Insurance Quote For Car Insurance

Securing a competitive insurance quote for your car insurance is a crucial step in ensuring you have adequate coverage for your vehicle while also managing your expenses. The process of obtaining quotes involves understanding the various factors that influence rates, comparing options from different providers, and ultimately making an informed decision to protect your investment.

Understanding the Factors that Influence Car Insurance Quotes

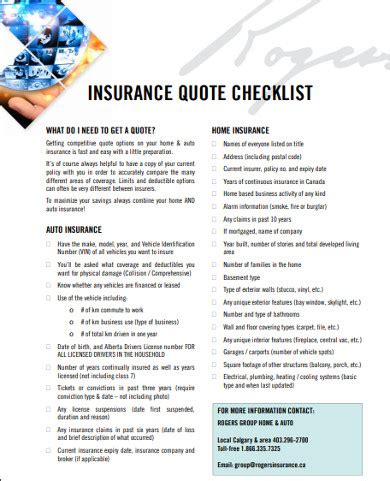

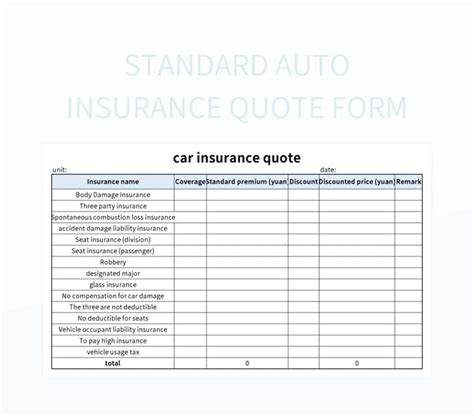

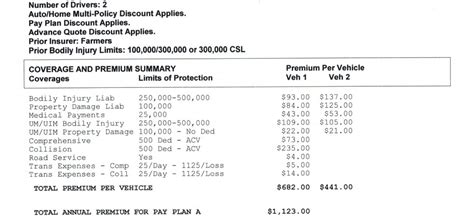

Several variables come into play when determining car insurance quotes. These factors include the type of vehicle you own, your driving history, the location where the car is primarily driven and parked, and your personal demographics. Additionally, the coverage options you choose, such as liability, comprehensive, and collision coverage, will impact the overall quote.

For instance, if you own a high-performance sports car, your insurance quote is likely to be higher compared to someone with a standard sedan. This is because sports cars are often more expensive to repair and are associated with higher risks due to their performance capabilities. Similarly, if you have a history of traffic violations or accidents, your quote may reflect a higher risk profile.

| Factor | Description |

|---|---|

| Vehicle Type | The make, model, and age of your car can impact repair costs and risk profile. |

| Driving History | Past accidents, violations, and claims can affect your perceived risk. |

| Location | Areas with higher crime rates or frequent natural disasters may have increased premiums. |

| Coverage Options | The level of coverage you choose directly influences your quote. |

The Role of Location in Insurance Quotes

Your geographic location plays a significant role in determining insurance quotes. Insurance companies consider factors such as crime rates, the frequency of natural disasters, and even the average cost of living in your area. Areas with higher crime rates or a history of frequent accidents may result in higher premiums. For instance, if you live in an urban area with a high rate of car thefts, your insurance quote is likely to reflect this increased risk.

Additionally, the cost of living in your area can impact repair costs, which in turn affects your insurance quote. In regions where the cost of living is higher, the cost of repairing or replacing a vehicle is generally more expensive. Insurance companies take this into account when calculating quotes to ensure they can cover the potential expenses associated with claims.

Comparing Quotes from Multiple Insurance Providers

Obtaining multiple insurance quotes is essential to ensure you’re getting the best value for your money. Different insurance providers may offer varying rates for the same level of coverage due to their unique assessment of risk and their business strategies. By comparing quotes, you can identify the most competitive options and potentially save money on your car insurance premiums.

When comparing quotes, pay attention to the specific coverage details. Ensure that the quotes you're comparing offer the same or similar levels of coverage. This includes liability limits, deductibles, and any additional coverage options you may have selected, such as rental car reimbursement or roadside assistance.

Tips for Negotiating and Customizing Your Quote

While insurance quotes are largely determined by the factors mentioned above, there are strategies you can employ to potentially negotiate better rates or customize your coverage to fit your needs. Here are some tips:

- Bundle Policies: Consider bundling your car insurance with other policies, such as home or renters insurance. Many providers offer discounts when you bundle multiple policies, which can lead to significant savings.

- Increase Deductibles: Opting for higher deductibles can reduce your premium costs. However, ensure that you can afford the increased deductible in the event of a claim.

- Review Coverage Annually: Regularly review your insurance coverage to ensure it aligns with your current needs. Life circumstances can change, and your coverage should reflect those changes. For example, if you've recently purchased a new vehicle or moved to a different location, your insurance needs may have changed.

- Explore Discounts: Many insurance providers offer discounts for a variety of reasons, such as good driving records, safe vehicle equipment (like anti-theft devices), and loyalty discounts for long-term customers. Ask your insurer about any potential discounts you may qualify for.

The Importance of Accurate Information in Obtaining Quotes

Providing accurate and truthful information when obtaining insurance quotes is crucial. Insurance companies rely on the information you provide to assess your risk profile and determine an appropriate quote. Misrepresenting your driving history, the condition of your vehicle, or other relevant details can lead to issues down the line, including potential claim denials or increased premiums.

For example, if you fail to disclose a recent accident or traffic violation when obtaining a quote, the insurance company may discover this information during the claims process. This could result in a claim denial or an increase in your premiums to reflect the higher risk you pose. It's always best to be honest and transparent when providing information to insurance providers.

The Impact of Credit Score on Insurance Quotes

Your credit score is another factor that insurance companies may consider when determining quotes. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. As a result, insurance companies may use credit-based insurance scores to help assess risk and set premiums.

If you have a low credit score, it may impact your insurance quote negatively. However, it's important to note that the use of credit-based insurance scores varies by state and insurer. Some states have even implemented laws restricting or prohibiting the use of credit scores in insurance underwriting. Stay informed about your state's regulations regarding credit-based insurance scores to understand how this factor may impact your car insurance quote.

Conclusion: Making an Informed Decision for Your Car Insurance

Obtaining an insurance quote for your car insurance is a critical step in ensuring you have the right coverage at a competitive price. By understanding the factors that influence quotes, comparing options from multiple providers, and employing strategies to negotiate or customize your coverage, you can make an informed decision that best suits your needs and budget.

Remember, car insurance is not just about finding the lowest premium. It's about finding the right balance between cost and coverage to protect your vehicle and your financial well-being. Stay informed, compare quotes regularly, and don't hesitate to reach out to insurance professionals for guidance in navigating the complex world of car insurance quotes.

How often should I review my car insurance coverage and quotes?

+It’s recommended to review your car insurance coverage and quotes at least once a year, or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary features.

What is the difference between liability and comprehensive coverage?

+Liability coverage protects you financially if you’re at fault in an accident, covering the other party’s medical expenses and property damage. Comprehensive coverage, on the other hand, protects your own vehicle from non-collision incidents like theft, vandalism, or natural disasters.

Can I get an insurance quote without providing my Social Security number?

+In most cases, you can obtain an initial insurance quote without providing your Social Security number. However, to complete the application process and purchase insurance, insurers may require this information to conduct a full background check and credit score assessment.