Home Insurance Quotation

Home insurance is a vital aspect of protecting one's most valuable asset, their home. It provides financial security and peace of mind by covering various risks and liabilities associated with homeownership. Obtaining a home insurance quotation is an essential step in understanding the coverage options and costs involved. In this comprehensive guide, we will delve into the world of home insurance quotations, exploring the factors that influence rates, the coverage options available, and the steps to secure the best protection for your home.

Understanding Home Insurance Quotations

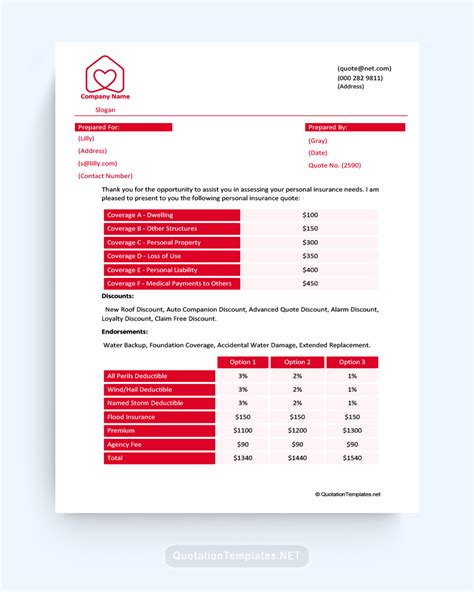

A home insurance quotation, often referred to as a quote, is an estimate of the cost of insuring your home. It is tailored to your specific needs and circumstances, taking into account factors such as the location, size, and age of your home, as well as your desired coverage limits and deductibles. Obtaining multiple quotes from different insurance providers allows homeowners to compare coverage options and prices, ensuring they find the most suitable and affordable policy.

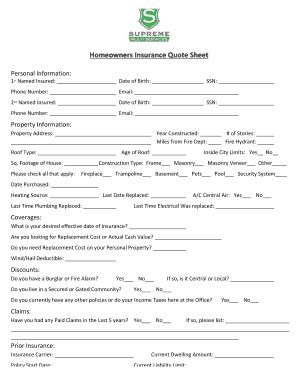

The process of acquiring a home insurance quotation typically involves providing detailed information about your home and its contents. Insurance providers assess these factors to determine the level of risk associated with insuring your property. Here are some key aspects that influence home insurance quotations:

- Location: The geographical location of your home plays a significant role in determining insurance rates. Areas prone to natural disasters, such as hurricanes, floods, or earthquakes, often carry higher premiums. Additionally, crime rates and the proximity to fire stations or emergency services can impact the quotation.

- Home Value and Age: The value and age of your home are crucial factors. Older homes may require specialized coverage for outdated electrical or plumbing systems, while newer homes might benefit from more modern and comprehensive policies.

- Construction Materials: The materials used in the construction of your home can affect the quotation. Homes built with fire-resistant materials or reinforced against natural disasters may qualify for lower rates.

- Coverage Limits: The amount of coverage you desire for your home and its contents will impact the quotation. Higher coverage limits generally result in higher premiums.

- Deductibles: Choosing a higher deductible can lower your insurance premium. A deductible is the amount you agree to pay out of pocket before the insurance coverage kicks in.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as loyalty, safety features (like smoke detectors or security systems), or bundling multiple insurance policies (e.g., home and auto insurance) with the same company.

Coverage Options and Customization

Home insurance quotations provide an opportunity to explore the various coverage options available. Understanding these options ensures that you can tailor your policy to fit your specific needs. Here are some common coverage types offered by home insurance providers:

Dwelling Coverage

This is the core coverage of a home insurance policy, protecting the physical structure of your home against damages caused by perils such as fire, windstorms, vandalism, and more. It covers the cost of repairs or rebuilding if your home is damaged or destroyed.

| Peril | Coverage |

|---|---|

| Fire | Repairs or rebuilding costs |

| Windstorms | Coverage for wind-related damage |

| Vandalism | Repairs for intentional damage |

| Smoke Damage | Repairs and restoration |

Personal Property Coverage

This coverage protects the contents of your home, including furniture, appliances, electronics, and personal belongings. It provides financial assistance if these items are damaged, stolen, or destroyed due to a covered peril.

