Quotation Insurance

In the complex world of finance and business, certain terms and concepts can sometimes be confusing, especially for those not familiar with the industry jargon. One such term is Quotation Insurance, which plays a crucial role in various sectors, particularly in construction and transportation. This comprehensive guide aims to demystify Quotation Insurance, exploring its definition, purpose, benefits, and real-world applications.

Understanding Quotation Insurance: A Definition

Quotation Insurance, often referred to as Quote-Based Insurance, is a unique form of coverage that is tailored to specific industries and their unique risk profiles. Unlike traditional insurance policies, which are based on a set of standard terms and conditions, Quotation Insurance is highly customizable and is designed to meet the specific needs and circumstances of the insured party.

This type of insurance operates on a case-by-case basis, with each policy being unique to the individual or business it covers. The insurance provider, through a detailed quotation process, assesses the risks associated with the insured's operations and then offers a tailored insurance solution. This process ensures that the policy provides adequate coverage for the specific risks the insured faces, making it a highly efficient and effective form of insurance.

The Quotation Process: A Step-by-Step Breakdown

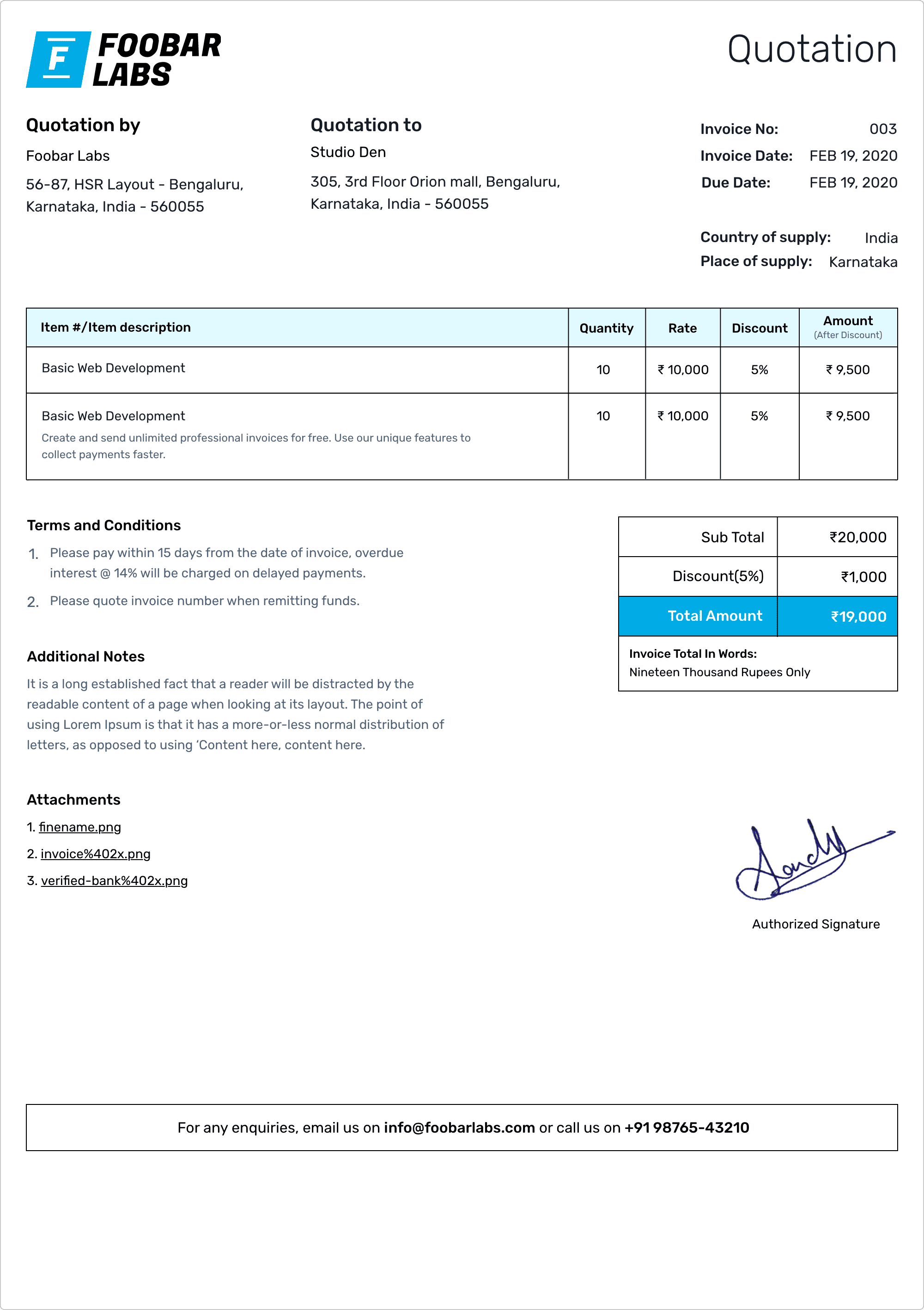

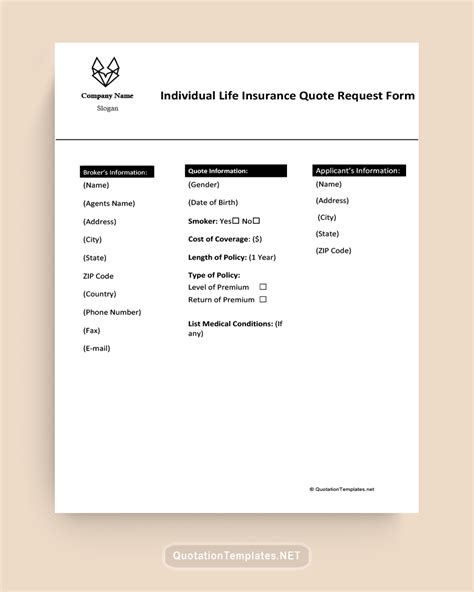

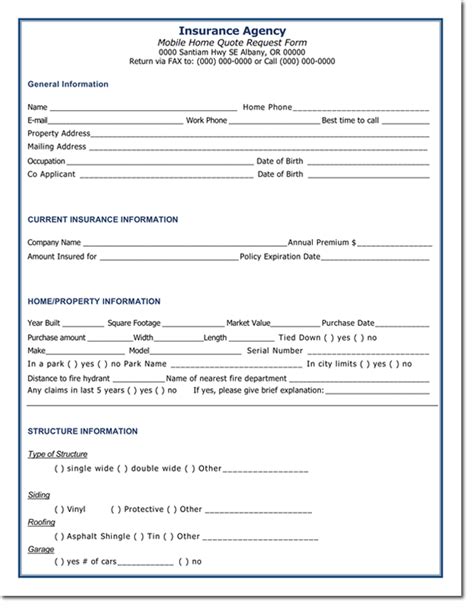

The quotation process for Quotation Insurance is intricate and involves several key steps. Firstly, the insured party provides detailed information about their operations, including their industry, the nature of their work, and any specific risks they face. This information is crucial in helping the insurance provider understand the unique needs of the insured.

