. Research the reputation and customer service record of each provider. Look for reviews and ratings from independent sources to get an unbiased perspective. Consider factors like response times, claims handling efficiency, and overall customer satisfaction.

Check for Discounts and Bundling Options

Inquire about any available discounts and bundling options. Many providers offer discounts for multiple policies (e.g., auto and home insurance) or for specific circumstances like good driving records or safety features in your vehicle. Bundling policies can often lead to significant savings.

Read the Fine Print

Before finalizing your choice, carefully read the policy documents. Pay attention to the details, including coverage limits, exclusions, and any conditions that might impact your coverage. Understanding these nuances can help you avoid surprises later on.

The Future of Auto Insurance

The auto insurance industry is undergoing significant transformations, driven by technological advancements and changing consumer preferences. One of the most notable trends is the increasing adoption of telematics and usage-based insurance (UBI). Telematics devices, which track driving behavior and vehicle usage, are becoming more common. These devices can provide real-time data on driving habits, such as acceleration, braking, and mileage, which insurance companies can use to offer more personalized and accurate premiums.

UBI programs, which reward safe driving with lower premiums, are gaining popularity. These programs often require drivers to install a telematics device or use a smartphone app to track their driving. By encouraging safer driving habits, UBI not only benefits individual drivers but also contributes to safer roads overall.

Another emerging trend is the use of artificial intelligence (AI) and machine learning in auto insurance. AI-powered systems can analyze vast amounts of data to identify patterns and make predictions, which can be used to more accurately assess risk and set premiums. This technology can also improve claims handling processes, making them more efficient and accurate.

FAQs

How do I know if I’m getting a good deal on auto insurance?

+To ensure you’re getting a good deal, compare quotes from multiple providers. Look for comprehensive coverage at a competitive price. Also, consider the reputation and customer service record of the insurer. A good deal should offer both value and peace of mind.

Can I get auto insurance without a license or a car?

+Obtaining auto insurance without a license or a car can be challenging but not impossible. Some insurers offer non-owner car insurance policies for those who occasionally borrow or rent vehicles. However, the availability of such policies and the specific requirements can vary by state and insurer.

What are some common mistakes to avoid when shopping for auto insurance?

+Common mistakes include settling for the first quote without comparison, not understanding the coverage limits, and neglecting to ask about discounts. Additionally, failing to review your policy regularly can lead to missing out on savings opportunities or not having the right coverage for your needs.

How can I improve my chances of getting lower auto insurance rates?

+To improve your chances of getting lower rates, maintain a clean driving record, explore discounts (e.g., safe driver, multi-policy), and consider increasing your deductible. Additionally, shopping around and comparing quotes from multiple insurers can help you find the best deal.

What should I do if I’m unhappy with my current auto insurance provider?

+If you’re dissatisfied with your current provider, consider shopping around for alternative options. Compare quotes from other insurers to see if you can find better coverage or more competitive rates. Don’t hesitate to switch providers if you find a better deal elsewhere.