Average Cost Of Auto Insurance By State

The cost of auto insurance is a significant concern for vehicle owners across the United States. While the average price of insurance policies can vary greatly from state to state, several factors contribute to these differences. In this comprehensive article, we will delve into the average cost of auto insurance by state, exploring the key influences, regional variations, and strategies to secure the best rates. By understanding these nuances, drivers can make informed decisions to optimize their insurance coverage and finances.

Unveiling the National Average: A Baseline for Comparison

Before diving into state-specific data, it’s essential to establish a national benchmark. The average cost of auto insurance in the United States currently stands at $1,674 per year, according to recent industry reports. This figure serves as a useful reference point, allowing drivers to gauge how their state’s insurance costs compare to the national average.

State-by-State Breakdown: Exploring Regional Disparities

Now, let’s embark on a journey across the United States to uncover the unique insurance landscapes of each state. This comprehensive analysis will highlight the key factors influencing insurance costs and provide valuable insights for drivers seeking affordable coverage.

California: A Competitive Market with Varied Rates

California, the most populous state in the nation, boasts a highly competitive auto insurance market. The average cost of insurance in the Golden State is $1,372 per year, which is notably lower than the national average. This can be attributed to the state’s strict regulations and the presence of numerous insurance providers competing for customers.

However, it’s important to note that insurance rates can vary significantly within California itself. Urban areas like Los Angeles and San Francisco often have higher premiums due to increased traffic and accident risks. In contrast, rural regions may enjoy more affordable rates due to lower population density and reduced accident likelihood.

Texas: Balancing Affordability and Regulation

Texas, the second-largest state by population, offers a unique insurance landscape. The average cost of auto insurance in the Lone Star State is $1,426 per year, which is slightly above the national average. This can be attributed to a combination of factors, including the state’s expansive highway system and diverse urban-rural mix.

Interestingly, Texas has implemented several regulations to enhance affordability. For instance, the state’s Insurance Affordability Plan aims to reduce costs for low-income drivers. Additionally, Texas allows drivers to opt for a state-sponsored auto insurance program, which can provide more affordable coverage for those struggling with traditional insurance rates.

New York: Navigating High-Cost Insurance Challenges

New York, the economic powerhouse of the East Coast, faces some of the highest auto insurance costs in the nation. The average premium in the Empire State is $2,046 per year, significantly surpassing the national average. This elevated cost can be attributed to a combination of factors, including high population density, extensive road networks, and stringent state regulations.

New York’s insurance landscape is further complicated by the prevalence of uninsured and underinsured drivers. This issue contributes to higher premiums for law-abiding drivers, as insurance companies must compensate for the risks posed by uninsured motorists. However, the state is actively working to address this problem through enhanced enforcement and educational campaigns.

Florida: Sun, Fun, and High Insurance Costs

Florida, the sunny peninsula known for its retirement communities and tourist attractions, faces unique insurance challenges. The average cost of auto insurance in the Sunshine State is $2,002 per year, making it one of the most expensive states for coverage. This can be attributed to a combination of factors, including high rates of car theft, severe weather events, and a large population of elderly drivers.

To combat these issues, Florida has implemented several initiatives. The state’s Fraud Fighter Task Force actively combats insurance fraud, which can drive up costs for all drivers. Additionally, Florida offers discounts for drivers who complete approved defensive driving courses, providing an incentive for safer driving behaviors.

Illinois: Balancing Urban and Rural Insurance Rates

Illinois, the Land of Lincoln, presents a diverse insurance landscape. The average cost of auto insurance in the Prairie State is $1,286 per year, which is notably lower than the national average. This can be attributed to a combination of factors, including the state’s balanced mix of urban and rural areas, as well as its strong regulatory framework.

Chicago, Illinois’ largest city, typically has higher insurance rates due to increased traffic and accident risks. However, rural regions of the state often enjoy more affordable coverage due to lower population density and reduced accident likelihood. Illinois’ insurance providers offer a range of discounts, including those for safe driving records and vehicle safety features, further enhancing affordability.

