How To Check Insurance Coverage

Understanding your insurance coverage is crucial to ensure you are adequately protected. It can be a complex process, but with the right approach and resources, you can easily navigate through your insurance policies and verify the extent of your coverage. This guide will walk you through the steps to check your insurance coverage, providing you with the knowledge to make informed decisions about your insurance needs.

Unraveling Your Insurance Policy

When it comes to insurance, having a clear understanding of your policy is essential. Your insurance policy is a legal document that outlines the specific terms and conditions of your coverage. It is crucial to review this document thoroughly to grasp the extent of your protection.

Key Elements to Look For

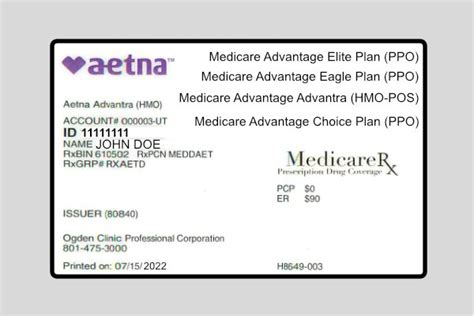

- Policy Type and Coverage: Start by identifying the type of insurance policy you hold. This could range from health insurance, auto insurance, home insurance, or life insurance. Each type of policy offers unique coverage, so understanding the specific details is crucial.

- Coverage Limits: Your policy will specify the maximum amount your insurer will pay out for a covered claim. This is especially important for understanding the financial protection provided by your insurance.

- Deductibles and Co-Payments: These are the out-of-pocket expenses you may need to pay before your insurance coverage kicks in. Understanding these costs is vital for budgeting and planning.

- Exclusions and Limitations: Insurance policies often come with exclusions, which are specific situations or events that are not covered. Knowing these limitations is crucial to avoid surprises when making a claim.

- Policy Duration and Renewal: Pay attention to the duration of your policy and the renewal process. Some policies are valid for a specific period, while others may renew automatically. Understanding this aspect ensures you maintain continuous coverage.

To illustrate, let's consider an example of an auto insurance policy. In this case, you would want to review the coverage limits for liability, collision, and comprehensive coverage. Additionally, understanding the deductible amounts and any specific exclusions, such as damage caused by natural disasters, would be crucial.

| Policy Type | Coverage Limits | Deductibles |

|---|---|---|

| Auto Insurance | $100,000 Liability, $5000 Collision, $2000 Comprehensive | $500 Deductible |

| Health Insurance | 80/20 Co-Insurance | $2000 Annual Deductible |

| Home Insurance | $500,000 Dwelling, $100,000 Personal Property | $1000 Deductible |

Online Resources and Tools

In today’s digital age, many insurance companies offer online platforms and tools to help policyholders understand their coverage. These resources can provide a quick and convenient way to review your policy details and gain a better understanding of your insurance coverage.

Online Portals and Apps

Many insurance providers have developed online portals or mobile apps specifically designed to enhance the policyholder experience. These platforms allow you to access your policy documents, view coverage details, and even make policy changes or additions. By logging into your account, you can review the following information:

- Policy Summary: A concise overview of your coverage, including policy limits, deductibles, and renewal dates.

- Covered Events and Incidents: A detailed list of the situations or events covered by your policy.

- Claims History: A record of any claims you have made in the past, along with the status and outcomes.

- Policy Add-Ons and Endorsements: Any additional coverage or changes made to your policy.

Interactive Tools and Calculators

Some insurance companies also offer interactive tools and calculators to help policyholders estimate their coverage needs and understand the financial implications of different scenarios. These tools can be particularly useful when considering additional coverage or adjusting your existing policy.

For instance, many health insurance providers offer cost estimators that allow you to input specific medical procedures or treatments. The tool then calculates the estimated out-of-pocket costs based on your coverage and deductible amounts. This can help you plan and budget for potential healthcare expenses.

Consulting with Insurance Professionals

While online resources can provide valuable insights, consulting with insurance professionals can offer a more personalized and comprehensive understanding of your coverage. Insurance agents, brokers, and customer service representatives are trained to guide you through your policy and answer any questions you may have.

Seeking Guidance from Insurance Experts

- Insurance Agents and Brokers: These professionals work directly with insurance companies and can provide detailed explanations of your policy. They can help clarify complex terms, explain coverage options, and even recommend additional coverage based on your specific needs.

- Customer Service Representatives: Insurance companies often have dedicated customer service teams ready to assist policyholders. They can provide quick answers to basic inquiries and guide you to the appropriate resources for more complex issues.

It's important to note that insurance professionals can also assist with filing claims and resolving any disputes or challenges you may encounter. They can act as your advocate and ensure you receive the coverage and benefits you are entitled to.

Regularly Reviewing and Updating Your Coverage

Insurance coverage is not a one-time process. It’s essential to regularly review and update your policies to ensure they align with your changing needs and circumstances. Life events such as marriage, having children, purchasing a new home, or starting a business can all impact your insurance requirements.

Assessing Your Changing Needs

As your life evolves, so do your insurance needs. Here are some key life events that may warrant a review of your insurance coverage:

- Marriage or Divorce: Changing marital status can impact your insurance needs, especially for health insurance and life insurance.

- Starting a Family: The birth or adoption of a child often prompts a review of health insurance and life insurance policies to ensure adequate protection for your growing family.

- Purchasing a Home: Homeownership comes with new responsibilities and risks. Reviewing your home insurance policy to ensure sufficient coverage for your property and belongings is crucial.

- Starting a Business: If you become self-employed or start a business, you may need additional insurance coverage, such as business liability insurance or professional indemnity insurance.

- Retirement: As you approach retirement, your insurance needs may change. Reviewing your life insurance and health insurance policies to ensure they align with your retirement plans is essential.

Conducting Annual Policy Reviews

To stay on top of your insurance coverage, consider conducting annual policy reviews. This practice allows you to assess whether your current policies still meet your needs and make any necessary adjustments. During these reviews, consider the following:

- Policy Changes: Check for any changes in your policy, such as increased deductibles or altered coverage limits.

- New Coverage Options: Explore any new coverage options offered by your insurance provider that may better suit your current needs.

- Cost Comparisons: Compare the costs of your current policies with those offered by other providers to ensure you are getting the best value.

- Claims History: Review your claims history and assess whether any recent claims have impacted your coverage or premiums.

What should I do if I find discrepancies in my insurance coverage?

+If you discover any discrepancies or inconsistencies in your insurance coverage, it’s essential to address them promptly. Contact your insurance provider and explain the issue. They can help clarify any misunderstandings or rectify any errors in your policy. It’s crucial to have accurate and up-to-date coverage information to ensure you are adequately protected.

Can I request a copy of my insurance policy if I don’t have one?

+Yes, you have the right to request a copy of your insurance policy from your provider. Simply reach out to their customer service team or your insurance agent, and they will provide you with a copy. It’s important to have a physical or digital copy of your policy for easy reference and to ensure you understand your coverage.

Are there any online resources or tools to help me understand my insurance coverage better?

+Absolutely! Many insurance companies offer online portals, apps, or interactive tools specifically designed to enhance policyholder understanding. These resources can provide detailed policy information, coverage summaries, and even cost estimators to help you assess your coverage needs. Exploring these digital tools can be a great way to gain a better grasp of your insurance coverage.