Meaning Life Insurance

In today's complex financial landscape, understanding the nuances of life insurance is more crucial than ever. With various types of policies, features, and benefits, life insurance offers a range of protections and financial strategies. This comprehensive guide aims to demystify the concept of meaningful life insurance, shedding light on its significance, the different types available, and how to make informed decisions to ensure a secure future for yourself and your loved ones.

The Significance of Life Insurance: A Meaningful Investment

Life insurance is a vital financial tool, offering more than just a safety net for uncertain times. It is an investment in the future, a promise of security, and a means to ensure that your loved ones are taken care of even in your absence. The primary objective of life insurance is to provide financial protection to beneficiaries, often family members or dependents, in the event of the policyholder's death.

This meaningful investment can cover a wide range of financial needs, from covering funeral expenses and immediate financial obligations to providing long-term financial support for surviving family members. It can also be used as a tool for estate planning, business protection, and even as a vehicle for tax-efficient savings and investments.

The significance of life insurance lies in its ability to offer peace of mind. By having a life insurance policy in place, individuals can rest assured that their loved ones will not face financial hardship or be burdened with debt in the event of their passing. It is a powerful tool that allows individuals to plan for the future with confidence, knowing that their legacy will be one of financial security and stability.

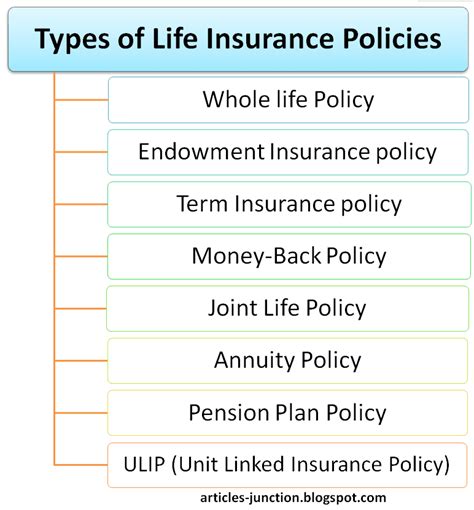

Types of Life Insurance: Navigating the Options

The world of life insurance is diverse, offering a variety of policies to cater to different needs and financial situations. Understanding the key types of life insurance is essential to making an informed decision.

Term Life Insurance

Term life insurance is a straightforward and affordable option, offering coverage for a specific period, often 10, 20, or 30 years. It provides a death benefit to the beneficiaries if the policyholder dies during the term of the policy. This type of insurance is ideal for individuals seeking coverage for a specific period, such as while their children are young or while they have significant financial obligations like a mortgage.

| Term Length | Coverage Period |

|---|---|

| 10 Years | Short-term protection for immediate needs |

| 20 Years | Mid-term coverage for growing families |

| 30 Years | Long-term security for lifelong protection |

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder's entire life. This type of policy offers a death benefit to beneficiaries upon the policyholder's death and also accumulates cash value over time, which can be borrowed against or withdrawn while the policyholder is alive.

Whole life insurance is often chosen for its stability and long-term financial benefits. The cash value component can be used for various purposes, such as funding retirement, paying for a child's education, or covering unexpected expenses. It provides a guaranteed death benefit and a consistent premium throughout the policyholder's life, making it a reliable choice for long-term financial planning.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows policyholders to adjust their premium payments and death benefit coverage over time. This policy type offers more flexibility than whole life insurance, as it provides the option to increase or decrease the death benefit and premium payments based on changing financial needs and circumstances.

Universal life insurance policies also accumulate cash value, which can be used for various financial goals. The policyholder can choose to pay a fixed premium or vary the premium payments, depending on their financial situation and needs. This flexibility makes universal life insurance an attractive option for individuals seeking a customizable life insurance policy.

Variable Life Insurance

Variable life insurance is another form of permanent life insurance that allows policyholders to invest a portion of their premiums in separate accounts, offering the potential for higher returns. The death benefit and cash value of the policy are tied to the performance of these separate investment accounts.

While variable life insurance can provide higher returns than other types of life insurance, it also carries more risk. The policyholder assumes the risk of potential losses if the investments perform poorly. This type of policy is best suited for individuals who are comfortable with investment risk and have a long-term financial horizon.

Group Life Insurance

Group life insurance is often provided through employers as part of an employee benefits package. It offers coverage to a group of individuals, such as employees, at a lower cost than individual policies. Group life insurance typically provides a basic level of coverage and may not offer the same level of customization or benefits as individual policies.

While group life insurance is a convenient and often affordable option, it may not meet all of an individual's life insurance needs. It is important to assess personal financial goals and circumstances to determine if additional individual life insurance coverage is necessary.

Factors to Consider When Choosing Life Insurance

When navigating the complex world of life insurance, there are several key factors to consider to ensure you make the right choice for your unique circumstances.

Financial Needs and Goals

Assessing your financial needs and goals is the first step in choosing the right life insurance policy. Consider your short-term and long-term financial obligations, such as mortgage payments, education expenses for children, and retirement planning. Determine the level of coverage needed to ensure your loved ones can maintain their standard of living and meet their financial goals in your absence.

Policy Features and Benefits

Different life insurance policies offer a range of features and benefits. Some policies may include additional riders or options, such as accelerated death benefits for terminal illness or waivers of premium in case of disability. Understanding these features and how they align with your needs is crucial in making an informed decision.

