Quotes In Insurance

In the world of insurance, understanding the intricacies of policies and coverage is essential. Among the various aspects, quotes play a pivotal role in shaping the insurance landscape. A quote, often a simple numerical representation, holds immense significance for both insurers and policyholders. It serves as the foundation for building comprehensive insurance plans, providing individuals and businesses with the financial protection they require. In this comprehensive article, we will delve into the world of quotes in insurance, exploring their importance, the process of obtaining them, and the factors that influence these numerical assessments.

The Significance of Quotes in Insurance

Quotes are the initial step in the insurance journey, offering a glimpse into the potential cost and coverage of a policy. For insurers, quotes are a strategic tool used to assess risk and determine the premium amounts. On the other hand, for policyholders, quotes provide valuable insights into the financial commitment required to secure adequate insurance coverage.

The process of obtaining a quote involves a delicate balance of providing accurate information and understanding the underlying risks. Insurers rely on a myriad of factors to calculate quotes, including the type of insurance, the insured's location, their personal or business characteristics, and historical data. These factors collectively contribute to the complexity of quote generation, ensuring that the premium accurately reflects the potential risks involved.

The Quote Generation Process: A Step-by-Step Guide

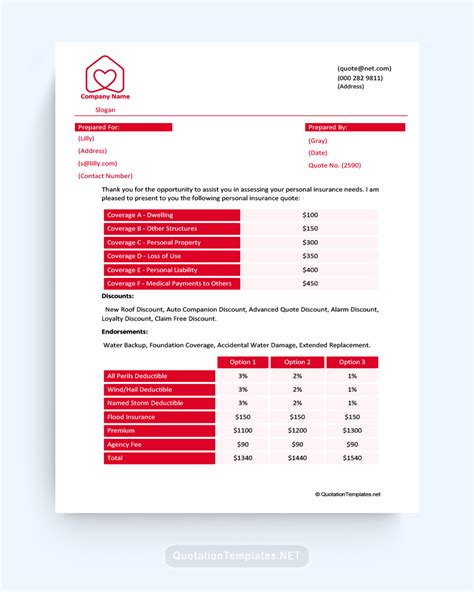

Obtaining a quote is a systematic process that begins with a thorough understanding of the insurance needs. Whether it’s for auto, home, health, or business insurance, the first step is to identify the specific coverage requirements.

- Defining Insurance Needs: Policyholders must assess their unique circumstances and determine the type and extent of coverage they require. This involves evaluating potential risks and understanding the financial implications of various scenarios.

- Gathering Relevant Information: Once the insurance needs are defined, the next step is to gather the necessary information. This may include personal details, such as age, gender, and occupation, as well as specific details about the property or vehicle to be insured.

- Contacting Insurance Providers: With the required information at hand, policyholders can reach out to insurance providers. This can be done through online platforms, insurance brokers, or directly contacting insurance companies.

- Providing Detailed Information: Insurance providers will request detailed information to accurately assess the risk and generate a quote. This information may include driving records for auto insurance, property details for home insurance, or health records for life or health insurance.

- Risk Assessment: Insurance providers analyze the provided information and assess the level of risk associated with the policyholder. This assessment takes into account various factors, including historical data and industry trends.

- Quote Generation: Based on the risk assessment, insurance providers generate a quote. This quote represents the estimated premium that the policyholder would pay for the desired coverage.

- Review and Comparison: Policyholders should carefully review the quotes they receive, considering not only the premium but also the coverage and any additional benefits or exclusions. Comparing quotes from multiple providers can help identify the most suitable and cost-effective option.

- Finalizing the Policy: Once a satisfactory quote is obtained, policyholders can proceed with finalizing the insurance policy. This involves signing the necessary documents and making the initial premium payment.

The quote generation process is a critical step in the insurance journey, ensuring that policyholders receive accurate and tailored coverage. It is important to note that quotes are not set in stone and may be subject to change based on additional information or adjustments to the coverage requirements.

Factors Influencing Insurance Quotes: A Comprehensive Overview

Insurance quotes are influenced by a multitude of factors, each playing a unique role in the risk assessment process. Understanding these factors provides valuable insights into the complexities of insurance pricing.

Type of Insurance

The type of insurance sought significantly impacts the quote. Different insurance products, such as auto, home, health, or life insurance, carry varying levels of risk and, consequently, different premium amounts. For instance, auto insurance quotes are influenced by factors like the make and model of the vehicle, driving history, and the level of coverage desired.

Location

The insured’s location is a critical factor in quote generation. Insurance providers assess the geographical area’s historical data, including crime rates, natural disaster frequency, and local regulations. Areas with higher risks, such as regions prone to hurricanes or with high crime rates, may result in higher insurance quotes.

Personal or Business Characteristics

Individual or business characteristics play a pivotal role in determining insurance quotes. For personal insurance, factors such as age, gender, occupation, and health status are considered. Businesses, on the other hand, are assessed based on their industry, size, and historical claims data. These characteristics help insurance providers gauge the level of risk associated with the policyholder.

Historical Data and Claims

Insurance providers rely on historical data and claims records to assess the risk profile of policyholders. Past claims, especially those related to the specific insurance type, can impact future quotes. A history of frequent claims may result in higher premiums, as it indicates a higher likelihood of future claims.

