The General Automobile Insurance

Welcome to a comprehensive exploration of The General Automobile Insurance, a well-known insurance provider in the United States. With a focus on offering affordable car insurance policies, The General has become a popular choice for many drivers seeking comprehensive coverage without breaking the bank. In this article, we will delve into the company's history, its unique approach to insurance, the range of services it offers, and its impact on the insurance industry.

A Legacy of Innovation: The General’s Story

The General Automobile Insurance Services, Inc., more commonly known as The General, has an intriguing history that dates back to the early 20th century. Founded in 1927, the company initially operated under the name Permanent General Auto Insurance. Over the years, it has evolved and adapted to the changing landscape of the insurance industry, always aiming to provide accessible and affordable insurance solutions.

One of the key milestones in The General's journey was its acquisition by American Family Insurance in 2012. This strategic move allowed The General to expand its reach and leverage American Family's resources and expertise. Since then, The General has continued to grow, offering its services in 48 states and the District of Columbia.

What sets The General apart is its commitment to making insurance more accessible. The company understands that not all drivers have the same financial means, and it strives to provide coverage options that cater to a diverse range of budgets. This approach has earned The General a reputation for being a reliable and customer-centric insurance provider.

A Suite of Services: Automobile Insurance and Beyond

The General Automobile Insurance offers a comprehensive suite of services designed to meet the diverse needs of its customers. While the company specializes in automobile insurance, it also provides a range of other insurance products to protect individuals and their assets.

Automobile Insurance

The core offering of The General is its car insurance policies. The company provides coverage for a wide range of vehicles, including:

- Standard Vehicles: From sedans to SUVs, The General offers insurance for everyday cars used for personal transportation.

- High-Performance Cars: For enthusiasts and collectors, The General provides specialized coverage for sports cars and luxury vehicles.

- Classic and Antique Cars: Recognizing the unique needs of classic car owners, The General offers tailored insurance plans to protect these valuable assets.

- Motorcycles: The General extends its coverage to motorcycles, ensuring riders have the necessary protection on the road.

- RVs and Motorhomes: For those who love the open road, The General offers insurance for recreational vehicles, providing peace of mind during road trips.

The company's automobile insurance policies include a variety of coverage options, such as:

- Liability Coverage: This protects policyholders from financial losses if they are found at fault in an accident.

- Collision Coverage: In the event of an accident, collision coverage helps cover the cost of repairing or replacing the insured vehicle.

- Comprehensive Coverage: This option provides protection against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): PIP coverage helps pay for medical expenses and lost wages if the policyholder is injured in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders if they are involved in an accident with a driver who has little or no insurance.

The General's automobile insurance policies can be customized to meet the specific needs of each driver. The company offers various discounts and packages to make insurance more affordable, including:

- Multi-Car Discount: Policyholders can save by insuring multiple vehicles under one policy.

- Good Student Discount: Students with good academic standing may be eligible for a discount on their insurance premiums.

- Safe Driver Discount: Drivers with a clean driving record can benefit from reduced premiums.

- Homeowner Discount: Individuals who own a home may receive a discount on their insurance policy.

Other Insurance Products

In addition to automobile insurance, The General offers a range of other insurance products to provide comprehensive protection to its customers:

- Homeowners Insurance: Protect your home and its contents with The General's homeowners insurance policies. These policies cover a wide range of perils, including fire, theft, and natural disasters.

- Renters Insurance: For individuals renting a home or apartment, The General provides renters insurance to protect their personal belongings and provide liability coverage.

- Life Insurance: The General offers life insurance policies to provide financial protection to loved ones in the event of the policyholder's untimely demise.

- Business Insurance: Small business owners can find tailored insurance solutions with The General, covering liabilities and protecting their business assets.

- Commercial Auto Insurance: The General also serves the needs of commercial vehicle owners, offering insurance for trucks, vans, and other business vehicles.

