Is Progressive A Good Insurance

Progressive, a well-known name in the insurance industry, has garnered significant attention and popularity over the years. With its innovative approach and comprehensive offerings, Progressive has become a go-to choice for many individuals and businesses seeking insurance solutions. In this comprehensive analysis, we delve into the various aspects of Progressive's services, exploring its reputation, products, customer experience, and overall value proposition to determine if it truly lives up to its reputation as a good insurance provider.

Progressive’s Reputation and Industry Standing

Progressive Insurance has established itself as a prominent player in the insurance market, known for its forward-thinking strategies and commitment to customer satisfaction. Founded in 1937, Progressive has grown exponentially, currently ranking as the third-largest auto insurance company in the United States, according to data from Insurance Journal as of 2023.

The company's reputation is built on a foundation of innovation and customer-centric policies. Progressive was among the first insurance providers to embrace technology, offering online quotes and policy management, making insurance more accessible and convenient for customers. This digital-first approach has not only streamlined the insurance experience but has also set Progressive apart from traditional insurance companies.

A Diverse Range of Insurance Products

One of Progressive’s key strengths lies in its extensive product portfolio. Beyond its core auto insurance offerings, Progressive provides a wide array of insurance solutions to cater to the diverse needs of its customers.

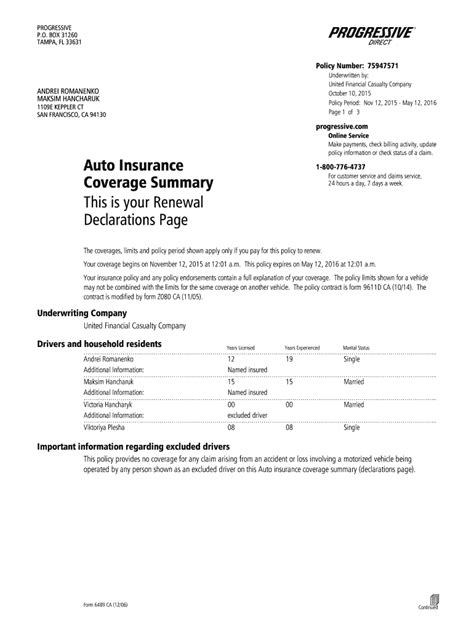

Auto Insurance

Progressive’s auto insurance policies are tailored to provide comprehensive coverage, including liability, collision, comprehensive, and personal injury protection (PIP) options. The company offers customizable plans to suit different driving needs and budgets, ensuring that customers can find the right fit for their vehicles.

| Policy Type | Coverage Highlights |

|---|---|

| Standard Auto Insurance | Covers bodily injury, property damage, and medical expenses. |

| Collision Coverage | Protects against damage caused by collisions with other vehicles or objects. |

| Comprehensive Coverage | Provides coverage for non-collision incidents like theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Offers protection in case of accidents with drivers who lack sufficient insurance. |

Home Insurance

Progressive’s home insurance policies offer comprehensive protection for homeowners and renters. The company provides coverage for dwelling structures, personal property, liability, and additional living expenses in case of a covered loss. Progressive’s home insurance plans are designed to be flexible, allowing customers to choose the level of coverage that aligns with their specific needs.

Business Insurance

For businesses, Progressive offers a comprehensive range of commercial insurance products, including general liability, property, workers’ compensation, and professional liability insurance. These policies are tailored to protect businesses of various sizes and industries, ensuring that entrepreneurs have the necessary coverage to mitigate risks and protect their operations.

Life Insurance

Progressive also ventures into the life insurance realm, providing term life and whole life insurance policies. These plans offer customers the opportunity to secure their financial future and protect their loved ones in the event of unforeseen circumstances.

Customer Experience and Claims Process

Progressive prioritizes delivering an exceptional customer experience, with a focus on convenience, accessibility, and personalized service. The company’s digital platforms and mobile apps make it easy for customers to manage their policies, file claims, and access important documents anytime, anywhere.

The claims process is designed to be efficient and customer-friendly. Progressive's claims adjusters are known for their expertise and dedication to ensuring a smooth and fair claims experience. The company offers 24/7 claims reporting, enabling customers to address emergencies promptly.

Additionally, Progressive's claims satisfaction guarantee demonstrates its commitment to customer satisfaction. If a customer is not satisfied with the claims settlement, Progressive promises to review the claim and make adjustments to ensure a fair outcome.

