Quote Home Insurance Online

Securing your home with comprehensive insurance coverage is a crucial step for any homeowner. In today's digital age, the convenience of obtaining quote home insurance online has become increasingly popular, offering an efficient and accessible way to protect your most valuable asset. This article delves into the world of online home insurance quotes, exploring the benefits, process, and key considerations to ensure you make an informed decision when safeguarding your home.

The Rise of Online Home Insurance Quotes

The insurance industry has undergone a digital transformation, and the introduction of online platforms for quote home insurance has revolutionized the way homeowners access coverage. With just a few clicks, you can now obtain multiple quotes, compare policies, and even purchase coverage, all from the comfort of your own home.

The convenience and speed of online quotes have made them an attractive option for busy individuals and those seeking a streamlined insurance experience. No longer do you need to spend hours meeting with agents or making countless phone calls to compare rates. The online process allows for a quick and efficient way to assess your options and make an informed choice.

Benefits of Obtaining Quotes Online

There are numerous advantages to leveraging the power of the internet for your home insurance needs. Here are some key benefits:

- Time Efficiency: Online quotes save you valuable time. You can quickly input your details and receive multiple offers within minutes, eliminating the need for lengthy appointments or waiting for callbacks.

- Convenience: The ability to access quotes anytime, anywhere, is a significant advantage. Whether you're at home or on the go, you can easily compare policies and make decisions at your own pace.

- Transparency: Online platforms often provide detailed breakdowns of coverage options and costs, allowing you to understand the specifics of each policy and make comparisons with ease.

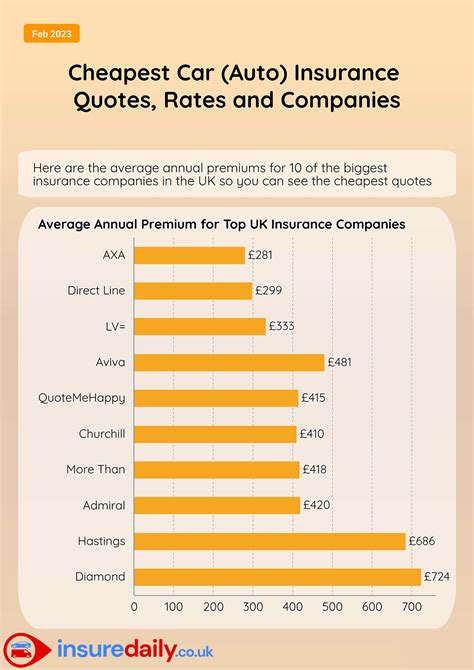

- Competition: By comparing quotes from various providers, you can ensure you're getting the best possible rate and coverage. The competitive nature of the online market often leads to more favorable terms and lower premiums.

- Customization: Many online quote tools offer customizable options, allowing you to tailor your coverage to your specific needs. This ensures you're not paying for unnecessary features and can find a policy that aligns with your unique circumstances.

The Process of Getting Online Home Insurance Quotes

Obtaining quote home insurance online is a straightforward process. Here’s a step-by-step guide to help you navigate the journey:

- Choose a Reputable Platform: Start by selecting a trusted online insurance marketplace or direct insurer's website. Look for platforms with positive reviews and a user-friendly interface to ensure a smooth experience.

- Gather Information: Before beginning the quote process, gather the necessary details about your home and current insurance needs. This may include the type of home, square footage, location, and any specific coverage requirements.

- Enter Basic Information: Most online quote tools will prompt you to provide basic details such as your name, address, and contact information. This information is essential for generating accurate quotes.

- Select Coverage Options: The next step involves choosing the type and level of coverage you require. This may include options for dwelling coverage, personal property, liability, and additional endorsements to suit your needs.

- Provide Home Details: You'll be asked to provide specific information about your home, such as its age, construction type, and any recent renovations or upgrades. Accurate details are crucial for an accurate quote.

- Review and Compare: Once you've received your quotes, take the time to review and compare the policies side by side. Pay attention to the coverage limits, deductibles, and any exclusions or endorsements.

- Customize and Purchase: If you find a policy that aligns with your needs, you can often customize it further by adding or removing specific coverages. Once satisfied, you can proceed with the purchase and secure your coverage online.

Key Considerations for Online Home Insurance Quotes

While the convenience of online quotes is undeniable, there are a few considerations to keep in mind:

- Accuracy of Information: Ensure you provide accurate and up-to-date information about your home and insurance needs. Inaccurate details can lead to incorrect quotes and potential issues down the line.

- Policy Limits and Deductibles: Carefully review the coverage limits and deductibles offered by each policy. Higher limits and lower deductibles may result in higher premiums, so strike a balance that suits your financial situation and risk tolerance.