Next, the insurance provider conducts a thorough risk assessment. This involves analyzing the information provided by the insured, researching the industry, and potentially conducting on-site inspections to gain a comprehensive understanding of the risks involved. Based on this assessment, the provider then develops a tailored insurance policy, which is presented to the insured in the form of a quotation.

The quotation outlines the coverage, terms, and conditions of the proposed insurance policy. It details the risks that are covered, the premiums to be paid, and any specific exclusions or limitations. The insured then has the opportunity to review and accept or negotiate the terms of the quotation before the policy is finalized.

The Benefits of Quotation Insurance: A Closer Look

Quotation Insurance offers a range of benefits that make it an attractive option for businesses and individuals in high-risk industries. Firstly, the customization aspect ensures that the insured receives a policy that is perfectly suited to their needs. This level of personalization is particularly beneficial for businesses with unique or complex risk profiles, as it allows them to secure comprehensive coverage without paying for unnecessary features.

Secondly, the quotation process itself is a valuable tool for risk management. By thoroughly assessing the insured's operations and providing a detailed quotation, the insurance provider helps the insured understand and mitigate their risks. This process encourages a proactive approach to risk management, which can lead to reduced losses and improved business resilience.

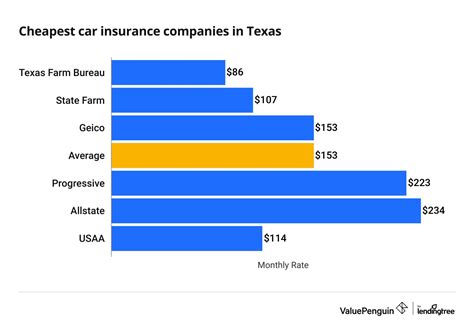

Additionally, Quotation Insurance often provides more competitive premiums compared to traditional insurance policies. Because the policy is tailored to the insured's specific needs, the insurance provider can offer more accurate pricing, taking into account the actual risks faced by the insured. This can result in significant cost savings for businesses, particularly those operating in high-risk industries.

