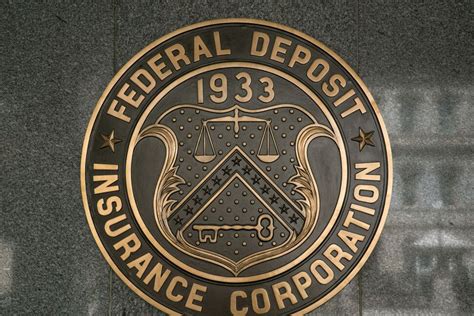

Fdic Insurance Meaning

FDIC insurance is a critical financial safeguard that protects the hard-earned savings of millions of Americans. It stands for the Federal Deposit Insurance Corporation, an independent agency of the United States government established to maintain stability and public confidence in the nation's financial system. With the FDIC insurance program, depositors' funds are secured, offering peace of mind and financial security in an ever-changing economic landscape.

Understanding FDIC Insurance

The Federal Deposit Insurance Corporation (FDIC) is a government-backed entity that insures deposits in banks and savings associations. Its primary mission is to promote confidence in the U.S. financial system by protecting depositors against losses should their bank fail. FDIC insurance is a cornerstone of the nation’s banking system, providing a safety net for individuals, businesses, and public entities.

FDIC insurance covers various deposit accounts, including checking accounts, savings accounts, money market deposit accounts (MMDAs), and certificates of deposit (CDs). It does not, however, insure investments such as stocks, bonds, mutual funds, or life insurance policies.

The History and Evolution of FDIC Insurance

The FDIC was established in 1933 as a response to the thousands of bank failures during the Great Depression. Its creation was a pivotal moment in U.S. banking history, aimed at restoring public trust and preventing widespread panic and bank runs. Since its inception, the FDIC has played a crucial role in maintaining financial stability, with its insurance program providing a critical backstop during economic downturns and ensuring that depositors’ funds are protected.

Over the years, the FDIC has adapted its policies and coverage limits to meet the evolving needs of the financial system. Initially, FDIC insurance provided coverage of up to $2,500 per depositor, per bank. Today, that coverage has significantly increased, providing greater protection for depositors.

| FDIC Coverage Limit Timeline | Coverage Limit |

|---|---|

| 1933-1980 | $2,500 |

| 1980-2008 | $100,000 |

| 2008-2010 (Temporary Increase) | $250,000 |

| 2010-Present | $250,000 |

The temporary increase in coverage during the 2008 financial crisis was a crucial measure to bolster confidence in the banking system and reassure depositors during a period of economic uncertainty.

How FDIC Insurance Works

FDIC insurance is a critical component of the U.S. banking system, offering protection to depositors in the event of a bank failure. Here’s a closer look at how it works:

- Bank Membership: All FDIC-insured banks and savings associations are required to be members of the FDIC. This membership ensures that these institutions adhere to FDIC regulations and maintain the necessary capital to cover potential losses.

- Deposit Insurance Coverage: FDIC insurance covers deposit accounts, including checking, savings, and certain types of money market accounts. It does not, however, insure investments like stocks, bonds, or mutual funds. Each depositor is insured up to a specific limit per ownership category in each bank or savings association.

- Ownership Categories: FDIC insurance takes into account different ownership categories, such as single accounts, joint accounts, trusts, and business accounts. Each category has its own coverage limit, allowing individuals and entities to maximize their FDIC insurance coverage by properly categorizing their accounts.

- Coverage Limits: The FDIC currently insures deposits up to $250,000 per ownership category in each bank or savings association. This means that if you have multiple accounts at the same institution, the total balance of those accounts must not exceed $250,000 to be fully insured.

- Calculating Coverage: The FDIC provides tools and resources to help depositors calculate their coverage. These tools consider the various ownership categories and account types to ensure depositors understand their insurance coverage.

Maximizing FDIC Insurance Coverage

While FDIC insurance provides a robust safety net for depositors, understanding how to maximize coverage is essential to fully protect your savings. Here are some strategies to optimize your FDIC insurance coverage:

Utilizing Ownership Categories

FDIC insurance coverage is categorized by ownership, allowing depositors to maximize protection by utilizing different account types and ownership categories. Here’s a breakdown of the primary ownership categories and how they can be used to increase FDIC insurance coverage:

- Single Accounts: Single accounts are owned by one person and are insured up to $250,000. This is the most common ownership category and is typically used for personal checking and savings accounts.

- Joint Accounts: Joint accounts are owned by two or more people and are insured up to $250,000 per co-owner. This category is ideal for couples or families who want to pool their resources while maintaining FDIC insurance protection.

- Trust Accounts: Trust accounts are legal entities that hold assets for the benefit of another person or entity. They are insured up to $250,000 per beneficiary. This category is often used for estate planning and ensuring that beneficiaries have access to funds in the event of the account holder's death.

- Business Accounts: Business accounts are owned by corporations, partnerships, or sole proprietorships. They are insured up to $250,000 per ownership category, which can include different types of business accounts such as checking, savings, and money market accounts.

By understanding and utilizing these ownership categories, depositors can effectively manage their accounts to maximize FDIC insurance coverage. For example, a couple can open a joint account to pool their savings while maintaining the $250,000 insurance limit per co-owner.

Spreading Deposits Across Institutions

Another strategy to maximize FDIC insurance coverage is to spread deposits across multiple institutions. Each bank or savings association is insured separately, allowing depositors to increase their overall coverage by diversifying their accounts. Here’s how it works:

- Single Institution: If you have all your deposits at one bank, your total coverage is limited to $250,000 per ownership category.