- Additional Coverages: Consider any unique circumstances or valuable possessions you may have that require additional coverage. Online quote tools may not always capture these specific needs, so discuss them with an agent if necessary.

- Bundling Options: If you have multiple insurance needs, such as auto and home insurance, explore bundling options to potentially save on premiums. Many insurers offer discounts for bundling multiple policies.

- Read the Fine Print: Don't forget to carefully read the policy documents and understand the terms and conditions. This ensures you're aware of any exclusions, limitations, or specific requirements associated with the coverage.

| Consideration | Action |

|---|---|

| Inaccurate Information | Double-check details for accuracy |

| Coverage Limits | Review and adjust as needed |

| Additional Coverages | Discuss with an agent if necessary |

| Bundling Options | Explore discounts for multiple policies |

| Policy Documents | Read and understand the fine print |

Maximizing Your Online Quote Experience

To make the most of your online quote journey, consider these tips:

- Shop Around: Don't settle for the first quote you receive. Compare multiple offers from different insurers to find the best combination of coverage and price.

- Understand Your Needs: Before starting the quote process, take the time to assess your specific insurance requirements. This will help you make more informed decisions and avoid unnecessary coverages.

- Consider Discounts: Explore potential discounts such as loyalty discounts, safety device discounts, or even discounts for paying your premium annually rather than monthly.

- Review Policy Changes: Regularly review your home insurance policy to ensure it still aligns with your needs. Life changes, such as renovations or adding valuables, may require adjustments to your coverage.

- Utilize Online Resources: Many insurance providers offer online tools and resources to help you understand your coverage and make informed decisions. Take advantage of these resources to educate yourself.

Online Quote vs. Agent-Based Quotes

While quote home insurance online offers convenience and speed, some homeowners may prefer the personalized guidance of an insurance agent. Here’s a comparison to help you decide:

| Online Quotes | Agent-Based Quotes |

|---|---|

| Quick and efficient process | Personalized advice and guidance |

| Access to multiple quotes | In-depth understanding of your needs |

| Transparency and comparison | Expertise and industry knowledge |

| Convenience and flexibility | Tailored coverage recommendations |

| Potential for lower premiums | Long-term relationship and support |

Ultimately, the decision between online and agent-based quotes depends on your personal preferences and the level of assistance you require. Many homeowners find a balance by leveraging online tools for initial research and then consulting with an agent for a more personalized touch.

The Future of Home Insurance Quotes

As technology continues to advance, the home insurance industry is likely to embrace further digital innovations. Here are some potential future developments to watch out for:

- AI-Powered Quotes: Artificial intelligence may play a more significant role in the quote process, offering personalized recommendations and tailored coverage suggestions based on your unique circumstances.

- Real-Time Data Integration: Insurance providers may utilize real-time data, such as weather patterns or property value fluctuations, to provide more accurate and up-to-date quotes.

- Enhanced Personalization: Online platforms could offer even more customization options, allowing homeowners to build policies that precisely match their needs and preferences.

- Digital Policy Management: Insurers may develop comprehensive digital platforms for policy management, enabling homeowners to easily access and update their coverage details, make payments, and submit claims online.

- Collaborative Insurance Models: The rise of collaborative insurance models, such as peer-to-peer insurance, may offer new ways for homeowners to pool resources and obtain coverage collectively.

Conclusion

The world of quote home insurance online offers a convenient and efficient way to secure comprehensive coverage for your home. By understanding the process, considering key factors, and leveraging the benefits of online platforms, you can make an informed decision that protects your investment and provides peace of mind.

As the insurance landscape evolves, staying informed and adaptable is essential. Whether you choose online quotes or opt for the expertise of an insurance agent, ensuring your home is adequately protected is a crucial step in responsible homeownership.

How accurate are online home insurance quotes?

+

Online quotes are generally accurate, but they rely on the information you provide. Ensure you enter precise details about your home and insurance needs to receive the most accurate estimates.

Can I customize my home insurance policy online?

+

Yes, many online quote platforms offer customization options. You can typically add or remove coverages to create a policy that suits your specific requirements.

Are there any hidden fees or surprises with online quotes?

+

Online quotes should provide transparent pricing. However, always review the policy documents thoroughly to understand any potential fees or exclusions that may not be immediately apparent.

Can I bundle my home and auto insurance for better rates?

+

Absolutely! Many insurers offer discounts when you bundle multiple policies. By combining your home and auto insurance, you can potentially save on your premiums.

What should I do if I have specific coverage requirements?

+

If you have unique coverage needs, it’s best to consult with an insurance agent who can provide personalized recommendations. They can help you navigate complex coverage requirements and find the right policy.