How Do I File An Insurance Claim

Navigating the world of insurance claims can be a daunting task, especially when unexpected incidents occur. Understanding the process and having the right information can make a significant difference in ensuring a smooth and successful claim experience. This comprehensive guide aims to demystify the insurance claim process, providing you with expert insights and practical steps to effectively file a claim.

Understanding the Insurance Claim Process

An insurance claim is a formal request made by an insured individual to their insurance provider, seeking compensation for losses or damages covered by their policy. The process begins with recognizing the need for a claim, which could arise from various events such as accidents, natural disasters, theft, or medical emergencies. It’s essential to act promptly and initiate the claim process as soon as possible after the incident.

Here's a step-by-step breakdown of how to file an insurance claim effectively:

Step 1: Notify Your Insurance Provider

Contact your insurance company as soon as you become aware of the incident. Most insurance providers have dedicated claims departments with specific phone numbers or email addresses for reporting claims. Ensure you have your policy number and relevant details about the incident ready when making the initial contact.

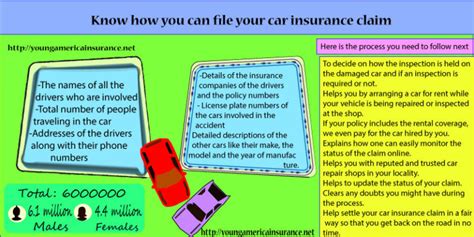

Step 2: Gather Essential Information

Collect all the necessary information and documents related to the claim. This may include photographs of the damage or loss, police reports (if applicable), medical records (for health insurance claims), and any other relevant evidence. The more comprehensive your documentation, the stronger your claim will be.

Step 3: Complete the Claim Form

Your insurance provider will typically send you a claim form or provide an online platform for submitting your claim. Fill out the form accurately and provide as much detail as possible. Be sure to include all the relevant information, such as the date, time, and location of the incident, as well as a clear description of the loss or damage.

Step 4: Submit Supporting Documents

Along with the completed claim form, attach all the supporting documents you’ve gathered. This may include copies of contracts, receipts, invoices, or any other evidence that supports your claim. Make sure the documents are clear and legible, and provide additional copies if necessary.

Step 5: Wait for the Insurance Company’s Response

Once you’ve submitted your claim, the insurance company will review the information and assess the validity of your claim. This process may take some time, depending on the complexity of the claim and the insurance provider’s workload. During this period, it’s essential to remain patient and keep in touch with your insurer to ensure the process is moving forward.

Step 6: Negotiate and Settle the Claim

After the insurance company’s assessment, they will either approve or deny your claim. If your claim is approved, they will provide you with a settlement offer. If you believe the offer is fair and adequate, you can accept it and conclude the claim process. However, if you feel the offer is insufficient, you have the right to negotiate further. This is where understanding your policy and the extent of your coverage becomes crucial.

💡 Expert Tip: Familiarize yourself with your insurance policy before filing a claim. Review the coverage limits, deductibles, and any specific exclusions or conditions. This knowledge will empower you during the negotiation process and help you maximize your claim settlement.

Step 7: Finalize the Claim

Once you’ve reached an agreement with your insurance company, finalize the claim by accepting the settlement terms. The insurance provider will then process the payment, which may be in the form of a check or direct deposit, depending on your preference and the terms of your policy.

Tips for a Successful Insurance Claim

Filing an insurance claim is not just about following the steps; it’s also about ensuring the process goes smoothly and you receive the compensation you deserve. Here are some additional tips to consider:

- Document Everything: Take detailed notes and photographs of the incident and any damages. This documentation will serve as valuable evidence during the claim process.

- Be Proactive: Don't wait for the insurance company to contact you. Take the initiative to gather information and provide updates on your claim. This shows your commitment to resolving the issue promptly.

- Understand Your Policy: Know your rights and the extent of your coverage. Review your insurance policy carefully, and if needed, seek clarification from your insurer or an insurance expert.

- Keep Records: Maintain a record of all communications with your insurance provider, including phone calls, emails, and letters. This documentation can be crucial if any disputes arise.

- Seek Professional Advice: If you're unsure about any aspect of the claim process or feel overwhelmed, consider consulting an insurance broker or an attorney who specializes in insurance claims. They can provide valuable guidance and support.

The Importance of Timely Claims

Time is of the essence when filing an insurance claim. Most insurance policies have specific time limits within which a claim must be submitted. Failing to meet these deadlines could result in your claim being denied. Additionally, prompt reporting of incidents allows for a more accurate assessment of damages and a quicker resolution.

Common Challenges and How to Overcome Them

While the insurance claim process is designed to be straightforward, there can be challenges along the way. Here are some common obstacles and strategies to overcome them:

Disputes and Denials

Insurance companies may deny claims for various reasons, such as inadequate documentation, policy exclusions, or disputes over the cause of the loss. If your claim is denied, don’t despair. Review the denial letter carefully and identify the reasons for the denial. Gather additional evidence or seek professional advice to strengthen your case and resubmit the claim.

Complex Claims

Some claims, particularly those involving significant losses or complex situations, may require specialized knowledge or expertise. In such cases, consider engaging an insurance adjuster or public adjuster who can advocate for your interests and ensure a fair settlement.

Communication Delays

Sometimes, communication between the insured and the insurance company can break down, leading to delays in the claim process. To avoid this, maintain regular contact with your insurer, follow up on any outstanding requests, and provide prompt responses to their inquiries.

Conclusion: Empowering You for a Successful Claim

Filing an insurance claim doesn’t have to be a stressful experience. By understanding the process, being prepared, and seeking expert guidance when needed, you can navigate the claim journey with confidence. Remember, your insurance policy is a valuable tool to protect your assets and ensure financial security in times of need. With the right approach, you can effectively file a claim and receive the compensation you deserve.

How long does it typically take to receive a settlement after filing an insurance claim?

+The time it takes to receive a settlement can vary widely depending on the complexity of the claim and the insurance provider’s workload. Simple claims with clear evidence may be resolved within a few weeks, while more complex cases could take several months. It’s important to remain patient and keep in touch with your insurer for regular updates.

What should I do if my insurance claim is denied?

+If your claim is denied, carefully review the denial letter to understand the reasons for the denial. Gather additional evidence or seek professional advice to strengthen your case. You can then resubmit your claim with the new information. If the denial still stands, you may consider appealing the decision or seeking legal advice.

Can I file an insurance claim online?

+Many insurance providers now offer online platforms for filing claims. This can be a convenient and efficient way to initiate the claim process. However, some complex claims may still require additional documentation or in-person assessments, so it’s important to follow the instructions provided by your insurer.