Estimated Auto Insurance

Auto insurance is an essential aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other mishaps. The cost of auto insurance can vary significantly, depending on numerous factors, and understanding these variables is crucial for drivers to make informed decisions about their coverage.

Factors Influencing Auto Insurance Estimates

Numerous elements contribute to the calculation of auto insurance premiums. These factors are often unique to each driver and can greatly impact the overall cost of their insurance policy.

Driver Profile

Your personal information and driving history play a significant role in determining insurance rates. Age, for instance, is a critical factor; younger drivers, especially those under 25, often face higher premiums due to their relative inexperience on the road. Gender can also influence rates, with some insurers considering males under 25 to be higher-risk drivers.

Your driving record is another crucial aspect. A clean record, free from accidents and traffic violations, can lead to lower premiums. Conversely, a history of accidents or traffic citations may result in higher insurance costs. Some insurers also consider credit scores when determining rates, as they believe individuals with higher credit scores are less likely to file claims.

| Driver Profile Factor | Impact on Premiums |

|---|---|

| Age | Younger drivers often pay more |

| Gender | Males under 25 may face higher rates |

| Driving Record | Clean records lead to lower costs |

| Credit Score | Higher scores may result in lower premiums |

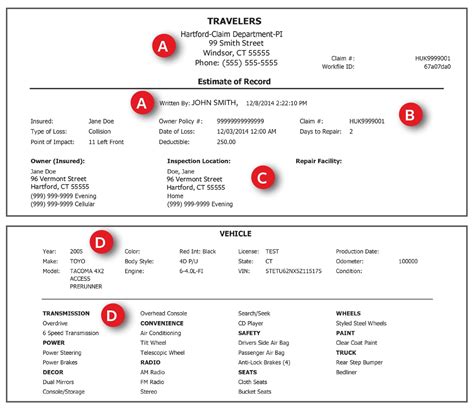

Vehicle Details

The type of vehicle you drive can significantly affect your insurance premiums. Make and model are key considerations, as some vehicles are more expensive to repair or are more frequently involved in accidents. Insurers also factor in the vehicle’s age and mileage, as older vehicles with higher mileage may be more prone to breakdowns and accidents.

The primary use of your vehicle is another consideration. If you primarily use your car for work, especially if it involves a lot of driving, your insurance costs may be higher. On the other hand, if your vehicle is primarily used for personal, pleasure, or occasional commuting, your rates might be lower.

Coverage and Deductibles

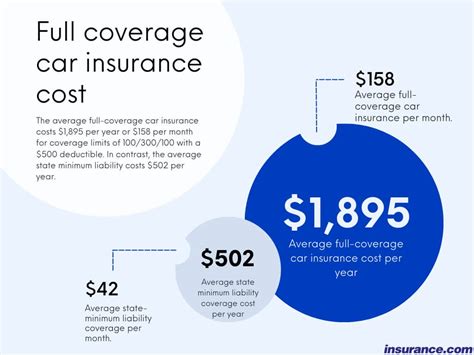

The level of coverage you choose directly impacts your insurance premiums. Comprehensive coverage, which includes protection against theft, fire, and other non-collision incidents, often comes at a higher cost. Conversely, liability-only coverage, which only covers damages you cause to others, can be more affordable.

The deductible you select also affects your premiums. A higher deductible means you'll pay more out of pocket if you file a claim, but it can result in lower monthly premiums. Conversely, a lower deductible means you pay less upfront but higher monthly premiums.

Location and Usage

Your location plays a significant role in determining insurance rates. Areas with higher populations, more traffic, and a higher incidence of accidents or thefts tend to have higher insurance costs. The number of miles driven annually is another consideration; the more you drive, the higher the chance of being involved in an accident, leading to potentially higher premiums.

Obtaining Accurate Auto Insurance Estimates

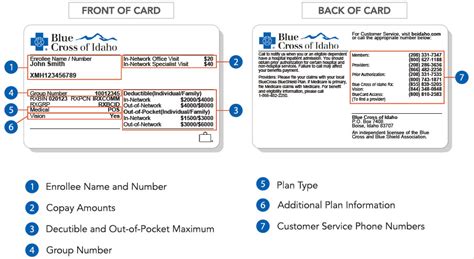

To get an accurate estimate for your auto insurance, it’s essential to provide detailed and honest information to your insurance provider. This includes accurate details about your vehicle, driving history, and intended usage.

Comparison Shopping

Shopping around and comparing quotes from multiple insurers is a wise strategy. Each insurer uses its own formula to calculate premiums, and rates can vary significantly between companies. Online tools and comparison websites can make this process easier, allowing you to quickly obtain multiple quotes.

When comparing quotes, pay attention to the coverage limits and deductibles offered. While a lower premium might be appealing, it's crucial to ensure that the coverage meets your needs and provides adequate protection.

Bundle Discounts

If you have multiple insurance needs, such as home and auto, consider bundling your policies with one insurer. Many insurers offer bundle discounts, which can significantly reduce your overall insurance costs.

Discounts and Special Offers

Insurers often provide various discounts to attract and retain customers. These can include safe driver discounts, multi-policy discounts, loyalty discounts, and good student discounts. Be sure to ask your insurer about any applicable discounts that could lower your premiums.

The Future of Auto Insurance Estimates

The auto insurance industry is evolving, and technology is playing a significant role in how insurance rates are determined. With the advent of telematics and usage-based insurance (UBI), insurers can now collect real-time data about a driver’s behavior, including their speed, braking habits, and mileage.

This data-driven approach to insurance allows for more accurate risk assessments and can potentially lead to lower premiums for safe drivers. However, it also means that drivers who exhibit risky behavior on the road may face higher insurance costs.

The Rise of Telematics and UBI

Telematics devices, which can be installed in vehicles or come built-in, collect data about a driver’s behavior. This data is then transmitted to the insurer, who uses it to calculate premiums. With UBI, drivers can potentially pay lower premiums if they drive safely and less frequently.

While telematics and UBI offer a more personalized and fair approach to insurance pricing, they also raise concerns about privacy and data security. It's important for drivers to understand how their data is being used and to ensure that their insurers have robust data protection measures in place.

The Impact of Autonomous Vehicles

The emergence of autonomous vehicles is expected to revolutionize the auto insurance industry. With self-driving cars, the risk of human error-related accidents could significantly decrease, potentially leading to lower insurance costs for all drivers. However, new risks associated with the technology itself may also emerge, such as software glitches or cyberattacks, which could affect insurance rates.

Conclusion

Understanding the factors that influence auto insurance estimates is crucial for drivers to make informed choices about their coverage. By providing accurate information, shopping around, and taking advantage of available discounts, drivers can often find more affordable insurance options that meet their needs. As the industry continues to evolve with technological advancements, drivers can expect more personalized and data-driven insurance solutions.

How do I know if I’m getting a fair insurance quote?

+Comparing quotes from multiple insurers is a good way to gauge fairness. Look for policies with similar coverage limits and deductibles, and ensure you’re comparing apples to apples. Also, be aware of any discounts you may be eligible for, as these can significantly reduce your premiums.

What are some common discounts offered by insurers?

+Common discounts include safe driver discounts for accident-free driving, multi-policy discounts for bundling home and auto insurance, loyalty discounts for long-term customers, and good student discounts for students with good grades. Some insurers also offer discounts for certain professions or membership in specific organizations.

How does my credit score affect my insurance premiums?

+Many insurers use credit-based insurance scores to help determine premiums. In general, individuals with higher credit scores are seen as lower-risk customers and may qualify for lower premiums. However, the use of credit scores in insurance pricing is not allowed in all states.