Online Business Insurance Quotes

In today's digital age, an increasing number of entrepreneurs are venturing into the world of online businesses. From e-commerce stores to digital service providers, the online realm offers countless opportunities for growth and success. However, with the unique risks and challenges that come with operating a business in the virtual sphere, it is crucial for these entrepreneurs to protect their ventures with comprehensive insurance coverage.

Securing online business insurance quotes is a vital step towards safeguarding your digital enterprise. This process enables you to explore various insurance options, compare policies, and make informed decisions to ensure your business is adequately protected. In this comprehensive guide, we will delve into the world of online business insurance quotes, offering valuable insights and practical advice to help you navigate this essential aspect of business ownership.

Understanding Online Business Insurance

Online business insurance is a specialized form of coverage designed to address the unique risks associated with conducting business primarily or exclusively online. It provides protection for a range of potential liabilities and incidents that could arise in the digital realm, ensuring your business can weather any storms that may come its way.

While traditional brick-and-mortar businesses face their own set of risks, online businesses face a different landscape of potential hazards. From data breaches and cyber attacks to customer disputes and intellectual property issues, the online world presents a myriad of challenges that require tailored insurance solutions.

Key Coverages for Online Businesses

When seeking online business insurance quotes, it’s essential to understand the key coverages that should be included in your policy. Here are some of the critical aspects that should be considered:

- Cyber Liability Insurance: This coverage is a must-have for any online business. It provides protection against the financial losses and legal liabilities that can arise from cyber attacks, data breaches, and other online security incidents.

- Professional Liability Insurance (also known as Errors and Omissions Insurance): This coverage safeguards your business against claims of negligence, errors, or omissions in the services you provide. It is particularly relevant for businesses that offer professional advice or services online.

- General Liability Insurance: While primarily associated with physical businesses, general liability insurance is also crucial for online ventures. It covers a range of common liabilities, including bodily injury, property damage, and advertising injuries that may occur as a result of your business operations.

- Product Liability Insurance: If your online business involves the sale of physical products, product liability insurance is essential. It protects you against claims of harm or injury caused by your products.

- Business Owners Policy (BOP): A BOP is a bundled insurance package that typically includes a combination of property, liability, and business interruption insurance. It can be an affordable and comprehensive solution for small online businesses.

The Process of Obtaining Online Business Insurance Quotes

The journey towards securing the right online business insurance coverage begins with obtaining quotes from reputable insurance providers. Here’s a step-by-step guide to help you navigate this process:

Step 1: Identify Your Insurance Needs

Before you start seeking quotes, take the time to assess your specific insurance needs. Consider the nature of your online business, the risks it faces, and the potential liabilities you want to protect against. Understanding your unique requirements will help you tailor your insurance search and ensure you don’t overspend on unnecessary coverage.

For instance, if you run an e-commerce store that primarily sells digital products, you may not require extensive product liability insurance. However, if you offer web design services or provide online consulting, professional liability insurance should be a priority.

Step 2: Research Insurance Providers

With a clear understanding of your insurance needs, it’s time to research reputable insurance providers that offer coverage for online businesses. Look for providers with a strong track record in the industry, positive customer reviews, and a comprehensive range of policies tailored to digital enterprises.

Utilize online resources, industry publications, and recommendations from other business owners to compile a list of potential insurance providers. Compare their offerings, customer service reputation, and any additional services or resources they provide to help you manage your insurance needs effectively.

Step 3: Gather Necessary Information

To obtain accurate online business insurance quotes, you’ll need to provide certain information to insurance providers. This typically includes details about your business, such as:

- Business name and structure (sole proprietorship, partnership, LLC, etc.)

- Nature of your business operations and any specific services or products you offer

- Annual revenue and expected growth

- Number of employees and any plans for future hiring

- Details about your business location(s) and any physical assets or inventory you have

- Any existing insurance policies you currently hold

It's important to provide accurate and comprehensive information to ensure you receive precise quotes. Be prepared to discuss any specific risks or challenges your business faces, as this will help insurance providers tailor their quotes to your needs.

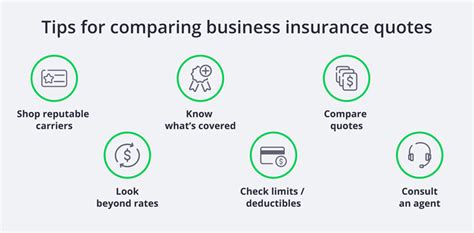

Step 4: Compare Quotes and Choose a Provider

Once you’ve gathered quotes from multiple insurance providers, it’s time to compare and analyze them. Consider the following factors when making your decision:

- Coverage Limits and Deductibles: Evaluate the coverage limits offered by each provider. Ensure that the limits are sufficient to protect your business adequately. Also, consider the deductibles, as higher deductibles can lower your premium but may require you to pay more out-of-pocket in the event of a claim.

- Policy Terms and Conditions: Carefully read through the policy documents to understand the terms and conditions of each quote. Look for any exclusions or limitations that may affect your coverage.

