Cheap Commercial Car Insurance

Securing affordable commercial car insurance is a priority for any business that relies on vehicles for its operations. Whether you're a small business owner with a single delivery van or a fleet manager overseeing dozens of trucks, finding the right insurance coverage at a reasonable cost is essential. This comprehensive guide will delve into the intricacies of cheap commercial car insurance, offering expert insights and practical strategies to help you make informed decisions.

Understanding Commercial Car Insurance

Commercial car insurance is a specialized form of coverage designed to protect vehicles used for business purposes. Unlike personal auto insurance, it caters to the unique needs of businesses, providing liability and property damage coverage for vehicles involved in commercial activities. This includes a range of vehicles, from vans and trucks to specialized equipment like snowplows or construction vehicles.

The cost of commercial car insurance can vary significantly based on factors such as the type of business, the number of vehicles, and the nature of their use. Understanding these variables is crucial for businesses aiming to minimize their insurance expenses without compromising on essential coverage.

Types of Commercial Car Insurance Coverage

Commercial car insurance offers a variety of coverage options to cater to different business needs. These include:

- Liability Coverage: This is the cornerstone of any commercial car insurance policy. It protects the business against claims resulting from bodily injury or property damage caused by the insured vehicle. Liability coverage is mandatory in most states and is essential for safeguarding your business from financial ruin in the event of an accident.

- Physical Damage Coverage: This type of coverage is crucial for protecting your vehicles from damage or loss. It includes collision coverage, which pays for repairs or replacement if your vehicle is involved in an accident, and comprehensive coverage, which covers damages caused by non-collision events like theft, vandalism, or natural disasters.

- Medical Payments Coverage: Also known as MedPay, this coverage provides for the medical expenses of the insured driver and passengers following an accident, regardless of fault. It offers a quick and straightforward way to cover medical bills without waiting for liability claims to be resolved.

- Uninsured/Underinsured Motorist Coverage: This coverage protects your business and its employees in the event of an accident with a driver who has insufficient or no insurance. It ensures that your business and its employees are compensated for injuries and damages in such situations.

- Additional Coverages: Depending on your business needs, you may opt for additional coverages such as rental car reimbursement, which covers the cost of renting a vehicle while yours is being repaired, or roadside assistance, which provides emergency services like towing and flat tire repairs.

Factors Influencing Commercial Car Insurance Costs

The cost of commercial car insurance is determined by a multitude of factors, each playing a unique role in the overall premium. Understanding these factors is essential for businesses aiming to reduce their insurance expenses.

Vehicle Type and Usage

The type of vehicle being insured and its intended use are significant factors in determining insurance costs. For instance, a business van used for local deliveries may attract a lower premium compared to a heavy-duty truck used for long-haul transportation. The reason for this discrepancy lies in the inherent risks associated with different types of vehicles and their usage patterns.

Additionally, the age and condition of the vehicle can also impact insurance costs. Older vehicles may be considered a higher risk due to their potential mechanical issues or reduced safety features. Similarly, vehicles in excellent condition with regular maintenance records may be seen as lower-risk and therefore attract more affordable insurance rates.

Driver Profile and Record

The driving history and personal characteristics of the primary drivers are crucial in determining insurance premiums. Drivers with a clean record, particularly those with extensive safe driving experience, are often rewarded with lower insurance rates. Conversely, drivers with a history of accidents or traffic violations may face higher premiums, as they are statistically more likely to be involved in future incidents.

Other factors such as age, gender, and marital status can also influence insurance costs. Younger drivers, particularly males, are often considered higher-risk due to their tendency for more aggressive driving behaviors. Married individuals, on the other hand, are often seen as lower-risk, as they tend to drive more conservatively and have a lower likelihood of being involved in accidents.

Business Characteristics and Claims History

The nature of your business and its claims history are significant factors in determining insurance costs. High-risk industries, such as construction or transportation, often face higher insurance premiums due to the inherent risks associated with their operations. Similarly, businesses with a history of frequent claims may also attract higher premiums, as insurance companies consider them a greater financial risk.

However, it's not all bad news. Businesses with a long-standing relationship with their insurer and a consistent record of safe operations may be eligible for loyalty discounts or other incentives. Additionally, businesses that implement robust safety measures and have a low frequency of claims may also benefit from reduced insurance costs.

Strategies for Affordable Commercial Car Insurance

Securing affordable commercial car insurance requires a combination of strategic planning and proactive measures. Here are some expert tips to help you reduce your insurance costs:

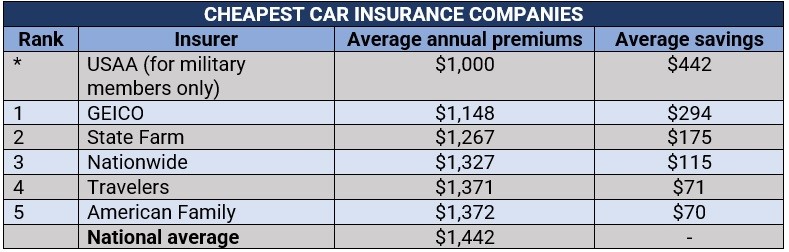

Shop Around and Compare Quotes

One of the simplest yet most effective ways to save on commercial car insurance is to shop around and compare quotes from multiple insurers. Insurance rates can vary significantly between companies, so getting multiple quotes can help you identify the most competitive rates for your business.