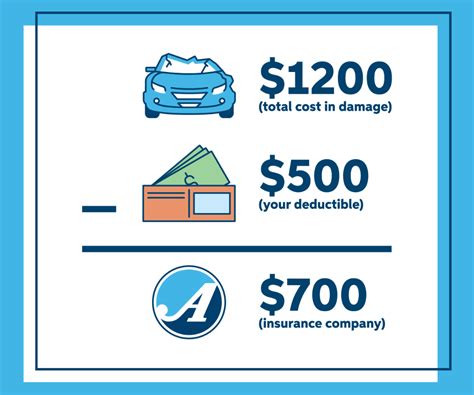

Coverage and Deductibles

The level of coverage and the chosen deductibles significantly influence insurance quotes. Higher coverage limits and lower deductibles often result in higher premiums, as they provide more extensive protection. Policyholders can customize their coverage and deductibles to find a balance between cost and protection that aligns with their needs.

| Coverage Type | Coverage Amount | Premium Impact |

|---|---|---|

| Basic | Low | Affordable |

| Standard | Moderate | Moderate Cost |

| Comprehensive | High | Higher Premium |

Risk Assessment Models

Insurance providers utilize advanced risk assessment models to analyze data and generate quotes. These models consider a wide range of factors, including those mentioned above, to calculate the likelihood of claims and determine appropriate premium amounts. The sophistication of these models allows for accurate and tailored quotes, ensuring a fair assessment of risk.

Competitive Landscape

The competitive landscape within the insurance industry also influences quotes. Insurance providers aim to offer competitive rates to attract customers, considering the quotes offered by their competitors. This dynamic ensures that policyholders have access to a range of options, promoting fair pricing and encouraging insurers to continuously improve their offerings.

Regulatory and Legal Considerations

Insurance quotes are subject to regulatory and legal frameworks, ensuring compliance and fairness. Insurance providers must adhere to state and federal regulations, which may impact the pricing and availability of certain insurance products. Understanding these regulations is essential for both insurers and policyholders to navigate the insurance landscape effectively.

Market Trends and Economic Factors

Market trends and economic factors play a role in shaping insurance quotes. Economic downturns or increases in claim frequencies can impact insurance rates. Additionally, advancements in technology and changes in consumer behavior may influence the way insurance is priced and delivered.

The Future of Insurance Quotes: Technological Advancements and Personalization

The insurance industry is witnessing a transformative era with the advent of technological advancements and a shift towards personalized insurance experiences. These developments are reshaping the way quotes are generated and delivered, offering enhanced convenience and accuracy for policyholders.

Digital Platforms and Instant Quotes

The rise of digital platforms has revolutionized the insurance quote process. Policyholders can now access online platforms and mobile applications, providing a seamless and efficient experience. These platforms utilize advanced algorithms and data analytics to generate instant quotes, offering real-time assessments of insurance needs.

Personalized Insurance and Risk Assessment

Personalized insurance is gaining traction, allowing policyholders to customize their coverage based on their unique needs and circumstances. This approach considers individual factors, such as lifestyle, health, and preferences, to offer tailored insurance solutions. By leveraging advanced risk assessment models and data analytics, insurers can provide accurate quotes that reflect the policyholder’s specific risks.

Telematics and Usage-Based Insurance

Telematics technology is transforming the auto insurance industry, enabling usage-based insurance models. These models utilize telematics devices to track driving behavior and assess risk in real-time. By analyzing factors like driving distance, speed, and time of day, insurers can offer dynamic quotes that reflect the policyholder’s actual driving patterns. This approach promotes safe driving habits and rewards policyholders with personalized premiums.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of insurance innovation, enhancing the accuracy and efficiency of quote generation. These technologies enable insurers to analyze vast amounts of data, including historical claims, weather patterns, and social media trends, to identify emerging risks and develop more precise quotes. AI-powered chatbots and virtual assistants also provide policyholders with instant support and quote comparisons, streamlining the insurance journey.

Blockchain Technology for Secure Transactions

Blockchain technology is emerging as a secure and transparent solution for insurance transactions. By leveraging distributed ledger technology, insurers can streamline quote generation and policy administration, ensuring secure data sharing and verification. Blockchain also enables smart contracts, automating various insurance processes and reducing administrative burdens.

Insurtech Partnerships and Innovation

Insurtech partnerships are driving innovation in the insurance industry, bringing together traditional insurers and tech-savvy startups. These collaborations leverage the strengths of both parties, combining insurance expertise with technological advancements. Insurtech partnerships are fostering the development of innovative quote generation tools, risk assessment models, and personalized insurance products, shaping the future of the industry.

Conclusion

Quotes in insurance serve as the gateway to comprehensive coverage, providing individuals and businesses with the financial protection they need. Throughout this article, we have explored the significance of quotes, the intricate process of obtaining them, and the myriad of factors that influence their generation. By understanding the underlying complexities and advancements in the insurance landscape, policyholders can navigate the quote generation process with confidence and make informed decisions about their insurance needs.

As the insurance industry embraces technological advancements and personalized approaches, the future of quotes holds exciting possibilities. Policyholders can anticipate more efficient, accurate, and tailored quote generation, ensuring they receive the coverage they require at a fair and competitive price. By staying informed and engaged with the evolving insurance landscape, individuals and businesses can secure their financial well-being and protect what matters most.

How often should I review my insurance quotes and policies?

+It is recommended to review your insurance quotes and policies annually or whenever significant life changes occur. Life events such as marriage, buying a new home, or starting a business can impact your insurance needs. Regular reviews ensure that your coverage remains adequate and up-to-date.

Can I negotiate insurance quotes?

+While insurance quotes are typically based on standardized calculations, it is possible to negotiate certain aspects of your policy. Discuss with your insurance provider to explore options for customizing your coverage and potentially reducing your premium. However, keep in mind that negotiating may require providing additional information or making adjustments to your coverage limits.

What should I do if my insurance quote seems unusually high or low?

+If your insurance quote seems significantly higher or lower than expected, it is important to carefully review the coverage and factors influencing the quote. Contact your insurance provider to discuss any concerns and seek clarification. They can help identify potential errors or explain the specific factors that impact your quote.