Liability Coverage

Liability coverage is essential for protecting you against legal claims and lawsuits arising from accidents or injuries that occur on your property. It covers medical expenses and legal defense costs if someone sustains an injury while on your premises.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, this coverage helps cover the additional costs of temporary housing and living expenses until you can return to your home.

Other Specialized Coverages

Depending on your needs, you may opt for additional coverages such as:

- Flood Insurance: Provides coverage for flood-related damages, which are often excluded from standard home insurance policies.

- Earthquake Insurance: Protects against damages caused by earthquakes, a crucial coverage in seismically active regions.

- Identity Theft Protection: Offers assistance and resources to help you recover from identity theft.

- Personal Injury Coverage: Covers legal expenses if you are sued for libel, slander, or other personal injuries.

The Quotation Process: A Step-by-Step Guide

Obtaining a home insurance quotation is a straightforward process, but it requires attention to detail to ensure you receive an accurate estimate. Here’s a step-by-step guide to help you through the process:

Step 1: Research Insurance Providers

Start by researching reputable insurance providers in your area. Consider their financial stability, customer reviews, and the range of coverage options they offer. Some popular providers include State Farm, Allstate, Liberty Mutual, and Progressive, among others.

Step 2: Gather Necessary Information

Before requesting a quotation, gather the following information to ensure an accurate estimate:

- Details about your home, including its age, size, and construction materials.

- The estimated value of your home and its contents.

- Information about any recent home improvements or renovations.

- Details of any existing safety features, such as smoke detectors, fire extinguishers, or security systems.

- The desired coverage limits and deductibles for your policy.

Step 3: Contact Insurance Providers

Reach out to your selected insurance providers to request quotations. You can do this online, over the phone, or by visiting their local offices. Provide them with the information you’ve gathered to ensure an accurate quote.

Step 4: Compare Quotations

Once you’ve received multiple quotations, take the time to compare them. Evaluate the coverage limits, deductibles, and any additional benefits or discounts offered. Consider the financial stability and reputation of each provider. Look for any exclusions or limitations in the policy language.

Step 5: Tailor Your Coverage

Based on your comparison, choose the provider and policy that best fit your needs and budget. Work with your chosen insurer to tailor the coverage to your specific requirements. Discuss any concerns or questions you may have to ensure you understand the policy’s terms and conditions.

Step 6: Finalize the Quotation

Once you’re satisfied with the coverage and quotation, you can proceed to finalize the policy. This typically involves providing additional information, such as your personal details and payment information. Ensure you review the policy documents carefully before signing.

Conclusion: Protecting Your Home’s Future

Obtaining a home insurance quotation is a critical step in safeguarding your most valuable asset. By understanding the factors that influence quotations and exploring the various coverage options, you can make an informed decision to protect your home and its contents. Remember, it’s not just about the cost; it’s about ensuring comprehensive protection for your home and peace of mind for you and your family.

How often should I review my home insurance policy and quotation?

+It’s recommended to review your home insurance policy and quotation annually, especially if your circumstances or the value of your home has changed. Regular reviews ensure that your coverage remains adequate and up-to-date.

Can I bundle my home insurance with other policies to save money?

+Yes, bundling your home insurance with other policies, such as auto insurance, can often result in significant savings. Many insurance providers offer multi-policy discounts to encourage customers to bundle their coverage.

What should I do if I’m unsure about the coverage limits in my quotation?

+If you’re unsure about the coverage limits, it’s best to consult with an insurance professional. They can guide you in determining the appropriate limits based on the value of your home and its contents, ensuring you have adequate protection.