Pricing and Value for Money

Progressive is renowned for its competitive pricing and value-added services. The company offers a range of discounts and incentives to help customers save on their insurance premiums. These include multi-policy discounts, good student discounts, and safe driver rewards, among others.

Progressive's Name Your Price® tool is a unique feature that allows customers to set their desired auto insurance price range and receive tailored policy options. This innovative approach empowers customers to find the right balance between coverage and cost, ensuring they get the best value for their insurance needs.

Customer Service and Support

Progressive places a strong emphasis on excellent customer service, ensuring that its representatives are knowledgeable, responsive, and dedicated to meeting customer needs. The company’s customer service team is available 24⁄7, providing timely assistance and support.

Progressive's MyPolicy® platform further enhances the customer experience by offering a centralized hub for policy management. Customers can access their policy details, make payments, and update their information easily through this intuitive online platform.

Progressive’s Technological Innovations

Progressive’s commitment to innovation extends beyond its product offerings. The company continuously invests in cutting-edge technologies to enhance the insurance experience for its customers.

Snapshot®

Progressive’s Snapshot® program is a revolutionary usage-based insurance (UBI) offering. By installing a small device in their vehicles, customers can voluntarily share their driving data with Progressive. This data, which includes factors like mileage, time of day driven, and braking habits, is used to calculate personalized insurance rates, rewarding safe drivers with potential discounts.

Digital Claims Processing

Progressive has streamlined its claims process through digitalization, enabling customers to file claims and track their progress online or through the Progressive app. This digital approach not only expedites the claims process but also provides customers with real-time updates, enhancing transparency and convenience.

Community Engagement and Corporate Social Responsibility

Progressive demonstrates a strong commitment to corporate social responsibility and community engagement. The company actively supports various charitable initiatives and has established the Progressive Insurance Foundation, which focuses on educating and empowering youth through its Drive Smart campaign.

Progressive's community involvement extends to environmental sustainability efforts. The company has implemented green initiatives, such as paperless billing and eco-friendly office practices, to minimize its environmental footprint.

Progressive’s Awards and Recognitions

Progressive’s dedication to excellence has been recognized by numerous industry awards and accolades. Some notable recognitions include:

- J.D. Power named Progressive as the top-rated auto insurance company for overall customer satisfaction in its 2022 U.S. Auto Insurance Study.

- Progressive has consistently received A ratings from AM Best, a leading insurance rating agency, indicating its strong financial stability and ability to meet its obligations.

- The company was recognized as one of the Best Places to Work for LGBTQ+ Equality by the Human Rights Campaign Foundation for its commitment to diversity and inclusion.

Conclusion: Is Progressive a Good Insurance Provider?

Progressive Insurance stands out as a reliable and innovative insurance provider, offering a comprehensive range of insurance products and an exceptional customer experience. From its diverse product offerings to its commitment to technological advancements and customer satisfaction, Progressive has established itself as a leading choice in the insurance industry.

With competitive pricing, a strong focus on innovation, and a dedication to community engagement, Progressive continues to earn its reputation as a good insurance provider, delivering value and peace of mind to its customers.

What sets Progressive apart from other insurance companies?

+Progressive distinguishes itself through its focus on innovation and customer-centric policies. Its embrace of technology, personalized pricing options, and comprehensive product offerings set it apart from traditional insurance providers.

Does Progressive offer any discounts on insurance premiums?

+Yes, Progressive provides a range of discounts, including multi-policy discounts, good student discounts, and safe driver rewards. These incentives help customers save on their insurance premiums.

How does Progressive’s claims process work, and what sets it apart from competitors?

+Progressive’s claims process is designed to be efficient and customer-friendly. The company offers 24⁄7 claims reporting and a claims satisfaction guarantee, ensuring a fair and timely resolution. Its digital claims processing further enhances convenience and transparency.

What are some of Progressive’s notable community engagement initiatives?

+Progressive actively supports various charitable initiatives and has established the Progressive Insurance Foundation, which focuses on educating and empowering youth through its Drive Smart campaign. The company also implements green initiatives to promote environmental sustainability.

Is Progressive a financially stable insurance provider?

+Yes, Progressive has consistently received A ratings from AM Best, a leading insurance rating agency, indicating its strong financial stability and ability to meet its obligations. This ensures that customers can rely on Progressive’s financial strength.