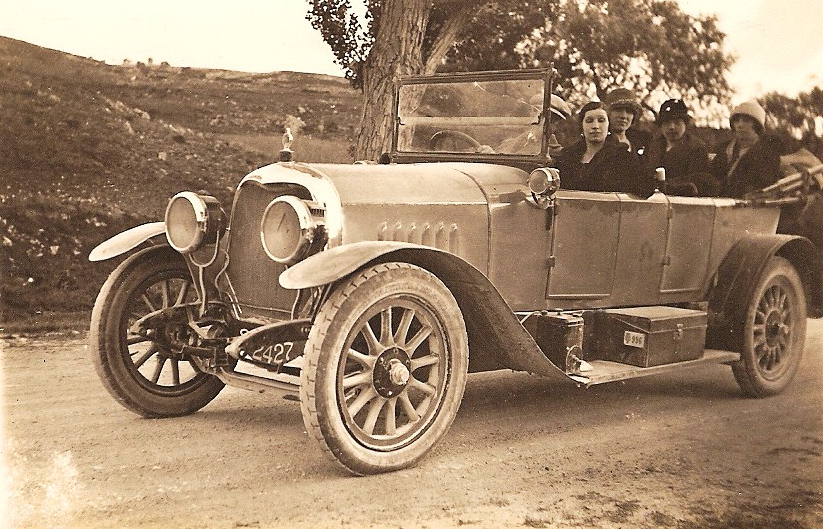

Insurance On An Old Car

As a responsible car owner, it's important to understand the unique considerations that come with insuring an older vehicle. With the right approach, you can protect your investment, minimize risks, and potentially save money on insurance premiums. This comprehensive guide will delve into the world of insurance for old cars, exploring the factors that influence coverage, costs, and the best practices to ensure a smooth and cost-effective process.

Understanding the Value of an Old Car

The value of an old car is not solely determined by its age; various factors contribute to its worth. These include the make and model, the condition of the vehicle, its mileage, and its historical significance or rarity. Classic cars, for instance, can appreciate in value over time, making them a unique asset. Understanding the true value of your old car is crucial for accurate insurance coverage and appropriate compensation in the event of a claim.

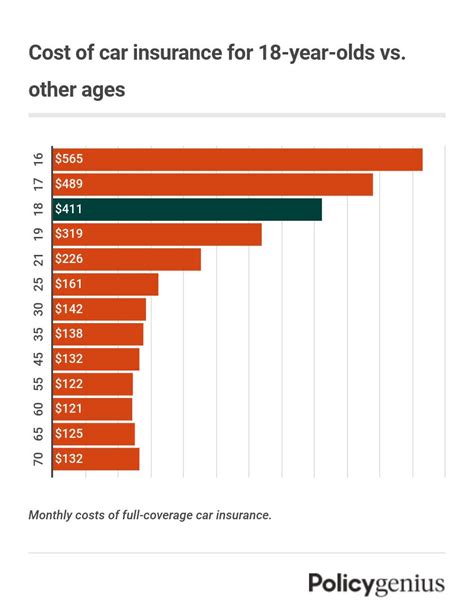

Factors Influencing Insurance Premiums

Insurance premiums for old cars can vary significantly depending on a multitude of factors. These include the make and model of the vehicle, its age, the driver’s age and driving history, the coverage level desired, and the geographical location. Insurance companies also consider the car’s value, which can be determined through independent appraisals or specialized valuation services. It’s important to note that older cars may have different coverage options and limitations compared to newer vehicles.

Coverage Options for Old Cars

When insuring an old car, you’ll typically have three main coverage options: comprehensive, collision, and liability. Comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters. Collision coverage covers damages to your vehicle in the event of a collision, regardless of fault. Liability coverage, on the other hand, protects you financially if you’re at fault in an accident, covering damages to the other party’s vehicle or property. It’s essential to tailor your coverage to your specific needs and the value of your old car.

Potential Limitations and Exclusions

Insurance policies for old cars may have certain limitations and exclusions. For instance, some policies may not cover modifications or custom parts, which are common in older vehicles. There might also be restrictions on the use of the vehicle, such as limiting it to pleasure driving or requiring it to be stored in a secure location. Additionally, older cars may not qualify for certain discounts or benefits that are typically offered for newer vehicles.