Real-World Applications: How Quotation Insurance Makes a Difference

Quotation Insurance finds its application in a wide range of industries, but its impact is particularly notable in sectors like construction and transportation, where risks are varied and often unique.

In the construction industry, for instance, Quotation Insurance can provide coverage for a multitude of risks, including property damage, liability claims, and even project delays. For a large-scale construction project, a traditional insurance policy might not adequately cover all the potential risks. With Quotation Insurance, however, the policy can be tailored to cover specific aspects of the project, such as the use of heavy machinery, the transportation of materials, or even the unique weather conditions of the project site.

| Risk Category | Quotation Insurance Coverage |

|---|---|

| Property Damage | Covers loss or damage to project assets. |

| Liability Claims | Protects against third-party claims arising from the project. |

| Project Delays | Provides financial support in case of unexpected delays. |

Similarly, in the transportation industry, Quotation Insurance can offer tailored coverage for various modes of transport, including road, rail, air, and sea. For example, a transportation company specializing in cargo shipping might require coverage for cargo loss or damage, liability for personal injuries, and even protection against piracy or other maritime risks. With Quotation Insurance, the policy can be customized to include these specific risks, providing comprehensive coverage tailored to the company's operations.

The Future of Quotation Insurance: Innovations and Trends

As technology advances and the insurance industry continues to evolve, Quotation Insurance is poised to become even more sophisticated and accessible. One of the key trends in this sector is the increasing use of data analytics and artificial intelligence (AI) in risk assessment and quotation processes.

With the ability to analyze vast amounts of data quickly and accurately, insurance providers can make more informed decisions when assessing risks and developing tailored policies. AI-powered tools can also streamline the quotation process, making it faster and more efficient for both the insurance provider and the insured. This technology-driven approach not only enhances the accuracy of insurance policies but also makes them more accessible to a wider range of businesses.

Emerging Technologies: A Glimpse into the Future

In addition to data analytics and AI, other emerging technologies are set to revolutionize Quotation Insurance. For instance, the use of Internet of Things (IoT) devices can provide real-time data on various aspects of a business’s operations, from the condition of construction equipment to the location and status of transportation fleets. This real-time data can further enhance the accuracy and effectiveness of Quotation Insurance policies, ensuring that coverage is always up-to-date and relevant to the insured’s current circumstances.

Furthermore, the integration of blockchain technology into the insurance industry is another exciting development. Blockchain can provide a secure and transparent platform for managing insurance policies, including Quotation Insurance. It can facilitate faster and more secure transactions, improve data sharing between insurers and insureds, and potentially reduce administrative costs, leading to more competitive premiums for businesses.

| Emerging Technology | Potential Impact on Quotation Insurance |

|---|---|

| Data Analytics and AI | Enhances risk assessment and policy development, making the quotation process more efficient. |

| Internet of Things (IoT) | Provides real-time data, ensuring policies are always up-to-date and relevant. |

| Blockchain Technology | Offers secure and transparent management of insurance policies, potentially reducing costs. |

As these technologies continue to mature and find wider adoption, Quotation Insurance is expected to become even more efficient, effective, and accessible. This will not only benefit businesses in high-risk industries but also contribute to the overall growth and stability of these sectors.

Conclusion: The Power of Customization

Quotation Insurance is a powerful tool for businesses operating in industries where risks are varied and unique. By offering tailored coverage, competitive premiums, and a deeper understanding of risk management, Quotation Insurance empowers businesses to navigate their specific challenges with confidence. As the insurance industry continues to innovate and adapt, Quotation Insurance is poised to play an even more significant role in protecting businesses and promoting economic growth.

FAQ

How does Quotation Insurance differ from traditional insurance policies?

+

Quotation Insurance differs from traditional policies in that it is highly customizable and tailored to the specific needs of the insured. Traditional insurance policies, on the other hand, are often based on standard terms and conditions, which may not adequately cover the unique risks faced by certain businesses.

What industries benefit the most from Quotation Insurance?

+

Industries that often benefit the most from Quotation Insurance include construction, transportation, and other sectors where risks are varied and unique. These industries often require specialized coverage that traditional insurance policies may not provide.

How does the quotation process work in Quotation Insurance?

+

The quotation process involves a detailed risk assessment where the insurance provider analyzes the insured’s operations and specific risks. Based on this assessment, a tailored insurance policy is developed and presented to the insured in the form of a quotation. The insured can then review and negotiate the terms before the policy is finalized.