When comparing quotes, pay attention to the coverage limits and deductibles offered. While lower premiums may be attractive, ensure that the coverage provided meets your business's needs. It's essential to strike a balance between cost-effectiveness and adequate protection.

Implement Risk Management Strategies

Insurance companies reward businesses that take proactive measures to reduce risks. By implementing robust safety programs and training initiatives, you can demonstrate your commitment to safety and potentially qualify for lower insurance premiums.

Some effective risk management strategies include:

- Regular vehicle maintenance and inspections to ensure they are in good working condition.

- Driver training programs to promote safe driving behaviors and reduce accident risks.

- Implementation of telematics systems to monitor driving behavior and identify areas for improvement.

- Establishment of clear safety policies and procedures for all employees involved in driving.

Optimize Your Insurance Policy

Reviewing your insurance policy regularly and making necessary adjustments can help you save money without compromising on coverage. Here are some strategies to consider:

- Increase your deductibles: Opting for higher deductibles can significantly reduce your insurance premiums. However, ensure that the chosen deductible is affordable and won't cause financial strain in the event of a claim.

- Combine policies: If your business has multiple insurance needs, consider bundling them with the same insurer. Many insurers offer discounts for businesses that consolidate their insurance needs with them.

- Evaluate coverage limits: Regularly review your coverage limits to ensure they align with your business's current needs. Reducing unnecessary coverage limits can help lower your insurance costs.

- Explore additional discounts: Many insurers offer a range of discounts, such as loyalty discounts, safety discounts, or discounts for businesses with good financial stability. Ensure you're taking advantage of all applicable discounts.

Future Outlook and Innovations in Commercial Car Insurance

The commercial car insurance landscape is evolving rapidly, driven by advancements in technology and changing industry dynamics. Here's a glimpse into the future of commercial car insurance and some of the key trends and innovations to watch out for:

Telematics and Usage-Based Insurance

Telematics, the use of technology to monitor vehicle performance and driver behavior, is increasingly being adopted by insurers. This technology allows insurers to collect real-time data on driving habits, such as acceleration, braking, and cornering, which can then be used to calculate insurance premiums more accurately.

Usage-based insurance, also known as pay-as-you-drive insurance, is a direct offshoot of telematics. It allows insurers to charge premiums based on actual driving behavior rather than on broad statistical averages. This approach rewards safe drivers with lower premiums and provides a more personalized insurance experience.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the insurance industry, including commercial car insurance. These technologies are being used to streamline processes, improve risk assessment, and enhance fraud detection.

For example, AI-powered systems can analyze vast amounts of data to identify patterns and trends, helping insurers make more accurate predictions about risk levels. This can lead to more precise pricing and better risk management for both insurers and policyholders.

Connected Vehicles and Data Analytics

The rise of connected vehicles, equipped with advanced telematics and data transmission capabilities, is transforming the way commercial car insurance is underwritten and managed. These vehicles can provide real-time data on a wide range of factors, including vehicle performance, driver behavior, and even road conditions.

By analyzing this data, insurers can gain deeper insights into risk factors and make more informed decisions about coverage and pricing. This data-driven approach can lead to more efficient risk management and potentially lower insurance costs for businesses that demonstrate safe driving behaviors and vehicle maintenance practices.

Collaborative Insurance Models

The traditional insurance model, where insurers and policyholders have a transactional relationship, is evolving towards more collaborative models. In these models, insurers and policyholders work together to reduce risks and share in the benefits of improved safety and reduced claims.

For example, some insurers are offering incentives for businesses to implement safety programs or provide training for their drivers. By encouraging these proactive measures, insurers can reduce the likelihood of claims and, in turn, offer more competitive premiums to businesses that demonstrate a commitment to safety.

Conclusion

Securing cheap commercial car insurance is a balancing act that requires a thorough understanding of your business needs and the insurance market. By implementing the strategies outlined in this guide, such as shopping around for the best rates, optimizing your insurance policy, and adopting risk management practices, you can significantly reduce your insurance costs without compromising on coverage.

As the commercial car insurance landscape continues to evolve, driven by technological advancements and changing industry dynamics, staying informed about emerging trends and innovations will be crucial for businesses. By embracing these changes and leveraging the power of data and technology, businesses can not only secure affordable insurance but also contribute to a safer and more sustainable commercial transportation sector.

How often should I review my commercial car insurance policy?

+It’s recommended to review your policy annually, or whenever there are significant changes to your business or vehicle fleet. Regular reviews ensure that your coverage remains aligned with your business needs and any changes in insurance rates or market conditions.

What are some common discounts available for commercial car insurance?

+Common discounts include loyalty discounts, safety discounts for businesses with strong safety records, and discounts for businesses that bundle multiple insurance policies with the same insurer. Additionally, insurers may offer discounts for businesses that implement telematics systems or usage-based insurance programs.

How can I improve my chances of securing affordable commercial car insurance?

+To improve your chances of securing affordable insurance, focus on maintaining a strong safety record for your business and vehicles. This includes regular vehicle maintenance, driver training programs, and the implementation of robust safety policies. Additionally, shopping around for quotes from multiple insurers and optimizing your insurance policy can help you find the best rates.