Cost and Affordability

The cost of life insurance can vary significantly depending on the type of policy, the level of coverage, and individual factors such as age, health, and lifestyle. It's important to consider your budget and financial capacity when choosing a policy. While life insurance is a crucial investment, it should not strain your finances or impact your ability to meet other financial obligations.

Flexibility and Customization

The level of flexibility and customization offered by a life insurance policy is another important consideration. Some policies, like universal life insurance, offer more flexibility in adjusting coverage and premium payments as your financial situation changes. Others, like whole life insurance, provide a more stable and consistent structure.

Company Reputation and Financial Strength

Choosing a reputable and financially stable insurance company is essential to ensure your policy remains secure and your benefits are protected. Research the company's financial ratings, customer reviews, and track record of claim payments to ensure they are a reliable partner for your long-term financial needs.

The Process of Applying for Life Insurance

Applying for life insurance involves a series of steps to ensure the policy meets your needs and the insurer can accurately assess the level of risk.

Understanding the Application Process

The application process typically begins with a review of your personal and financial information. This includes details such as your age, health status, lifestyle habits, and financial goals. The insurer will use this information to determine the level of risk associated with insuring you and to tailor a policy that meets your needs.

Medical Examinations and Underwriting

Most life insurance policies require a medical examination as part of the application process. This examination assesses your overall health and can include blood tests, urine tests, and other diagnostic procedures. The results of these examinations, along with your medical history, will be used by the insurer's underwriting team to determine your eligibility for coverage and the premium rate.

The underwriting process considers a range of factors, including your age, health, family medical history, and lifestyle habits such as smoking or participation in high-risk activities. Based on this assessment, the insurer will determine the level of risk associated with insuring you and set the premium rate accordingly.

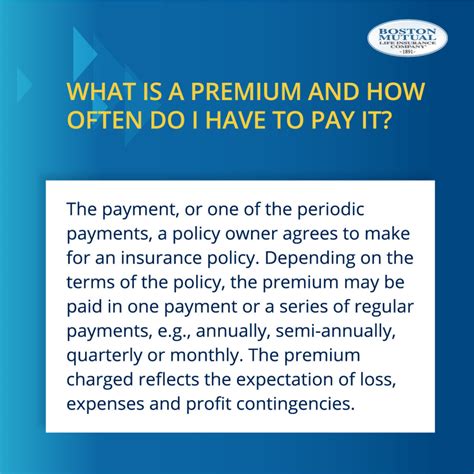

Policy Selection and Premium Payment

Once you have been approved for coverage, you will select the specific policy and its features that best meet your needs. This may involve choosing the type of policy (term, whole life, etc.), the level of coverage, and any additional riders or options. You will then be required to pay the initial premium, which establishes your policy and begins the coverage period.

Maximizing the Benefits of Life Insurance

Life insurance offers more than just a financial safety net. With the right approach, it can be a powerful tool for achieving various financial goals and ensuring a secure future for yourself and your loved ones.

Estate Planning and Legacy Protection

Life insurance can be a vital component of your estate planning strategy. It can provide liquidity to your estate, ensuring that your beneficiaries have the financial resources to cover taxes, debts, and other expenses associated with settling your estate. By incorporating life insurance into your estate plan, you can leave a lasting legacy and ensure your loved ones are provided for.

Business Protection and Continuity

For business owners, life insurance can be a critical tool for protecting their business and ensuring its continuity. Key person life insurance, for instance, provides coverage for individuals who are vital to the success of the business. In the event of their death, the insurance proceeds can help cover the financial impact and ensure the business can continue operating smoothly.

Tax-Efficient Savings and Investments

Certain types of life insurance policies, such as whole life and universal life, offer the potential for tax-efficient savings and investments. The cash value component of these policies grows on a tax-deferred basis, meaning it is not subject to annual taxation. This can be a powerful tool for building wealth over time and maximizing the benefits of your life insurance policy.

Long-Term Financial Planning

Life insurance can be a valuable component of your long-term financial planning strategy. By incorporating life insurance into your overall financial plan, you can ensure that your loved ones are provided for in the event of your death, and you can also use the policy's cash value for various financial goals, such as funding retirement or paying for a child's education.

Frequently Asked Questions (FAQ)

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your individual circumstances and financial goals. A common rule of thumb is to aim for coverage that is 10-15 times your annual income. However, it's important to consider your specific needs, such as outstanding debts, mortgage payments, and future financial obligations like children's education. Consulting with a financial advisor can help you determine the appropriate level of coverage.

Can I switch my life insurance policy later on if my needs change?

+Yes, you can typically switch your life insurance policy if your needs change. This may involve converting a term policy to a permanent policy or adjusting the coverage and premium payments of a permanent policy. However, it's important to note that switching policies may result in additional costs or changes to your benefits, so it's advisable to consult with your insurance provider or a financial advisor before making any changes.

What happens if I miss a premium payment on my life insurance policy?

+Missing a premium payment on your life insurance policy can have serious consequences. Depending on the terms of your policy, you may have a grace period of 30 days or more to make the payment before your coverage lapses. If you fail to make the payment within the grace period, your policy may be terminated, and you will lose your coverage and any accumulated cash value. It's important to stay on top of your premium payments to maintain your coverage.

Understanding the meaning of life insurance and its various aspects is crucial for making informed decisions about your financial future. By exploring the different types of policies, considering key factors, and understanding the application and benefits process, you can ensure that your life insurance investment provides the security and peace of mind you and your loved ones deserve.