Cheap Car Insured

Welcome to a comprehensive guide on navigating the world of affordable car insurance. In today's economic climate, finding cost-effective solutions for essential services like car insurance is more important than ever. This article aims to provide an in-depth exploration of the factors influencing cheap car insurance, along with practical tips and strategies to secure the best deals available.

Understanding the Fundamentals of Cheap Car Insurance

Cheap car insurance is not merely a matter of luck or random discounts; it is a strategic approach that considers a multitude of factors. The cost of car insurance is influenced by a complex interplay of variables, including the insurer, the policyholder’s personal details, the vehicle itself, and external factors like location and usage.

Key Factors in Determining Car Insurance Rates

When insurers calculate premiums, they consider a range of details about the policyholder and their vehicle. These include:

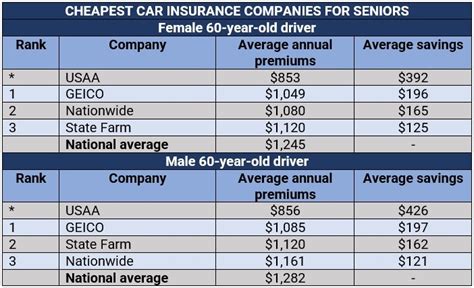

- Age and Gender: Generally, younger drivers (especially males) are considered higher-risk and face higher premiums. However, this can vary based on individual driving histories.

- Driving History: A clean driving record with no accidents or traffic violations is a major factor in securing cheap car insurance. Insurers view such records as indicators of responsible driving behavior.

- Vehicle Type and Usage: The make, model, and year of the vehicle, as well as how it is used (commuting, leisure, business, etc.), can significantly impact insurance rates. Certain vehicles, particularly those with high-performance engines, may attract higher premiums.

- Location: The area where the vehicle is garaged and driven plays a crucial role. Urban areas often have higher premiums due to the increased risk of accidents and theft.

- Coverage Levels: The level of coverage desired by the policyholder can affect the overall cost. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, will typically cost more than basic liability coverage.

Comparing Insurance Providers

With so many insurance providers in the market, it’s crucial to shop around and compare quotes. Each insurer has its own methodology for calculating premiums, and some may offer more competitive rates for certain types of drivers or vehicles. Online comparison tools can be invaluable in this process, allowing you to quickly and easily compare quotes from multiple insurers.

The Impact of Discounts and Incentives

Insurance companies often offer a variety of discounts and incentives to attract new customers and retain existing ones. These can significantly reduce the overall cost of insurance. Some common discounts include:

- Multi-Policy Discounts: Insurers frequently offer discounts when you bundle multiple policies (e.g., car insurance and home insurance) with them.

- Safe Driver Discounts: These rewards are given to policyholders with clean driving records and can lead to substantial savings.

- Loyalty Discounts: Some insurers reward long-term customers with discounts or other incentives to encourage loyalty.

- Student Discounts: Many insurers offer discounts to students, especially those who maintain good grades.

- Safety Feature Discounts: Vehicles equipped with advanced safety features like anti-lock brakes, air bags, and anti-theft devices may qualify for discounts.

Maximizing Savings on Car Insurance

Beyond comparing quotes and taking advantage of discounts, there are several strategies you can employ to further reduce your car insurance costs.

Raising Your Deductible

One of the most effective ways to lower your insurance premium is by increasing your deductible. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you’re essentially accepting more financial responsibility in the event of a claim, which can lead to significant savings on your premium.

Bundle Your Policies

If you have multiple insurance needs, such as car insurance, home insurance, or even life insurance, consider bundling these policies with the same insurer. Many insurance companies offer discounts when you combine multiple policies, as it simplifies their administrative processes and reduces the risk of a policyholder leaving for a competitor.

Take Advantage of Telematics

Telematics, or usage-based insurance, is a system where your driving behavior is monitored and your insurance premium is adjusted accordingly. While this may seem invasive, it can actually work in your favor if you’re a safe driver. Many insurance companies offer telematics programs that reward drivers who exhibit responsible driving habits with lower premiums.

Maintain a Good Credit Score

Believe it or not, your credit score can have a significant impact on your car insurance rates. Many insurers use credit-based insurance scores to help determine premiums, as they believe there is a correlation between financial responsibility and driving behavior. By maintaining a good credit score, you may be able to secure lower insurance rates.

Consider Pay-As-You-Drive Insurance

If you don’t drive frequently, pay-as-you-drive insurance, also known as pay-per-mile insurance, could be a cost-effective option. This type of insurance policy charges you based on the number of miles you drive, rather than a flat rate. It can be particularly beneficial for low-mileage drivers, such as those who primarily use public transport or work from home.