- Cost and Payment Options: Compare the premiums and any additional fees associated with each policy. Consider the payment options offered, such as monthly or annual payments, and assess which fits your business's financial situation best.

- Customer Service and Claims Process: Research the reputation and reliability of each insurance provider's customer service and claims handling process. Opt for a provider with a positive track record in this regard, as it can make a significant difference in the event of a claim.

- Additional Benefits and Resources: Some insurance providers offer additional benefits or resources that can enhance your coverage and provide valuable support. These may include risk management tools, educational resources, or discounts for implementing safety measures.

By thoroughly comparing quotes and considering these factors, you can make an informed decision and choose the online business insurance provider that best suits your needs.

Optimizing Your Online Business Insurance Coverage

Once you’ve secured your online business insurance policy, it’s essential to regularly review and optimize your coverage to ensure it remains aligned with your business’s evolving needs.

Regular Policy Review

Schedule regular reviews of your insurance policy, ideally on an annual basis or whenever significant changes occur in your business. This review process allows you to assess whether your current coverage is still adequate and make any necessary adjustments.

During your policy review, consider the following aspects:

- Evaluate any changes in your business operations, such as new products or services, increased revenue, or expanded employee base. Ensure that your insurance coverage aligns with these changes.

- Review your claims history and assess whether any trends or patterns indicate the need for additional coverage.

- Stay informed about any changes in industry regulations or standards that may impact your insurance needs.

- Discuss any concerns or questions you have with your insurance provider to ensure you fully understand your policy and its benefits.

Bundling Insurance Policies

Consider bundling your insurance policies to potentially save money and streamline your coverage. Many insurance providers offer discounts when you purchase multiple policies from them. For example, you may be able to bundle your online business insurance with personal insurance policies, such as auto or home insurance.

Implementing Risk Management Strategies

Taking proactive steps to mitigate risks and prevent potential liabilities can not only reduce the likelihood of claims but also lower your insurance premiums. Implement robust risk management strategies tailored to your online business’s unique needs.

Here are some strategies to consider:

- Conduct regular cybersecurity audits and implement robust security measures to protect against cyber attacks and data breaches.

- Establish clear policies and procedures for handling customer data and ensure compliance with relevant privacy laws and regulations.

- Regularly review and update your website's content to minimize the risk of copyright infringement or other intellectual property issues.

- Implement robust quality control measures for any products you sell to reduce the likelihood of product liability claims.

- Stay informed about industry best practices and emerging trends to stay ahead of potential risks and challenges.

Conclusion: Navigating the Digital Insurance Landscape

Obtaining online business insurance quotes is a critical step towards protecting your digital enterprise and ensuring its long-term success. By understanding the unique risks associated with online businesses and carefully selecting the right insurance coverage, you can safeguard your venture against a range of potential liabilities.

Remember, the process of securing online business insurance quotes involves identifying your specific needs, researching reputable providers, gathering necessary information, and thoroughly comparing quotes. By following this comprehensive guide, you can make informed decisions and choose the insurance coverage that best suits your business's requirements.

As you navigate the digital insurance landscape, stay proactive in reviewing and optimizing your coverage to adapt to your business's evolving needs. By staying informed, implementing robust risk management strategies, and partnering with the right insurance provider, you can confidently navigate the challenges of the online business world while protecting your hard-earned success.

What are the typical costs of online business insurance quotes?

+The cost of online business insurance quotes can vary significantly depending on several factors, including the nature of your business, the coverage limits you choose, and the insurance provider. Generally, premiums can range from a few hundred dollars to several thousand dollars per year. It’s important to compare quotes from multiple providers to find the most competitive rates for your specific needs.

How can I determine the appropriate coverage limits for my online business insurance policy?

+Determining appropriate coverage limits involves assessing the potential risks and liabilities your business faces. Consider factors such as the value of your assets, the potential for significant financial losses in the event of a claim, and any legal requirements or industry standards. It’s recommended to consult with an insurance professional who can guide you in selecting adequate coverage limits based on your specific circumstances.

Are there any discounts available for online business insurance policies?

+Yes, many insurance providers offer discounts for online business insurance policies. These discounts may be available for bundling multiple policies (e.g., business and personal insurance), maintaining a good credit score, implementing robust security measures, or participating in risk management programs. Be sure to inquire about potential discounts when obtaining quotes and explore ways to optimize your insurance coverage while reducing costs.

What should I do if I’m unsure about the coverage I need for my online business?

+If you’re unsure about the coverage you need for your online business, it’s best to consult with an insurance professional who specializes in business insurance. They can assess your specific needs, provide guidance on the appropriate coverage types and limits, and help you tailor a policy that provides comprehensive protection for your unique business operations. Don’t hesitate to seek expert advice to ensure you have the right coverage in place.

How often should I review and update my online business insurance policy?

+It’s recommended to review and update your online business insurance policy at least annually or whenever significant changes occur in your business. This ensures that your coverage remains aligned with your current needs and any new risks or liabilities that may have emerged. Regular policy reviews help you stay proactive in protecting your business and make necessary adjustments to your insurance coverage as your enterprise evolves.