Usaa Home Insurance Reviews

Welcome to an in-depth exploration of USAA Home Insurance, where we delve into the experiences, ratings, and insights provided by its customers. With a focus on transparency and education, this review aims to offer a comprehensive overview of the coverage, customer satisfaction, and unique benefits that USAA Home Insurance brings to the table. Join us as we navigate through real-world reviews and analyze the key aspects that make this insurance provider stand out in the competitive home insurance market.

USAA Home Insurance: An Overview

USAA, short for United Services Automobile Association, is a financial services group primarily catering to the military community, including active-duty military personnel, veterans, and their families. While USAA is best known for its automobile insurance offerings, its home insurance products have also gained recognition for their competitive pricing and tailored coverage options.

USAA Home Insurance offers a comprehensive suite of coverage options, designed to protect one of the most significant investments many individuals make in their lifetimes – their homes. From standard coverage for common perils to more specialized protection for unique needs, USAA aims to provide a customized insurance experience for its diverse clientele.

Coverage Options and Customization

At the core of USAA Home Insurance’s appeal is its flexibility and customization. The provider offers a range of coverage types to suit different homeownership scenarios, including:

- Homeowners Insurance: Traditional coverage for single-family homes, condos, and mobile homes, protecting against damages caused by fire, storms, vandalism, and more.

- Renters Insurance: Essential coverage for renters, safeguarding their personal belongings and providing liability protection in case of accidents.

- Condo Insurance: Customized coverage for condo owners, protecting their personal property and offering liability coverage while excluding the building's structure, which is typically covered by the condo association.

- Landlord Insurance: Specialized coverage for landlords, providing protection for rental properties and offering additional liability coverage for potential accidents or injuries on the rental premises.

Beyond these standard coverage types, USAA also offers several unique and customizable add-ons, allowing policyholders to tailor their insurance to their specific needs. These add-ons include:

- Earthquake Insurance: Additional coverage for damages caused by earthquakes, which is particularly valuable in seismically active regions.

- Flood Insurance: Separate coverage for flood-related damages, as standard home insurance policies typically exclude flood protection.

- Personal Property Replacement: An optional endorsement that replaces damaged or stolen personal belongings on a new-for-old basis, ensuring policyholders receive the full value of their items without depreciation.

- Scheduled Personal Property: Coverage for high-value items such as jewelry, art, or collectibles, which may be excluded or have limited coverage under standard home insurance policies.

Competitive Pricing and Discounts

One of the most appealing aspects of USAA Home Insurance is its competitive pricing. The provider is known for offering some of the most affordable rates in the market, particularly for military personnel and their families. This competitive pricing is often a result of USAA’s commitment to its unique customer base and its efficient operational model.

USAA also offers a range of discounts to further reduce policyholders' premiums. These discounts include:

- Multi-Policy Discount: Policyholders can save by bundling their home insurance with other USAA policies, such as auto insurance or life insurance.

- Loyalty Discount: Long-term policyholders are rewarded with loyalty discounts, providing an incentive to stay with USAA over the long haul.

- Security System Discount: Policyholders with monitored security systems in their homes may be eligible for discounts, as these systems can deter theft and reduce the risk of damage.

- Retirement Discount: USAA offers a discount to policyholders who have retired from military service, providing additional savings for veterans.

Claims Process and Customer Satisfaction

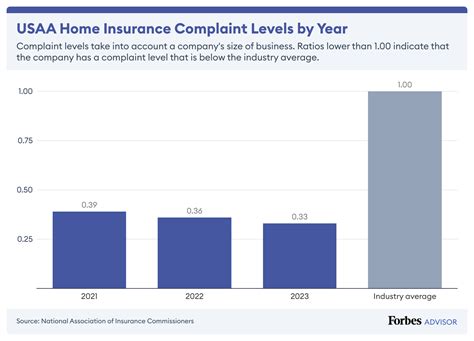

The true test of any insurance provider is often its claims process and how well it serves its policyholders in times of need. USAA Home Insurance has consistently received high marks for its claims handling, with many policyholders praising the provider’s efficient and empathetic approach.

USAA's claims process is designed to be straightforward and accessible. Policyholders can file claims online, over the phone, or via the USAA mobile app, ensuring convenience and ease of use. The provider's claims adjusters are known for their responsiveness and willingness to go the extra mile to ensure policyholders receive the coverage they need.

Customer reviews frequently highlight USAA's commitment to providing fair and prompt settlements. The provider's extensive network of preferred repair and replacement services also ensures that policyholders have access to high-quality repair options, often at discounted rates.

In addition to its claims handling, USAA Home Insurance also excels in customer service. The provider offers 24/7 support, ensuring that policyholders can always reach a representative when they need assistance. USAA's customer service team is highly trained and knowledgeable, providing accurate and timely information to help policyholders make informed decisions about their coverage.

Unique Benefits and Perks

As a financial services provider catering to the military community, USAA offers several unique benefits and perks that set it apart from traditional insurance companies.

- Military Discounts: USAA offers exclusive discounts to active-duty military personnel and veterans, recognizing their service and providing additional savings on home insurance premiums.

- Deployment Assistance: For policyholders who are deployed, USAA provides assistance with managing their insurance policies, including temporary policy suspensions and flexibility in payment schedules.

- Military Spouse Career Advancement Program: USAA supports military spouses in their career pursuits, offering scholarships and career development resources to help them achieve their professional goals.

- Financial Education and Planning: USAA provides a range of financial tools and resources to help policyholders manage their finances, including budgeting tools, investment advice, and retirement planning.

Conclusion: Why Choose USAA Home Insurance

USAA Home Insurance stands out as a top choice for many homeowners, particularly those with military affiliations. With its competitive pricing, comprehensive coverage options, and excellent claims handling, USAA offers a well-rounded insurance experience. The provider’s commitment to its unique customer base and its focus on providing tailored solutions have earned it a strong reputation in the industry.

Whether you're a homeowner, renter, condo owner, or landlord, USAA Home Insurance has a coverage option that fits your needs. With its range of customizable add-ons and discounts, policyholders can create a personalized insurance plan that offers the right balance of protection and affordability. Additionally, USAA's unique benefits and perks for military personnel and their families further enhance the overall insurance experience.

As with any insurance decision, it's essential to carefully review your coverage needs and compare options to find the best fit. However, for those seeking a reliable and reputable home insurance provider, USAA Home Insurance is undoubtedly a strong contender worth considering.

How does USAA determine insurance rates for home insurance policies?

+USAA calculates insurance rates based on a variety of factors, including the policyholder’s location, the type of home (single-family, condo, mobile home), the home’s age and construction, and the level of coverage selected. Additionally, USAA may consider the policyholder’s credit score and claims history to assess risk and determine premiums.

What types of discounts are available for USAA home insurance policies?

+USAA offers a range of discounts for home insurance policies, including multi-policy discounts for bundling home and auto insurance, loyalty discounts for long-term policyholders, security system discounts for homes with monitored security systems, and retirement discounts for policyholders who have retired from military service.

How does USAA handle claims for home insurance policies?

+USAA has a streamlined claims process that allows policyholders to file claims online, over the phone, or via the USAA mobile app. Claims adjusters are known for their responsiveness and willingness to provide fair and prompt settlements. USAA also has a network of preferred repair and replacement services, ensuring policyholders have access to high-quality repair options at discounted rates.