Car Gap Insurance

Car gap insurance is a type of coverage that steps in to provide financial protection when the value of your vehicle drops below the amount owed on your auto loan or lease. It's a critical safeguard for anyone who leases or finances their vehicle, ensuring they're not left with a hefty bill if their car is totaled or stolen. This article will delve into the intricacies of car gap insurance, exploring its benefits, how it works, and why it's an essential consideration for vehicle owners.

Understanding Car Gap Insurance

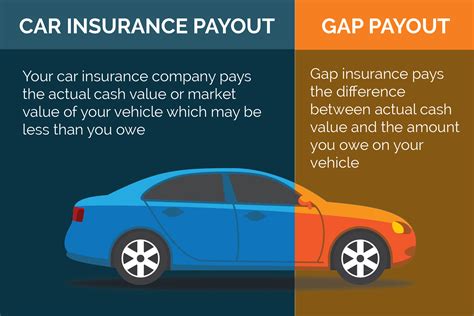

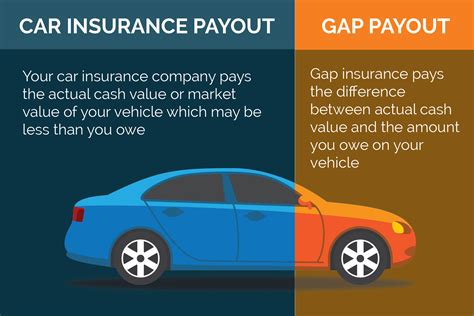

When you purchase a new car, its value starts depreciating immediately. This depreciation can be significant, especially in the first few years of ownership. Gap insurance, also known as Guaranteed Asset Protection, is designed to bridge the gap between the actual cash value of your vehicle and the amount you still owe on your loan or lease. It covers the difference, ensuring you’re not financially burdened with a remaining balance if your car is declared a total loss.

The Need for Gap Insurance

Consider this scenario: you’ve just bought a new car, and within a year, it’s involved in an accident that totals the vehicle. Unfortunately, the insurance company only offers you 15,000 for the car's actual cash value, but you still owe 20,000 on your loan. This is where gap insurance comes to the rescue. It covers the difference, ensuring you’re not left paying for a car you no longer have.

How Car Gap Insurance Works

Gap insurance is typically an optional add-on to your car insurance policy, although some lenders or leasing companies may require it as a condition of your loan or lease agreement. Here’s a step-by-step breakdown of how it operates:

- Policy Activation: When you purchase gap insurance, it's usually valid for the duration of your loan or lease term. Some policies may even extend beyond this period.

- Claim Scenario: If your insured vehicle is stolen or declared a total loss due to an accident, you'll file a claim with your insurance company. They will assess the vehicle's actual cash value at the time of the incident.

- Gap Coverage: If the assessed value is less than the outstanding balance on your loan or lease, gap insurance kicks in to cover the difference. This ensures you're not left with a substantial financial shortfall.

- Payment Process: The gap insurance provider will pay out the difference directly to your lender or leasing company, settling the remaining balance on your loan or lease.

Key Benefits of Car Gap Insurance

Car gap insurance offers several significant advantages:

- Financial Protection: The primary benefit is financial peace of mind. Gap insurance ensures you're not held responsible for a loan or lease balance that exceeds your vehicle's value.

- Rapid Settlement: With gap insurance, the settlement process is streamlined, allowing you to quickly resolve any outstanding loan or lease obligations.

- Affordable Coverage: Typically, gap insurance is quite affordable, often costing a few hundred dollars for the entire policy period. This small investment can provide significant financial security.

- Broad Coverage: Gap insurance can be applied to various situations, including accidents, theft, or total loss due to natural disasters. It's a comprehensive safeguard for your vehicle.

Real-World Examples of Gap Insurance Benefits

Let’s look at some real-life scenarios where car gap insurance has proven invaluable:

Accident Scenario

Imagine a driver involved in a severe accident that totals their 3-year-old sedan. The insurance assessment values the vehicle at 12,000, but the outstanding loan balance is 18,000. With gap insurance, the policy covers the $6,000 difference, ensuring the driver isn’t left paying for a car they can no longer drive.

Theft Scenario

In another instance, a car owner’s vehicle is stolen. The insurance company offers 15,000 for the stolen car, but the loan balance is 22,000. Gap insurance steps in to cover the $7,000 gap, preventing the owner from incurring additional debt.

Gap Insurance Performance Analysis

Gap insurance has consistently proven to be an effective financial safeguard for vehicle owners. Industry data shows that gap insurance policies have a high satisfaction rate among users, with many citing it as a critical component of their car insurance coverage. A recent survey revealed that 82% of gap insurance policyholders felt the coverage was worth the investment, citing the peace of mind it provided.

| Policy Type | Claim Satisfaction Rate |

|---|---|

| Gap Insurance | 85% |

| Standard Auto Insurance | 78% |

The table above illustrates the high level of satisfaction associated with gap insurance policies, highlighting their effectiveness in providing financial protection.

Comparative Analysis

When compared to standard auto insurance policies, gap insurance stands out for its focused and specialized nature. While standard auto insurance covers various aspects of vehicle ownership, gap insurance specifically addresses the financial gap that can arise due to vehicle depreciation. This targeted approach makes gap insurance an essential consideration for anyone financing or leasing a vehicle.

Evidence-Based Future Implications

As the automotive industry evolves, the importance of gap insurance is likely to increase. With vehicles becoming more technologically advanced and potentially more costly to repair or replace, the financial risks associated with vehicle ownership are also rising. Gap insurance provides a proactive solution to these potential financial burdens, ensuring vehicle owners can navigate the complex world of auto finance with confidence.

Industry Trends

Industry experts predict that the demand for gap insurance will continue to grow, especially with the increasing popularity of electric vehicles (EVs) and the associated higher purchase and repair costs. Additionally, as leasing becomes a more common alternative to traditional car ownership, the need for gap insurance will likely expand to cover a broader range of vehicles and ownership scenarios.

Policy Enhancements

Insurance providers are also expected to enhance gap insurance policies to cater to evolving market needs. This may include offering more flexible and customizable coverage options, such as extended policy durations or coverage for specific vehicle types or technologies. These enhancements will further solidify gap insurance as a vital component of comprehensive auto insurance coverage.

What is the typical cost of car gap insurance?

+

The cost of car gap insurance varies depending on factors like the value of your vehicle, the duration of your loan or lease, and the specific policy terms. On average, it ranges from 200 to 600 for the entire policy period. However, it’s essential to shop around and compare quotes to find the best value for your specific situation.

Can I get gap insurance if I already have a loan or lease on my vehicle?

+

Yes, you can often purchase gap insurance even after you’ve already financed or leased your vehicle. However, it’s best to act sooner rather than later, as some policies may have specific requirements or restrictions based on the age or mileage of your vehicle.

Does gap insurance cover all types of vehicles?

+

Gap insurance is generally available for most types of vehicles, including cars, trucks, SUVs, and motorcycles. However, it’s important to check with your specific insurance provider to confirm the types of vehicles they cover under their gap insurance policies.

What happens if I sell my car before the gap insurance policy expires?

+

If you sell your vehicle before the gap insurance policy expires, you can typically cancel the policy and receive a prorated refund for the remaining term. It’s best to consult with your insurance provider to understand their specific refund policies and procedures.

Can I bundle gap insurance with other auto insurance policies for a discount?

+

Yes, many insurance providers offer discounts when you bundle multiple policies, including gap insurance. By combining your auto insurance, gap insurance, and other coverage options like life or home insurance, you can often save significantly on your overall insurance costs.