Maximizing Coverage and Savings

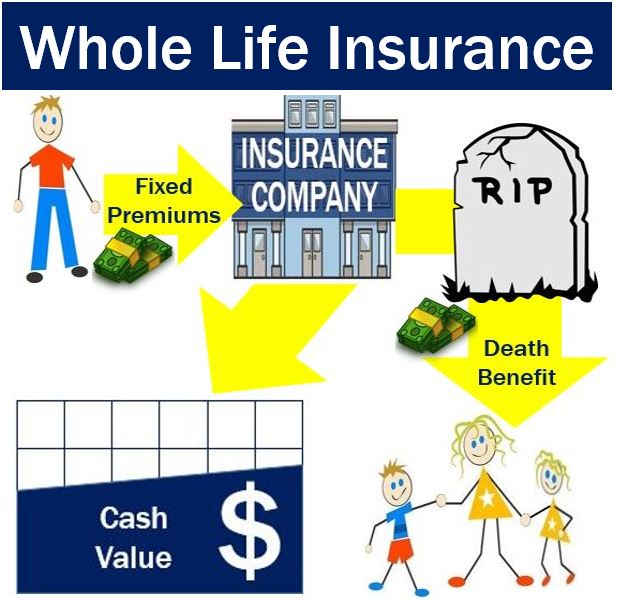

Insuring an old car doesn’t have to be a financial burden. There are several strategies to maximize coverage and save on premiums. One effective approach is to bundle your insurance policies. By combining your car insurance with other policies, such as home or life insurance, you can often negotiate better rates. Additionally, maintaining a clean driving record and taking advantage of safety features or discounts can lead to significant savings. It’s also worth exploring specialized insurance companies or brokers that cater specifically to classic or antique car owners, as they may offer more comprehensive coverage and competitive rates.

Specialized Insurance Companies

Specialized insurance companies that focus on classic or antique cars can offer tailored coverage and unique benefits. These companies often have a deep understanding of the specific risks and needs associated with older vehicles. They may provide coverage for modifications, offer flexible usage policies, and even provide access to exclusive events or resources for classic car enthusiasts. Additionally, they might have partnerships with restoration specialists or parts suppliers, ensuring you have the support you need to maintain and enjoy your old car.

Bundling Policies and Discounts

Bundling your insurance policies can be a smart financial move. By combining your car insurance with other policies, such as home or renters insurance, you can often qualify for significant discounts. Many insurance companies offer multi-policy discounts, which can reduce your overall premiums. Additionally, maintaining a good driving record and taking advantage of safety features can lead to further savings. Some companies also offer discounts for low-mileage usage, mature drivers, or safety courses, so it’s worth exploring these options to maximize your savings.

Protecting Your Old Car: Tips and Considerations

Insuring an old car requires a thoughtful approach to ensure adequate protection. Here are some key considerations and tips to keep in mind:

- Document and maintain a detailed record of your car's maintenance and repair history. This documentation can be invaluable in the event of a claim.

- Consider installing security features like an alarm system or a GPS tracking device. These can not only deter theft but also lead to insurance discounts.

- Regularly inspect and maintain your car's mechanical and electrical systems. Proper maintenance can prevent unexpected breakdowns and reduce the risk of accidents.

- Be mindful of your driving habits and avoid high-risk behaviors. A clean driving record can lead to lower premiums and better coverage options.

- Explore options for storing your car in a secure location, especially if it's not your daily driver. This can reduce the risk of theft or vandalism and potentially lower your insurance premiums.

Regular Maintenance and Inspections

Regular maintenance is crucial for the longevity and reliability of your old car. It’s recommended to follow the manufacturer’s maintenance schedule or, for classic cars, consult with experts or enthusiasts who can provide guidance on appropriate maintenance practices. Regular inspections can help identify potential issues before they become major problems, ensuring your car remains in optimal condition. Additionally, maintaining a well-documented service history can be beneficial when it comes to insurance claims or resale value.

Storing and Securing Your Old Car

The storage and security of your old car are important aspects of ownership. If you’re not using your car daily, consider storing it in a secure location, such as a garage or a specialized storage facility. This can reduce the risk of theft, vandalism, or weather-related damage. Additionally, investing in security measures like an alarm system or a tracking device can provide peace of mind and potentially lead to insurance discounts. Proper storage and security measures can help protect your investment and ensure your old car remains in excellent condition.

