Insurance For Old Cars

As a vehicle ages, its value depreciates, and the risks associated with it increase. This raises important questions for car owners: Is it still necessary to insure an old car? If so, what kind of insurance coverage is suitable for an older vehicle? In this comprehensive guide, we will delve into the world of insurance for old cars, exploring the unique challenges, benefits, and strategies to ensure peace of mind and financial protection.

Understanding the Insurance Landscape for Old Cars

The insurance landscape for old cars differs significantly from that of newer vehicles. Insurance companies assess risk based on several factors, including the vehicle’s age, make, model, and historical performance. As a result, older cars often face different insurance considerations and may require specialized coverage.

The Impact of Age on Insurance Premiums

One of the primary challenges of insuring an old car is the impact of age on insurance premiums. Generally, as a vehicle ages, its replacement and repair costs decrease, leading to lower insurance rates. However, this trend is not linear, and there are certain age thresholds where insurance costs may fluctuate or increase unexpectedly.

For instance, let’s consider a hypothetical case study of a 10-year-old sedan. While this vehicle may benefit from reduced insurance rates compared to a brand-new model, it might still face higher premiums than a 5-year-old car of the same make and model. This is because insurance companies consider the likelihood of increased wear and tear, mechanical issues, and potential safety concerns associated with older vehicles.

To illustrate the impact of age on insurance premiums, here’s a table comparing average insurance rates for different age groups of a popular sedan model:

| Vehicle Age | Average Annual Insurance Premium |

|---|---|

| New (0-2 years) | 1,200</td> </tr> <tr> <td>3-5 years old</td> <td>950 |

| 6-10 years old | 780</td> </tr> <tr> <td>11-15 years old</td> <td>650 |

| 16+ years old | $820 |

As seen in the table, insurance premiums generally decrease as the vehicle ages from 0-10 years. However, there’s a notable increase in premiums for vehicles aged 16 years and above. This trend highlights the complex relationship between age and insurance costs, which can vary based on the vehicle’s make, model, and other factors.

Assessing the Risks of Older Vehicles

When insuring an old car, it’s crucial to assess the risks associated with it. Older vehicles may have higher maintenance costs due to increased wear and tear, and they might be more susceptible to mechanical failures or breakdowns. Additionally, older cars may have lower safety ratings, especially if they haven’t been updated with modern safety features.

To mitigate these risks, insurance companies often offer specialized coverage options for old cars. These policies can provide comprehensive protection, covering repairs, replacements, and even unique challenges such as classic car restoration costs. By understanding the specific risks of your old car, you can choose an insurance plan that offers the right balance of coverage and affordability.

Insurance Coverage Options for Old Cars

When it comes to insuring an old car, there are several coverage options available to car owners. The right choice depends on the vehicle’s age, value, and the owner’s specific needs and budget. Here’s a detailed look at some of the most common insurance coverage options for old cars:

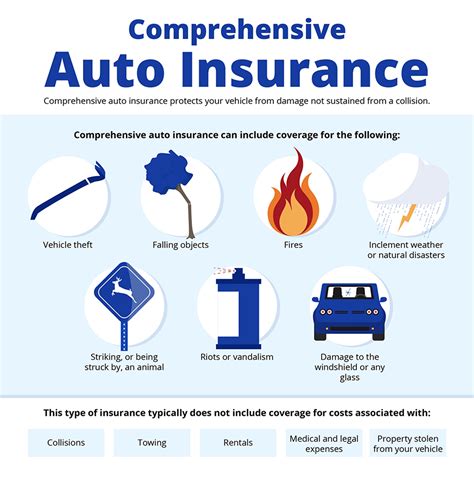

Comprehensive Coverage for Old Cars

Comprehensive insurance is a popular choice for old car owners as it provides broad protection against various risks. This type of coverage typically includes protection against theft, vandalism, natural disasters, and collisions. Additionally, comprehensive insurance often covers the cost of repairs or replacements, ensuring that your old car is well-protected.

For instance, let’s say you own a 15-year-old classic sports car. Comprehensive insurance can safeguard your vehicle against potential hazards like hail damage, which could be costly to repair due to the car’s unique and potentially rare parts. By opting for comprehensive coverage, you can rest assured that your classic car is protected against unforeseen circumstances.

