Best Property Insurance Plans

Securing the right property insurance is crucial for homeowners and businesses alike, as it provides financial protection against various risks and unexpected events. With numerous insurance providers offering a range of plans, choosing the best coverage can be a challenging task. This comprehensive guide aims to shed light on the essential aspects of property insurance, helping you make informed decisions to safeguard your valuable assets.

Understanding Property Insurance

Property insurance is a vital safeguard against potential losses and damages that can affect your home or business premises. It offers financial protection in the event of unforeseen circumstances such as natural disasters, theft, or accidental damage. By understanding the intricacies of property insurance and selecting the right coverage, you can ensure peace of mind and adequate protection for your assets.

Here's a detailed breakdown of the key components and considerations when evaluating property insurance plans:

Coverage Options

Property insurance plans offer a variety of coverage options to address different risks. Here’s a glimpse into some of the most common coverages:

- Dwelling Coverage: This essential coverage protects the physical structure of your home or building, including its permanent fixtures and attached structures. It covers damages caused by perils such as fire, lightning, windstorms, and vandalism.

- Personal Property Coverage: This coverage safeguards your personal belongings, such as furniture, electronics, and clothing, in case of theft, damage, or loss. It provides compensation for the replacement or repair of these items.

- Liability Coverage: Liability insurance is crucial as it protects you from legal liabilities arising from accidents or injuries that occur on your property. It covers medical expenses, legal fees, and potential settlements or judgments.

- Additional Living Expenses: In the event of a covered loss that renders your home uninhabitable, this coverage reimburses you for the additional costs incurred during temporary relocation, such as hotel stays and restaurant meals.

- Medical Payments Coverage: This coverage provides financial assistance for medical expenses incurred by visitors who suffer an injury on your property, regardless of liability.

It's important to note that coverage options and limits can vary widely among insurance providers. Understanding your specific needs and tailoring your coverage accordingly is essential to ensure adequate protection.

Assessing Your Risks

Evaluating the risks unique to your property is a critical step in choosing the right insurance plan. Consider the following factors when assessing your risks:

- Location and Natural Hazards: Assess the geographical location of your property and the associated natural hazards. Are you located in an area prone to earthquakes, hurricanes, floods, or wildfires? Understanding these risks can help you select insurance coverage that addresses your specific vulnerabilities.

- Theft and Crime Rates: Research the crime rates in your neighborhood or business district. Higher theft or vandalism rates may warrant increased coverage limits for personal property or liability protection.

- Age and Condition of the Property: The age and overall condition of your property can impact insurance rates and coverage options. Older properties may require additional inspections or specialized coverage to address potential issues.

- Valuable Possessions : Identify any valuable possessions or collections that may require separate or additional coverage. High-value items such as jewelry, art, or antiques may require specific endorsements to ensure adequate protection.

By conducting a thorough risk assessment, you can make informed decisions about the coverage limits and deductibles that align with your property's unique characteristics and vulnerabilities.

Choosing the Right Provider

Selecting the right insurance provider is just as important as choosing the right coverage. Consider the following factors when evaluating insurance companies:

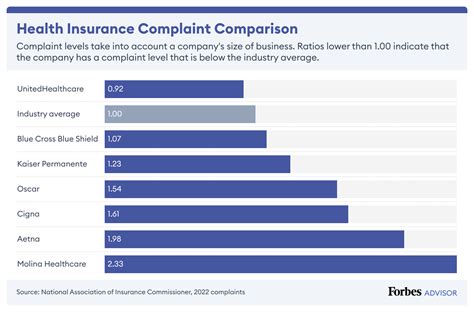

- Financial Stability: Look for insurance providers with a strong financial rating. This ensures that the company has the financial resources to pay out claims promptly and reliably.

- Reputation and Customer Service: Research the provider's reputation and customer satisfaction ratings. Positive feedback and a track record of prompt claim processing can indicate a reliable and customer-centric insurance company.

- Coverage Customization: Choose a provider that offers customizable coverage options to suit your specific needs. The ability to tailor your policy ensures that you're not overpaying for coverage you don't require.

- Discounts and Bundling Options: Explore providers that offer discounts for bundling multiple insurance policies, such as combining home and auto insurance. Additionally, look for discounts based on safety features or other qualifications.