The Role of Appraisals and Valuations

Accurate appraisals and valuations are essential when insuring an old car. These assessments help determine the true value of your vehicle, which is crucial for appropriate coverage and compensation in the event of a claim. Independent appraisers or specialized valuation services can provide an impartial assessment of your car’s worth, taking into account factors like rarity, condition, and historical significance. Having a professional appraisal can give you peace of mind and ensure you have adequate insurance coverage for your valuable old car.

The Benefits of Professional Appraisals

Professional appraisals offer several advantages when it comes to insuring an old car. These appraisals provide an impartial and expert assessment of your vehicle’s value, taking into account various factors that may influence its worth. This detailed evaluation can help you understand the true value of your car, which is crucial for obtaining appropriate insurance coverage. Additionally, professional appraisals can be used as evidence in the event of a dispute or claim, ensuring you receive fair compensation for your old car.

Factors Considered in Appraisals

Appraisers consider a range of factors when evaluating the value of an old car. These include the make, model, and year of the vehicle, as well as its overall condition and any modifications or custom features. The car’s rarity, historical significance, and market demand are also taken into account. Appraisers may also assess the vehicle’s mechanical and cosmetic condition, as well as any recent repairs or maintenance. By considering these factors, appraisers can provide an accurate and comprehensive valuation of your old car, ensuring you have the appropriate insurance coverage.

Future Outlook and Potential Opportunities

The insurance landscape for old cars is evolving, presenting both challenges and opportunities. As the classic car market continues to grow, insurance companies are adapting their policies and coverage options to meet the unique needs of this niche market. This includes offering specialized coverage for classic and antique cars, as well as exploring innovative solutions like usage-based insurance or peer-to-peer insurance models. With the right approach and a forward-thinking mindset, insuring an old car can be a rewarding and cost-effective endeavor.

Emerging Trends in Old Car Insurance

The insurance industry is constantly evolving, and this extends to the coverage of old cars. One emerging trend is the increasing availability of specialized insurance policies tailored specifically for classic and antique cars. These policies often provide more comprehensive coverage, taking into account the unique needs and risks associated with older vehicles. Additionally, the use of technology is becoming more prevalent, with insurance companies offering digital solutions for policy management, claims processing, and even usage-based insurance options that reward safe driving behaviors.

Exploring Peer-to-Peer Insurance Models

Peer-to-peer insurance models are gaining traction in the insurance industry, offering unique opportunities for old car owners. These models connect drivers directly with each other, allowing them to pool resources and share risks. By participating in a peer-to-peer insurance program, you can potentially access more affordable premiums and customized coverage options. These programs often leverage technology to facilitate efficient risk sharing and claims processing, providing a flexible and community-oriented approach to insurance.

Conclusion: A Well-Informed Decision

Insuring an old car is a thoughtful process that requires a comprehensive understanding of the unique considerations involved. From determining the true value of your vehicle to exploring specialized insurance options and maximizing coverage and savings, this guide has provided a detailed roadmap. By staying informed and taking a proactive approach, you can protect your old car, minimize risks, and enjoy the peace of mind that comes with adequate insurance coverage.

How often should I have my old car appraised for insurance purposes?

+

It’s recommended to have your old car appraised every few years or whenever significant changes are made to the vehicle, such as modifications or restorations. Regular appraisals ensure that your insurance coverage remains aligned with the current value of your car.

Are there any tax benefits associated with insuring an old car?

+

In some cases, insuring an old car may offer tax benefits, particularly if it’s considered a classic or antique vehicle. These benefits can vary depending on your location and the specific regulations, so it’s advisable to consult with a tax professional or your insurance provider for accurate information.

What should I do if my old car is damaged in an accident?

+

If your old car is damaged in an accident, it’s important to follow the steps outlined in your insurance policy. This typically involves contacting your insurance provider, providing detailed information about the accident, and cooperating with their claims process. Depending on the extent of the damage and your coverage, you may have the option to repair or replace your vehicle.

Can I insure an old car that is not roadworthy or primarily used for display purposes?

+

Yes, you can insure an old car that is not roadworthy or primarily used for display purposes. Specialized insurance companies often offer coverage for these types of vehicles, taking into account their unique usage and risks. This ensures that your valuable old car is protected even if it’s not driven regularly.