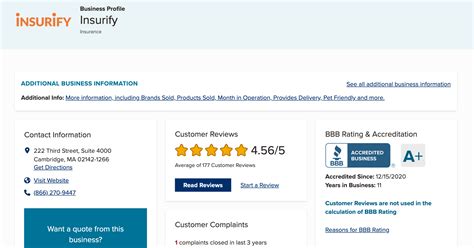

Insurify Insurance

Welcome to a comprehensive guide on Insurify Insurance, a digital insurance platform revolutionizing the way individuals and businesses access and manage their insurance needs. In today's fast-paced world, convenience and efficiency are paramount, and Insurify is at the forefront of this digital transformation, offering a seamless and user-friendly experience. With its innovative approach, Insurify has become a trusted name in the insurance industry, empowering individuals to make informed decisions and take control of their insurance coverage.

Empowering Users with Instant Insurance Quotes

Insurify’s journey began with a simple yet powerful mission: to simplify the insurance shopping process. The platform leverages cutting-edge technology to provide users with instant insurance quotes, saving them valuable time and effort. By inputting their details and preferences, users can explore a wide range of insurance options tailored to their needs, making the often-daunting task of insurance comparison a breeze.

The Power of Comparison

Insurify understands that insurance is not a one-size-fits-all proposition. Different individuals and businesses have unique requirements, and Insurify’s comparison tool shines in this regard. Users can easily compare insurance policies from multiple providers, ensuring they find the best coverage at the most competitive prices. Whether it’s auto, home, health, or life insurance, Insurify’s comprehensive database ensures users have access to a vast array of options.

| Insurance Type | Providers Available |

|---|---|

| Auto Insurance | Over 50 National Carriers |

| Home Insurance | Top Regional & National Providers |

| Health Insurance | Leading Health Insurance Companies |

| Life Insurance | Diverse Range of Providers |

By offering such a diverse selection, Insurify ensures that users can make well-informed decisions, considering factors like coverage limits, deductibles, and add-on options. This level of transparency and choice is a game-changer in the insurance industry, putting the power back in the hands of the consumer.

A Seamless Digital Experience

Insurify’s digital platform is designed with user experience at its core. The intuitive interface makes it effortless for users to navigate through the various insurance options, customize their preferences, and obtain quotes. The entire process is streamlined, ensuring users can complete their insurance journey without any unnecessary complications.

The Benefits of Digital Insurance

- Convenience: Users can access Insurify’s platform from the comfort of their homes or on the go, eliminating the need for in-person meetings or tedious paperwork.

- Real-Time Updates: With Insurify, users receive instant updates on policy changes, renewals, and even claims, ensuring they are always informed and in control.

- Personalized Experience: Insurify’s algorithms learn user preferences over time, offering increasingly accurate and personalized insurance recommendations.

- Secure Transactions: The platform employs advanced security measures to protect user data and ensure a safe and seamless transaction process.

Insurify's digital approach not only saves time but also reduces the environmental impact by minimizing the need for physical paperwork, making it an eco-friendly choice for conscious consumers.

Tailored Insurance Solutions

One of Insurify’s standout features is its ability to offer tailored insurance solutions. Whether a user is a young driver seeking affordable auto insurance, a homeowner looking for comprehensive coverage, or a business owner needing specialized commercial insurance, Insurify has a solution.

Customized Coverage

Insurify understands that every individual’s insurance needs are unique. That’s why its platform allows users to customize their insurance plans, adding or removing coverages based on their specific requirements. For instance, a homeowner may wish to include flood insurance in their policy, while a business owner might require liability coverage tailored to their industry.

| Insurance Type | Customizable Options |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Medical Payments, Uninsured Motorist, and more. |

| Home Insurance | Dwelling Coverage, Personal Property, Liability, Medical Payments, Additional Living Expenses, and specialized coverages like Flood or Earthquake. |

| Life Insurance | Term Life, Whole Life, Universal Life, and Variable Life insurance with customizable death benefit amounts and riders. |

By offering such flexibility, Insurify ensures that users can create insurance plans that truly meet their needs, providing peace of mind and financial protection.

The Future of Insurance: Insurify’s Vision

Insurify is not just a digital insurance platform; it’s a visionary company driving the future of the insurance industry. With a focus on innovation and technology, Insurify is continuously developing new features and partnerships to enhance the user experience and expand its reach.

Expanding Horizons

Insurify’s vision extends beyond the traditional insurance landscape. The company is actively exploring new avenues, such as insurance for emerging technologies like self-driving cars and space travel. By staying at the forefront of these developments, Insurify ensures it can offer relevant and timely insurance solutions to its users, catering to their evolving needs.

Additionally, Insurify is committed to promoting insurance literacy and financial wellness. The platform provides educational resources and tools to help users understand their insurance policies, manage their coverage effectively, and make informed financial decisions. This commitment to user education sets Insurify apart as a trusted advisor in the insurance space.

The Impact of Technology

Technology is at the heart of Insurify’s success. The company leverages advanced algorithms, machine learning, and artificial intelligence to deliver accurate quotes and personalized recommendations. These technologies also enable Insurify to streamline the claims process, making it faster and more efficient for users.

| Technology Focus | Impact |

|---|---|

| Artificial Intelligence | AI-powered chatbots provide 24/7 assistance, answering user queries and guiding them through the insurance process. |

| Machine Learning | ML algorithms learn user preferences, improving the accuracy of quotes and recommendations over time. |

| Data Analytics | Insurify uses data analytics to identify trends and patterns, helping providers offer more competitive rates and users make better-informed decisions. |

Insurify's commitment to technology ensures that its platform remains dynamic and adaptable, meeting the evolving needs of its users and staying ahead of the curve in the insurance industry.

Conclusion: A Trusted Companion in Your Insurance Journey

Insurify Insurance is more than just a digital insurance platform; it’s a trusted companion on your journey towards financial security and peace of mind. With its innovative approach, user-centric design, and commitment to education, Insurify has transformed the way we perceive and interact with insurance.

As you explore the world of insurance, Insurify stands ready to guide and support you, offering a seamless, efficient, and empowering experience. Whether you're a first-time insurance buyer or a seasoned policyholder, Insurify is here to help you navigate the complex world of insurance with ease and confidence.

FAQ

How does Insurify ensure data security and privacy?

+Insurify prioritizes data security and employs robust encryption protocols and security measures to protect user information. The platform complies with industry-standard security practices and regularly conducts security audits to ensure the safety of user data.

Can I switch my existing insurance policy to Insurify?

+Absolutely! Insurify can help you find better insurance rates and coverage to replace your existing policy. The platform’s comparison tools make it easy to identify more affordable or comprehensive options, and their expert team can guide you through the switching process.

What if I need assistance or have questions during the insurance process?

+Insurify provides 24⁄7 customer support through various channels, including live chat, email, and phone. Their team of insurance experts is always ready to assist, answer questions, and provide guidance, ensuring a smooth and stress-free insurance experience.