Performance and Customer Experience

The General Automobile Insurance has consistently delivered exceptional performance and customer satisfaction. The company's focus on accessibility and affordability has made it a go-to choice for many drivers. Here are some key performance indicators and customer experience highlights:

| Metric | Value |

|---|---|

| J.D. Power Rating | 4.5 out of 5 stars |

| AM Best Rating | A (Excellent) |

| Customer Satisfaction | 92% of customers reported high satisfaction with The General's services |

| Claim Satisfaction | 88% of policyholders expressed satisfaction with the claims process |

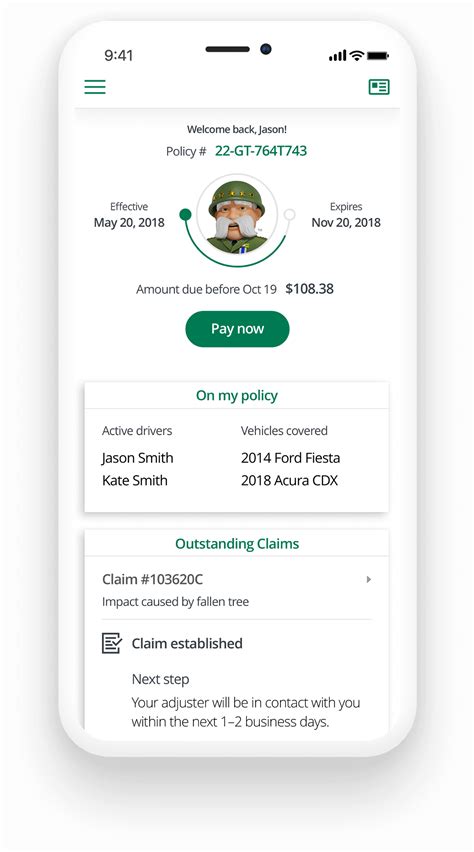

The General's commitment to customer service is evident in its 24/7 claims hotline, which ensures prompt assistance for policyholders in the event of an accident or loss. The company also provides a user-friendly online platform for customers to manage their policies, view billing information, and file claims digitally.

Future Prospects and Industry Impact

As the insurance industry continues to evolve, The General Automobile Insurance is well-positioned to adapt and thrive. With its parent company, American Family Insurance, The General has access to a vast network of resources and expertise, allowing it to stay ahead of industry trends.

The company's focus on innovation and technology is evident in its recent initiatives. The General has invested in digital transformation, enhancing its online presence and customer engagement platforms. This move towards a more digital-centric approach allows for improved efficiency and a more personalized customer experience.

Additionally, The General is exploring new insurance products and services to meet the evolving needs of its customers. The company is actively researching and developing solutions for emerging risks, such as autonomous vehicles and electric cars. By staying at the forefront of these advancements, The General aims to provide comprehensive coverage for the future of transportation.

The impact of The General's presence in the insurance industry is significant. Its commitment to making insurance more accessible has helped bridge the gap for individuals who may have faced challenges in obtaining affordable coverage. By offering competitive rates and customizable policies, The General has contributed to a more inclusive insurance landscape.

Conclusion

The General Automobile Insurance has solidified its position as a trusted and reliable insurance provider in the United States. With a rich history, a diverse range of services, and a customer-centric approach, The General continues to make a positive impact on the lives of its policyholders. As the company embraces technological advancements and adapts to the changing insurance landscape, it is poised to remain a leader in the industry for years to come.

What makes The General’s automobile insurance policies unique?

+The General’s automobile insurance policies stand out for their focus on affordability and customization. The company offers a range of coverage options and discounts to ensure that drivers can find a policy that fits their budget and specific needs.

How does The General ensure customer satisfaction?

+The General prioritizes customer satisfaction through its 24⁄7 claims hotline, efficient online platforms, and a dedicated customer service team. The company’s focus on providing prompt assistance and personalized support has earned it high customer satisfaction ratings.

What are some of the benefits of choosing The General for insurance needs?

+Choosing The General offers several advantages, including affordable insurance rates, customizable coverage options, a strong financial rating, and a commitment to customer satisfaction. The company’s focus on accessibility and innovation makes it a reliable choice for a wide range of insurance needs.