- Multiple Institutions: By spreading your deposits across different banks, you can increase your overall coverage. For example, if you have $500,000 in savings, you can split this amount between two banks, with $250,000 in each, ensuring full FDIC insurance protection.

It's important to note that this strategy requires careful planning and coordination to ensure that all accounts are properly categorized and that the total balance at each institution does not exceed the FDIC insurance limit.

FDIC-Insured Products and Accounts

FDIC insurance covers a wide range of deposit accounts, offering protection for various financial needs. Understanding which products and accounts are FDIC-insured is crucial to maximizing your coverage. Here’s an overview of the primary types of accounts covered by FDIC insurance:

- Checking Accounts: FDIC insurance covers traditional checking accounts, which are used for everyday transactions such as paying bills, making purchases, and receiving direct deposits.

- Savings Accounts: Savings accounts are designed for storing money and earning interest. They are a popular choice for building an emergency fund or saving for specific goals. FDIC insurance ensures that these savings are protected.

- Money Market Deposit Accounts (MMDAs): MMDAs offer higher interest rates than traditional savings accounts and provide check-writing privileges. They are a flexible savings option, and FDIC insurance covers the funds in these accounts.

- Certificates of Deposit (CDs): CDs are time-based savings accounts that offer higher interest rates in exchange for keeping your money in the account for a set period. FDIC insurance protects the principal amount invested in CDs.

- Retirement Accounts: Certain retirement accounts, such as Individual Retirement Accounts (IRAs) and employer-sponsored retirement plans, are also covered by FDIC insurance. This protection ensures that your retirement savings are secure.

It's important to note that while these accounts are FDIC-insured, the coverage limits apply to the total balance in each account. Depositors should carefully manage their accounts to ensure that they do not exceed the FDIC insurance limits.

FDIC Insurance and the Future of Banking

As the banking industry continues to evolve, the role of FDIC insurance remains critical in maintaining financial stability and protecting depositors. Here’s a look at how FDIC insurance is adapting to meet the changing landscape of banking and the future implications for depositors:

Digital Banking and FDIC Insurance

The rise of digital banking has transformed the way individuals and businesses manage their finances. Online and mobile banking platforms have become increasingly popular, offering convenience and accessibility. FDIC insurance plays a vital role in this digital landscape, providing the same protection for deposits made through online channels as it does for traditional brick-and-mortar banks.

With the convenience of digital banking, depositors can easily manage their accounts, transfer funds, and even open new accounts online. FDIC insurance ensures that these digital deposits are just as secure as those made at a physical bank branch. This has opened up new opportunities for depositors to maximize their FDIC insurance coverage by taking advantage of online banking services and a wider range of financial institutions.

Financial Innovation and FDIC Insurance

The banking industry is constantly evolving, with new financial products and services emerging to meet the changing needs of consumers and businesses. FDIC insurance must adapt to keep pace with these innovations and ensure that depositors’ funds remain protected.

One area of financial innovation that FDIC insurance is addressing is the rise of fintech companies. These companies are disrupting traditional banking models by offering digital-first financial services, such as mobile payment platforms and peer-to-peer lending. While these companies may not be traditional banks, they often partner with FDIC-insured institutions to provide deposit accounts that are eligible for FDIC insurance protection.

As fintech continues to evolve, the FDIC is working to ensure that depositors have clear information about which accounts are FDIC-insured and which are not. This transparency helps depositors make informed decisions about where to keep their funds and ensures that their savings remain protected.

The Future of FDIC Insurance

Looking ahead, the FDIC is committed to maintaining its role as a critical backstop for the U.S. financial system. While the coverage limits and policies may evolve over time to meet changing economic conditions, the core mission of protecting depositors’ funds remains unchanged.

As the banking industry continues to innovate and adapt, the FDIC will play a crucial role in ensuring that depositors have the confidence and security they need to manage their finances. Whether it's through traditional banks, digital platforms, or fintech partnerships, FDIC insurance will remain a cornerstone of the U.S. financial system, providing a safety net for depositors and contributing to the overall stability of the economy.

FAQs

What is the current FDIC insurance coverage limit for deposit accounts?

+

The current FDIC insurance coverage limit is $250,000 per depositor, per ownership category, in each bank or savings association.

Does FDIC insurance cover all types of accounts and investments?

+

FDIC insurance covers various deposit accounts, including checking, savings, and certain types of money market accounts. However, it does not insure investments such as stocks, bonds, mutual funds, or life insurance policies.

How can I maximize my FDIC insurance coverage if I have a large amount of savings?

+

To maximize FDIC insurance coverage for large savings, you can utilize different ownership categories (single, joint, trust, business) and spread your deposits across multiple FDIC-insured institutions. This ensures that your savings are fully protected up to the insurance limit.

Are online and mobile banking deposits covered by FDIC insurance?

+

Yes, deposits made through online and mobile banking platforms at FDIC-insured institutions are covered by FDIC insurance, providing the same protection as traditional brick-and-mortar banks.

What happens if my bank fails, and I have deposits exceeding the FDIC insurance limit?

+

If your bank fails and you have deposits exceeding the FDIC insurance limit, the FDIC works to ensure that insured deposits are made available to depositors as quickly as possible. While you may experience some delays in accessing your funds, the FDIC will work to protect your insured deposits up to the coverage limit.