Negotiate and Shop Around Regularly

Don’t be afraid to negotiate with your insurance provider. Many insurers are willing to offer loyalty discounts or other incentives to keep long-term customers. Additionally, it’s a good practice to shop around for insurance quotes at least once a year. Insurance rates can fluctuate, and you may find a better deal elsewhere.

Potential Pitfalls to Avoid

While it’s important to find ways to save on car insurance, it’s equally crucial to avoid certain pitfalls that could lead to higher costs or even denied coverage.

Don’t Skimp on Coverage

While it’s tempting to choose the cheapest insurance option, it’s important to ensure that you’re adequately covered. Insufficient coverage can leave you vulnerable to significant financial losses in the event of an accident. Always review your policy to ensure it meets your needs and provides the necessary protection.

Avoid Lapses in Coverage

Letting your car insurance lapse, even for a short period, can have negative consequences. Many insurers consider a lapse in coverage as a red flag, potentially indicating higher risk. This can lead to higher premiums when you try to reinstate your policy or switch insurers.

Be Mindful of Claims

While it’s important to file a claim when necessary, frequent claims can lead to higher premiums. Consider the severity of the damage and your deductible amount before filing a claim. For minor damages, it may be more cost-effective to pay out of pocket rather than risk a premium increase.

The Future of Affordable Car Insurance

As technology continues to advance, the insurance industry is evolving rapidly. The rise of telematics and usage-based insurance is just one example of how insurers are using innovative methods to assess risk and offer more personalized rates. Additionally, the increasing popularity of electric and autonomous vehicles may lead to new insurance products and pricing models in the future.

The Impact of Electric and Autonomous Vehicles

Electric vehicles (EVs) and autonomous vehicles (AVs) are expected to have a significant impact on the insurance industry. EVs, with their lower maintenance costs and advanced safety features, may lead to reduced insurance premiums. Similarly, AVs, which are designed to eliminate human error, could potentially result in lower accident rates and thus, lower insurance costs.

The Role of Data Analytics

Advanced data analytics and machine learning are enabling insurers to more accurately assess risk and price policies. By analyzing vast amounts of data, insurers can identify patterns and trends that were previously invisible, leading to more efficient underwriting and potentially lower premiums for policyholders.

The Promise of Pay-Per-Mile Insurance

Pay-per-mile insurance, as mentioned earlier, is gaining traction as a cost-effective option for low-mileage drivers. With the increasing awareness of environmental sustainability and the rise of remote work, this type of insurance is likely to become even more popular in the future, offering a flexible and affordable solution for many drivers.

Conclusion

Finding cheap car insurance is not just about luck; it’s about understanding the factors that influence insurance rates and taking proactive steps to reduce your premium. By comparing quotes, utilizing discounts, and adopting smart strategies like increasing your deductible or bundling policies, you can significantly lower your car insurance costs. Additionally, staying informed about the latest industry developments and emerging technologies can help you stay ahead of the curve and make more cost-effective decisions.

What is the average cost of car insurance in the US?

+The average cost of car insurance in the US varies greatly depending on factors like location, age, vehicle type, and driving history. According to data from the Insurance Information Institute, the average annual premium for liability-only coverage was 563 in 2021, while the average for full coverage was 1,674. However, these figures can be significantly higher or lower based on individual circumstances.

Can I get car insurance without a license?

+While it’s generally not possible to get a traditional car insurance policy without a valid driver’s license, there are certain situations where coverage might still be available. For instance, if you’re purchasing a car but don’t plan to drive it (e.g., it’s for your teenager who’s still learning), you might be able to get a limited policy that covers the vehicle against theft or damage. However, these policies often come with restrictions and may not provide the same level of coverage as a standard policy.

What factors can increase my car insurance premium?

+Several factors can lead to an increase in your car insurance premium. These include getting into accidents or receiving traffic violations, which indicate a higher risk to the insurer. Other factors include changes in your personal circumstances, such as getting a new job that requires a longer commute or moving to a different area with a higher crime rate. Additionally, if you make changes to your vehicle that increase its value or performance, your premium may also increase.

Is it worth getting comprehensive car insurance?

+Whether or not comprehensive car insurance is worth it depends on your individual circumstances and the value of your vehicle. Comprehensive coverage provides protection against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. If your vehicle is relatively new or has a high resale value, comprehensive coverage can provide significant peace of mind. However, if your car is older and has a lower value, the cost of comprehensive coverage may outweigh the potential benefits.

How often should I review my car insurance policy?

+It’s generally recommended to review your car insurance policy at least once a year, or whenever your policy is up for renewal. This allows you to assess whether your current coverage still meets your needs and to shop around for better deals. Additionally, if your personal circumstances change significantly (e.g., you get married, move to a new area, or purchase a new vehicle), it’s a good idea to review your policy sooner to ensure it aligns with your new situation.