When considering comprehensive insurance for an old car, it’s essential to understand the potential exclusions and limitations. Some insurance providers may have specific restrictions on the age or condition of vehicles they insure comprehensively. It’s crucial to carefully review the policy terms and conditions to ensure you have the coverage you need.

Collision Coverage for Older Vehicles

Collision coverage is another crucial aspect of insuring an old car. This type of insurance provides protection in the event of a collision, covering the cost of repairs or replacements. Collision coverage is especially important for older vehicles, as they may be more prone to accidents due to their age and potential mechanical issues.

Imagine you’re driving your 12-year-old SUV, and unfortunately, you’re involved in a fender bender. With collision coverage in place, you can have peace of mind knowing that your insurance will cover the repairs needed to get your SUV back on the road. This coverage ensures that you don’t have to bear the full financial burden of the accident.

When choosing collision coverage for an old car, it’s essential to consider your vehicle’s value and the potential cost of repairs. You can opt for a higher deductible to reduce your insurance premiums, but this means you’ll have to pay more out of pocket in the event of a claim. Finding the right balance between coverage and affordability is key when selecting collision insurance for your old car.

Liability Coverage for Old Cars

Liability insurance is a critical component of any car insurance policy, including those for old cars. This coverage protects you against claims made by other drivers or pedestrians in the event of an accident you’re at fault for. It covers damages to their vehicles, medical expenses, and even legal fees if necessary.

For example, let’s say you’re driving your 8-year-old sedan, and you accidentally rear-end another vehicle at a stoplight. With liability coverage in place, you can rest assured that your insurance will handle the costs associated with the other driver’s vehicle repairs and any medical bills they may incur as a result of the accident.

When selecting liability coverage for your old car, it’s important to consider the minimum requirements set by your state or province. While the minimum coverage may be sufficient to meet legal obligations, it’s often recommended to opt for higher limits to provide more comprehensive protection. This ensures that you’re adequately covered in the event of a serious accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an essential addition to any old car insurance policy. This coverage protects you if you’re involved in an accident with a driver who either doesn’t have insurance or has insufficient coverage to pay for the damages they caused.

Imagine you’re driving your 10-year-old compact car, and another driver runs a red light and collides with your vehicle. If the other driver is uninsured or underinsured, your uninsured/underinsured motorist coverage can step in to cover the costs of repairing your car and any medical expenses you may incur as a result of the accident.

Having this coverage provides an extra layer of protection, ensuring that you’re not left financially burdened if you’re involved in an accident with an uninsured or underinsured driver. It’s a crucial consideration when insuring an old car, as it can provide peace of mind and financial security in unexpected situations.

Tips for Insuring Your Old Car

Insuring an old car requires a thoughtful approach to ensure you get the right coverage at an affordable price. Here are some valuable tips to help you navigate the insurance landscape for your beloved vintage vehicle:

Research and Compare Insurance Providers

The insurance market for old cars can vary significantly between providers. Take the time to research and compare different insurance companies that specialize in, or at least cater to, older vehicles. Look for providers that offer tailored coverage options and competitive rates for classic or vintage cars. Compare their policies, coverage limits, and any additional perks or discounts they offer.

For instance, Company A might have a reputation for providing excellent coverage for classic cars, with specialized policies that include restoration coverage and flexible valuation options. On the other hand, Company B might offer more affordable rates for older vehicles, making it a better choice for budget-conscious car owners.

By researching and comparing insurance providers, you can make an informed decision that aligns with your specific needs and budget. Don’t hesitate to reach out to their customer service or consult with an insurance broker to get a clearer understanding of their offerings.

Consider Your Car’s Value and Usage

Before choosing an insurance policy for your old car, carefully assess its value and how you intend to use it. If your old car is a daily driver, you’ll likely need a more comprehensive policy with collision and liability coverage. However, if your vintage vehicle is primarily for weekend drives or special occasions, you might opt for a more specialized policy that focuses on specific risks associated with classic cars, such as classic car events or restoration costs.

For example, if you own a 1960s muscle car that you drive regularly, you’ll want a policy that provides broad coverage, including collision and comprehensive protection. On the other hand, if you have a vintage sports car that you only drive occasionally for car shows or special events, you might consider a policy that offers limited mileage coverage and specialized protection for classic car events.

Understanding your car’s value and usage patterns will help you tailor your insurance coverage to your specific needs, ensuring that you have the right protection without paying for unnecessary coverage.