- Claim Process and Response Time: Understand the provider's claim process and response time. Efficient and prompt claim handling is crucial during times of need. Look for providers with a track record of quick and fair claim settlements.

Policy Terms and Conditions

Delving into the fine print of your insurance policy is essential to ensure you fully understand the terms and conditions. Here’s what to consider:

- Coverage Limits: Verify the coverage limits for each type of coverage in your policy. Ensure that the limits are sufficient to cover potential losses without leaving you financially vulnerable.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Consider your financial situation and choose a deductible that aligns with your ability to cover initial costs in the event of a claim.

- Exclusions and Limitations: Carefully review the policy's exclusions and limitations. Understand what perils or circumstances are not covered by your policy to avoid any surprises during a claim.

- Renewal and Cancellation Policies: Understand the provider's policies regarding policy renewals and cancellations. Ensure that the terms are favorable and that you have the flexibility to switch providers if needed.

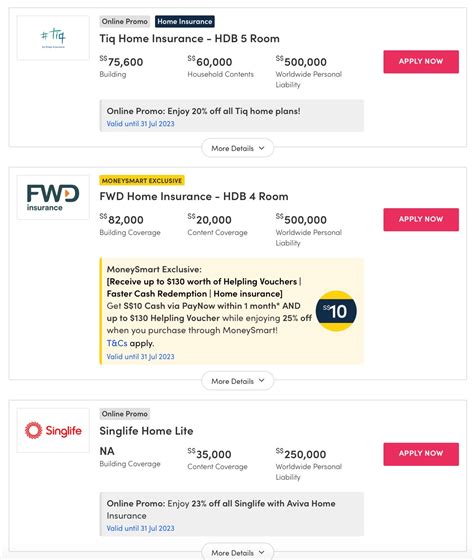

Comparing Quotes and Making a Decision

Obtaining multiple quotes from different insurance providers is crucial to ensure you’re getting the best value for your money. Here’s how to approach the comparison process:

- Compare Apples to Apples: Ensure that you're comparing policies with similar coverage options and limits. This allows for an accurate assessment of the value and cost of each plan.

- Consider Additional Benefits: Beyond coverage and cost, assess the additional benefits and perks offered by each provider. These could include discounts, rewards programs, or access to exclusive services.

- Read Reviews and Testimonials: Take the time to read reviews and testimonials from existing customers. This can provide valuable insights into the provider's customer service, claim handling, and overall satisfaction.

- Seek Professional Advice: Consult with an insurance broker or agent who can provide expert guidance tailored to your specific needs. They can help navigate the complexities of insurance policies and ensure you make an informed decision.

Remember, choosing the best property insurance plan involves a careful evaluation of your risks, a thorough understanding of coverage options, and a comparison of quotes from reputable providers. By taking a thoughtful and comprehensive approach, you can secure the protection your property deserves.

Table: Sample Property Insurance Coverage Limits

| Coverage Type | Standard Limit | Optional Increased Limit |

|---|---|---|

| Dwelling Coverage | 300,000</td> <td>500,000 | |

| Personal Property Coverage | 100,000</td> <td>200,000 | |

| Liability Coverage | 300,000</td> <td>1,000,000 | |

| Additional Living Expenses | 20% of Dwelling Coverage | 30% of Dwelling Coverage |

| Medical Payments Coverage | 5,000</td> <td>10,000 |

Frequently Asked Questions

How often should I review my property insurance coverage?

+It’s recommended to review your property insurance coverage annually or whenever significant changes occur in your life or the value of your property. This ensures that your coverage remains adequate and up-to-date.

What factors can impact my property insurance rates?

+Various factors can influence your property insurance rates, including the location of your property, its age and construction, the value of your belongings, your claims history, and the coverage limits you choose.

Are there any discounts available for property insurance?

+Yes, many insurance providers offer discounts for property insurance. These may include multi-policy discounts (bundling home and auto insurance), safety discounts for features like smoke detectors or security systems, and loyalty discounts for long-term customers.

What should I do if I need to file a property insurance claim?

+If you need to file a property insurance claim, contact your insurance provider promptly and provide them with detailed information about the incident. Follow their instructions and gather any necessary documentation to support your claim. Keep a record of all communications and be prepared to work with adjusters to assess the damage and determine the appropriate compensation.