Understanding the Factors Behind State-Specific Insurance Costs

The variation in insurance costs across states is influenced by a multitude of factors. These include:

- Population Density: Highly populated urban areas often have higher insurance rates due to increased traffic, congestion, and accident risks.

- Road and Weather Conditions: States with harsh winters, frequent severe weather events, or extensive road networks may face higher insurance costs.

- Crime Rates: Regions with higher rates of car theft or vandalism often experience elevated insurance premiums.

- Regulatory Environment: State laws and regulations can significantly impact insurance costs. Some states mandate more comprehensive coverage, while others implement measures to enhance affordability.

- Demographics: States with a higher proportion of young or elderly drivers may face increased insurance costs due to the perceived higher risk associated with these age groups.

Strategies for Securing Affordable Auto Insurance

Navigating the complex world of auto insurance can be daunting, but there are strategies drivers can employ to secure more affordable coverage. Here are some expert tips:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online comparison tools can be particularly useful for this task.

- Understand Your Coverage Needs: Evaluate your specific needs and choose a policy that provides adequate coverage without unnecessary add-ons. This can help reduce costs.

- Maintain a Clean Driving Record: A spotless driving history is often rewarded with lower insurance premiums. Avoid accidents and moving violations to keep your rates affordable.

- Take Advantage of Discounts: Many insurance providers offer discounts for a variety of factors, including safe driving, vehicle safety features, and multi-policy bundles. Be sure to inquire about all available discounts.

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly premiums, but it’s important to ensure you can afford the deductible in the event of a claim.

The Future of Auto Insurance: Emerging Trends and Technologies

The auto insurance industry is constantly evolving, and several emerging trends and technologies are set to shape its future. Here’s a glimpse into what lies ahead:

- Telematics and Usage-Based Insurance: Telematics devices and apps that track driving behavior are gaining popularity. These tools can offer personalized insurance rates based on individual driving habits, providing incentives for safe driving.

- Artificial Intelligence and Data Analytics: AI and advanced data analytics are being used to enhance fraud detection and risk assessment. This technology can help insurance providers offer more accurate and affordable coverage.

- Connected Car Technology: The integration of connected car features, such as advanced driver-assistance systems (ADAS), can lead to safer driving and reduced accident risks. This may result in lower insurance premiums for policyholders.

- Blockchain and Smart Contracts: Blockchain technology has the potential to streamline insurance processes, enhance security, and reduce costs. Smart contracts can automate certain insurance tasks, improving efficiency and accuracy.

Conclusion: Empowering Drivers with Knowledge

Understanding the average cost of auto insurance by state is a crucial step in making informed decisions about coverage and finances. By exploring the unique insurance landscapes of each state and the factors influencing rates, drivers can take control of their insurance costs. Remember, shopping around, maintaining a clean driving record, and taking advantage of discounts are powerful strategies for securing affordable coverage.

As the auto insurance industry continues to evolve, embracing emerging technologies and trends can further enhance affordability and safety. Stay informed, compare quotes, and choose the insurance provider and policy that best meets your needs and budget. With the right knowledge and approach, navigating the world of auto insurance can be a smooth and rewarding experience.

What is the cheapest state for auto insurance in the US?

+The cheapest state for auto insurance in the US is typically Ohio, with an average annual premium of around $770. However, it’s important to note that rates can vary significantly within a state, and individual factors such as driving history and vehicle type can also impact the cost.

How do I find the average cost of auto insurance in my state?

+You can find the average cost of auto insurance in your state by researching online resources and insurance comparison websites. These platforms often provide state-specific data and allow you to compare quotes from multiple providers. Additionally, checking with your local insurance agents or state insurance departments can provide valuable insights into average rates.

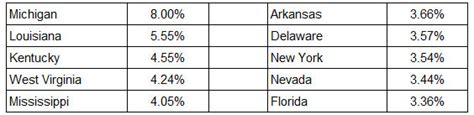

Are there any states with particularly high auto insurance rates?

+Yes, several states are known for having high auto insurance rates. These include New York, Florida, Michigan, and California. These states often have a combination of factors that contribute to elevated insurance costs, such as high population density, severe weather events, and strict regulatory environments.