Humana Insurance Dental

Welcome to a comprehensive guide on Humana Insurance's Dental Coverage. In today's fast-paced world, maintaining optimal oral health is essential, and having the right dental insurance can make a significant difference. Humana, a renowned name in the healthcare industry, offers a range of dental plans designed to cater to various needs. This article will delve into the specifics of Humana's dental insurance, exploring its benefits, coverage options, and how it can impact your overall dental care experience.

Understanding Humana’s Dental Coverage

Humana’s dental insurance plans are crafted to provide comprehensive care for individuals and families. With a focus on preventive measures and a wide network of dental providers, Humana aims to make dental care accessible and affordable. Let’s break down the key aspects of their dental coverage.

Preventive Care: A Priority

Humana recognizes the importance of preventive dentistry in maintaining long-term oral health. As such, their dental plans often cover essential preventive services such as:

- Dental cleanings and check-ups: Regular visits to the dentist are encouraged and typically covered at 100% with no out-of-pocket expenses.

- X-rays: Diagnostic tools like X-rays are crucial for early detection of dental issues. Humana often includes these in their basic coverage plans.

- Fluoride treatments: Especially beneficial for children and those at risk of tooth decay, fluoride treatments are often included to promote strong teeth.

By prioritizing preventive care, Humana aims to reduce the need for costly and extensive dental procedures down the line.

Restorative and Cosmetic Procedures

In addition to preventive care, Humana’s dental plans also cover a range of restorative and cosmetic procedures. These may include:

- Fillings: Whether it’s a small cavity or a larger issue, Humana often covers the cost of fillings to restore damaged teeth.

- Root canals: For more complex issues, root canal treatments are typically included in their coverage, ensuring you can receive necessary care without financial strain.

- Dental crowns and bridges: In cases where teeth need to be replaced or reinforced, Humana’s plans may cover the cost of crowns and bridges.

- Teeth whitening: Some plans even offer coverage for cosmetic procedures like teeth whitening, helping you achieve a brighter smile.

Orthodontic Treatment

Humana understands that orthodontic care is often a necessity, especially for children and teens. Their dental plans may include coverage for:

- Braces: Whether traditional metal braces or more discrete options like Invisalign, Humana’s coverage can help make these treatments more accessible.

- Orthodontic consultations and adjustments: Regular visits to the orthodontist are often covered, ensuring you can monitor your progress and make any necessary adjustments.

Network of Providers

One of the key advantages of Humana’s dental insurance is their extensive network of dental providers. With a wide range of dentists, specialists, and orthodontists to choose from, you can find a provider that suits your needs and preferences. Humana’s network includes:

- General dentists: For routine check-ups and basic procedures.

- Specialists: Including periodontists, endodontists, and oral surgeons for more complex issues.

- Orthodontic practices: For specialized care related to teeth alignment and bite correction.

By partnering with these providers, Humana ensures that their insured individuals have access to high-quality dental care across the country.

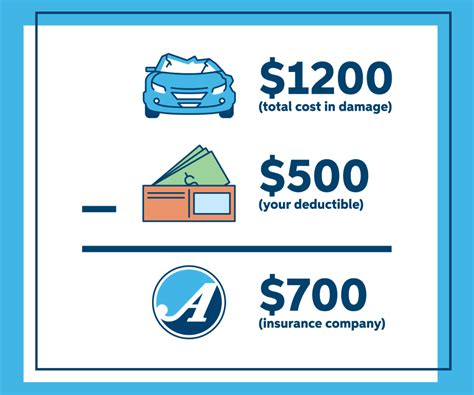

Coverage Limits and Deductibles

Like most insurance plans, Humana’s dental coverage comes with certain limits and deductibles. These may vary depending on the specific plan you choose and the level of coverage you opt for. Here’s a general overview:

| Coverage Category | Typical Coverage |

|---|---|

| Preventive Care | 100% coverage for most plans, with no deductibles or copays. |

| Basic Procedures (fillings, extractions) | Typically covered at 80% after the deductible, with a copay for the remaining 20%. |

| Major Procedures (root canals, crowns) | Covered at 50% after the deductible, with a higher copay for the remaining 50%. |

| Orthodontic Treatment | Coverage and limits vary widely, often with a separate annual maximum. |

It’s important to carefully review the specific plan details and understand the coverage limits and deductibles to ensure you choose a plan that aligns with your dental needs.

The Impact of Humana’s Dental Insurance

Having dental insurance can significantly impact your oral health journey. Here’s how Humana’s dental coverage can make a difference:

Encouraging Regular Dental Visits

With preventive care covered at 100%, Humana’s plans encourage individuals to schedule regular dental check-ups and cleanings. This consistency is key to early detection of dental issues and maintaining optimal oral health.

Reducing Financial Barriers

Dental procedures can be costly, especially for those without insurance. Humana’s coverage helps reduce the financial burden, making essential dental care more accessible. Whether it’s a routine cleaning or a more complex procedure, having insurance can make a significant difference in your ability to seek the care you need.

Promoting Better Oral Health

By prioritizing preventive care and covering a range of restorative procedures, Humana’s dental plans promote better oral health outcomes. With early intervention and regular maintenance, individuals can avoid more severe dental issues and maintain a healthy smile.

Peace of Mind

Knowing that you have insurance coverage for dental emergencies or unexpected procedures can provide significant peace of mind. Humana’s plans ensure that you’re prepared for any dental challenges that may arise, allowing you to focus on your overall well-being.

Choosing the Right Humana Dental Plan

With a range of plans to choose from, selecting the right Humana dental insurance can be a crucial decision. Here are some factors to consider when making your choice:

Your Dental Needs

Evaluate your current and future dental needs. Do you require basic coverage for routine check-ups, or do you anticipate more complex procedures? Understanding your needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

Cost Considerations

Consider the premiums, deductibles, and copays associated with each plan. While some plans may have lower premiums, they might come with higher out-of-pocket expenses. Weigh these factors against your budget and dental needs to find the most cost-effective option.

Network Flexibility

If you have a preferred dentist or specialist, ensure that they are part of Humana’s network. Some plans may offer a wider network, giving you more flexibility in choosing your dental care providers.

Additional Benefits

Look for plans that offer additional benefits beyond basic coverage. This could include discounts on dental products, access to a 24⁄7 dental hotline, or coverage for alternative dental treatments like dental implants.

Conclusion: Humana’s Commitment to Dental Care

Humana’s dental insurance plans are a testament to their commitment to promoting accessible and affordable dental care. With a focus on preventive measures and a wide range of coverage options, they strive to meet the diverse needs of their insured individuals. By choosing Humana’s dental insurance, you can take a proactive approach to your oral health, knowing that you have a reliable partner in your dental journey.

How do I choose the right Humana dental plan for my family’s needs?

+Consider your family’s current and future dental needs. Assess whether you require basic coverage or more extensive procedures. Review the plan’s coverage limits, deductibles, and copays to find a balance that suits your budget and needs. Additionally, ensure that your preferred dental providers are part of Humana’s network for added convenience.

What is the typical waiting period for Humana’s dental insurance plans?

+Most Humana dental plans have a waiting period of 6 months for basic procedures and 12 months for major procedures. However, preventive care is often covered immediately, encouraging individuals to start their dental care journey right away.

Are there any discounts or promotions available for Humana’s dental insurance plans?

+Humana occasionally offers promotional discounts or incentives for enrolling in their dental plans. It’s advisable to check their official website or contact their customer support for the latest offers. Additionally, some employers or organizations may negotiate group rates, providing further cost savings.