Pet Insurance Cost And Coverage

Pet insurance is a vital consideration for any pet owner, offering peace of mind and financial protection in the event of unexpected veterinary costs. With the rising expenses associated with pet healthcare, understanding the cost and coverage of pet insurance is crucial for making informed decisions about your pet's welfare. This comprehensive guide delves into the factors influencing pet insurance costs, the types of coverage available, and the key considerations when choosing the right policy for your furry companion.

Understanding the Cost of Pet Insurance

The cost of pet insurance varies significantly based on several key factors. These include the type of pet you have, their breed, age, and pre-existing medical conditions. Additionally, the level of coverage you opt for, the insurer, and your location all play a role in determining the price.

Factors Affecting Premium Costs

One of the primary factors affecting pet insurance premiums is the breed and age of your pet. For instance, certain dog breeds are more prone to specific health issues, which can influence the cost of insurance. Similarly, older pets often require more medical attention, leading to higher premiums.

The level of coverage you choose also significantly impacts the cost. Policies offering comprehensive coverage for accidents, illnesses, and routine care will typically be more expensive than those covering only accidents and emergencies. It's crucial to strike a balance between the coverage you need and the premium you can afford.

Your location can also influence the cost of pet insurance. This is because veterinary fees and the cost of living vary across different regions. Insurers often adjust their rates based on these factors, which can result in significant variations in premium costs.

| Pet Type | Average Annual Premium |

|---|---|

| Dogs | $500 - $1,000 |

| Cats | $300 - $700 |

| Exotic Pets | Varies Widely |

It's important to note that these are average estimates, and actual costs can vary significantly based on the factors mentioned above. Additionally, some insurers offer discounts for multiple pets, or for pets insured at a younger age, which can further influence the overall cost.

Types of Pet Insurance Coverage

Pet insurance policies can be broadly categorized into three main types: accident-only, accident and illness, and comprehensive coverage. Each type offers a different level of protection, catering to the specific needs of pet owners.

Accident-Only Coverage

As the name suggests, accident-only pet insurance policies cover injuries resulting from accidents, such as fractures, burns, or injuries sustained in road accidents. However, they typically do not cover illnesses or routine care. This type of coverage is often the most affordable option, making it suitable for pet owners on a budget.

Accident and Illness Coverage

Accident and illness policies provide coverage for both accidental injuries and illnesses, including chronic conditions like diabetes or arthritis. These policies offer a higher level of protection, ensuring your pet receives the necessary medical care without you having to worry about the financial burden. However, they also come with a higher premium cost.

Comprehensive Coverage

Comprehensive pet insurance policies are the most extensive, offering coverage for accidents, illnesses, and often routine care such as vaccinations, spaying/neutering, and annual check-ups. These policies provide the highest level of financial protection for pet owners, but they also carry the highest premium costs.

Key Considerations When Choosing Pet Insurance

When selecting a pet insurance policy, there are several key considerations to keep in mind. These include the coverage limits, deductibles and co-pays, and the insurer’s reputation and financial stability.

Coverage Limits and Deductibles

Understanding the coverage limits of a policy is crucial. This refers to the maximum amount an insurer will pay out for a specific condition or the total annual limit for all claims. Exceeding these limits means you’ll have to cover the costs out of pocket.

Similarly, deductibles and co-pays are important factors. A deductible is the amount you must pay before the insurance coverage kicks in, while a co-pay is a fixed amount or percentage of the claim you must pay after the deductible. Policies with lower deductibles and co-pays can provide more financial protection, but they often come with higher premiums.

Reputation and Financial Stability

When choosing a pet insurance provider, it’s essential to consider their reputation and financial stability. Look for insurers who have a good track record of paying claims promptly and fairly. You can check online reviews and ratings, as well as financial stability ratings from independent agencies, to get an idea of an insurer’s reliability.

Exclusions and Waiting Periods

Review the policy’s exclusions carefully. These are the conditions or treatments that are not covered by the policy. Common exclusions include pre-existing conditions, breed-specific disorders, and certain types of routine care. Understanding these exclusions can help you choose a policy that aligns with your pet’s specific needs.

Additionally, be aware of waiting periods. These are the periods of time after you purchase a policy during which certain conditions or treatments are not covered. Waiting periods can range from a few days to several months, depending on the insurer and the type of coverage.

Maximizing Your Pet Insurance Coverage

To get the most out of your pet insurance policy, there are several strategies you can employ. These include shopping around for the best rates, reviewing your policy regularly, and understanding the claims process.

Shopping for the Best Rates

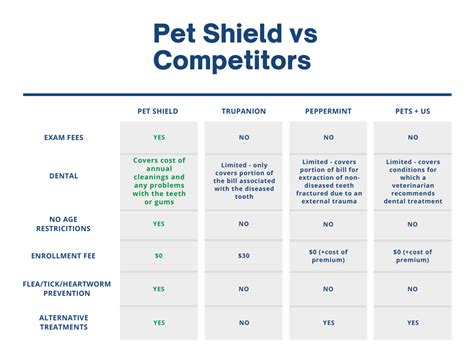

Pet insurance is a competitive market, so it’s worth shopping around to find the best rates and coverage for your needs. Compare policies from different insurers, taking into consideration the factors mentioned earlier, such as coverage limits, deductibles, and exclusions.

Reviewing Your Policy Regularly

Your pet’s healthcare needs may change over time, so it’s important to review your insurance policy regularly. This can help you ensure that your coverage remains adequate and that you’re not paying for features you no longer need.

Understanding the Claims Process

Familiarize yourself with the claims process of your chosen insurer. This includes understanding what documentation is required, how to submit claims, and the typical turnaround time for reimbursement. Being prepared can help streamline the process and ensure you receive the benefits you’re entitled to.

Future Trends in Pet Insurance

The pet insurance industry is evolving, and several trends are shaping the future of this market. These include the increasing popularity of telemedicine for pets, the rise of specialty pet insurance providers, and the integration of technology into the claims process.

Telemedicine and Specialty Providers

With the advancement of technology, telemedicine is becoming more prevalent in the pet healthcare industry. This trend is expected to influence pet insurance, with insurers potentially offering coverage for virtual consultations and diagnostics. Additionally, the rise of specialty providers focusing on specific breeds or types of pets is likely to offer more tailored coverage options.

Technology Integration

Insurers are increasingly leveraging technology to streamline the claims process. This includes the use of mobile apps for policyholders to submit claims, as well as the integration of wearable technology and pet tracking devices to monitor pet health and behavior. These advancements can lead to more efficient and accurate claims handling, as well as potentially lower premiums for policyholders.

Can I get pet insurance for an older pet?

+

Yes, many insurers offer policies for older pets. However, premiums may be higher due to the increased likelihood of health issues. It’s important to shop around and compare policies to find the best coverage and rates for your older pet.

Are there any discounts available for pet insurance?

+

Yes, several insurers offer discounts for various reasons. These can include discounts for multiple pets, automatic payments, or enrolling at a young age. Additionally, some insurers may offer promotional discounts or partner with certain organizations to provide discounted rates.

How do I choose the right pet insurance provider?

+

Choosing the right pet insurance provider involves several factors. Consider the coverage options, premium costs, reputation, financial stability, and customer service. Read reviews, compare policies, and assess the insurer’s claims process to ensure they meet your needs and provide reliable coverage.