Review Your Coverage Regularly

Insurance needs can change over time, especially for old cars. As your vehicle ages, its value and risks may evolve, and so should your insurance coverage. Regularly review your policy to ensure it aligns with your current needs. Consider factors such as changes in your driving habits, the vehicle’s condition, and any modifications or upgrades you’ve made.

For instance, if you’ve recently restored your classic car to its former glory, you’ll want to update your insurance policy to reflect the increased value and any specialized coverage needed for the restored vehicle. Similarly, if you’ve added custom parts or upgraded the engine, you should inform your insurance provider to ensure your policy covers these modifications.

By staying proactive and regularly reviewing your insurance coverage, you can make necessary adjustments to maintain the right level of protection for your old car.

The Future of Insurance for Old Cars

As the automotive industry evolves, so does the landscape of insurance for old cars. The increasing popularity of classic and vintage vehicles has led to a growing demand for specialized insurance coverage. Insurance companies are recognizing the unique needs of old car owners and developing innovative solutions to address these challenges.

Emerging Trends in Old Car Insurance

One emerging trend in old car insurance is the rise of usage-based insurance (UBI) policies. These policies use telematics technology to monitor driving behavior and offer customized insurance rates based on individual driving habits. For old car owners, UBI policies can provide a more accurate assessment of risk, potentially leading to lower insurance premiums.

Additionally, insurance providers are exploring ways to leverage technology to enhance the claims process for old car owners. This includes the use of advanced diagnostic tools and digital platforms that streamline the claims filing and settlement process, ensuring a faster and more efficient experience for policyholders.

Furthermore, the growing interest in classic car restoration and preservation has prompted insurance companies to develop specialized policies that cater to the unique needs of these vehicles. These policies often include coverage for classic car events, transportation to restoration facilities, and even assistance with finding rare or hard-to-find parts.

The Role of Technology in Old Car Insurance

Technology plays a pivotal role in shaping the future of insurance for old cars. Advanced telematics and data analytics enable insurance companies to gather valuable insights into driving behavior and vehicle performance. This data-driven approach allows insurers to offer more accurate and personalized coverage, taking into account the specific risks and needs of old car owners.

Moreover, technology enables insurance providers to offer innovative solutions such as on-demand insurance coverage. This allows car owners to activate insurance for their old cars only when they’re planning to drive them, providing flexibility and cost-efficiency. Such on-demand insurance policies can be especially beneficial for classic car enthusiasts who primarily use their vehicles for occasional drives or special events.

As technology continues to advance, we can expect further developments in the insurance landscape for old cars. From improved risk assessment to enhanced claims processing and personalized coverage options, technology will play a crucial role in shaping a more efficient and tailored insurance experience for vintage vehicle owners.

How do I determine the value of my old car for insurance purposes?

+Determining the value of your old car for insurance purposes involves several factors. First, consider the make, model, and year of your vehicle. Research the average market value of similar vehicles in good condition. Additionally, assess the condition of your car, including any modifications or upgrades. You can consult with an insurance broker or use online valuation tools to get an accurate estimate of your car’s value. It’s important to provide accurate information to ensure proper coverage and avoid any discrepancies in the event of a claim.

Are there any discounts available for insuring an old car?

+Yes, there are often discounts available for insuring old cars. Insurance providers may offer reduced rates for vehicles that are considered classic or vintage. Additionally, if your old car is well-maintained and has a clean driving record, you may qualify for discounts based on your driving history. It’s worth exploring different insurance providers and their specific discount programs to find the best deal for your old car.

Can I insure an old car that is not currently drivable?

+Yes, it is possible to insure an old car that is not currently drivable. Insurance providers offer specialized policies for classic or vintage vehicles that are undergoing restoration or are stored in a garage. These policies often provide coverage for the vehicle’s value and offer additional protection during the restoration process. It’s important to consult with an insurance broker who specializes in classic car insurance to understand the specific requirements and coverage options available.

What should I do if my old car is involved in an accident?

+If your old car is involved in an accident, it’s important to follow these steps: First, ensure the safety of yourself and others involved. Call emergency services if needed. Next, contact your insurance provider as soon as possible to report the accident. Provide them with all the necessary details, including any photos or documentation of the damage. Cooperate with your insurer’s claims process and provide any additional information they may require. Remember to keep records of all communications and expenses related to the accident.